“A Back Up In Yields In The Coming Years Will Be An Extinction-Level Event”

Submitted by Thomas Thornton via Hedge Fund Telemetry

The Walking Dead Market

The Walking Dead TV show premiered in 2010 and is going on its 10th year. My wife and I watched it up to season 5 and then it became tedious watching zombies get shot, or hacked in the head. It sort of feels like that if you’re short market indexes in the past 6 weeks as the justification for the continued strength really doesn’t make sense. I’ve seen these periods before and know they don’t last. One of my derivative traders said to me yesterday “This will be a downturn that nobody could catch…since it’s burned everyone out.” It was this way in 1999 when value investors who were short the obvious ridiculously overvalued stocks were carried out like Julian Robertson at Tiger Management. It worked out OK for Julian in the end by the way. The further this current market overshoots the extreme bullish sentiment and technical indicators the more severe and sharp the downturn just like what happened in 1999/2000 and even in 2007. If everyone is waiting to sell in 2020 to push out capital gains which might be the case then buy some downside protection in January now.

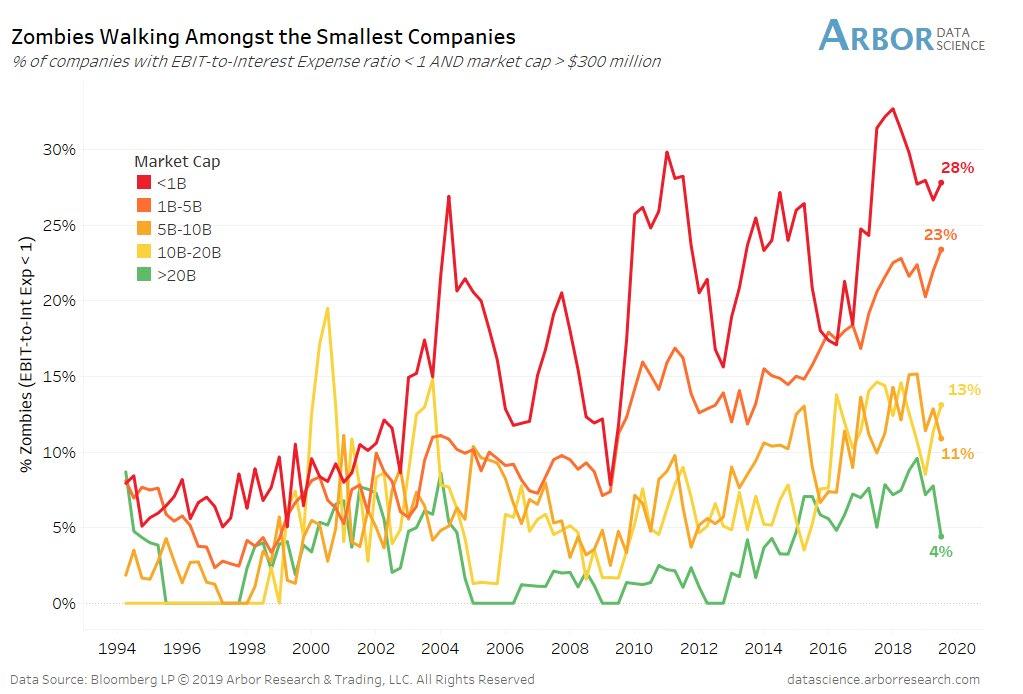

I was thinking of calling today’s note “Dawn of the Fed” because the Fed is 100% responsible for the zombie market which has kept rates extremely low and pushing money into risky assets. The sudden U-turn from last year by the Fed is rather unprecedented and in so many ways the continued massive amount of money now being thrown out by the Fed since September with Repo and “not QE” should be of more concern to the markets since it is similar to when the Fed added stimulus ahead of the “Y2K” worry. What happened after that stimulus was taken away? The bubble burst.

Companies that are not profitable that continue to tap the credit markets are zombie companies. Think Tesla. Many people think of it as a start-up (it’s 16 years old and has never had a full-year profit) or perhaps it’s a cult of a small group of fund managers who believe in a mission? They now have a market cap of $73 billion vs Ford at $37 billion and GM at $53 billion. Tesla will sell 350,000 cars in 2019 (don’t forget Elon Musk tweeting they would sell 500k which was retracted). Ford and GM will sell over 5.5 million cars. I’m short Tesla and after having a run of 12/16 profitable trades in the past few years with an average gain of 15%, I am underwater with the stock lifting like an internet stock in 1999 with the backdrop of more people leaving the company and a mysterious $1 billion in accounts receivables each of the last 4 quarters (no other car companies have AR’s like this). I am not covering my short since my size remains inline with a small percentage of my portfolio. I am adding a new put idea buy the Feb 360-300 put spread for $11.10 and sell the Feb 480 (20% up) call for $9.30 for a total cost of $ 2.00. If this is under 300 at expiration the total gain is 30x. If this rises above 480 you have unlimited risk. Keep in mind Tesla stock makes no sense so keep your size reasonable if you do this trade. It may not work.

