China Won’t Rush Into Buying US Farm Products Under Phase One Deal, Warns US Trade Advisor

Tom Kehoe, an adviser to the US Department of Agriculture and US trade representative Robert Lighthizer, said the Chinese aren’t going to rush into agriculture purchases under the phase one deal, reported the Shanghai Morning Post.

“These are businesspeople,” Kehoe said.

“They are going to have to be in a competitive situation. Otherwise, they are not going to buy it.”

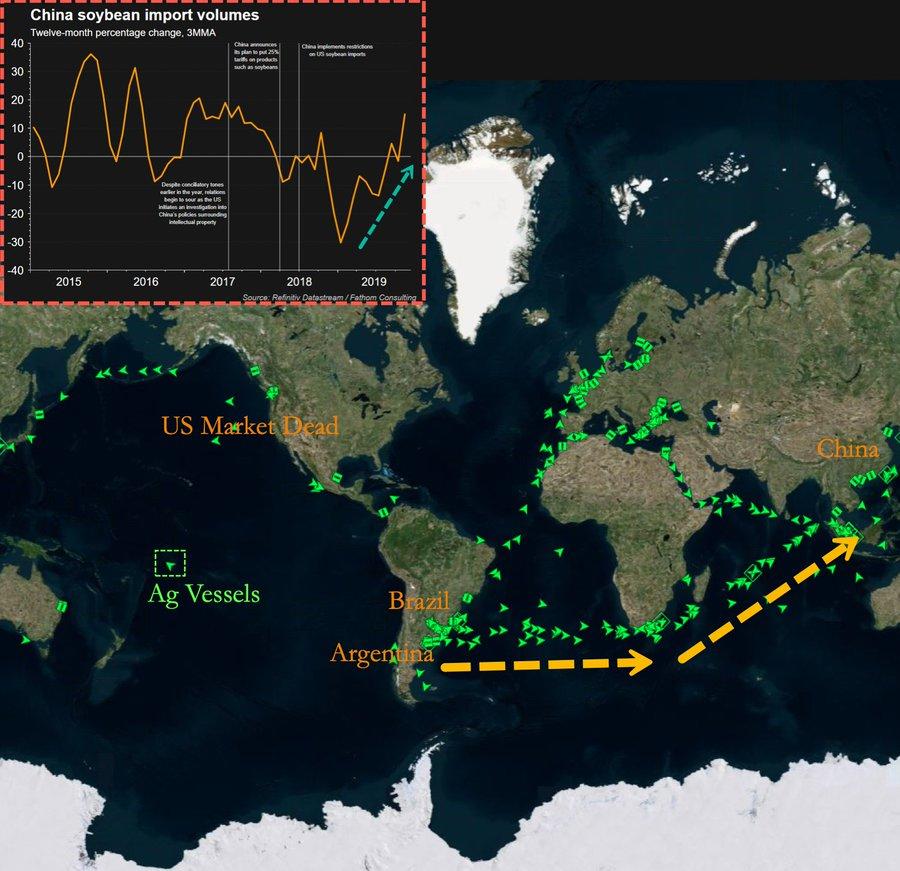

Kehoe said the Chinese had been more frequently sourcing farm products from Brazil and Argentina, where currencies have been weakened thanks to the global slowdown. Shown below, there’s an abundance of vessels carrying farm products from South America to China versus a relatively quiet North America.

