Democrats, Deficits, & Whistling Past The Graveyard

Authored by Lance Roberts via RealInvestmentAdvice.com,

I was stunned by a recent article from Marshall Auerback via The Nation entitled “Why Democrats Need To Stop Worrying And Love The Deficit.”

“Delivering on big progressive ideas like Medicare for All and the Green New Deal will never happen until Democrats get over their fear of red ink.”

While the article is long, winding, and a convoluted mess of ideas, the following is the all you really need to read:

The perceived problem:

“In an environment increasingly characterized by slowing global economic growth, businesses are understandably hesitant to invest in a way that creates high-quality, high-paying jobs for the bulk of the domestic workforce. The much-vaunted Trump corporate “tax reform” may have been sold to the American public on that basis, but corporations have largely used their tax cut bonanza to engage in share buybacks, which fatten executive compensation but have done nothing for the rest of us. At the same time, private households still face constraints on their consumption because of stagnant wages, rising health care costs, declining job security, poorer employment benefits, and rising debt levels.

Instead of solving these problems, the reliance on extraordinary monetary policy from the Federal Reserve via programs such as quantitative easing has exacerbated them. In contrast to properly targeted fiscal spending, the Federal Reserve’s misguided monetary policies have fueled additional financial speculation and asset inflation in stock markets and real estate, which has made housing even less affordable for the average American.”

The Non-Solution

According to Mr. Auerback is the solution is simple:

“Democrats should embrace the ‘extremist’ spirit of Goldwater and eschew fiscal timidity (which, in any case, is based on faulty economics). After all, Republicans do it when it suits their legislative agenda. Likewise, Democrats should go big with deficits—as long as they are used for the transformative programs that progressives have long talked about and now have the chance to deliver.”

This is essentially the adoption of Modern Monetary Theory (MMT), which, as discussed previously, is the assumption debt and deficits “don’t matter,” as long as there is no inflation.

“Modern Monetary Theory is a macroeconomic theory that contends that a country that operates with a sovereign currency has a degree of freedom in their fiscal and monetary policy, which means government spending is never revenue constrained, but rather only limited by inflation.” – Kevin Muir

However, the solution isn’t really a solution.

Mr. Auerback suggests the Democrats should go big with deficits to fund the “transformative programs” they have long talked about. These programs are, as we know, socialistic from government-run healthcare to more social welfare, to free college.

The problem is that these progressive programs lack an essential component of what is required for “deficit” spending to be beneficial – a “return on investment.”

This was a point addressed by Dr. Woody Brock previously in “American Gridlock;”

Country A spends $4 Trillion with receipts of $3 Trillion. This leaves Country A with a $1 Trillion deficit. In order to make up the difference between the spending and the income, the Treasury must issue $1 Trillion in new debt. That new debt is used to cover the excess expenditures but generates no income leaving a future hole that must be filled.

Country B spends $4 Trillion and receives $3 Trillion income. However, the $1 Trillion of excess, which was financed by debt, was invested into projects, infrastructure, that produced a positive rate of return. There is no deficit as the rate of return on the investment funds the “deficit” over time.

There is no disagreement about the need for government spending. The disagreement is with the abuse and waste of it.

John Maynard Keynes’ was correct in his theory that in order for government “deficit” spending to be effective, the “payback” from investments being made through debt must yield a higher rate of return than the debt used to fund it.

Currently, the U.S. is “Country A.”

