Stocks & VIX Decouple Ahead Of Op-Ex, Bond Dump-n-Pump Pattern Continues

Complacency just hit ’11’…

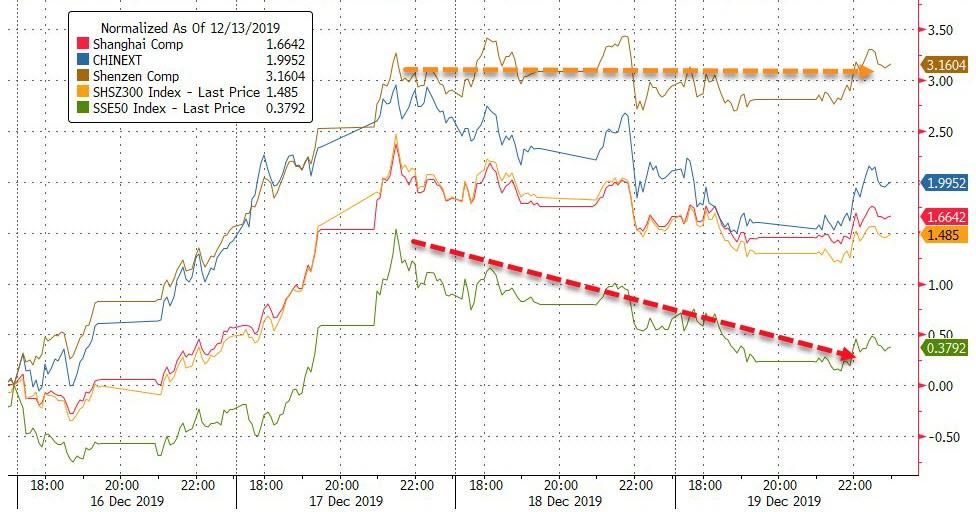

Chinese stocks were flat again, not experiencing the same exuberance as US markets…

Source: Bloomberg

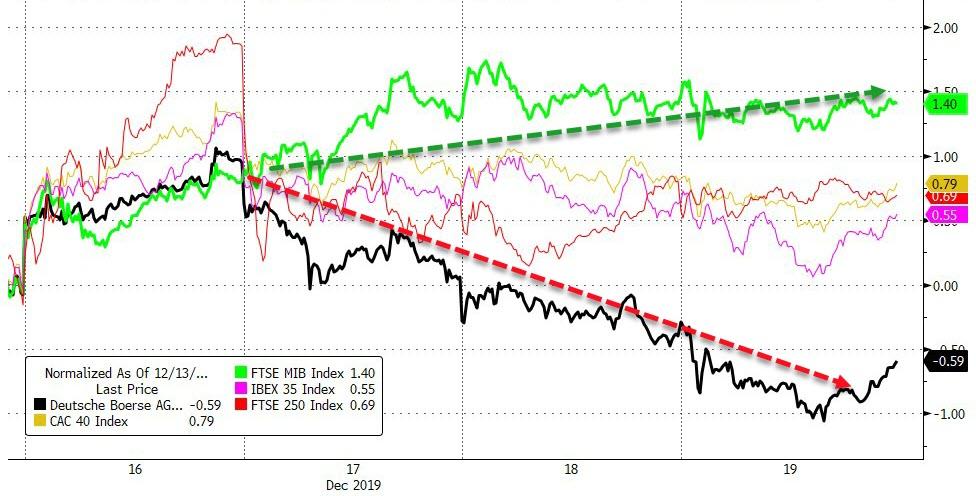

Germany lagged among European stocks once again with Italy leading still…

Source: Bloomberg

US majors were all higher again today, melting up into tomorrow’s op-ex… Nasdaq and Small Caps are the week’s big winners so far…

