Cycle Top? CEO Resignations Jump Amid Collapse In Corporate Confidence

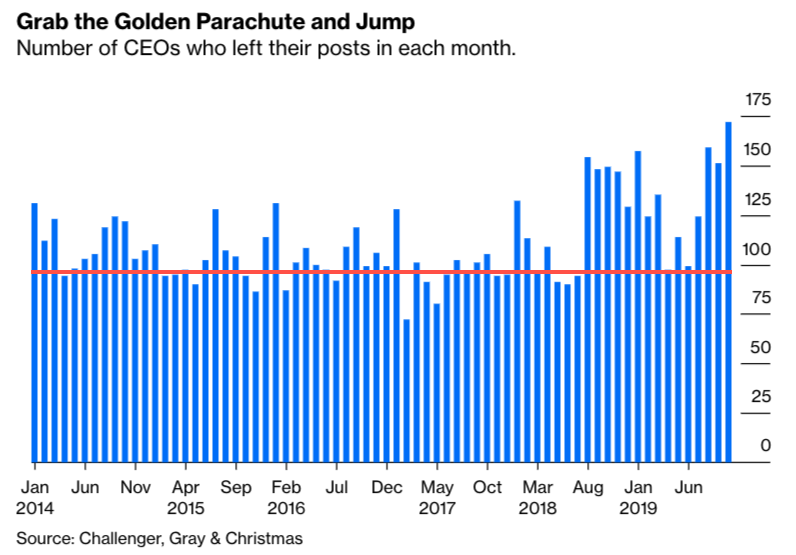

CEOs generally have a good lead on the economy and can spot acceleration and deceleration periods in the business cycle. With the current economy cycling lower into year-end, CEOs are departing companies at a record rate, fastest in nearly two decades, amid their collapse in confidence in the outlook of the economy.

Bloomberg notes that CEOs are voluntarily abandoning ship [their respected companies] as the economic expansion slows and risks a further deceleration into 2020 with the treat of a mild recession in the back half of the year.

“Historical patterns indicate that when we see this rate of turnover, the economic expansion is almost certainly in its final inning,” Bloomberg warned.

Several studies show CEO turnover occurs during the boom cycle and right before a turning point in the economy. As we noted, CEOs have a lead on the economy and understand when a turning could be nearing.

So it makes sense why the turn over rate is at 17-year highs in the “greatest economy ever,” because CEOs understand what could happen next, after all this economic hype from President Trump is exhausted (likely next year) — the economy could turn down.

