The Stock Market Has Become A Private Club For The Elite

Authored by Lance Roberts via RealInvestmentAdvice.com,

A recent Peter G Peterson Foundation poll, as reported by the Financial Times, revealed a statistic that we have suspected for quite some time. To wit:

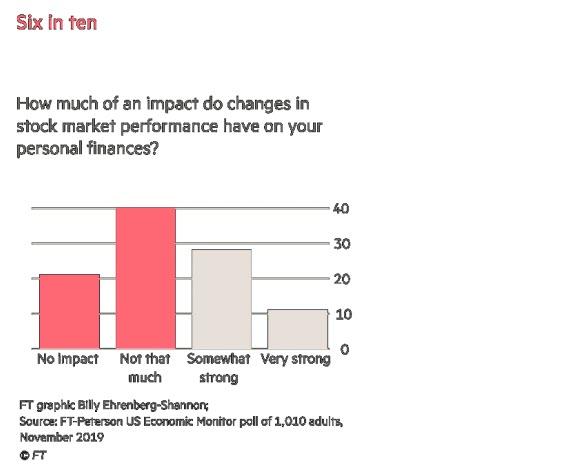

“Nearly two-thirds of Americans say this year’s record-setting Wall Street rally has had little or no impact on their personal finances, calling into question whether one of the strongest bull markets in a decade will boost Donald Trump’s re-election chances.

A poll of likely voters for the Financial Times and the Peter G Peterson Foundation found 61-percent of Americans said stock market movements had little or no effect on their financial well-being. 39-percent said stock market performance had a “very strong” or “somewhat strong” impact.

The survey suggested most Americans are not aware of market movements, with just 40-percent of respondents correctly saying the stock market had increased in value in 2019. 42-percent of likely voters said the market was at “about the same” levels as at the start of the year, while 18-percent believed it had decreased.”

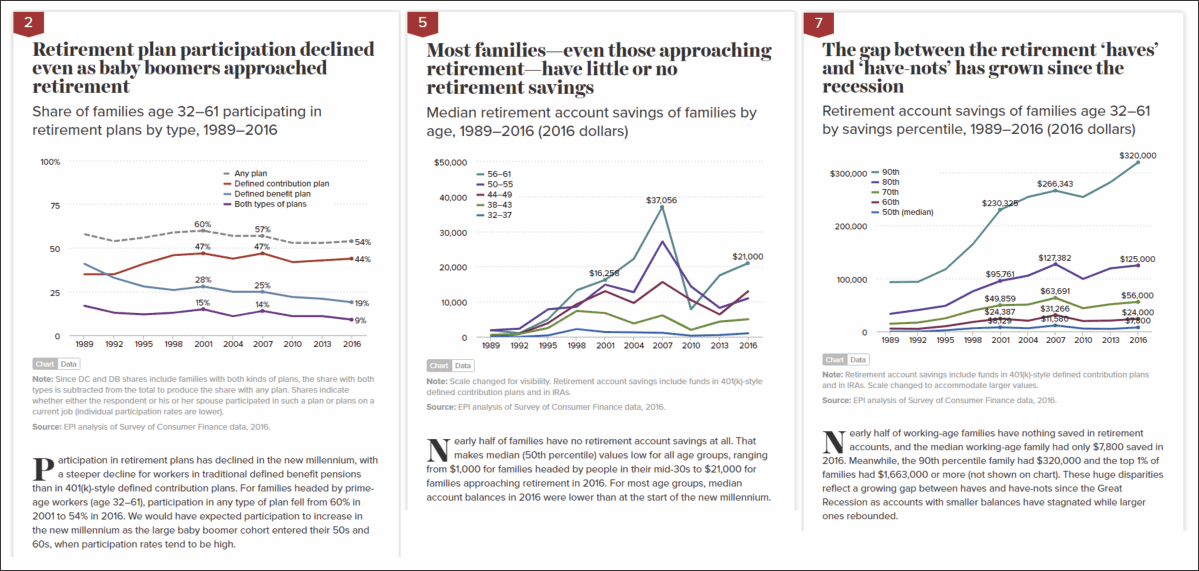

Another article by Shawn Langlois via MarketWatch revealed much the same discussing a recent publication from the Economic Policy Institute. That study also revealed the increasingly inadequate retirement savings of Americans, as well as the dispersion of wealth among income earners.

As Shawn penned:

“The big gap between the mean retirement savings of $120,809 and the median retirement savings is yet another example of how the rich are getting richer and the poor are getting poorer in this country.”

