Farmers “Deeply Worried” As Argentina’s Fernandez Aims To Hike Export Taxes Twice In Three Days

Farmers in Argentina are finding out the wonderful benefits of taxation and government micromanagement first hand. Just three days after the government hiked export taxes for farmers, it is considering doing it again, causing outrage on the Pampas crop belt.

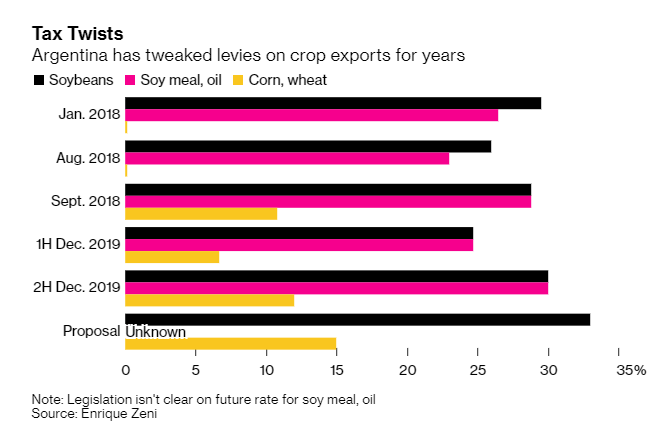

A bill sent to lawmakers proposes that taxes on soybean shipments could hike to 33%, according to Bloomberg. That compares to 30% currently and 24.7% last week. Corn and wheat would rise to 15%, from 12% currently and just 6.7% last week.

President Alberto Fernandez will need opposition votes to get the legislation through congress, despite holding a majority in the senate. Approval could come by the end of the month, should he get the votes he needs. The bill also contains a provision to reduce rates for exports with “added value”, meaning that soy meal and oil may be charged less than 33% “in a boon to crushers that have lost competitiveness and seen idle capacity rise after the differential with raw beans was scrapped last year.”

Argentina is a top exporter of soy meal, used as animal feed, and soy cooking oil. So far, it is unknown whether or not beef, the nation’s other major export, will be considered a value added product.

This move comes after Fernandez raised taxes on Saturday, which was just days after he took office. The hikes caused outrage among rural farmers and leaders who claimed they weren’t told it was coming. They also warned that output could suffer as a result.

One of Argentina’s biggest farm associations, CRA, said: “We are deeply worried about the latest measures.”

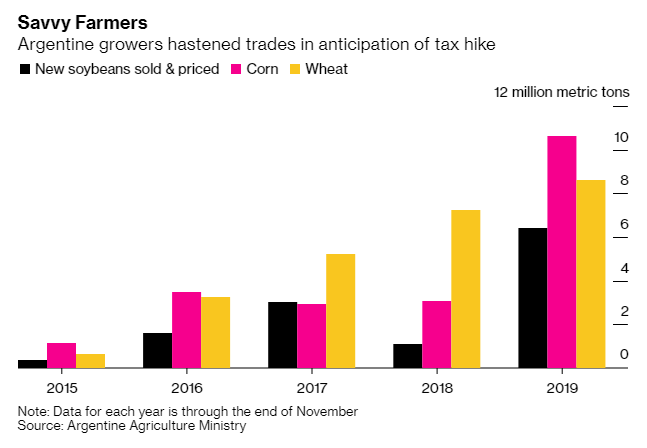

Farmers are concerned that, despite Fernandez’s intentions to revive the economy, that he’s instead creating a hostile attitude toward farmers. Profit margins will suffer as a result of corn and wheat shipments being charged 15% – this could force farmers out of crop rotation strategies that came about in recent years to plant cheaper soybeans instead.

The effects of the tax hikes will be most prevalent next year, as this season’s wheat is already being harvested. It’s also too late to change plans for soybeans and corn. According to Jacob Christy, a trader at Andersons Inc., farmer selling could slow “considerably” and there could be an impact on global markets, despite some commodity traders already anticipating the increase.

Tyler Durden

Thu, 12/19/2019 – 19:45

via ZeroHedge News https://ift.tt/2EF1tGA Tyler Durden