The Last Time We Had Such A Dramatic Improvement In Sentiment Was… Early 2008

New record highs in stocks, VIX testing multi-year lows, consumer-confidence soaring, PMIs rebounding… and a Nirvana-like jobs number. The last couple of weeks have provided everything the passive investor could want to confirm all those fears of “recession” were just the typical doomsayers spoiling the party for the ‘smart’ investors who so cleverly are able to see through collapsing earnings, manufacturing recessions, and a global liquidity shortage (saying nothing of repo panic and CLO chaos).

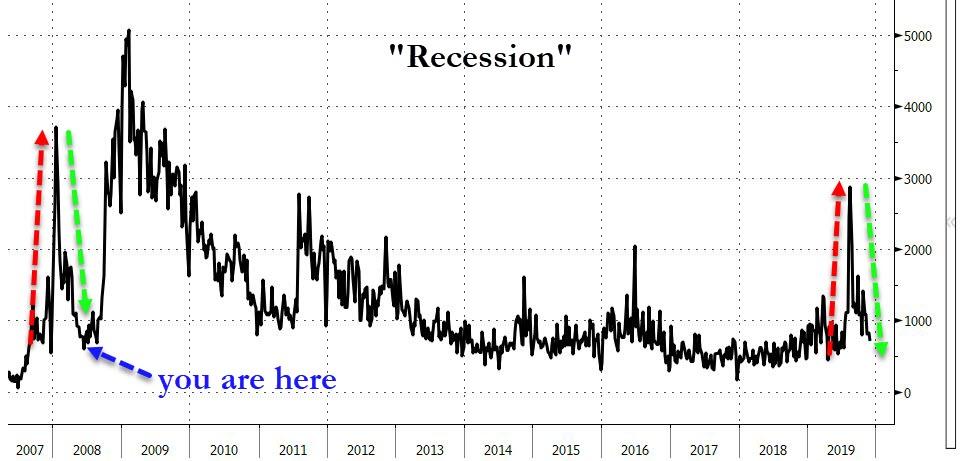

One look at the chart below “proves” everything is awesome again…

Source: Bloomberg

There’s just one thing…

As Bloomberg’s John Authers notes, the last time we saw a peak in recession searches followed by a sudden wave of relief like we saw over the summer was…in early 2008.

Source: Bloomberg

In case you needed your memory jogged, Authers explains that fears were high at the beginning of the year as subprime lenders went to the wall, but the headline macro data stayed the right side of recession as the Fed eased aggressively. By mid-summer, even after the fire sale of Bear Stearns and the nationalization of Fannie Mae and Freddie Mac, recession fears were as low as they are now.

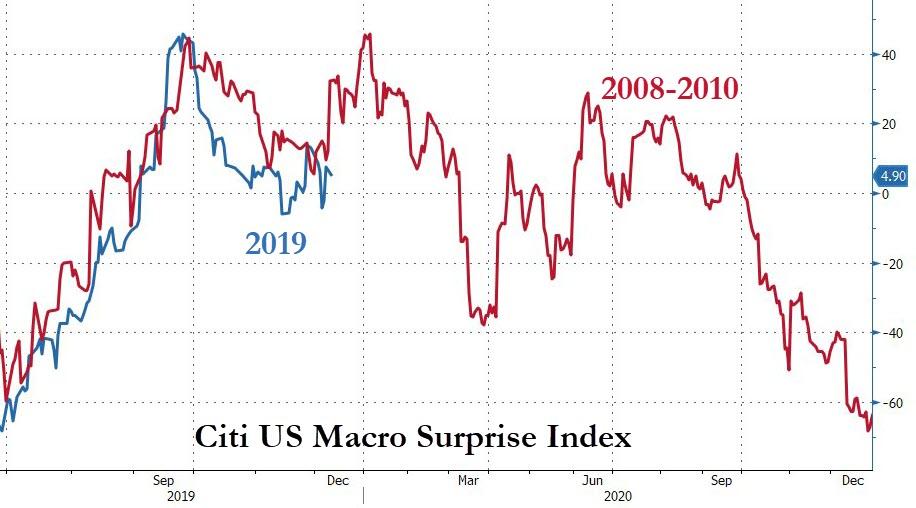

Additionally, the “use it or lose it” surge in spending into fiscal year-end is very similar to what occurred during the crisis, both of which left a sudden gaping hole that invited the recession fears – before rebounding (everything is fine, don’t worry)…

Source: Bloomberg

Of course, we all know what happened next… all the worst parts of the bible.