Thanks to another opening short-squeeze…

Source: Bloomberg

Despite all the exuberance, it’s defensives that are more bid that cyclicals…

Source: Bloomberg

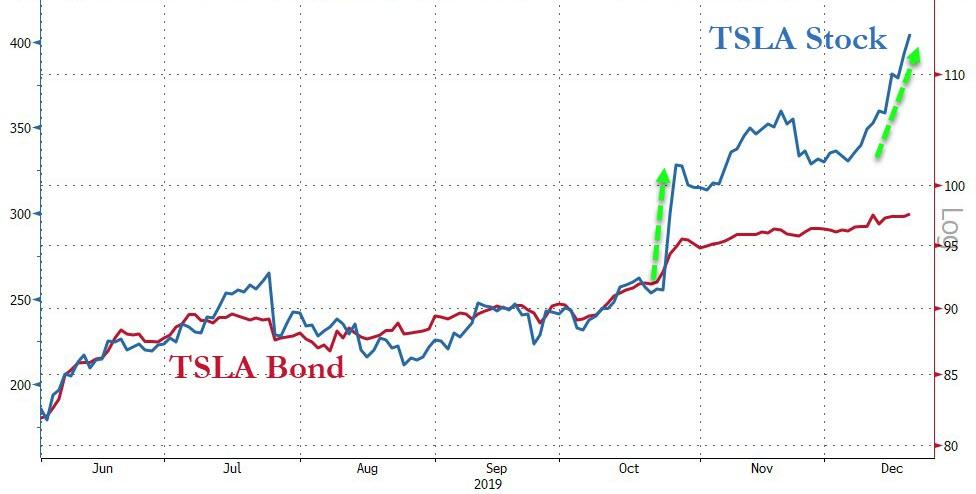

Tesla stock continued it short-squeeze to new highs, decoupling further from its bonds…

Source: Bloomberg

VIX has dramatically decoupled from stocks in the last few days ahead of tomorrow’s big option expiration…

