WTI Surges Above $61 On Crude Draw, Demands Rebounds From 3-Year Lows

Oil prices remain lower following last night’s surprise crude inventory build reported by API but analysts continue to expect a draw in the official data this morning.

“As much as the API has taken the wind out of bulls’ sails, the lull in upside is expected to be short-lived,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London.

“After all, recent positive developments have given oil fundamentals for next year a supportive shot in the arm.”

API

-

Crude +4.7mm (-1.5mm exp)

-

Cushing -0.3mm

-

Gasoline +5.6mm – biggest build since Jan

-

Distillates +3.7mm

DOE

-

Crude -1.085mm (-1.75mm exp)

-

Cushing -265k

-

Gasoline +2.529mm (+2mm exp)

-

Distillates +1.509mm

Unlike API’s data, DOE reported a crude inventory draw in the last week (though smaller than analysts expected) and gasoline inventories rose for the 6th week in a row…

Source: Bloomberg

Cushing stocks have fallen for the past six weeks and the market will be looking for signs of improvement in refinery runs, particularly in the Gulf Coast, which have been low compared with previous years, says Bob Yawger, futures director at Mizuho Securities.

Additionally, Gasoline stockpiles are the highest they’ve been this time of year in data going back to 1990.

US oil production held near record highs…

Source: Bloomberg

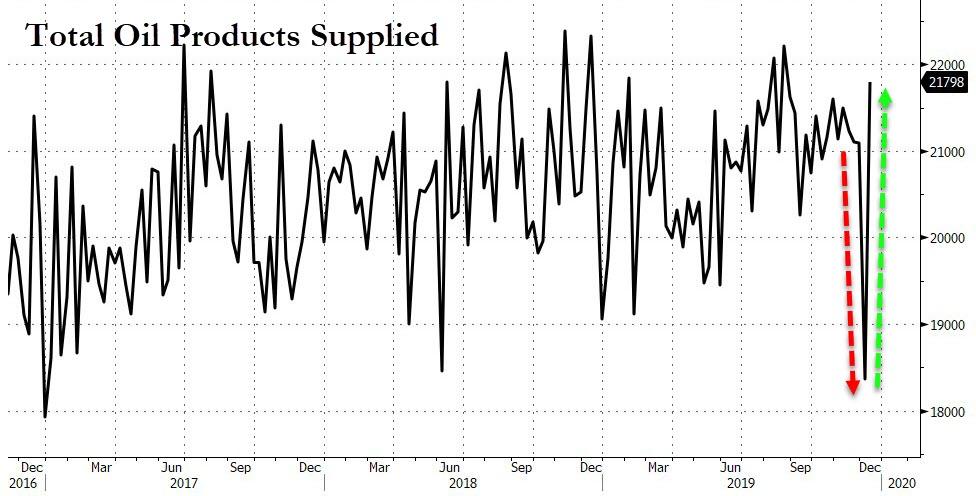

Demand rebounded strongly after last week’s plunge to 3-year lows…

Source: Bloomberg

WTI had held its post-API losses ahead of the DOE data but siared above yesterday’s highs on the crude draw, breaking above $61…

Tyler Durden

Wed, 12/18/2019 – 10:36

via ZeroHedge News https://ift.tt/2ExgytQ Tyler Durden