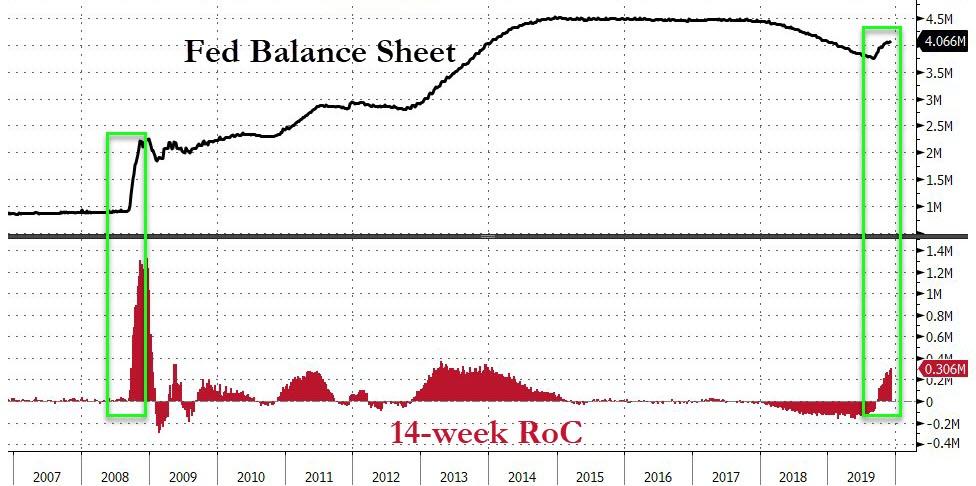

There is of course a vast difference between then and now (as every asset-gatherer and commission-taker will tell you). Here’s one big difference: The Fed’s balance sheet was less than $1 trillion in 2008 (before exploding higher on QE1 etc…) whereas now it is over $4 trillion and accelerating at its fastest rate since the crisis…

Source: Bloomberg

Crucially, the depth of the fear this summer dramatically increase the risk that the market will now get too far ahead of itself in its complacent confidence that The Fed has its back (and besides a trade deal is imminent right?)… And that should really frighten everyone, because, as Authers so ominously notes, history tells us that over enthusiasm at times like these can take us to some dark places.

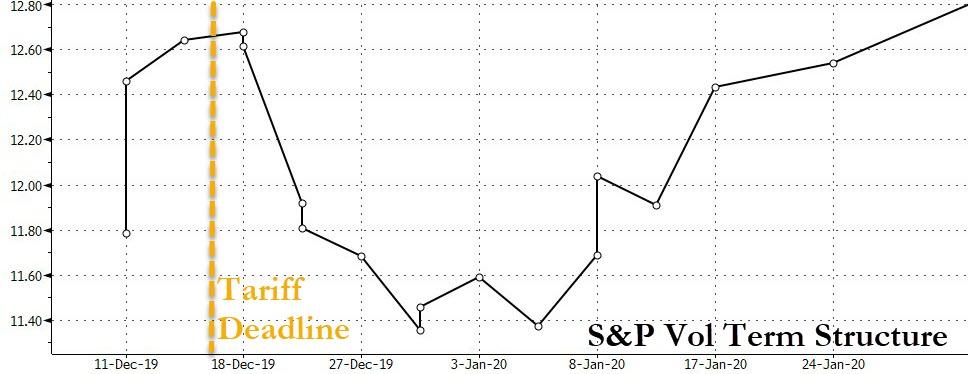

Even the vol market is starting to get a little worried about next week’s tariff deadline…

Source: Bloomberg

Trade accordingly.

Tyler Durden

Mon, 12/09/2019 – 21:20

via ZeroHedge News https://ift.tt/2PvcD64 Tyler Durden