“The Boom In Orders Is Over” – Commercial Jet Bubble Set To Implode

CNBC has pieced together a new report that details how the commercial jetliner boom is over, and Airbus and Boeing are entering the 2020s with uncertain futures as the global economy and air traffic growth exhibit a slowdown.

“The boom in orders is over,” said Sheila Kahyaoglu, aerospace analyst at Jefferies.

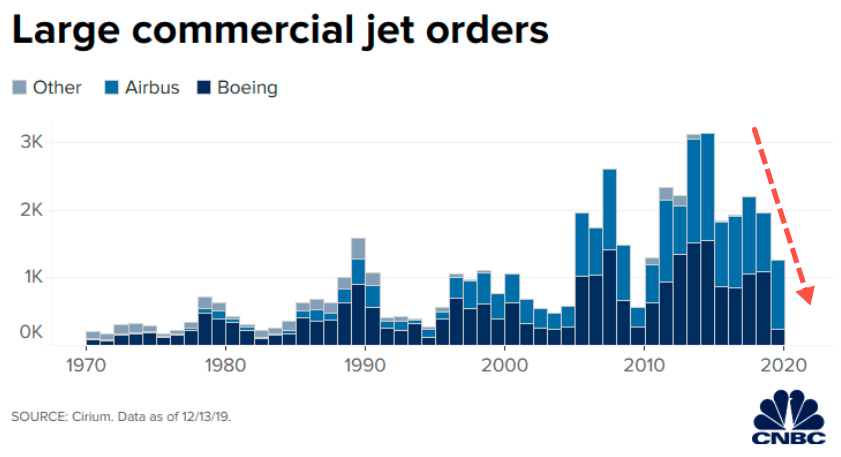

Shown in the chart below, large commercial jet orders for Airbus and Boeing took off after 2009 after central banks slammed rates to zero and produced a synchronized recovery in the global economy that allowed airline carriers to rapidly updated and expanded their fleets.

Airbus and Boeing recorded more than 20,000 orders for jetliners in the past ten years, a 66% increase over the previous decade.

Orders peaked in 2014/15 as carriers were concerned about fuel prices, labor increases, and slowing global growth, which forced many airlines to slash demand for new passenger jets.

Aerospace and defense analysis firm Teal Group said Airbus and Boeing have about $800 billion of order backlogs.

“The industry is probably on the other side the peak,” said Ron Epstein, research analyst at Bank of America. “The question is going to be a soft landing or a hard landing, and it looks like a soft landing.”

Growth in air travel has slipped as the global economy continues to decelerate in a synchronized fashion with the threat of a trade recession increasing.

The International Air Transport Association warned that “traffic growth continues to be depressed compared to historical long-term growth levels, reflecting continued moderating economic activity in some key markets and sagging business confidence.”

“If you’re a manufacturer, you kind of got addicted to growth,” said Richard Aboulafia, an analyst at Teal Group. “How do you explain to investors: ‘It’s okay. It’ll be a plateau’?”

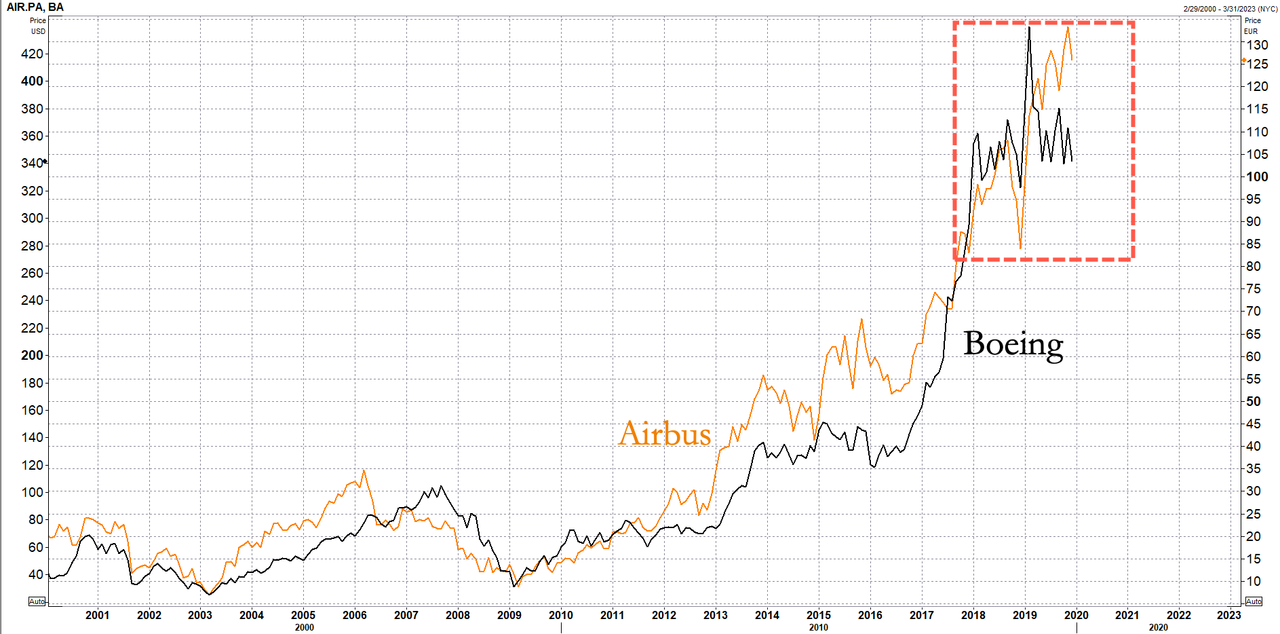

Even though Airbus and Boeing are sitting on a massive backlog of orders, new orders are crashing lower with a global economy that is sinking. Equity shares in both manufacturers could have already hit some near term tops.

Tyler Durden

Mon, 12/16/2019 – 13:55

via ZeroHedge News https://ift.tt/2PsTa7h Tyler Durden