Stocks Set For New All Time High On Trump Impeachment Day

Global stocks hovered just off record highs on Wednesday after climbing for five straight sessions, while S&P futures are gently levitating after getting stuck in a 10 points range for 3 days, as Britain’s pound nursed heavy losses in the wake of renewed Brexit uncertainty, wiping out all of its post-election gains and then some.

With global stocks at all-time highs, after rallying 23% this year and set for their best year in a decade and the fourth-best year ever, and the U.S.-China trade accord announced Friday yet to be signed, traders are finding few reasons to bid prices higher according to Bloomberg. The silver lining: the outlook for US monetary policy remains steady – two Fed officials repeated that interest rates are on hold indefinitely – yet yesterday’s miserable results from FedEx were a reminder of the headwinds to growth.

FedEx Corp reported Q4 19 Adj EPS USD 2.51 vs. Exp. 2.84, Revenue USD 17.3bln vs. Exp. USD 17.69bln. Co. cut its FY 20 EPS to USD 9.10-10.35 vs. Prev. USD 10.00-12.00. Co. said quarterly results declined due to weak global economic conditions, higher ground costs, loss of business from a large customer. FDX Shares declined almost 7% in after-market trade.

“We are a little bit cautious going into 2020, not getting too carried away with the optimism that the equity markets are displaying right now,” said OIC managing director Susan Buckley. “We are still looking at an outlook of slow growth in 2020.”

“I expect markets to end the year quietly but mildly positively, especially if the PBoC does nibble down the lending interest rate later this week,” said Chris Bailey European strategist at Raymond James. “Bigger challenges naturally await for next year … but I think traders and investors will be happier to grapple with these actually in 2020.”

US equity futures pointed to a directionless open a day after the S&P 500 Index closed just one index point higher at a new record high for the 4th straight session thanks to stronger factory and housing data. However FedEx plunged again on dismal earnings and catastrophic guidance for the second straight quarter, dragging down transport and logistic stocks. Meanwhile, the Emini has traded in the range 3,190 to 3,200 for three straight days.

The Stoxx Europe 600 Index fluctuated with country benchmarks mixed, fading all early gains as Germany’s Dax underperformed even as data showed business expectations improved for a third month.

French PSA Group rose and Fiat Chrysler Automobiles was steady after the auto giants agreed to combine in a deal to create the world’s fourth-biggest auto manufacturer. Volvo Group rallied after agreeing to sell its UD Trucks unit to Isuzu Motors Ltd. for about $2.3 billion. Luxury TV and stereo maker Bang & Olufsen plunged after issuing its fourth profit warning in a year.

Earlier in the session, Asian stocks drifted near an 18-month high, as investor weighed strong U.S. factory data against rising concerns about a hard Brexit. Markets in the region were mixed, with Thailand up and Japan down. Energy producers led gains while industrial companies retreated. The Topix slipped, driven by drug makers and electronic firms. Japanese exports dropped for a 12th straight month in November, dragged down by value of cars and construction and mining equipment. The Shanghai Composite Index slipped, ending a three-day rising streak; China Yangtze Power and China Life Insurance were among the biggest drags. India’s Sensex advanced, heading for a new record, as HDFC Bank and ITC offered strong support.

Today the political drama comes to a crescendo, as President Donald Trump is set to be impeached after the House votes on two articles that will likely set up a January trial in the Senate, where he’s expected to be acquitted. Helping Trump is the dramatic improvement in economic sentiment, and as reported yesterday, BofA Global Research’s latest survey of fund managers showed that a record surge in global growth expectations over the last two months had drastically cut recession worries.

While few expect the Republican-dominated Senate to force Trump from office, the impeachment process could focus investors’ attention on next year’s U.S. election risks.