Source: Bloomberg

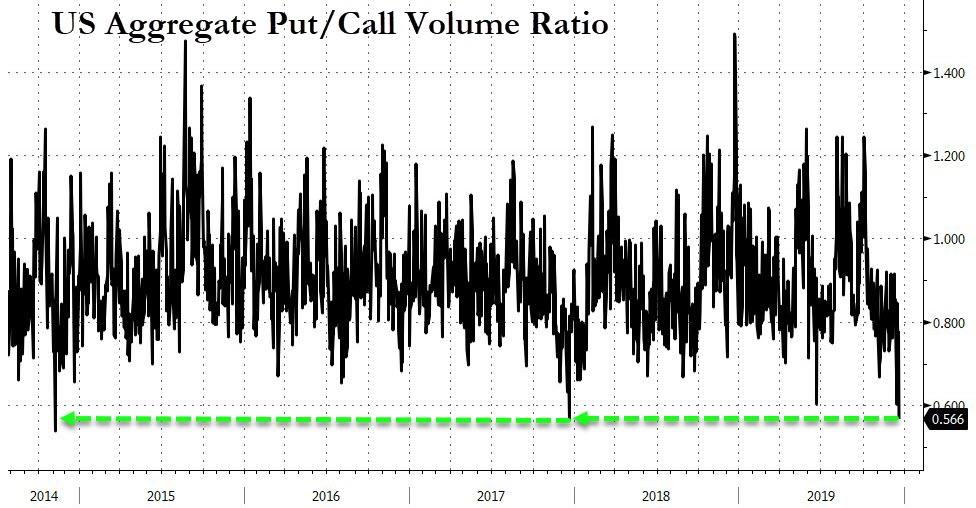

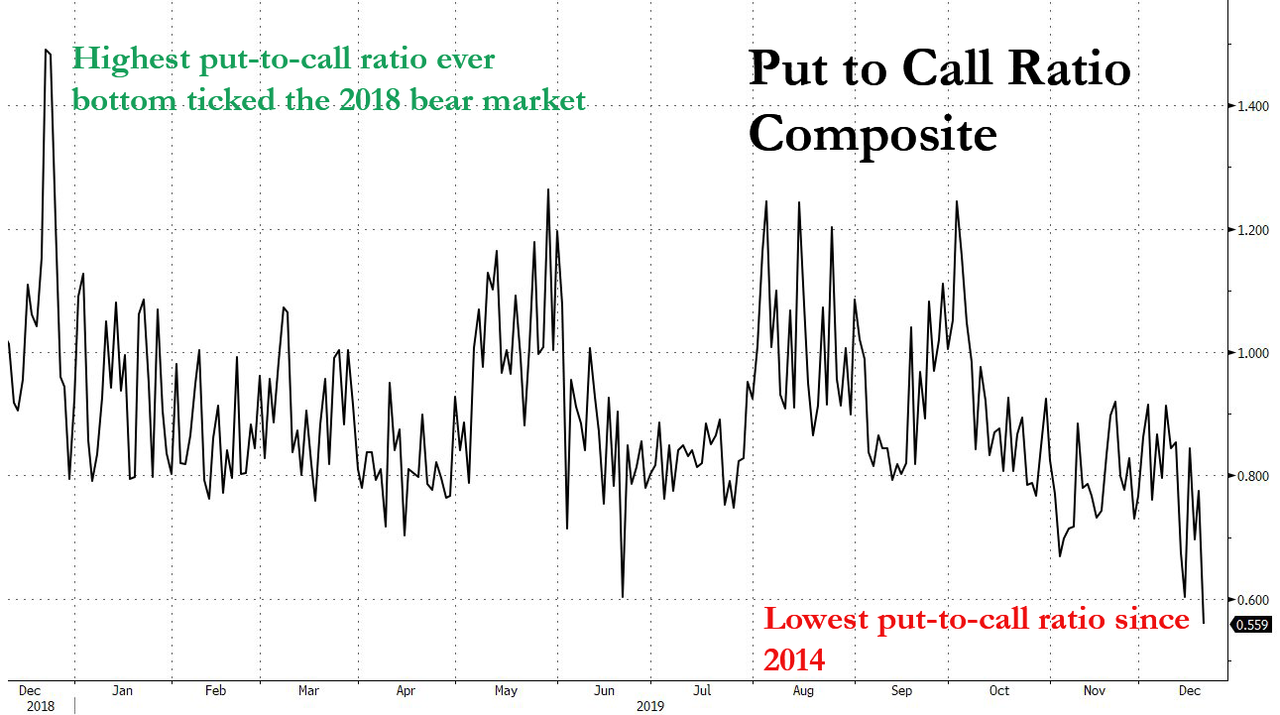

As aggregate put volumes collapse relative to call volumes hit lowest since 2014…

Source: Bloomberg

Will this be the inverse of the Dec 2018 lows?