Now we go to politics (I am a centrist and generally despise most politicians especially the further right and left they go). We have a zombie President who just was impeached at the exact same time he was giving a campaign speech for his reelection with his supporters cheering him on. The market has gone up all year on “hopes for a trade deal” and now that we have a watered-down deal that still is not signed or even any documentation public. The deficit is out of control in the “greatest economy ever” and some friends believe it’s why the Fed is doing QE to fund the deficit. The chances of Trump being reelected are surprisingly good considering all of his controversies. Look at the zombies running on the Democratic side and the policies they are proposing which is all about higher taxes and higher government spending on “free everything”. Joe Biden still is in the lead. I don’t think it will be him. By the way, the drinking game for tonight’s Democratic debate: Joe Biden says “fact of the matter” or Elizabeth Warren says “I have a plan” or Bernie Sanders says “billionaires.” Take a sip. Not a full shot.

Indexing and stock buybacks have risks that people don’t want to talk about when the markets are going up. With index funds popularity surge in the past 10 years, it’s lifted all boats especially the largest companies and when you combine those few mega-companies that have huge weightings in the indexes that are buying back proportionately the largest amount of stock it masks the risk in the future. Apple and Microsoft have combined in the past year attributed between 35% and 50% of the total gains in a few indexes. Over the last decade, the outflows from active managers have been steady into passive strategies. In the next decade, Apple and Amazon are not going up another 2400%. I guarantee that one.

Semiconductors are a leading indicator sector. Chips go into everything. Phones, computers, cars, tv’s, etc. In Q3 2018 Texas Instruments CEO said they felt the top in the cycle was in and considering the length of the cycle was very extended the downturn would last quite a while too. Investors reacted as expected but then they turned into zombies with the backdrop of the US-China trade war pricing in a recovery. Micron which makes commodity chips DRAM’s and NAND have had 10 year high levels in inventories and prices have plummeted in the last year. Normally when this happens semiconductor stock prices drop in a big way until there is a supply-demand equilibrium. Micron stock was down from the peak in 2018 56% and this year it’s up 93% from the December lows. They reported earnings last night summed up by my friend Fred Hickey of the High Tech Strategist. “Micron with a 1 penny EPS beat!! Whoohoo! If you can just ignore the 84% plunge in EPS YoY, the 86.2% collapse in operating income and the sharply lower guide for the current quarter, – revs, a miss and down another 10% sequentially and EPS 15% less than estimates (non-GAAP, down 80% YoY, ALL’S GREAT!” Stock is trading up 3.25% today. Boo yaa!

Sweden’s Central Bank the Riksbank , the world’s oldest central bank, became the first to charge commercial banks to hold deposits rather than pay interest in 2009 and in 2015 they followed the EU in lowering rates to under zero. Today they reversed that policy citing a housing bubble. The European bank index is down 40% from when negative rates began. The total dollar amount of negative-yielding debt several months ago hit $17 trillion and today it’s down to $11 trillion. There still is a lot of negative yielding debt especially in Japan where they have been the most aggressive central bank keeping rates low or negative. Betting against JGB’s was called a widow maker trade as shorting Japan’s bond market has never worked. I have a client who is head of global allocation at one of the largest allocators. He has to look out 5 years for trends in the future. Several years ago I asked him what the managers are thinking about buying negative-yielding bonds. He said, “they believe rates will always go down even lower.” The risk now is that if rates start to back up those people (many are pensions who are mandated to buy) will be holding a double loss on the principle and payment back to the government. But it’s more than this because the global feast on debt from the great financial crisis was not a “great deleveraging” as Ray Dalio called it then but a giant yield chase with exponentially more debt from government, central bank and corporate. A back up in yields in the coming years will be an extinction-level event.

That’s it for today. I remain very cautious and have some new downside put spreads I added recently and with some shorts that show some working and some with poor entries. I might make some changes to the Trade Ideas around 3 today. Just need to be there with short exposure into 2020 which will call “The Year Of Hindsight or What The Hell Were We Thinking.”

Tyler Durden

Thu, 12/19/2019 – 15:05

via ZeroHedge News https://ift.tt/2Z5TT1j Tyler Durden