Meanwhile, across the Atlantic, newly-elected British Prime Minister Boris Johnson has spooked markets by taking a hard line on Brexit talks. Johnson will use the prospect of a Brexit cliff-edge at the end of 2020 to demand the EU give him a comprehensive free trade deal in less than 11 months. The threat of a hard exit sent shivers through sterling, which slid 1.5% on Tuesday in its largest one-day fall this year. It then extended losses on Wednesday after tumbling Tuesday on renewed concern that a no-deal Brexit is possible, though it trimmed Wednesday’s decline when U.K. inflation came in steady. It fell another 0.2% on Wednesday and was last just below $1.31. The currency has shed all the gains made during the Conservative Party’s big election win.

“Johnson’s move aimed at cancelling the possibility of an extension, has essentially increased the possibility of a no deal Brexit,” said Rodrigo Catril, a senior FX strategist at NAB. “It suggests sterling’s path in 2020 looks set to be a volatile one, a hard Brexit cannot be ruled out, but the probability of a positive Brexit resolution has also increased.”

Elsewhere in FX, the euro was a shade softer at $1.1134, while Japan’s yen was little changed at 109.56 per dollar. The Turkish lira hit its weakest level against the dollar in more than two months after the U.S. Senate passed legislation with provisions to punish Ankara, raising concerns about already strained ties with Washington. It marked the lira’s fourth day of falls. The Turkish currency has lost more than 11% this year after a currency crisis chopped its value by 30% in 2018.

In commodities, oil prices eased from three-month highs as data showed U.S. crude stocks rose unexpectedly in the most recent week.

Looking at the day ahead we’ll get the final Euro Area CPI and core CPI readings for November, along with Canada’s CPI data. Meanwhile from central banks, there’s an ECB colloquium held in honour of Benoît Cœuré, whose 8-year term on the ECB’s Executive Board concludes at the end of the year. The conference will feature remarks from Cœuré himself, along with the ECB’s Lagarde and the Fed’s Brainard. Later on in the day, we’ll also hear from the Fed’s Evans.

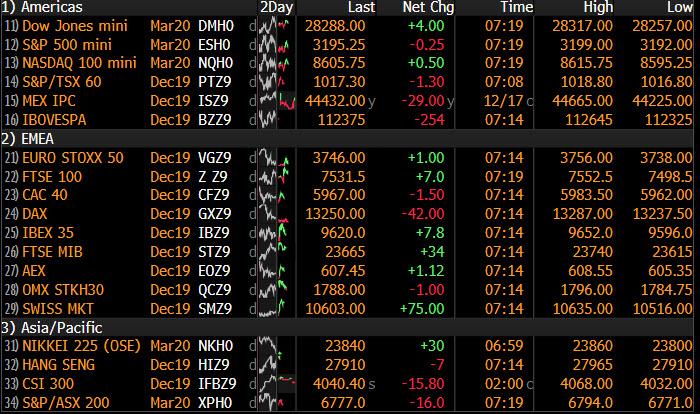

Market Snapshot

- S&P 500 futures up 0.08% to 3,194.50

- STOXX Europe 600 up 0.2% to 415.84

- MXAP down 0.05% to 170.37

- MXAPJ up 0.2% to 550.15

- Nikkei down 0.6% to 23,934.43

- Topix down 0.5% to 1,738.40

- Hang Seng Index up 0.2% to 27,884.21

- Shanghai Composite down 0.2% to 3,017.04

- Sensex up 0.5% to 41,565.09

- Australia S&P/ASX 200 up 0.06% to 6,851.42

- Kospi down 0.04% to 2,194.76

- German 10Y yield rose 1.5 bps to -0.28%

- Euro down 0.1% to $1.1139

- Italian 10Y yield fell 2.2 bps to 1.104%

- Spanish 10Y yield unchanged at 0.392%

- Brent Futures down 0.6% to $65.71/bbl

- Gold spot up 0.2% to $1,478.38

- U.S. Dollar Index up 0.04% to 97.26

Top Overnight News from Bloomberg

- German business expectations improved for a third month in December, a sign manufacturers are starting to see a way out of a yearlong downturn. The Ifo Institute’s gauge rose the most since mid-2018 to 93.8, exceeding most estimates in a Bloomberg survey. The measure of the current situation rose, as did the overall business climate indicator