Source: Bloomberg

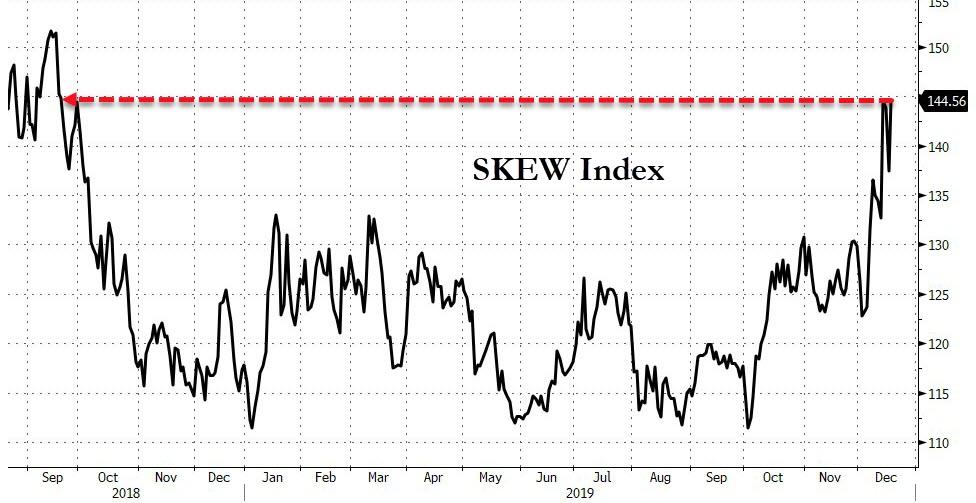

And at the same time, SKEW is back at its highest since September 2018…

Source: Bloomberg

After 11 straight days higher, HYG (the HY Bond ETF) tumbled today (ex-dvnd)…

Source: Bloomberg

Treasury yields were lower on the day (after spiking overnight once again) with the belly outperforming (5Y -2bps) and long-end lagging (30Y unchish)…

Source: Bloomberg

But for the 4th day in a row, Treasury yields followed the same path of Asia buying, Europe selling, and US buying (post EU close)…

Source: Bloomberg

The yield curve hit its steepest since Oct 2018…

Source: Bloomberg

Which is more indicative of an imminent recession than the initial inversion…

Source: Bloomberg

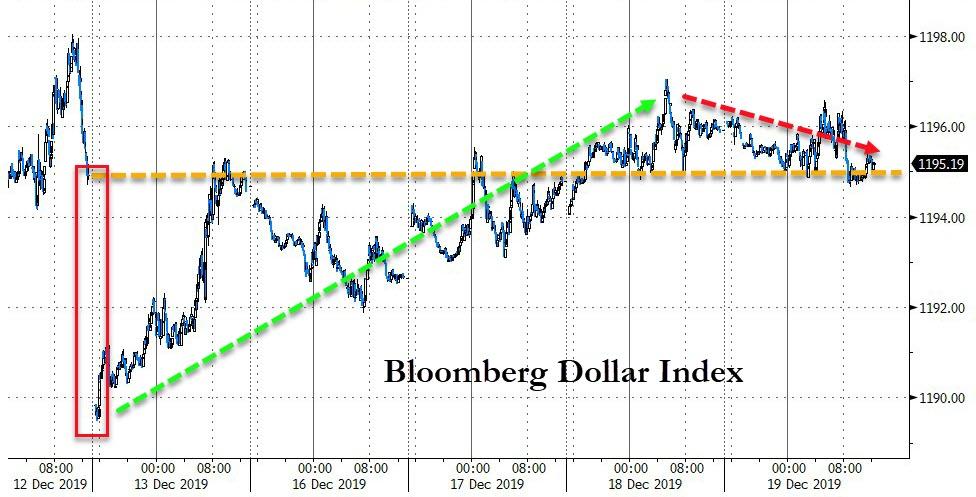

The dollar dipped marginally lower today, stalling at the Thursday night pre-plunge levels…

