Stocks Drop As Tariff Deadline, Central Banks Looms

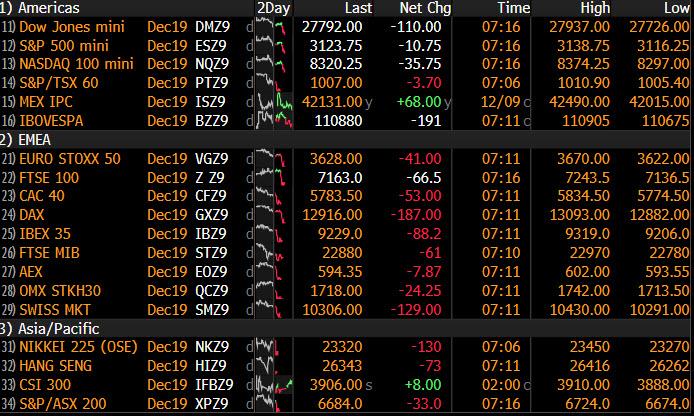

Global stocks, US equity futures, 10Y TSY yields and the US dollar dropped for a second day on Tuesday, amid what conventional wisdom said was “caution over a Dec. 15 deadline for the next round of U.S. tariffs” as well as looming Fed and ECB meetings and UK elections (although the real risk factor is the repo market as we will discuss shortly).

Following their counterparts in Asia, European shares fell again, with the Stoxx 600 index down over 1% on course for its biggest decline in a week as 18 of 19 industry sectors slipped, as Germany’s DAX fell to its lowest in a week. Europe’s open appeared to spring a trapdoor below the S&P futures which tumbled just around 3am, and undoing all post payroll gains.

The MSCI All-Country World Index was down 0.1%. Market uncertainty before this Sunday’s tariff deadline was reinforced by comments from U.S. Agriculture Secretary Sonny Perdue on Monday, who said President Donald Trump did not want to implement tariffs but did want to see “movement” from China. If that comment was supposed to inspire confidence, it has failed.

With investors reluctant to make big bets, MSCI’s broadest index of Asia-Pacific shares outside Japan was 0.17% lower. China’s benchmark Shanghai Composite index was off 0.08%. Australian shares were down 0.34%. Japan’s Nikkei fell 0.08%.

