Platts: 4 Commodity Charts To Watch This Week

Via S&P Global Platts Insight blog,

OPEC and allies may have reached a deal on crude oil production cuts, but the hard work to achieve a balanced market starts now. S&P Global Platts editors look at the challenge OPEC faces in early 2020, as well as key trends in global LNG, marine fuels and lithium.

1. Can OPEC deliver a balanced oil market in 2020?

What’s happening? OPEC has its work cut out to rebalance the market in the first half of 2020, despite the International Energy Agency lowering its forecast for non-OPEC oil supply growth on reduced expectations for US, Brazil and Ghana along with planned aggressive output cuts from OPEC’s allies.

What’s next? OPEC and its allies will be implementing their 1.7 million b/d production cut deal in January with potentially another 400,000 b/d in voluntary cuts from Saudi Arabia. However, it is dependent on all producers toeing the line, including Iraq and Nigeria, whose records on compliance have been poor. Along with the IEA, other analysts including Platts Analytics paint a not dissimilar picture of the OPEC alliance struggling in the face of non-OPEC supply growth and particularly weak first quarter seasonal demand.

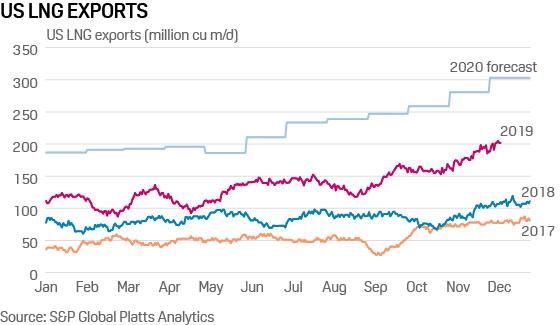

2. Global LNG supply glut keeps downward pressure on European prices

What’s happening? European gas markets saw a rare bounce December 12, with traders referencing “an overdue correction” and “a short squeeze” driven in part by newsflow on a possible US-China trade deal. A day later, however, and bearish fundamentals were see re-asserting themselves. Oversupply has been the dominant theme of 2019, with record levels of LNG flooding the global market. With Asian demand down, cargoes have had to find a home in European storage, which had maxed out by mid-Q4 2019.

What’s next? Large volumes of new LNG supply are due be added to the market in 2020, with supply predominately concentrated in the US. “Significant US delays at this point are unlikely, as the incremental increases are coming from the ongoing ramp up of two new three-train US projects and some expansions,” S&P Global Platts Analytics says. It forecasts addition of 32 Bcm of supply, versus an absolute liquefaction capacity increase of 40 Bcm.

3. Marine fuel suppliers mobilize on eve of IMO 2020

What’s happening? The International Maritime Organization’s global sulfur limit rule starting January 1, known by the shorthand IMO 2020, is set to spur demand for cleaner fuels and alter the dynamics of the bunker and shipping industries. At least 40 tankers are being used as floating storage units around Singapore and nearby Malaysian ports, mostly for fuel oil, according to market sources and Platts cFlow. The chart above shows soaring sales of lower-sulfur fuels in Singapore in recent months. The bulk of FSUs in the region are loaded with low sulfur fuel oil or blending components, in preparation for supplying compliant low-sulfur fuel for ships, market sources said.

What’s next? The number of tankers around the Singapore Strait will likely decline over the coming weeks as low-sulfur material in floating storage is moved to landed storage to meet rising demand for marine fuels compliant with the IMO rule. Several vessels storing low-sulfur fuel for weeks around Singapore, including five VLCCs and three Suezmaxes, have already moved out after offloading their cargoes, according to sources and cFlow, S&P Global Platts trade-flow software.

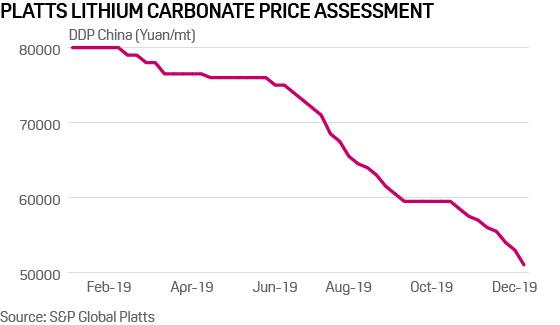

4. Lithium market may have further to fall

What’s happening? As the year draws to a close, lithium prices continue to stick to the script they have followed throughout 2019, pressured by oversupply and lackluster demand. Producers hoping to turn inventory into cash before the year end have let material go at ever lower prices, squeezing the Platts assessment of lithium carbonate delivered in China to just Yuan 51,000/mt, its lowest level since the assessment began.

What’s next? Despite having fallen in price for eight consecutive weeks, hopes of recovery for lithium look slim. The view from those in the market is that prices could slip below Yuan 50,000/mt. With some producers reportedly selling below the cost of production, there is an expectation that run rates could be reduced. However producers are reluctant to be the first to blink, fearing losing out on the resultant price bump. While the curtailment of production could help reduce the present oversupply, it will do little to improve demand which continues to suffer due to EV sales stalling. Looking even longer term, a major producer has said that they expect the oversupply to persist until the third quarter of 2020.

Tyler Durden

Mon, 12/16/2019 – 14:50

via ZeroHedge News https://ift.tt/38KclRz Tyler Durden