Central Banks Alarming Moves Towards Social Engineering

Authored by Bruce Wilds via Advancing Time blog,

Recently the central banks have found themselves grasping at straws when it comes to moving the economy forward. Signs have begun to appear on the horizon that in the future they will attempt to expand their power by increasing their role in social engineering. This is a term that refers to efforts to influence particular attitudes and social behaviors on a large scale. Its goal is to produce or change certain desired social characteristics in a population. In the past, this has been more the role of governments with the consent of the people often through laws and tax policies.

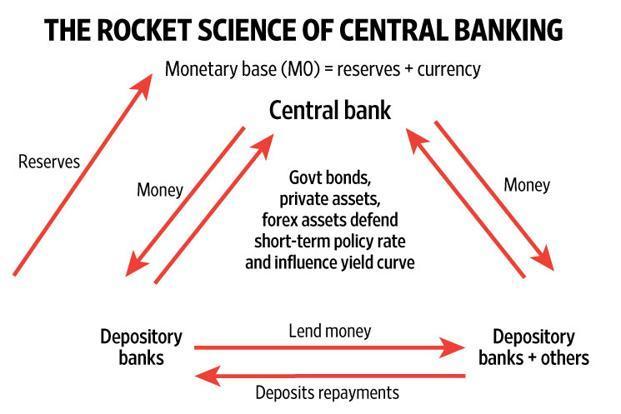

In America, the Fed was initially given the mandate to create a stable monetary environment. Since that time it has been expanded into what is now known collectively as the “dual mandate.” Now its two goals also include achieving maximum sustainable employment in conjunction with price stability. The Federal Reserve’s Federal Open Market Committee (FOMC), which sets U.S. monetary policy, has translated these mandates in rather broad terms.

In the last few weeks, Christine Lagarde, the new head of the ECB, said something that shocked many people. She stated,

“We should be happier to have a job than to have our savings protected… I think that it is in this spirit that monetary policy has been decided by my predecessors and I think they made quite a beneficial choice.”

If this is true we are in big trouble. It is a sign that something is terribly wrong, the idea that you can have a job but you can’t save anything, places workers in a position of servitude where they are dependent on, at the total mercy of the economy and the government.

Central Banks Basic Mission- click to enlarge

For many decades the entire financial system has been built on the premise that people save, either to purchase big items or for their old age. Is Lagarde suggesting that workers and those that have saved may soon be as dependent on the government as those already wrapped in the safety of government social programs that provide them with shelter and food? This comes at a time when it is predicted that more robots and automation will soon move in and strips humans of their jobs. With great sarcasm, one could opine that things would appear rather bleak without the generosity of central bankers.

The fact is, much of the money that has been saved by workers has flowed into pension systems and paper promises which the central banks feel compelled to support to keep the financial system afloat. Shortly after Lagarde’s remark Fed Chairman, Jay Powell commented that US central bankers see a “sustained expansion” ahead for the country’s economy, with the full impact of recent interest rate cuts still to be felt. This follows a massive injection of liquidity to financial markets,

On top of this, Japan has just laid out another massive stimulus package. This highlights the failure of negative interest rates to move the country forward. This should make it clear, that “extreme has become the new normal.” Now with the economy and governments totally dependent on freshly released goodies flowing from the central banks it looks like they are ready to up their game and move more into social engineering. This dovetails with the efforts of those endorsing a New World Order to push forward with “the Green New Deal” as a way to take control of the future.

A hint of her desire to move in this direction, for the “greater good,” came in Lagarde’s much anticipated first appearance as president of the ECB before at the European Parliament. Many of the questions at the parliament hearing focused on climate change, an area where the central bank is under pressure to play a bigger role. Lagarde indicated the fight against climate change should be a central part of policy. Lagarde also said it was also worth discussing whether climate concerns should impact the ECB’s QE policy.

Freaky Mural Of Thunberg In San Fransisco

This comes at a time when many media outlets are practically painting child Eco-activist Greta Thunberg as an authority on climate change. This portrayal rather than showing her as simply a passionate young person caught up in a frenzy tends to cement her claims in the minds of those concerned about the environment. TIME Magazine has even named the 16-year-old climate-alarmist Great Thunberg as “Person of the Year.” Because of the momentum behind environmental concerns, we may see a rush to enact strict environmental regulations without considering how they often do more harm than good or miss the target for which they are intended.

This intersects with globalists and those endorsing a New World Order pushing the Green New Deal agenda forward as a way to take control of the future. This extends into the dangerous area of central banks taking positions that propels forward investments in what is claimed to be environmentally friendly initiatives. Lagarde is out front with this as she goes about galvanizing her new position at the ECB. Now with an alarming new United Nations report screaming that climate change is probably the biggest challenge of our time she has something she can clone onto. Consider this an effort for central banks to regain their credibility and mitigate damage to their reputations for bailing out the very people that created the last economic crises. After exacerbating inequality they are now introducing to the conversation expanding and pursue new mandates

Lagarde is politically seasoned after her time as head of the IMF an organization that few people know much about and is highly overrated in its ability to solve problems. She demonstrated this when she asked EU lawmakers on Monday to give her time to “learn the ropes” of her new job and to reshape the ECB’s monetary policy. This, of course, circles back to politics and the fact our system is geared at getting politicians re-elected and fulfilling the most pressing needs of today. Things like profit, greed, and desire for growth is placed in front of longer-term issues and needs. Mapping out a logical and sustainable long-term plan requires delving into some rather hefty philosophical questions like what brings real happiness. This is far outside the banking sector.

Over the years we have been sold many empty promises. Much of this has been driven by mega-companies desire for larger markets and greed. Today, many large companies have more power than most nations and their power continues to grow. In the past, it was large oil conglomerates that held the power but today much of it has shifted to technology companies. Knowledge is power and this means is not just about large conglomerates that produce products or energy but extends into how internet companies, in particular, have placed themselves in the position where they control the communication networks collecting and storing data on all of us putting them in a position to manipulate us in every way.

The problem of giving these clowns (that have already failed to guide us towards a sustainable economic future) the power to assess whether and to what extent an asset is environmentally harmful or helpful is incredibly problematic. It is extremely difficult to think public officials and bankers that seem almost afraid to talk about conservation are in any way the answer. The dreaded “C” word, conserve, has no place in their vocabulary. Big business and their lobbyist have made this subject taboo because cutting back on waste would massively lower the GDP.

Forever and a day, the central banks and politicians have been busy urging consumers to buy, buy, and then buy more even if it puts you in debt. They have also encouraged people to make investments no matter if they are warranted or not. The thing they have not pursued is giving people enough reason to sacrifice and save. All this has been done to drive the economy forward. The idea they are capable of reversing decades of trained behavior and successfully replacing domestic consumption with quality infrastructure spending is pure folly. In the end, it will result in a slew of bridges to nowhere and failed boondoggles that line the pockets of the same mega-companies that have profited in the past.

Tyler Durden

Fri, 12/13/2019 – 11:55

via ZeroHedge News https://ift.tt/2RPeh5l Tyler Durden