This isn’t anything new.

We have been reporting on this issue over the last few years, and just recently dug into current details in our discussion on the “Savings Rate.” To wit:

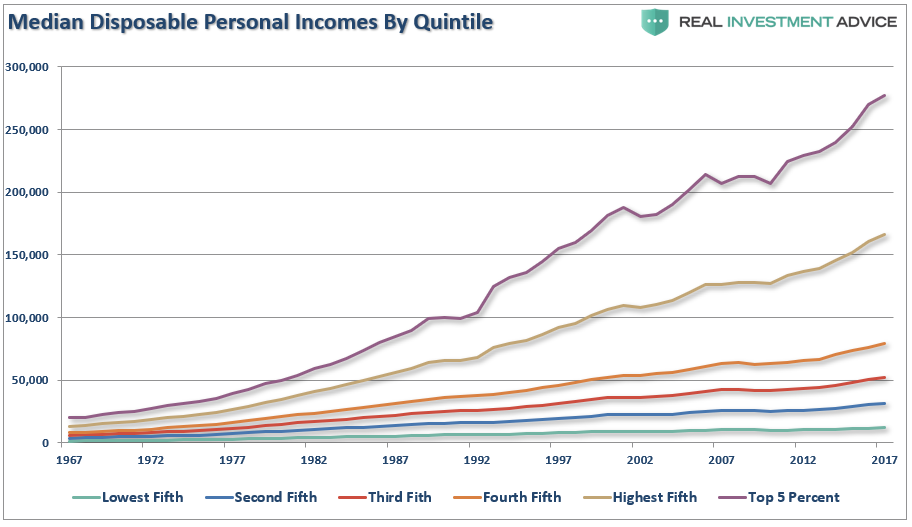

“The calculation of disposable personal income (which is income less taxes) is largely a guess, and very inaccurate, due to the variability of income taxes paid by households. More importantly, the measure is heavily skewed by the top 20% of income earners, and even more so by the top 5%. As shown in the chart below, those in the top 20% have seen substantially larger median wage growth versus the bottom 80%. (Note: all data used below is from the Census Bureau and the IRS.)”

The reality is the majority of Americans are struggling just to make ends meet, which has been shown in a multitude of studies.

“The [2019] survey found that 58 percent of respondents had less than $1,000 saved.” – Gobankingrates.com

Such levels of financial “savings” are hardly sufficient to support individuals through retirement, much less leave enough savings to actively participate in the “booming stock market.” Such confirms the Peterson study that the “longest bull market in history” has largely bypassed a vast majority of Americans.