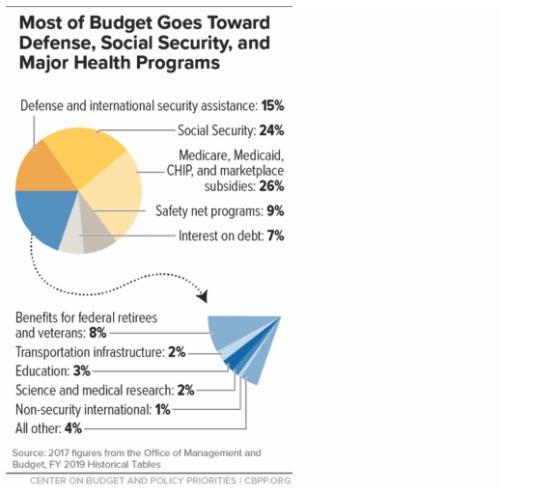

The programs that Mr. Auerback suggests the Democrats pursue with deficit spending, only exacerbate the current problem. According to the Center On Budget & Policy Priorities, roughly 75% of every current tax dollar goes to non-productive spending. (The same programs the Democrats are proposing.)

To make this clearer, in 2018, the Federal Government spent $4.48 Trillion, which was equivalent to 22% of the nation’s entire nominal GDP. Of that total spending, ONLY $3.5 Trillion was financed by Federal revenues, and $986 billion was financed through debt.

In other words, if 75% of all expenditures go to social welfare and interest on the debt, those payments required $3.36 Trillion of the $3.5 Trillion (or 96%) of the total revenue coming in.

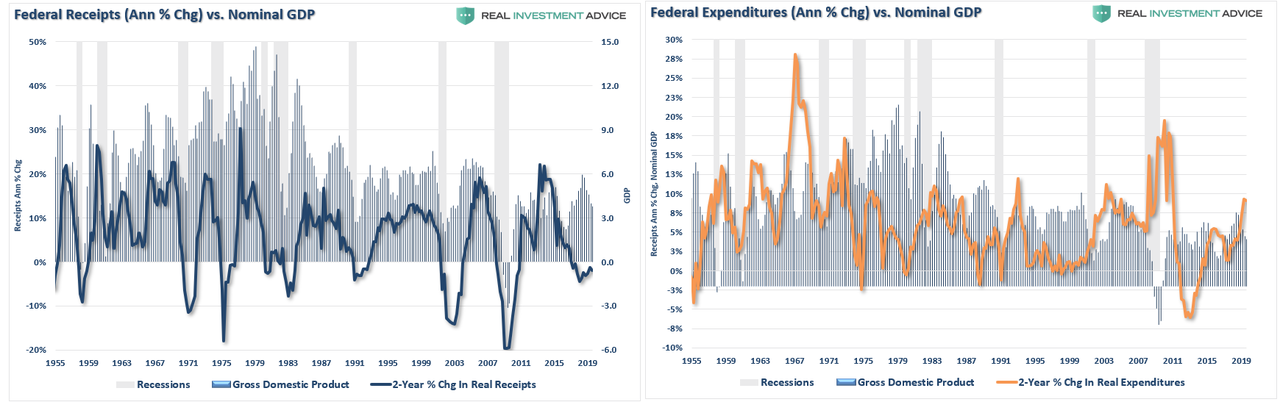

Currently, because of corporate tax cuts, a slowing economic environment, and weak wage growth, tax revenues have declined as federal expenditures have surged.

The result of unbridled fiscal largesse is a surging deficit that must be met by growing debt issuance.