- Donald Trump’s legacy will be forever marked on Wednesday by his impeachment at the hands of House Democrats, who say it’s a necessary rebuke for the president’s pursuit of a political vendetta. On the eve of the vote, Trump defiantly rejected the move as a predetermined partisan assault

- Sweden’s pension industry is about to get its first taste of life after negative interest rates. Funds with a total of about $630 billion in assets have a lot at stake as their central bank becomes the first to exit the experimental monetary policy

- The Bank of Thailand held its benchmark interest rate steady at an all-time low and cut its forecasts for economic growth, saying it was gauging whether further efforts were needed to restrain the local currency

- The ECB’s Single Supervisory Mechanism will likely lift the ceiling on Greek banks’ holdings of the country’s sovereign bonds, people familiar with the situation said

- PSA Group and Fiat Chrysler Automobiles NV agreed to combine to create the world’s fourth- biggest carmaker, in the biggest automotive deal since Daimler acquired Chrysler two decades ago. The French and Italo-American carmakers will each own half of the new company with global sales of 8.7 million vehicles.

Asian equity markets traded mixed as the region lacked conviction in the absence of any fresh catalysts and following a relatively quiet session on Wall Street heading into the holiday season, where stocks consolidated around record highs due to the improved trade climate and after several encouraging tier-2 data releases. ASX 200 (+0.1%) and Nikkei 225 (-0.5%) were mixed as defensives just about offset the losses in miners, tech and financials to keep Australia afloat, while sentiment in Tokyo was weighed by adverse currency flows and mixed trade data in which Exports contracted for a 12th consecutive month albeit at a slightly narrower than expected decline. Hang Sang (+0.1%) and Shanghai Comp. (-0.2%) were indecisive amid diminishing effects from the US-China phase one agreement, while the PBoC’s first liquidity injection in 21 sessions also failed to spur prices despite announcing a total of CNY 200bln via 7-day and 14-day reverse repos at a reduced rate (2.65% vs Prev. 2.70%) on the 14-day operation. Finally, 10yr JGBs were higher following the bull-steepening in the US and with the BoJ also in the market for over JPY 1.1tln of JGBs in 1yr-10yr maturities, but with advances restricted as the BoJ kick starts its 2-day policy meeting.

Top Asian News

- Insurance Scandal Destroyed Trust in Japan Post, Panel Finds

- Macau Chooses China Riches Over Democracy, Unlike Hong Kong

- Japan’s Budget to Top 100 Trillion Yen Again, Document Shows

- Xi Says Willing to Talk to Macanese on Issues of Common Concern

A choppy day thus far for European stocks [Eurstoxx 50 +0.2%] following on from a mixed APAC session as markets quietened ahead of the Christmas holidays. Sectors are broadly mixed with some underperformance seen in consumer discretionary whilst staples outperform. The session has been mostly driven by individual stock movers – Fiat Chrysler (-0.1%) and Peugeot (+1.2%) have officially announced an agreement for a 50/50 merger in a EUR 50bln deal – with annual run-rate synergies expected at around USD 3.7bln. Before the deal is closed, Fiat Chrysler stated it will distribute a special dividend of EUR 5.5bln while PSA will distribute to its shareholders its 46% stake in Faurecia (-1.5%). Further, Fiat Chrysler notes that its robot-making unit Comau is to be spun off after the merger. Elsewhere, FTSE-listed NMC Health (-0.5%) opened higher to the tune of 10% (following yesterday’s 20% drop) after the Co. reaffirmed its guidance and announced a GBP 200mln share buyback programme in response to Muddy Water’s negative note. Meanwhile, postal names including Deutsche Post (-0.7%), Royal Mail (-2.8%) and Austrian Post (-0.7%) all experience headwinds from FedEx’s (-7.4% pre-market) earnings last night which saw the company downgrade its EPS forecast alongside dismal earnings, citing weak global economic conditions. Elsewhere, Volvo (+4.1%) shares are supported after the Co. and Isuzu Motors (7202 JT) are mulling a strategic alliance. Volvo sees a positive impact on operating profit of SEK 2bln from the alliance. Finally, further angst for Scandi banks after the Swedish FSA opened as opened a sanctions case against the Co. and a probe into SEB’s (-1.6%) governance and control of measures to combat money laundering. FSA plans to communicate the outcome of the case in April 2020.

