Pound Dumps And Jump As BOE Keeps Rates Unchanged In 7-2 Decision, Says “Tightening May Be Needed”

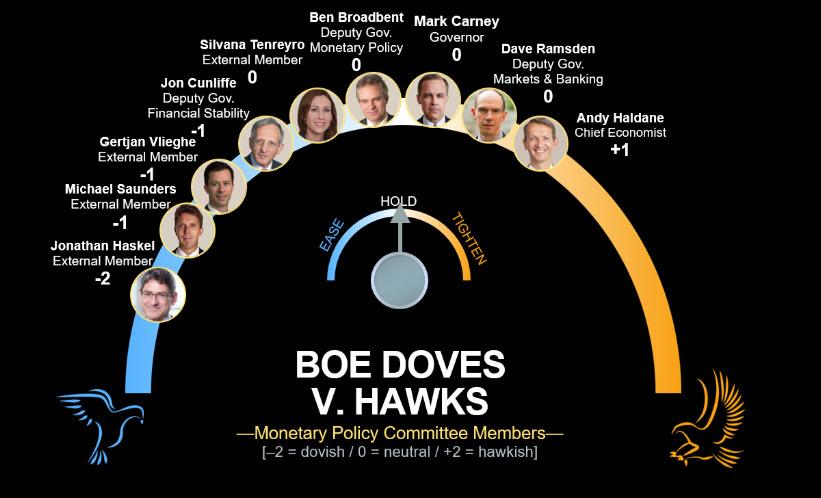

The Bank of England, which as reported previously was the source of countless leaks as HFT and Hedge Funds had secret access to one of its audio feeds, may or may not have leaked today’s rate decision, but it was hardly a surprise: the bank’s Monetary Policy Committee voted 7-2 (as expected) in favor of maintaining rates at 0.75%, with doves Jonathan Haskel and Michael Saunders voted in favor of a 25bps cut, saying that with little room for looser policy, “risk management considerations favored a prompt response to downside risks.”

MPC voted by a majority of 7-2 to keep #BankRate at 0.75% https://t.co/CCBAgbZL56 pic.twitter.com/DrmEJMv2rS

— Bank of England (@bankofengland) December 19, 2019

The decision details:

- Vote split on the base rate: MPC votes 7-2 to stand pat on rates at 0.75%

- Vote split on corporate bonds: MPC votes 9-0 to maintain the stock of corporate bonds at GBP 10bln

- Vote split on APF: MPC votes 9-0 to maintain the stock of UK government bond purchases at GBP 435bln

Coming in just days after the blowout Conservative victory which restored calm to the Brexit process by seemingly removing a no deal Brexit option, the bank signaled it would focus on the next phase of Brexit negotiations, as officially said it was too early to tell whether the clearer path for the U.K.’s departure from European Union on the back of Boris Johnson’s election win will improve sentiment.

“It was possible that household and business sentiment could pick up in the near term,” the bank said in minutes of its December meeting. “Further out, the responses of companies and households would depend on developments in the next stage of the Brexit process, including negotiations about the nature of, and the transition to, the U.K.’s future trading relationships.”

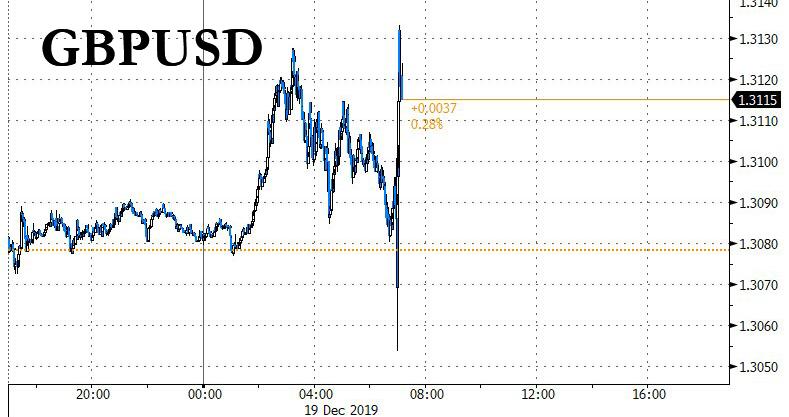

The announcement sent cable instantly lower after the BOE cut its projection for fourth-quarter growth to 0.1% from 0.2% and said it still expects inflation to slow to around 1.25% in the spring, well below the 2% target. The bank singled out business investment and export orders which have remained weak even as “household consumption has continued to grow steadily.” Adding to the dovish case, the BOE also repeated that monetary policy may need to add stimulus if Brexit uncertainty remains entrenched or global growth failed to stabilize.

However, cable then staged an instant reversal as traders focused on a hint by the bank that rate hikes may not be too far off, as the BOE said that should the economy perform broadly in-line with the MPC’s latest projections, “some modest tightening of policy, at a gradual pace and to a limited extent, may be needed to maintain inflation sustainably at the target.” The bank would revisit its forecasts next month.

The meeting is the first since Johnson’s decisive victory last week, and officials noted a reduction in domestic political uncertainty.

As Bloomberg notes, today’s decision means the BOE’s key rate has stayed at 0.75% throughout 2019, as U.K. officials stayed out of a wave of global easing that saw their peers in the US, Eurozone and elsewhere lower borrowing costs amid concerns over trade tensions and a global slowdown. That said, traders expect the BOE to act next year, with money markets pricing in around an 80% probability of the central bank cutting by December 2020. Some economists see a move coming as soon as the first quarter.

Some more details from the report:

- Overview: Since the previous meeting, economic data have been broadly inline with the November report. The partial de-escalation of the US-China trade war provides some additional support to the outlook, relative to November.

- Rate guidance: MPC reiterated that monetary policy could respond in either direction in order to hit its inflation target. Monetary policy could be required if global growth fails to stabilize and Brexit uncertainties remain entrenched. However, should these risks not materialize and the economy performs broadly in-line with the MPC’s projection, gradual and limited rate rises could be needed.

- Brexit: MPC recaps the assumptions of the November MPR that there will be an orderly transition to a deep free trade agreement between the UK and the EU.

- Domestic growth: Q3 GDP printed at 0.3% and is expected to come in at 0.1% in Q4. Household consumption has continued to grow steadily, but business investment and export orders remain weak.

- Inflation: CPI remained at 1.5% in November and core CPI remained at 1.7%, broadly as expected. MPC reiterates that the headline rate is expected to fall to around 1.25% by the spring, owing to the temporary effects of falls in regulated energy and water prices.

- Labor market: There have been some signs that the labor market has been loosening, although it remains tight and employment growth is around its record high.

Finally, hanging over the meeting was speculation about the identity of the successor to Carney, who is due to leave the bank at the end of next month. The appointment process has been long and delayed by the election, but investors are now awaiting a decision as soon as today.

Tyler Durden

Thu, 12/19/2019 – 07:25

via ZeroHedge News https://ift.tt/38WBdFC Tyler Durden