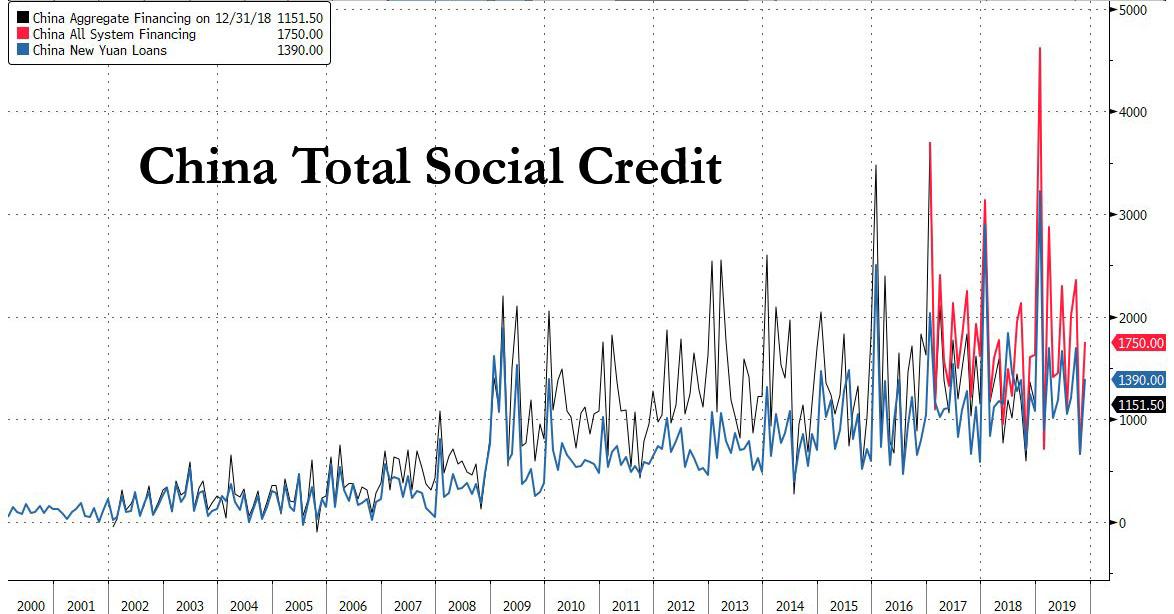

New data in China showed producer prices fell again in November while consumer prices spiked to the highest level since 2011 on the back of soaring food inflation, complicating efforts to boost demand as economic growth slows.

Additionally, China also reported its latest credit aggregate data which came in modestly stronger than expected, although it was still well below where it should be for China to stimulate its way out of a sub-6% GDP.

In addition to trade, investors were also keeping an eye on the U.S. Federal Reserve. The Fed is expected to keep rates unchanged at its two-day policy meeting although investors will be watching policymakers’ forecasts for future U.S. economic growth.

“What you have seen since the end of the third quarter and the beginning of the fourth quarter was these two risks were receding … And now this week you see those two concerns coming back on the market,” he said, adding that he expected their effect would be short-term.

Investors have focused this year on the risks of the UK crashing out of the European Union without a deal and a sharp escalation in trade war tensions, said Frank Benzimra, head of equity strategy at Societe Generale.

Euro zone government bond yields were mostly steady, refusing to budge from recent ranges. Germany’s benchmark Bund yield was steady at -0.30%, below a recent high of -0.26%. Italian 10-year bond yields, which fell on Monday, dipped 2.5 basis points to 1.36%. In the euro zone, Christine Lagarde holds her first meeting and news conference as ECB chief on Thursday.

“Expectations for policy action from the ECB and Fed are subdued,” said Commerzbank rates strategist Rainer Guntermann. “Lagarde’s communication style will be watched closely, but that’s unlikely to lead to any repricing in bond markets.”

European sentiment got another modest boost when Germany’s ZEW economic sentiment printed positive for the first time in six months.

In the US, two-year yields dropped to 1.619% on Tuesday, down from its close of 1.627% on Monday. The 10-year Treasury yield was at 1.8138% from a U.S. close of 1.8225% on Monday.

In FX, the Bloomberg Dollar Spot Index was little changed as EUR/USD edged higher after ZEW survey data. The pound edged higher even after data showed the U.K. economy unexpectedly stagnated in October, marking three straight months without growth for the first time since 2009. Norway’s krone dropped after Norges Bank’s regional survey of businesses showed lower growth than expected in the past months and in the half year ahead, lowering the probability of another rate hike

Worries over trade continued to push oil prices lower. Data released on Sunday showed that Chinese exports declined for a fourth straight month, underscoring the impact of the trade war between the U.S. and China, which is in its 17th month. Global benchmark Brent crude fell 0.09% to $64.20 a barrel and U.S. West Texas Intermediate crude dipped 0.1% to $58.95 a barrel. Gold rose, fetching $1,462.05 per ounce.