Debt Begets Debt

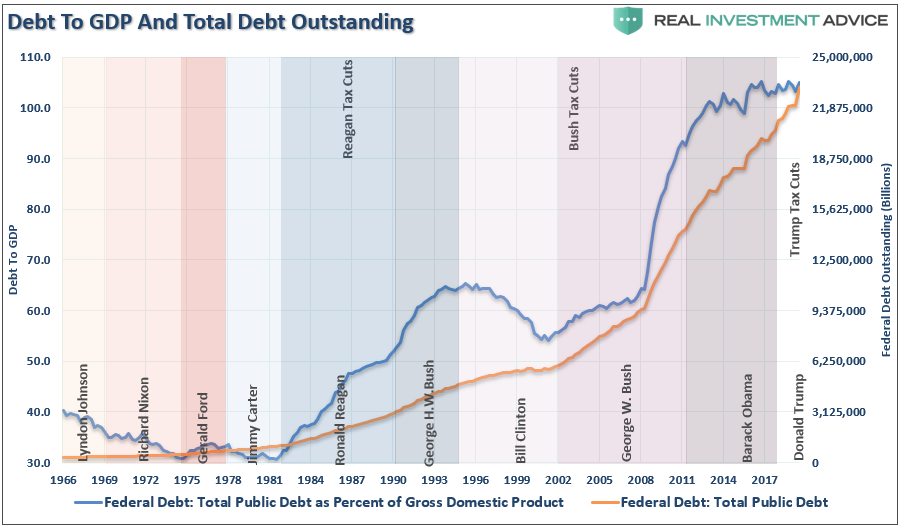

There used to be an actual debate between “Austerity” and “Spending.” Conservatives in Government used to at least talk a “good game” about cutting spending, budgeting, and debt reduction. Now, that is no longer the case as during the past several Administrations, both “conservative” and “liberal” have opted for more “fiscal largesse.”