Top European News

- German Business Outlook Improves as Slow Year Draws to Close

- Macron’s Government Renews Talks to End Pension Reform Gridlock

- U.K. Inflation Holds at Three-Year Low as BOE Decision Looms

- ECB May Let Greek Banks Buy More of Country’s Sovereign Debt

In FX, the broad Dollar and Index remains in positive territory thus far in a continuation of the upside seen overnight, with the DXY meandering just under current weekly highs and its 50 WMA, both near 97.360 – somewhat of a barrier in recent trade. News-flow on the US-Sino front has been quiet overnight, with US Treasury Secretary Mnuchin singing from the same hymn sheet as recent WH officials. Nonetheless, the lack of details regarding the Phase One deal has prompted caution among traders and investors. This tone is reflected in CNY and CNH, with the offshore choppy on either side of 7.000 vs. the USD and with a lack of conviction and awaiting further headlines. Meanwhile, today’s docket sees little by way of State-side data, although speakers include Fed’s Board of Governor member Brainard and 2020 non-voter Evans.

- EUR, GBP – Both trading modestly softer vs. the Buck and flat against each other. Sterling has held onto a bulk of yesterday’s losses and dipped below 1.3100 overnight before finding a base at around 1.3070 – with little reaction seen in light of mixed UK inflation metrics, in which headline CPI modestly topped forecasts alongside RPI, albeit PPI printed sub-par ahead of the BoE’s monetary policy update tomorrow. Elsewhere, EUR/USD saw very mild solace upon the German Ifo’s rosy release with all three metrics beating forecasts and priors seeing revisions higher. The institute added that the German Q4 German GDP is likely to increase by 0.2%. Aside from that, the Single Currency was little swayed by mostly unrevised EZ CPI figures with EUR/USD choppy within a tight 1.1127-54 intraday band (having retreated further below its 200 DMA at 1.1152). That said, decent option expiries may prompt some action amid holiday-thinned trade – with EUR 1.3bln expiring between strikes 1.1125-35 and a further EUR 1.6bln between 1.1140-50.

- AUD, NZD, CAD, JPY – All flat and within tight ranges vs. the USD in early EU trade, albeit more on the back of a firmer Buck as opposed to individual weakness – with the high beta on standby for their respective tier one data/events (aside from trade news-flow). AUD/USD hovers around 0.6850 at time of writing ahead of the much-anticipated Aussie jobs data due overnight as an indication of the RBA’s next policy move. Similarly, its Kiwi counterpart remains relatively sideways and just north of 0.6550 and ahead of its 50 WMA (0.6585) with NZ Q3 GDP on the radar. USD/CAD remains just above the 1.3150 mark and with little inspiration from softer energy prices as the Loonie looks ahead to its November CPI readings – with headline YY seen ticking higher in the month. Analysts at JPM believe that the USD/CAD risk-reward remains skewered towards to the topside as the bank sees the BoC reducing rates at least once next year – “CPI sticking around target shouldn’t challenge that, but if it were to come off, then it would be another excuse to cut”, JPM says. Finally, USD/JPY trades lacklustre just under the 109.50 mark ahead of the BoJ Monetary Policy Decision due to be released sometime during the Tokyo lunch break (Full preview available on the Newsquawk headline feed).