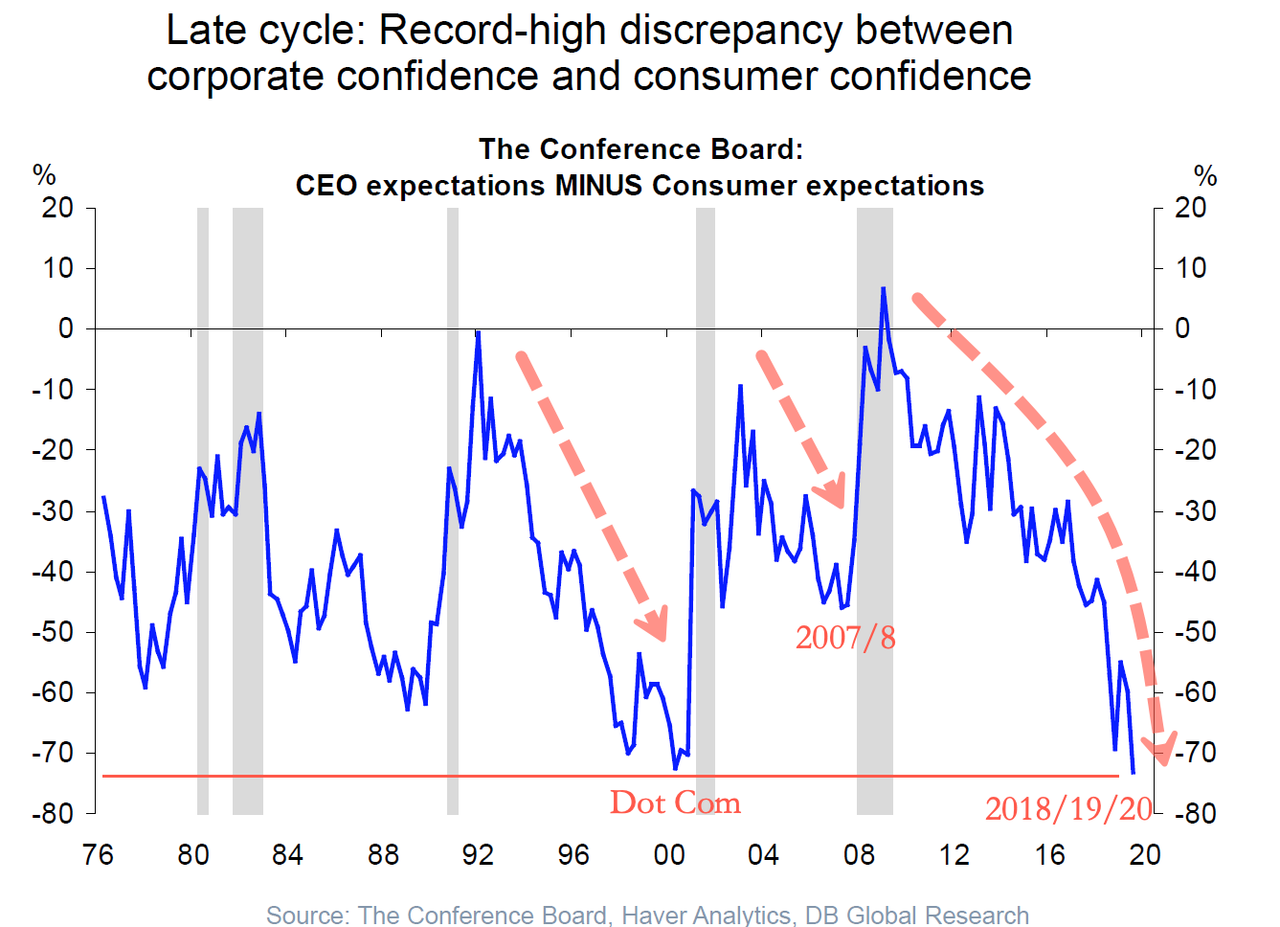

Deutsche Bank Research published a spread between corporate confidence and consumer confidence. It shows while the consumer is feeling wondering about the “greatest economy ever,” CEOs are quietly exhibiting unprecedented pessimism about the outlook.

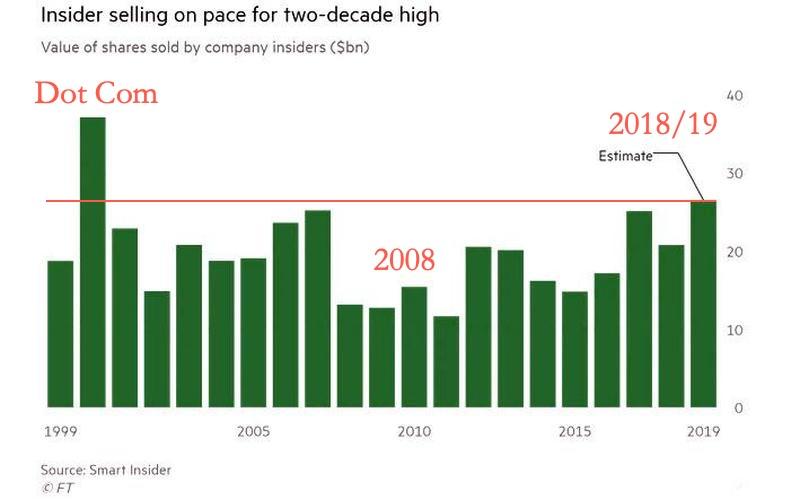

CEOs and C-Suite folks, all of whom have a firm grasp of what lays ahead of the US economy in 2020, are also selling stock at record amounts as markets are pumped to new highs on “trade optimism” headlines and massive central bank money printing.

Historical patterns show that when CEOs abandon their positions and C-Suite folks dump high amounts of stock, they all know what’s coming: a recession.

Tyler Durden

Wed, 12/11/2019 – 16:45

via ZeroHedge News https://ift.tt/36oq66q Tyler Durden