The World’s Most Liquid Stock Market Is Now As Illiquid As It Was In The 2008 Crisis

With so much attention being paid to the liquidity problems in the repo market, where the Fed has injected over $350BN in term repos alone in the past month…

The Fed has injected $351 Billion in liquidity via Term Repos in the past month, of which $131BN are “turn” repos into the new year. pic.twitter.com/aN3zAo5fhM

— zerohedge (@zerohedge) December 19, 2019

… ignoring hundreds of billions in overnight repos and T-Bill purchases courtesy of “NOT QE“, it is easy to forget that there is a far more illiquid market out there. Problematically, it also happens to be the world’s most “liquid” equity market in the world, the S&P500.

Conveniently, a recent note from BofA’s equity derivatives team, reminds us that just because the repo market may have been fixed thanks to a year-end Fed liquidity panic that has backstopped $490 billion in liquidity, the S&P remains as problematic as ever.

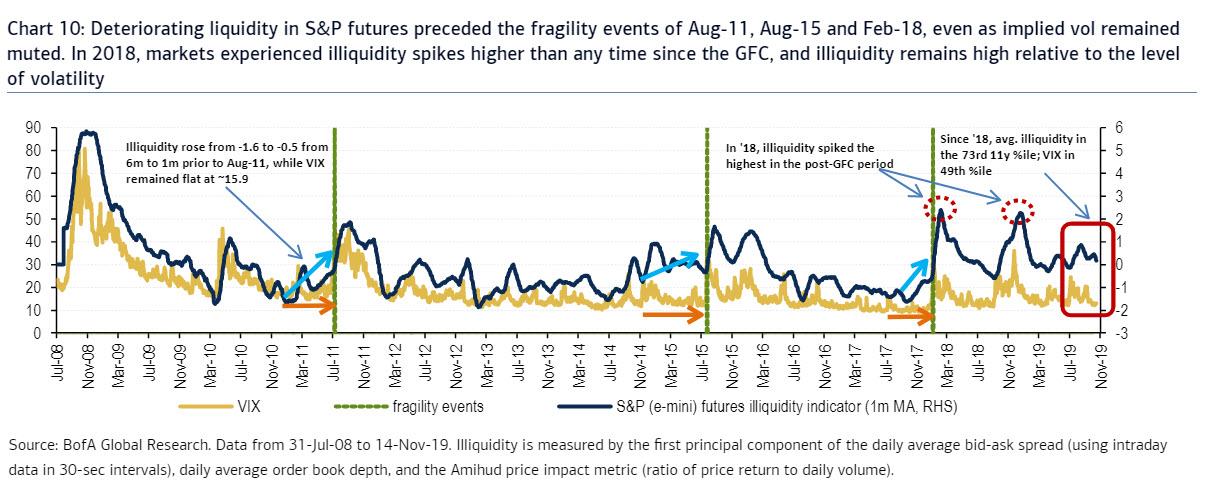

As BofA’s Benjamin Bowler writes, market liquidity is generally correlated with volatility, and yet in recent years, it is progressively deteriorating despite near record low levels on the VIX. According to BofA calculations, average “illiquidity” for S&P e-mini futures since 2018 has been in its 73rd% since 2008. Historically, the period when markets were less liquid was primarily during the ’08 crisis when the VIX was north of 40.

However, the VIX since 2018 has averaged 16.1, and earlier this week printed below 12.

It is also noteworthy that illiquidity rose ahead of the sharp fragility events of Aug-2011, Aug-2015, and Feb-2018, while implied vol remained muted until very near the selloffs, suggesting that VIX no longer reflect prevailing market stress, and confirms what Morgan Stanley said ten days ago, that Fed actions now directly seek to lower marketwide volatility.

Why does this matter? Because as BofA summarizes, the fact that liquidity seems to be progressively deteriorating over time suggests it’s difficult to see market fragility abating, particularly as long as crowding remains a problem and liquidity providers are incentivized to pull back from liquidity provision in times of stress. This reinforces the need to understand the risk fragility poses to one’s assets and the importance of efficiently hedging fragility risk.

Wait, what fragility?