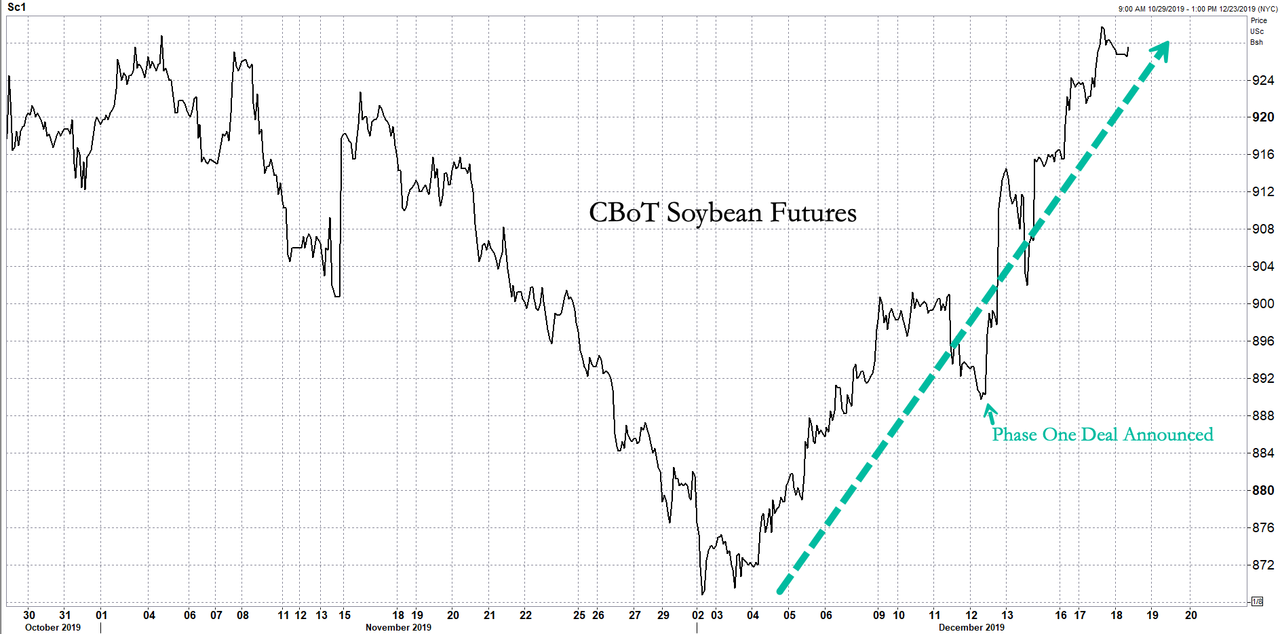

Spot prices for US farm products have been elevated this month, due to the prospects of a trade deal.

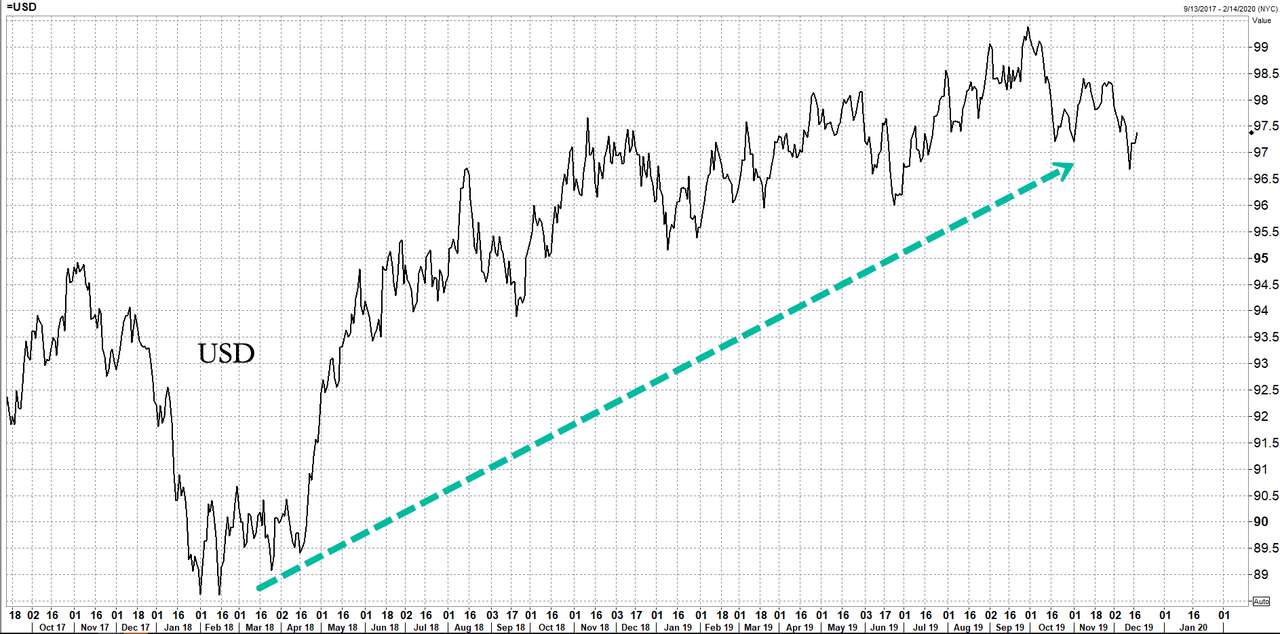

A stronger dollar, hovering above the 97-handle, has also made US farm products more expensive than the rest of the world.

Chinese importers are businesspeople – they need to make a spread, and will certainly not overpay for US farm products while they can buy the same products in South America for a discounted price.

China stressed last week that its agriculture buys will be based on market conditions and will source agriculture products from the US and other countries.

“.. while the Ministry of Commerce (Mofcom) statement outlined ‘six priorities, plus one’, including ‘properly dealing with China-US trade disputes’, there was not a single mention of the deal, nor did the ministry expand on that aim.” https://t.co/1jigDmV5mu

— Carl Quintanilla (@carlquintanilla) December 18, 2019

Beijing has promised to purchase $16 billion annually in commodities on top of the pre-trade war level of $24 billion and could buy as much as $50 billion annually, Lighthizer said last week.

There’s just one problem: as explained by former USDA Chief Economist and USTR ag negotiator, Joe Glauber, Beijing’s promise to quadruple US agricultural purchases to $50 billion is impossible (a detailed explanation can be found on the thread below).

1. So here is why I am skeptical about the size of the Phase 1 deal. US ag exports to China in FY 2017 were about $21.8 billion. Soybean exports accounted for $14.6 billion. pic.twitter.com/5LXRiZtjcU

— JoeGlauber–IFPRI (@JoeGlauber1) December 15, 2019

Given the execution risks going forward of the Chinese fulfilling their pledge of purchasing US farm products in the year ahead, highlighted by Kehoe, it seems that a strong dollar and elevated spot prices could force Chinese importers to continue sourcing from South America.

Tyler Durden

Wed, 12/18/2019 – 09:39

via ZeroHedge News https://ift.tt/34xrbaN Tyler Durden