Market Snapshot

- S&P 500 futures down 0.3% to 3,123.75

- STOXX Europe 600 down 1% to 402.25

- MXAP down 0.2% to 165.07

- MXAPJ down 0.3% to 524.35

- Nikkei down 0.09% to 23,410.19

- Topix down 0.08% to 1,720.77

- Hang Seng Index down 0.2% to 26,436.62

- Shanghai Composite up 0.1% to 2,917.32

- Sensex down 0.6% to 40,235.57

- Australia S&P/ASX 200 down 0.3% to 6,706.91

- Kospi up 0.5% to 2,098.00

- German 10Y yield rose 1.1 bps to -0.296%

- Euro up 0.1% to $1.1075

- Brent Futures down 0.3% to $64.07/bbl

- Italian 10Y yield fell 7.3 bps to 0.929%

- Spanish 10Y yield rose 0.4 bps to 0.458%

- Brent Futures down 0.3% to $64.07/bbl

- Gold spot up 0.2% to $1,464.71

- U.S. Dollar Index down 0.06% to 97.59

Top Overnight News

- The U.S. is unlikely to impose extra tariffs on a new $160 billion swath of Chinese goods including toys and smartphones come Sunday, Agriculture Secretary Sonny Perdue said. American and Chinese negotiators have signaled that they may be drawing closer to agreeing on phase one of a broader accord that would resolve the trade dispute, with the sides in almost “around-the- clock” talks, White House economic adviser Larry Kudlow said

- Australian Reserve Bank Governor Philip Lowe said he was surprised at the weakness of third-quarter consumption, but doesn’t think it is a pointer to a prolonged period of stagnant spending as households have received an infusion of cash

- China’s consumer inflation accelerated to a seven-year high in November while producer prices extended their run of declines, complicating the central bank’s efforts to support the economy

- South Africa’s state power company intensified rolling blackouts to a record, signaling a deepening crisis at the debt- ridden utility and raising the risk of a second recession in as many years

- Democrats are homing in on accusations that President Donald Trump abused his office in dealing with Ukraine and obstructed a congressional investigation into the matter, indicating they may be heading toward tightly drawn articles of impeachment

- Hong Kong police defused two homemade bombs at a local Catholic school, in a reminder of the potential for escalation in the restive financial center after a lull in protest violence

- House Democrats plan to unveil two articles of impeachment against President Donald Trump on Tuesday — one on abuse of power and the other involving obstruction of Congress, according to four people familiar with the proceedings

- Morgan Stanley is cutting about 1,500 jobs globally, including several managing directors, as part of a year-end efficiency push; the company was fined 20 million euros ($22.1 million) by French regulators after the bank’s London desk was accused of using “pump and dump” tactics to manipulate sovereign bond prices

- Christine Lagarde came to the Frankfurt-based ECB pledging to bind environmental concerns much more closely into policy decisions – – echoing her strategy when she ran the International Monetary Fund. Six weeks into the post, she’s refining her message after a clamor of warnings from colleagues such as Bundesbank President Jens Weidmann that their scope is limited by their mandate

- Sustainable financing has racked up almost half a trillion dollars of deals worldwide in 2019, fueled by a list of notable firsts. Next year may be even bigger

Asian equity markets resumed the cautious global risk tone heading into this week’s plethora of risk events and amid ongoing trade uncertainty from the looming US-China tariff deadline set for December 15th. ASX 200 (-0.3%) and Nikkei 225 (Unch.) were subdued with Australia pressured by underperformance in most of the trade sensitive sectors but with losses limited by resilience in commodity names, while favourable currency moves also helped stem the downside for Tokyo-listed exporters. Hang Seng (-0.2%) and Shanghai Comp. (Unch.) conformed to the lackadaisical picture as participants second-guessed whether the US will proceed with the 15% tariffs on virtually all of the remaining imports from China scheduled for Sunday and in which China have already set retaliatory tariffs due the same day. Furthermore, continued PBoC liquidity inaction, as well as warnings from a senior Chinese economist on looser fiscal and monetary policies next year also contributed to the subdued risk appetite. Finally, 10yr JGBs fluctuated in which prices were initially pressured and briefly slipped below the 152.00 level amid gains in yields in which the 10yr yield rose to 0.0% for the first time since March, with selling in JGBs exacerbated following the weaker results at the 5yr auction which showed a slightly softer b/c, a drop in accepted prices and wider tail in price, although 10yr JGBs then staged an aggressive rebound to recoup all the earlier losses.