Source: Bloomberg

Cryptos leaked back lower today after yesterday’s chaotic dump and pump…

Source: Bloomberg

Commodities were all higher on the day with oil and silver leading…

Source: Bloomberg

Silver is holding above the payrolls plunge levels…

Gold too…

WTI topped $61, accelerating out of its uptrend…

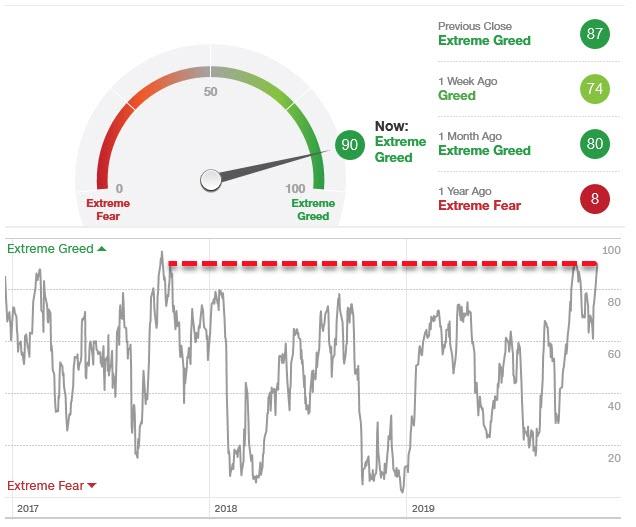

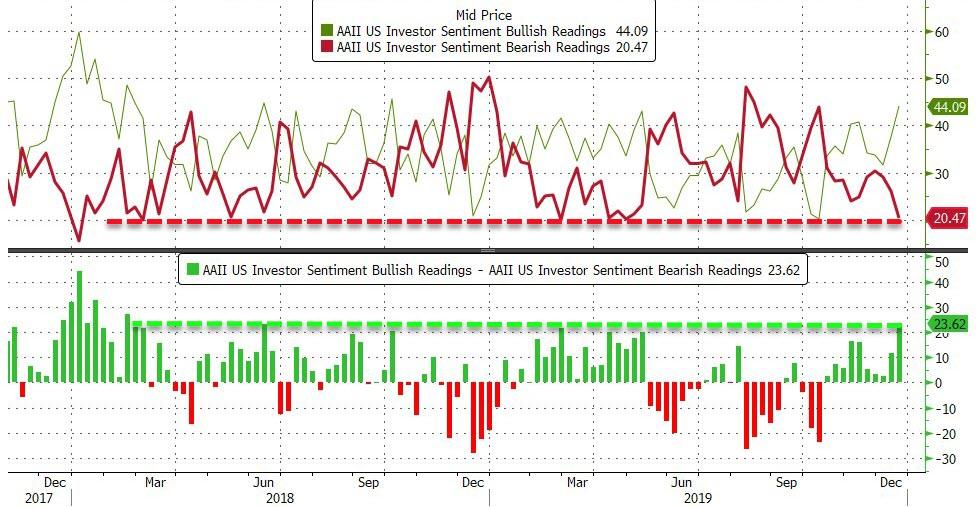

And finally, investors are the most extremely greedy since September 2017…

Bearish sentiment is back at cyclical lows and the spread between bulls and bears is soaring…

Source: Bloomberg

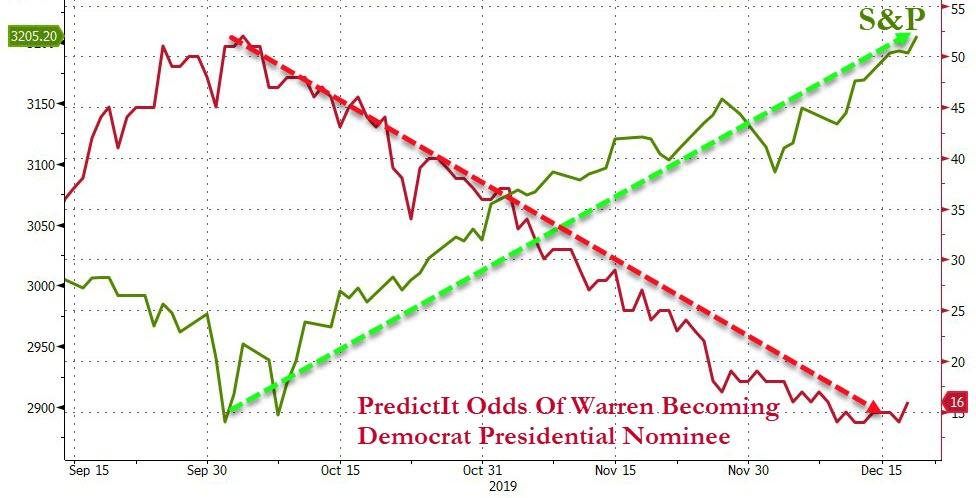

Apart from The Fed’s balance sheet expansion, we can thank the collapse of Elizabeth Warren’s candidacy for the stock meltup…

Source: Bloomberg

BTFImpeachment

Source: Bloomberg

Tyler Durden

Thu, 12/19/2019 – 16:00

via ZeroHedge News https://ift.tt/38WVsmT Tyler Durden