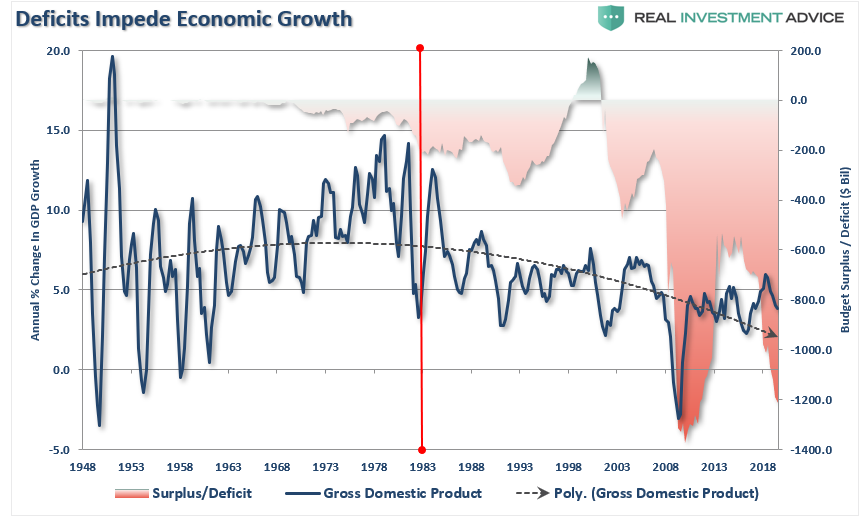

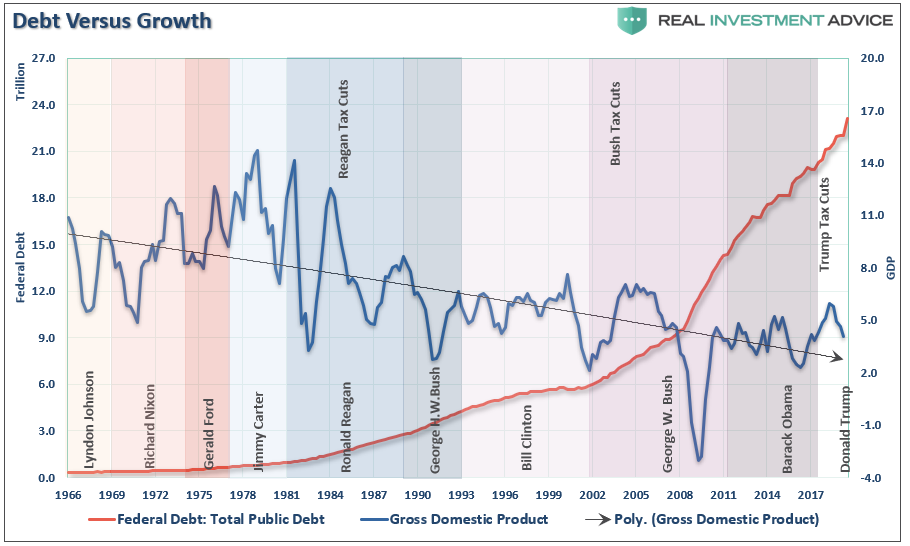

The irony is that increases in debt only lead to further increases in debt as economic growth must be funded with further debt. As this money is used for servicing debt, entitlements, and welfare, instead of productive endeavors, there is no question that high debt-to-GDP ratios reduce economic prosperity over time. In turn, the Government tries to fix the “economic problem” by adding on more “debt.” The Lowest Common Denominator provides more information on the accumulation of debt and its consequences.

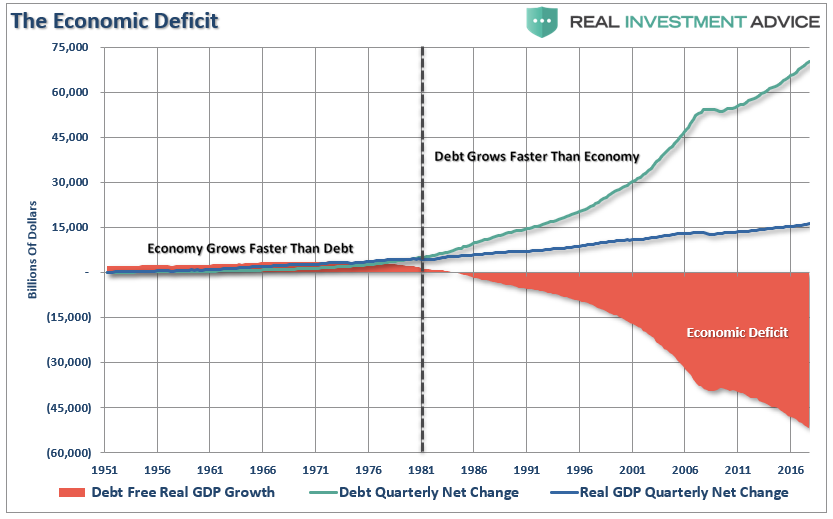

Another way to view the impact of debt on the economy is to look at what “debt-free” economic growth would be. In other words, without debt, there has been no organic economic growth.

For the 30-year period, from 1952 to 1982, the economic surplus fostered a rising economic growth rate which averaged roughly 8% during that period. Today, with the economy expected to grow at just 2% over the long-term, the economic deficit has never been greater. If you subtract the debt, there has not been any organic economic growth since 1990.

What is indisputable is that running ongoing budget deficits that fund unproductive growth is not economically sustainable long-term.

Whistling Past The Graveyard

Let me be clear.

As Dr. Brock notes, deficit spending can be beneficial when the debt is used in a productive manner. The U.S. has the labor, resources, and capital for a resurgence of a “Marshall Plan” which could foster the development of infrastructure with high rates of return on each dollar spent.

However, that isn’t what Mr. Auerback, the Democrats, are suggesting or offering. The Government has already delved into the MMT pool over the last 40-years spending trillions bailing out banks, boosting welfare support, supporting Wall Street, and reducing corporate tax rates, which all have a negative rate of return.

The results have been disappointing, and suggesting that more of the same will produce a different result is the precise definition of “insanity.”