Top Asian News

- China’s Inflation Fastest Since 2012 on Surging Pork Prices

- Blockchain Aggravates Swiss Money Laundering Risks, Says Finma

- Japan Bonds Rebound as Benchmark Yield’s Rise to 0% Spurs Demand

European stocks are plumbing the depths [Eurostoxx 50 -1.1%] with the losses seen at the EU cash open accelerating in early trade. DAX futures and cash have retreated below the key 13k level after the former breached its Dec 5th/6th low ~13045 and its Dec low at 12924, with eyes now on its Nov low (12888.5) and 50 DMA (12880) as the index future gives up the 12900 mark. Other major bourses are broadly in the red with little by way of fresh fundamental factors to add to the overall narrative during the session, that said, participants gear up for a risk-packed week, with the US imposition of China tariffs on Dec 15th still looming. Sectors are all in negative territory, although some resilience is seen in defensives which reflects the overall risk picture in the region. The healthcare sector is outperforming its peers as Sanofi (+4.8%) shares cushion the segment – after the drug-maker released plans to reorganise its business which will see it narrow the number of global business units in an attempt to bolster growth and profits, whilst aiming to save EUR 2.0bln by 2022. Other notable movers include Deutsche Bank (-0.3%) whose shares opened higher after affirming its 2019, 2020 and 2022 targets, albeit shares dipped into negative territory on the DAX’s demise. Elsewhere, Ashtead Group (-7.5%) rests at the foot of the FTSE 100 amid fears that the UK market will remain challenging.

Top European News

- U.K. Economy Fails to Grow Ahead of Brexit-Dominated Election

- German Investors Turn Optimistic for First Time Since April

- Ted Baker Chairman and Interim CEO Resign as Crisis Deepens

- Morgan Stanley Fined $22 Million for Rigging French Bond Markets

In FX, the clear G10 laggard as Eur/Nok bounces further from sub-1.1000 lows towards 10.1900 on the back of the latest Norwegian regional survey revealing downgrades to output over the previous quarter and outlook for 6 months ahead. Norges Bank contacts also reported slower growth in all sectors of the economy and several respondents noted more uncertainty due to the adverse knock-on effects of global trade turbulence. The Q4 findings overshadowed inflation data that came in as forecast across the board in contrast to softer Swedish Prospera CPIF expectations, albeit with relatively little impact on the SEK given the fact that the Riksbank has underscored December repo rate hike intentions.

- GBP/EUR – Sterling survived another bout of all round selling pressure amidst rising option volatility ahead of Thursday’s UK election and the final YouGov MRP poll to rebound firmly in Cable and Eur/Gbp cross terms even though data was disappointing on balance (m/m GDP flat, ip sub-consensus and trade gaps much wider than anticipated). In fact, the Pound is probing fresh peaks vs the Dollar circa 1.3190 and retesting 0.8400 against the single currency that has not derived much momentum from upbeat ZEW metrics for Germany and the Eurozone as a whole, with the former somewhat diluted by caveats. Indeed, Eur/Usd only mustered enough strength to register a 1.1080 high before fading and perhaps feeling the weight of hefty option expiries sitting between 1.1065-70 (2.3 bn).

- CHF/JPY – The Franc continues to claw back lost ground vs the Greenback and Euro regardless of the looming SNB quarterly policy review and prospect of any tweak in assessment of the Swiss currency, or even direct intervention, with Usd/Chf edging closer to 0.9850 and Eur/Chf eyeing 1.0900. However, the Yen continues to respect 108.50 resistance and a Fib retracement in very close proximity (108.49) amidst decent expiry interest from 108.60-65 (1.5 bn), as the DXY narrowly maintains 97.500+ status).

- CAD/NZD/AUD – The Loonie continues to trade on a firmer footing within 1.3245-25 parameters vs its US counterpart alongside the Mexican Peso (between 19.2450-19.2000 on the wide) on USMCA accord hopes, but the Kiwi and Aussie in particular are still treading cautiously ahead of the Fed and US-China tariff deadline, as Nzd/Usd and Aud/Usd pivot 0.6550 and 0.6825 respectively and Aud/Nzd keeps its head above 1.0400.