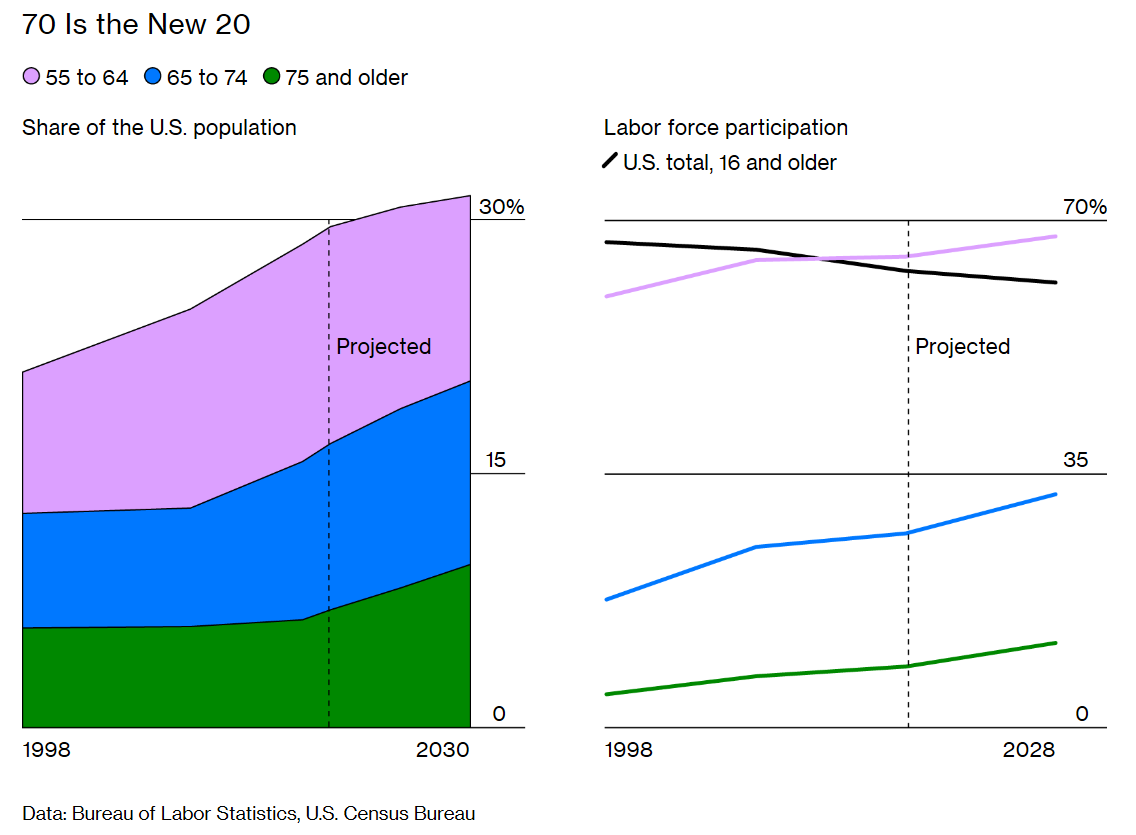

It also confirms why, after a decade-long bull market, that a rising trend of individuals over the age of 55 remain in the workforce.

“Growing numbers of U.S. boomers—currently 55 to 73—are working beyond the traditional retirement age, going back to school, and choosing to age in place in familiar neighborhoods instead of moving to senior communities.

For the first time in history, there are multiple generations alive together for long stretches of time.“

It’s not that “Boomers” don’t want to retire, it’s because they “can’t afford to.”

The Expanding Problem

Despite Central Bank’s best efforts globally to stoke economic growth by pushing asset prices higher, the effect has been entirely consumed by those with actual savings, and discretionary income, available to invest.

In other words, the stock market has become an almost “exclusive” club for the elite.

While monetary policies increased the wealth of those that already have wealth, the Fed has been misguided in believing that the “trickle down” effect would be enough to stimulate the entire economy.

It hasn’t.

The sad reality is that these policies have only acted as a transfer of wealth from the middle class to the wealthy and created one of the largest “wealth gaps” in human history. Via Forbes:

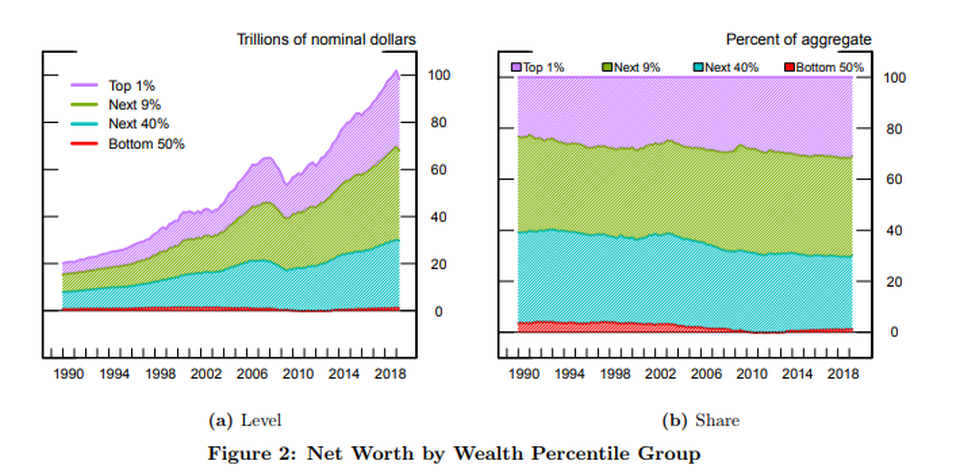

“‘The top 10% of the wealth distribution—the purple and green areas together—hold a large and growing share of U.S. aggregate wealth, while the bottom half (the thin red area) hold a barely visible share,’ Fed economists write in a paper outlining the new data set on inequality, which is more timely than exisiting statistics. The chart show that ‘while the total net worth of U.S. households has more than quadrupled in nominal terms since 1989, this increase has clearly accrued more to the top of the distribution than the bottom.’”

Lack Of Capital

The current economic expansion is already the longest post-WWII expansion on record. Of course, that expansion was supported by repeated artificial interventions rather than stable organic economic growth. As noted, while the financial markets have soared higher in recent years, it has bypassed a large portion of Americans NOT because they were afraid to invest, but because they have NO CAPITAL to invest with.

The ability to simply “maintain a certain standard of living” has become problematic for many, which forces them further into debt.