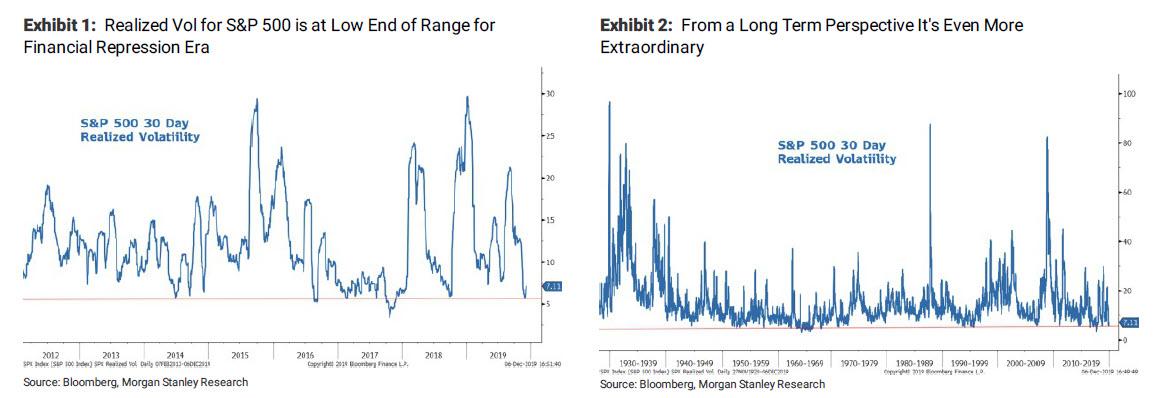

While we have extensively discussed the growing fragility of the market, manifesting itself in ever more frequent liquidity air pockets and “flash crashes”, here is a quick reminder, once again courtesy of Bank of America, which writes that despite the direct suppression of volatility by central banks, “markets have remained highly fragile in recent years.”

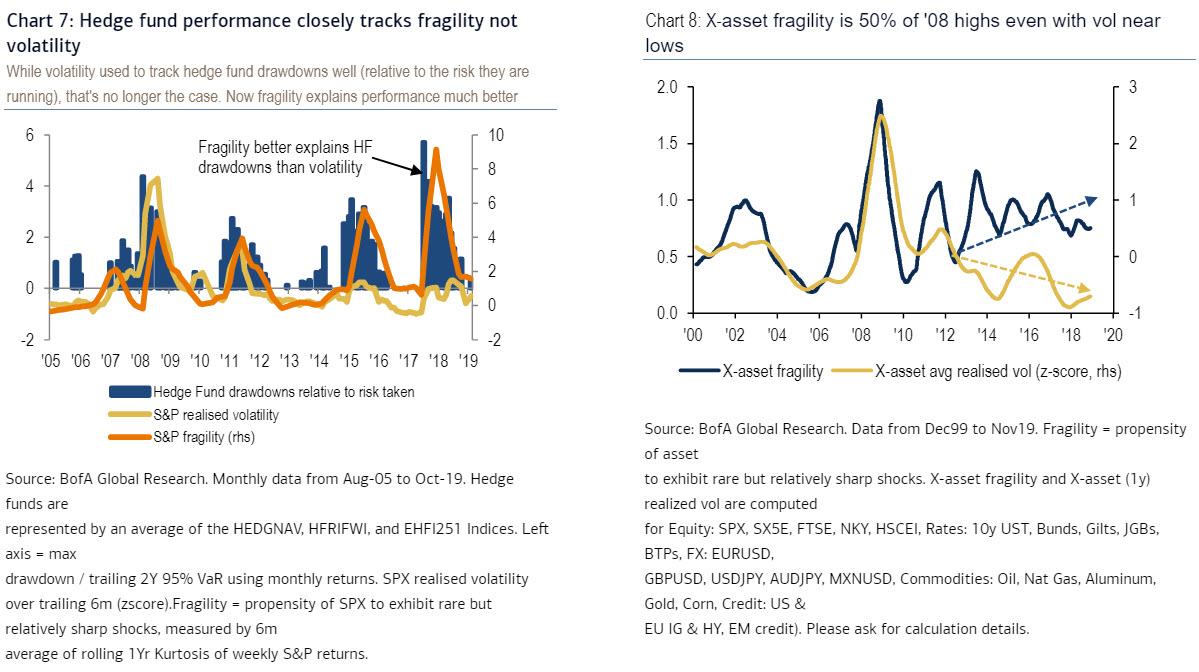

The left chart below shows that BofA’s fragility measure for the S&P 500 exceeded global financial crisis (GFC) levels during 2018 despite volatility remaining at or below its longer-run average. In fact, as the chart on the right shows, fragility across 25 markets covering five asset classes has been historically elevated vs. volatility in recent years.

This matters because as Bowler notes, it is fragility – not volatility – that is a better measure of the risk that active managers are exposed to. In this vein, BofA believes that high market fragility in the past few years (which corresponded to relatively large hedge fund drawdowns) “is driven by a combination of investor crowding in an alpha starved market and the increasingly fickle liquidity provision from high frequency traders (HFTs).“

Unfortunately, as Bowler concludes, “it is hard to see this environment improving as long as central banks continue to attempt to manipulate markets and with HFTs playing a dominant role in liquidity provision.” And yes, those are his own words: the time is long gone when respected Wall Street professionals dared not whisper that the Fed is manipulating market.

Bowler’s advice to investors: “the key is to hedge the fragility risk.” What Bowler did not expound on is that if the market is indeed as fragile as he represents, it is very likely that nobody will escape the next crash alive for the simple reason that markets – both cash, synthetic, and derivatives, will simply lock up, and any hedges layered on top of risk positions will simply expire worthless for the duration of the marketwide lock up.

Tyler Durden

Thu, 12/19/2019 – 15:50

via ZeroHedge News https://ift.tt/2MbHeoo Tyler Durden