- EM – The Turkish Lira has seen renewed weakness after US senate passed a defence bill calling for Turkey sanctions over its purchase of the S-400 defence system – a bill which now falls into the hands of US President Trump for signing. The Turkish Defence Ministry responded that the bill contained hostile elements towards Turkey, in a sign that the relationship between the two countries are further deteriorating. USD/TRY has gained 5.900+ status to a high of 5.9200 (vs. low of 5.8829). Meanwhile, the ZAR experienced some weakness in early EU trade following source reports that the US is to review South Africa’s trade status at the end of January next year. USD/ZAR has pared back earlier upside, potentially on stabilisation on the Eskom front – which expects no loadshedding today despite constrained systems.

In commodities, WTI and Brent are around USD 0.50/bbl lower at present but remain above the USD 60/bbl and USD 65/bbl levels respectively. News-flow for the crude complex, and generally, has been light this morning with price action continuing to be dictated by the surprise API build of 4.7mln barrels (Exp. draw 1.2mln barrels); ahead of today’s EIA release where expectations are for a headline draw of 1.288mln barrels. Looking ahead, UBS note that a extended period of inventory builds often begins in Q1 due to the gap between winter demand and US driving season; which, while expected they believe may prompt some profit taking. Elsewhere, spot gold is firmer by just shy of USD 3/oz and resides near the top of the sessions range, but remains below yesterday’s high of USD 1480.35/bbl. Finally, copper prices remain within a narrow range for the session given a quiet APAC session and no further updates, as of yet, on the US-China front.

US Event Calendar

- 7am: MBA Mortgage Applications -5.0%, prior 3.8%

DB’s Jim Reid concludes the overnight wrap

Welcome to my last EMR of the decade. Am doing the dreaded 750 mile drive to the Alps tomorrow with the car bursting full of kids presents, clothes, toys and of course Bronte the dog. I have been allocated a one square foot area for all my luggage with a special dispensation if my luggage contains presents for my wife. Thanks for all the interactions, feedback and support this year and this decade. Let’s make a vow to stay together over the next decade. Happy Xmas and NY to you and all your loved and even less loved ones. Henry will be in the EMR hot seat for Thursday and Friday before a two week break in publication.

Talking of the next decade a reminder that our Imagine 2030 Konzept magazine was out recently where we ponder what life will be like as we welcome in the following decade. We published this on our client site here and our public site here. Feel free to forward on to clients, friends and family. We’ve had approaching 50,000 downloads which is by far the highest of any Konzept. To be fair I’ve got a flavour of its reach as I’ve been bombarded by every Crypto obsessive on the planet since the publication given my assertion that we may be rebelling away from fiat money by the time 2030 arrives.

For now the central bank liquidity that will eventually threaten fiat money is helping to drive a Santa rally. However yesterday was a day for Santa to have a rest and recharge his batteries with probably the biggest story being the reversal of Sterling following the story we discussed yesterday about Prime Minister Johnson’s plans to enshrine in law the drop dead date of end 2020 for the U.K. to exit the transition period with or without a trade deal.

Sterling was down by around -1.5% yesterday against the Dollar and the Euro and is now below levels seen just before the exit poll prediction of a big Tory majority, extending its losses slightly this morning. Indeed, yesterday was the worst day for sterling against both currencies since November 2018. I wish I’d have changed my holiday money a day earlier. DB’s Oli Harvey, who cautioned on chasing the currency immediately after the election, turned bearish on Sterling after the transition news and targets 0.9 on EUR/GBP (currently c.0.849). See his report here for more including how the risks of a 2020 U.K. recession and rate cut have gone up. Overnight S&P have taken the negative outlook away from the U.K. and given it a stable one on what they see is the removal of some uncertainty. Earlier Fitch had removed the negative credit watch but kept a negative outlook. Sterling is largely ignoring this and is edging lower again this morning (-0.2%). In our monthly investor survey (link here), out of a list of 10-15 major currencies Sterling was the most favoured (25%) over the next 12 months and also the second least favoured (15%). So it’s fair to say we’re probably in for another volatile year for the pound.