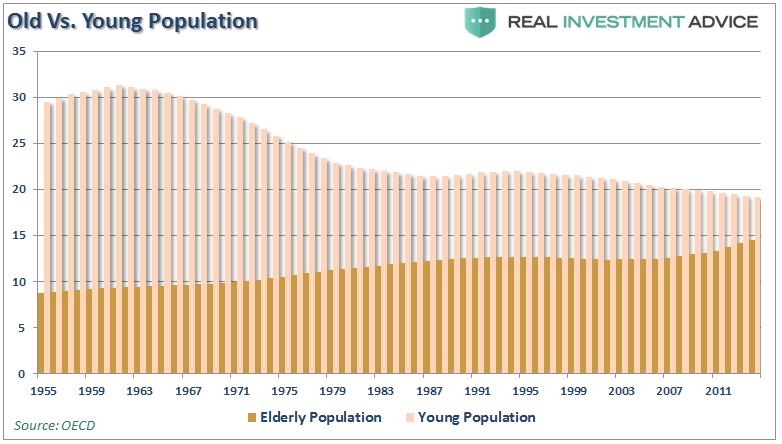

In the meantime, the aging of the population continues to exacerbate the underfunded problems of Social Security, Medicare, and Medicaid, which is roughly $70 trillion and growing. It is simply a function of demographics and math.

As Dr. Brock noted:

“Mathematics and Sex create performance anxiety in men – because you can’t fake the outcome of either.”

Two recent studies show the problem clearly.

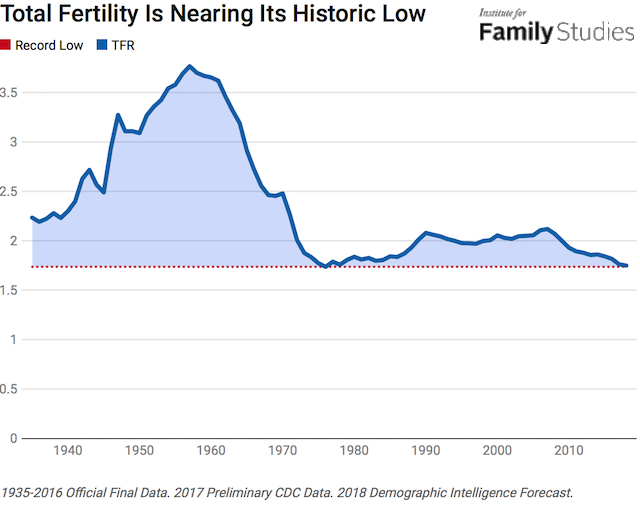

Demographics is an easy problem to see and mathematically calculate. The ratio of workers per retiree, as retirees are living longer (increasing the relative number of retirees), and lower birth rates (decreasing the relative number of workers), present a massive headwind to economic solvency.

The Institute for Family Studies, published a report showing the decline in the fertility ratio to the lowest levels since 1970,

With fertility rates low, the future “support-ratio” will continue to be a problem.

The second, and more immediate, problem is the vastly underfunded savings of the “baby boomer” generation heading into retirement. To wit:

” Anxiety over retirement and how to support oneself after calling it a career is impacting many Americans. A recent poll found that one in three adults has less than $5,000 in retirement savings.”

This is simple math.

Currently, 75.4 million Baby Boomers in America—about 26% of the U.S. population—have reached or will reach retirement age between 2011 and 2030. A vast majority of them are “under saved” and primarily unhealthy.

This combination ensures the demand on the health care system, along with Medicaid and Medicare, will increase at a rate faster than it can supply. Bankruptcy, without substantive changes, is inevitable.

Of course, it isn’t just the social welfare and healthcare system that is effectively “broken,” but the economic model itself.

The current path we are on is unsustainable. The remedies being applied today is akin to using aspirin to treat cancer. Sure, it may make you feel better for the moment, but it isn’t curing the problem.

Unfortunately, the actions being taken have been repeated throughout history as those elected into office are more concerned about “satiating the mob with bread and games” rather than suffering the short-term pain for the long-term survivability of the empire.

In the end, every empire throughout history fell to its knees under the weight of debt and the debasement of their currency.

As Dr. Brock suggests – it is truly “American Gridlock” as the real crisis lies between the choices of “austerity” and continued government “largesse.”

One choice leads to long-term economic prosperity for all, the other doesn’t.

“Today we are borrowing our children’s future with debt. We are witnessing the ‘hosing’ of the young.”

Tyler Durden

Mon, 12/16/2019 – 21:10

via ZeroHedge News https://ift.tt/35uTgR9 Tyler Durden