Goldman Is Displeased: “The Tariff Reduction Is Only Half What We Expected”

While a close read of the “Phase One” deal reveals that, when stripped of all the cheerleading, it is largely hollow with China making an impossible promise to quadruple its ag imports from the US, something it will never do, in exchange for the US not implementing Dec 15 tariffs and cutting in half the rate on the latest round of tariffs, something Trump was hoping to do to avoid a market crash, even those institutions that used its widely anticipated passage as grounds for a rebound in optimism can’t help but be critical of what the USTR announced earlier today.

Case in point: Goldman Sachs, which has for weeks predicted that the upcoming trade war truce would be critical for the company’s bullish bias on the 2020 economy, couldn’t help itself in pointing out that the tariff rollback announced today falls short of our baseline expectation.”

This means that net of the 50% tariff cut in the Sept 2019 tariffs, the overall decline in Chinese tariffs is effectively negligible and represents just a 10% reduction in all Section 301 duties on Chinese goods. Here Goldman had assumed that the agreement would eliminate tariffs on List 4A entirely, which would have represented a roughly 20% reduction in Section 301 tariffs.

In other words, for all the excitement, all the US has done is lower its blended tariffs on China by a token 10%, which will have no impact on any production, capex or supply chain substitution plans.

Goldman’s full report is below:

BOTTOM LINE: Officials from the US and China have made formal statements indicating that a deal has been reached. There is still some uncertainty regarding details, but the most important development is that the White House has agreed to reduce September 1 tariffs (List 4A) on roughly $120bn in imports from China from 15% to 7.5%. While this signals a clear shift in the direction of US-China trade policy—i.e., tariffs are falling, not rising—the reduction is only half as large as our baseline assumption. We note that there is still some uncertainty regarding the status of this agreement, as it appears once again that some technical and legal details are still in flux.

MAIN POINTS:

- Officials from the US and China have made formal statements indicating that they have reached agreement on a “Phase One” trade deal that, according to the US Trade Representative (USTR) addresses “intellectual property, technology transfer, agriculture, financial services, and currency and foreign exchange” and “includes a commitment by China that it will make substantial additional purchases of U.S. goods and services in the coming years.” Neither US nor Chinese officials have been specific about what the reforms are, nor has there been any detail provided regarding the size of Chinese agriculture purchases from the US.

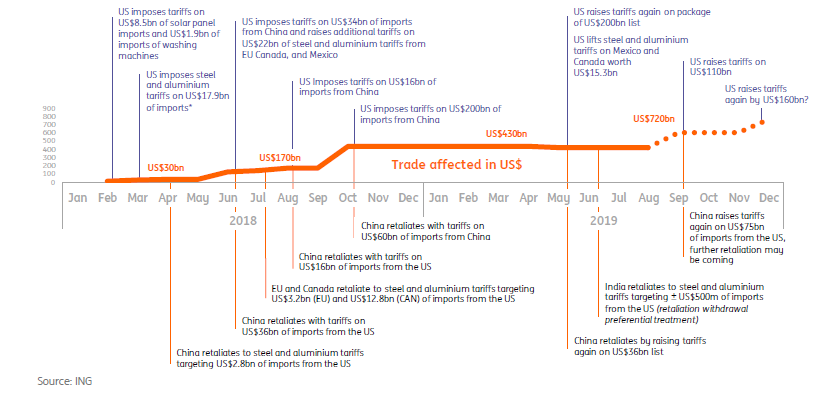

- The agreement includes a tariff rollback, as expected, but it falls short of our baseline expectation. Out of the slightly more than $500bn in goods the US imports from China, roughly $370bn are currently subject to tariffs, including roughly $120bn in goods that face 15% tariffs as of Sep. 1, known as “List 4A”. According to USTR, tariffs on List 4A will be reduced from 15% to 7.5%. This would represent a roughly 10% reduction in Section 301 duties on Chinese goods. We had assumed that the agreement would eliminate tariffs on List 4A entirely, which would have represented a roughly 20% reduction in Section 301 tariffs.

- While the smaller tariff rollback is slightly negative relative to our expectations, we note that the most important aspect of the agreement—assuming it is finalized—is that US tariffs are now set to decrease, marking a sharp turn from the US stance over the last two years. We estimate that, compared to our baseline assumption that the White House would remove tariffs on List 4A entirely, the impact of trade policy on Q4/Q4 US growth by the end of 2020 should be 0.07pp more negative than what had previously assumed, and that the impact on core PCE inflation should be 0.03pp higher. That said, these are relatively small numbers and the tariff reduction is still a net positive compared to the status quo.

- Our Asia Economics team believes that the incremental effect of this deal on the Chinese economy is also relatively small, as it is close to our baseline expectation of no additional tariffs and a roll back of the tariffs on List 4A. As a result, we do not expect the policy stance stated at the Central Economic Working Conference to be changed by this phase 1 deal.

- The lack of detail and statements that the agreement still needs to undergo “legal review” suggests that there is still some uncertainty regarding the specifics. That said, the fact that officials from both countries have made announced a deal along the same lines indicates, in our view, that the odds that the two sides fail to finalize the deal are low.

Tyler Durden

Fri, 12/13/2019 – 14:44

via ZeroHedge News https://ift.tt/2ssS1mQ Tyler Durden