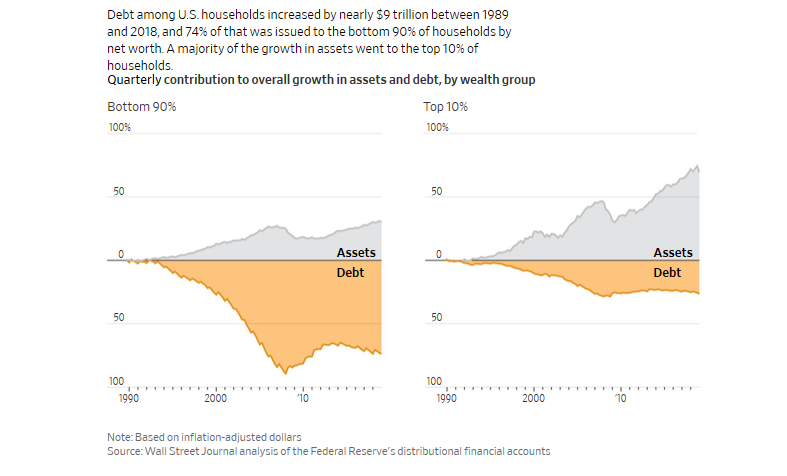

“The debt surge is partly by design, a byproduct of low borrowing costs the Federal Reserve engineered after the financial crisis to get the economy moving. It has reshaped both borrowers and lenders. Consumers increasingly need it, companies increasingly can’t sell their goods without it, and the economy, which counts on consumer spending for more than two-thirds of GDP, would struggle without a plentiful supply of credit.” – WSJ

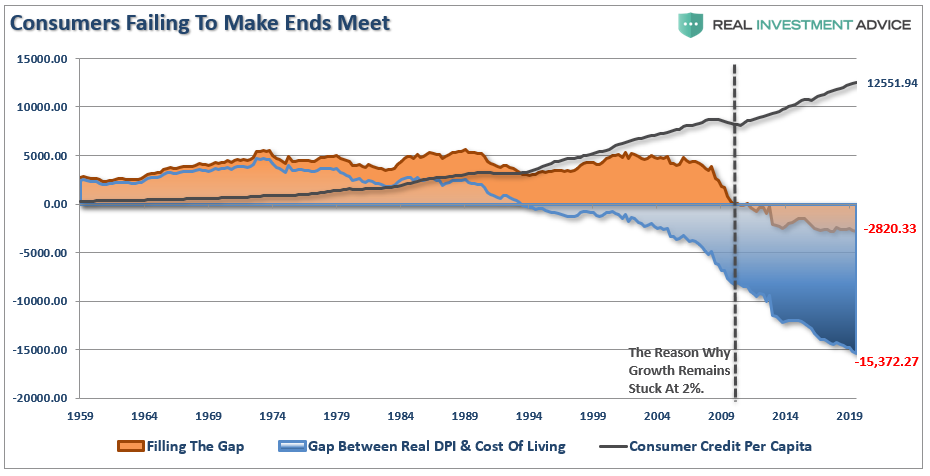

I often show the “gap” between the “standard of living” and real disposable incomes. Beginning in 1990, incomes alone were no longer able to meet the standard of living, so consumers turned to debt to fill the “gap.” However, following the “financial crisis,” even the combined levels of income and debt no longer fill the gap. Currently, there is almost a $2600 annual deficit that cannot be filled. (Note: this deficit accrues every year which is why consumer credit keeps hitting new records.)

The debt-to-income problem keeps individuals from building wealth, and government statistics obscure the basic reality. We discussed this point in detail in “Dimon’s View Of Economic Reality Is Still Delusional:”

“The median net worth of households in the middle 20% of income rose 4% in inflation-adjusted terms to $81,900 between 1989 and 2016, the latest available data. For households in the top 20%, median net worth more than doubled to $811,860. And for the top 1%, the increase was 178% to $11,206,000.

Put differently, the value of assets for all U.S. households increased from 1989 through 2016 by an inflation-adjusted $58 trillion. A third of the gain—$19 trillion—went to the wealthiest 1%, according to a Journal analysis of Fed data.