In commodities, crude markets are choppy – with recent action attributed to potential technical play. Front-month WTI and Brent futures popped higher to 59.40/bbl and 64.68/bbl respectively from below the round figures and with a lack of fresh fundamental news-flow to influence prices. Energy futures then reversed earlier gains and printed fresh session lows. Crude markets are susceptible to increased volatility as we go through the week with a number of key macro risk events on the radar – including FOMC and ECB monetary policy decisions, UK general election, US’ scheduled imposition of tariffs on USD 160bln worth of Chinese goods, whilst crude specific drivers include the weekly inventory data and the monthly oil reports – with the EIA STEO due later today. Meanwhile, gold prices remain underpinned by the downside in the equity complex and ahead of the aforementioned events, whilst in terms of commentary – Goldman Sachs and UBS both see the yellow metal prices climbing to USD 1600/oz, above Commerzbank view of USD 1500/oz, amid the current trade environment, but caveat that it is unclear what Central Banks will do during 2020. Meanwhile, copper prices remain on the front-foot and is poised (thus far) for a third straight session of gains as the red metal creeps up to USD 2.75/lb. ING highlight a number of factors driving the upside 1) last week’s positive trade message after china said they would wave tariffs on imports of US pork and soybean, 2) China’s Central Economic Conference vowing to maintain economic growth in a reasonable range – adding to copper demand 3) the downward trend in LME inventories and 4) disappointing short-term scrap import quotas. Finally, Dalian iron ore futures rose in excess of 3.0% to its highest in over four months amid supply uncertainties expected to arise in Q1 2020, with some miners such a Vale also lowering production outlook.

US Event Calendar

- 6am: NFIB Small Business Optimism, 104.7, est. 103, prior 102.4

- 8:30am: Nonfarm Productivity, est. -0.1%, prior -0.3%

- 8:30am: Unit Labor Costs, est. 3.4%, prior 3.6%

DB’s Jim Reid concludes the overnight wrap

Markets seem to be in a holding pattern ahead of the FOMC, U.K. election and ECB meetings on Wednesday/Thursday so a bit of time to fill in our survey hopefully. We’re also waiting with baited breath for news ahead of Sunday’s key tariff deadline. In the meantime sentiment has been a shade weaker over the last 24 hours albeit on very little news to get excited about. The trade situation in particular has been eerily quiet and rather it’s been the focus on geopolitical tensions in North Korea which appears to be the blame for the mild risk off.

Indeed following Trump’s tweet over the weekend saying that North Korean leader Kim Jong Un was “too smart and has far too much to lose” if he renewed hostility with the US, the state-run Korean Central News Agency released a statement calling Trump “an old man bereft of patience”. Further statements also indicated a bit of an escalation in rhetoric however the overall impact on markets was still fairly muted. The S&P 500 and NASDAQ closed -0.32% and -0.4% last night after the STOXX 600 had edged down -0.24% with the FTSE MIB (-0.97%) underperforming. The VIX also hovered around 1 month highs up 2.2pts to just below 16.

This morning markets in Asia are in a similar holding pattern, with the Nikkei (-0.06%), the Hang Seng (-0.09%) and the Shanghai Comp (-0.20%) all trading slightly lower, although the Kospi (+0.38%) has seen gains. Ahead of the US session, S&P 500 futures (+0.06%) have also struggled for direction. The more notable news is that the Japanese 10yr yield did edge above 0.00% earlier. It hasn’t closed above zero since March. However since it poked its head above ground it’s gone back to -0.02% as we type.

Staying with Asia, overnight we had the November inflation data out of China, where CPI yoy rose to +4.5% (vs. 4.3% expected), the highest reading since January 2012. The increase was driven by food prices, which were up +19.1%, thanks to pork prices which rose +110.2% as a result of a virus creating a large shortfall in supply. Stripping out the more volatile price components, and the core CPI number (excluding food and energy) actually fell a tenth to +1.4%, the lowest reading since February 2016. The PPI number was slightly above expectations, with a -1.4% drop in producer prices (vs. -1.5% expected).