This U.K. news occurred alongside the phase-one relief rally running out of steam even if US markets still inched to another record high yesterday, as the S&P 500 ended up +0.03%, while the Dow Jones (+0.11%) and the NASDAQ (+0.10%) also saw modest upward moves. There weren’t any obvious catalysts to write about, but the moves came alongside a number of strong data releases from the US, particularly on housing, with housing starts up to 1.365m (vs. 1.345m expected), and building permits up to 1.482m (vs. 1.410m expected), their highest level since May 2007. Industrial production also beat expectations, up +1.1% (vs. 0.9% expected) in November, the biggest mom increase since October 2017. Other risk assets also benefited, with Brent Crude up around a percent to a fresh 3-month high, though it was a more downbeat story in Europe, where the Stoxx 600 ended a run of 4 successive upward moves to close down -0.68%. Thanks to the weaker currency, the multinational FTSE 100 (+0.08%) outperformed, although the more domestically-oriented FTSE 250 underperformed, ending the session down -1.05%, its worst day since October.

In fixed income, European sovereign debt advanced while US was flat.10yr Yields on bunds (-1.9bps), OATs (-1.6bps) and BTPs (-2.3bps) all fell. Notably, the 2s10s curve in the US steepened around a basis point further, to 25.3bps, its steepest level in over a month.

Overnight in Asia, the Nikkei has slipped from yesterday’s one-year high, currently trading down -0.41%. Other indices have also lost ground, with the Hang Seng (-0.08%), the Shanghai Comp (-0.08%) and the Kospi (-0.12%) all slightly lower. Elsewhere, S&P 500 futures are currently flat while Brent Crude is down -0.53%, falling back from the 3-month high reached yesterday.

Onto central banks, and we got another tweet from President Trump yesterday, who reiterated his calls for easier monetary policy, saying “Would be sooo great if the Fed would further lower interest rates and quantitative ease. The Dollar is very strong against other currencies and there is almost no inflation. This is the time to do it. Exports would zoom!” We also heard from Dallas Fed President Kaplan, who said that “at the moment, whereas I thought earlier in the year risks were to the downside, I’d say they’re more balanced.” He also said that “I’d be willing to tolerate some overshoot of the 2% target as long as it’s not persistent”.

As an interesting aside, given I’m off to the French Alps I’ve been keeping an eye on the French nationwide strikes. Fortunately for me DB’s Marc de-Muizon published a Q&A on the dispute which has reforms to the French pension system at the heart of it. See the link here for more. (link here). He talks about the main issues involved, including the differences between the current and the proposed systems, the reasons behind the protests and whether the government will push onwards. He writes that he expects the government will continue with the reforms, but “some further concessions will probably be needed.”

We started today with the U.K. so let’s end the decade with the UK. The jobs data out yesterday beat expectations, with employment up +24k (vs. -14k expected) in the three months to October compared with the previous three-month period, sending the 16-64 year old employment rate up to 76.2%, its highest level since records began in 1971. The unemployment rate remained at 3.8% (vs. 3.9% expected), while average weekly earnings growth (excluding bonuses) fell a tenth to +3.5% (vs. +3.4% expected). Finally on the UK, Bloomberg reported yesterday that the UK government was close to making its decision on the next Bank of England governor, with the incumbent Governor Carney due to leave the BoE at the end of January. The report said the appointment could come as soon as this week.

To the day ahead now, and the main data highlight comes with the December Ifo survey from Germany, before we get UK inflation data for November. Staying with the inflation theme, later on we’ll then get the final Euro Area CPI and core CPI readings for November, along with Canada’s CPI data. Meanwhile from central banks, there’s an ECB colloquium held in honour of Benoît Cœuré, whose 8-year term on the ECB’s Executive Board concludes at the end of the year. The conference will feature remarks from Cœuré himself, along with the ECB’s Lagarde and the Fed’s Brainard. Later on in the day, we’ll also hear from the Fed’s Evans.

Tyler Durden

Wed, 12/18/2019 – 07:58

via ZeroHedge News https://ift.tt/36Ohqqg Tyler Durden