‘On the surface things look pretty good, but if you dig a little deeper you see different subpopulations are not performing as well,’ said Cris deRitis, deputy chief economist at Moody’s Analytics.” – WSJ

The One Problem The Fed Can’t Fix

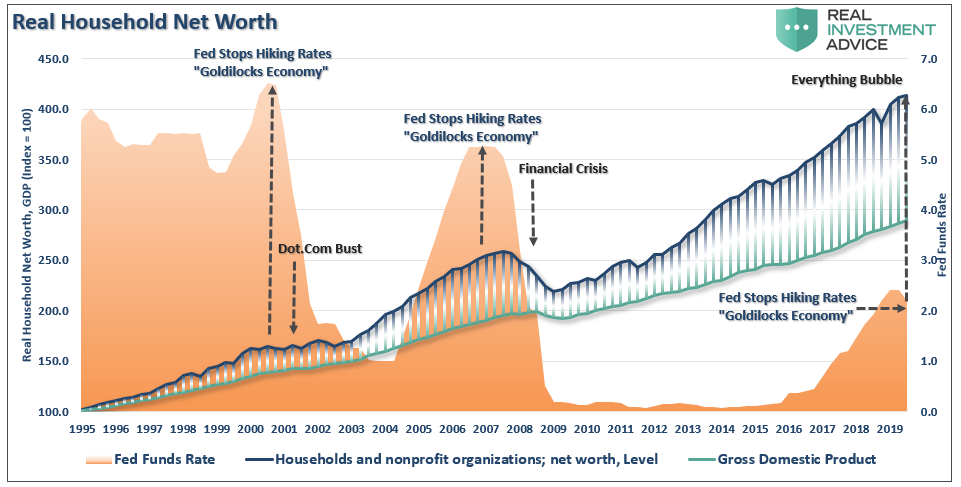

The problem with the Fed’s ongoing liquidity interventions is that they continue to benefit those in the top 20% of population which exacerbates the wealth gap between them and everyone else. Importantly, the current gap between household net worth and GDP is the greatest on record, and those previous gaps were filled by reversions with the most painful of outcomes.

While such a reversion in “net worth” will have the majority of its impact at the upper end of the income scale; it will be the job losses through the economy that will further damage and already ill-equipped population in their prime saving and retirement years.

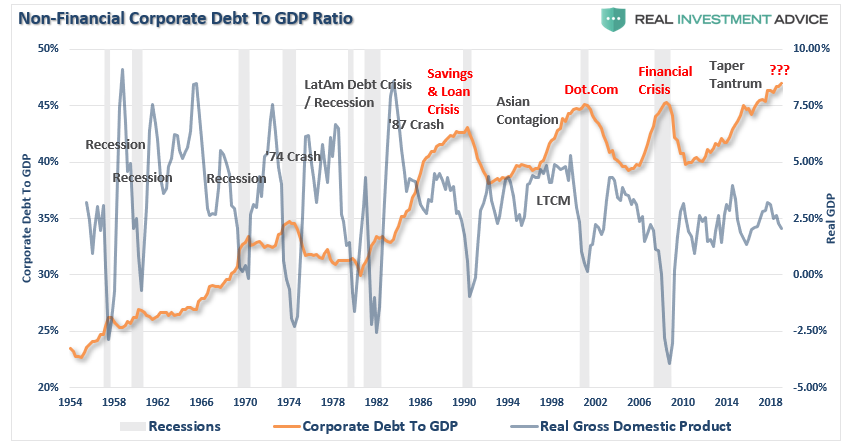

Compound that problem with the massive amount of corporate debt, which if it begins to default, will trigger further strains on the financial and credit systems of the economy.

The reality is that the U.S. is now caught in the same liquidity trap as Japan. With the current economic recovery already pushing the long end of the economic cycle, the risk is rising that the next economic downturn is closer than not. The danger is that the Federal Reserve is now potentially trapped with an inability to use monetary policy tools to offset the next economic decline when it occurs. Combine this with:

-

A decline in savings rates to extremely low levels which depletes productive investments

-

An aging demographic that is top heavy and drawing on social benefits at an advancing rate.

-

A heavily indebted economy with debt/GDP ratios above 100%.

-

A decline in exports due to a weak global economic environment.

-

Slowing domestic economic growth rates.

-

An underemployed younger demographic.

-

An inelastic supply-demand curve

-

Weak industrial production

-

Dependence on productivity increases to offset reduced employment

While the stock market may be an exclusive club for its members currently, the combined issues of #debt, #deflation, and #demographics is a problem the Fed can’t fix.

It isn’t a question of “if.” It is simply a function of “when.”

The next crisis will repair the “wealth gap” to some degree only because 2/3rds of American’s never participated in the bull market to begin with.

Tyler Durden

Thu, 12/19/2019 – 12:10

via ZeroHedge News https://ift.tt/38Wzyjq Tyler Durden