Speaking of China, our economists released their outlook for the country this morning (link here), where their view is that the economy is likely to bottom out in 2020, and they’re forecasting real GDP growth of +6.1% next year, compared with +6.0% in Q3 2019. The drivers behind this for them are a better outlook for exports as the global economy stabilises and further US tariffs come to an end or are even eased. They also see higher consumer spending, particularly on durable goods such as autos and cell phones, and finally they believe supportive fiscal and monetary policies will help growth thanks to infrastructure investment and higher credit growth.

Coming back to yesterday, the flip side of the weaker backdrop for equities was a slightly stronger day for bond markets. Indeed 10y Treasury yields closed down -1bps with the 2s10s curve also flattening -1.25bps. In Europe yields were also down 2-7bps led by BTPs as they reversed over half of the 12bps widening last week. An MNI story which hit the headlines in the afternoon suggesting that the ECB could be on hold for much of 2020 didn’t really change the narrative.

Meanwhile, in FX, Sterling held its gains from last week and is trading around $1.315 this morning with 2 days until the election. There was a poll yesterday, from ICM, which showed the Tories with only a 6ppt lead over Labour at 42% versus 36%. The ICM polls tend to show the narrowest lead for Tories and for context that gap narrowed by 1ppt from the last ICM poll on December 2nd. An interesting stat is that of the 65 polls published since campaigning began, 43 have shown a double digit Tory lead. The second YouGov MRP election model is out at 10pm tonight. The last one two weeks ago showed a healthy 68 seat majority for the Tories but the polls have slightly narrowed at the margin since then including YouGov’s ones so you would expect the predicted seats victory to be lower tonight. A reminder that this poll in 2017 correctly showed a hung Parliament c.9 days before Election Day and was counter to the vast majority of other polls showing a comfortable Tory victory. So it will be closely watched again.

In other news there was a bit of data yesterday but it didn’t really move the dial. In Germany exports surprised to the upside in October (+1.2% vs. -0.3% expected) while imports (0.0% mom vs. -0.1% expected) were more or less in line. Elsewhere, the December Sentix investor confidence reading improved 5.2pts to +0.7 (vs. -5.3 expected). That’s actually the strongest reading since May. Continuing with Germany our local economists reported that the SPD’s party congress ended on Sunday without a revolution against the government coalition but with delegates voting for a package of resolutions that should sharpen the SPD’s leftist profile and will further fuel tensions between the coalition partners once they shift into pre-election mode. See their note here for more.

Staying with Europe, yesterday DB’s Mark Wall published his outlook for Europe next year. First and foremost Mark has raised his forecast for euro area growth from 0.8% to 1.0%. This is the first upgrade in over a year and is broadly equalling trend growth. It reflects leading indicators brightening slightly and risks reducing. Mark urges caution though. The trade war and hard Brexit remain risks and he notes the scope for significant upgrades is limited. There are also headwinds such as the auto sector’s struggle with CO2 regulations. See more in Mark’s full note here.

Staying with the outlook theme, Francis Yared published his rates’ outlook yesterday (link here) and his forecasts for 10y Treasuries and Bunds by the end of next year are 1.90% and 0%, respectively. This assumes that none of the major geopolitical risks materialise. In addition, risks to this yield forecast are tilted to the downside in the US and upside in Europe. Francis also flags that the year-end forecasts hide a tortuous path. The US election uncertainty and seasonal effects should put some downside pressure on yields in Q2/Q3 before recovering in Q4 once election uncertainty dissipates.

To the day ahead now, where the highlight datawise this morning is the December ZEW survey in Germany. Also due out is the October monthly GDP and trade data in the UK along with October industrial production prints in the UK, France and Italy. In the US today we’re due to get the November NFIB small business optimism print and final Q3 revisions for nonfarm productivity and unit labour costs.

Tyler Durden

Tue, 12/10/2019 – 07:56

via ZeroHedge News https://ift.tt/2YxMJml Tyler Durden