Merry Quad Witchmas: Global Meltup Sends Stocks To All Time High

Christmas has come early on Wall Street and across global market, as world stocks melted up to new record highs on Friday, amid subdued trading as desks wound down before the year-end holidays, while the British pound was heading for its biggest weekly loss in more than two years amid renewed worries over how Britain will leave the European Union (and just as every sellside analyst turned bullish on cable).

As a reminder, today’s Quadruple Witching may prompt significant volatility around expiry times, especially with market liquidity near all time lows. The schedule for today’s options expirations is below:

- 5:15EST: FTSE 100 Dec’19 Futures and Options Expiry

- 6:00EST: Euro Stoxx 50 Dec’19 Futures and Options Expiry

- 7:00EST: DAX 30 Dec’19 Futures and Options Expiry

- 9:30EST: E-mini S&P Dec’19 Futures and Options Expiry

- 9:30EST: NASDAQ (Inc. E-mini) Dec’19 Futures and Options Expiry

- 9:30EST: DJIA Dec’19 Futures and Options Expiry

- 10:00EST: CAC 40 Dec’19 Futures and Options Expiry

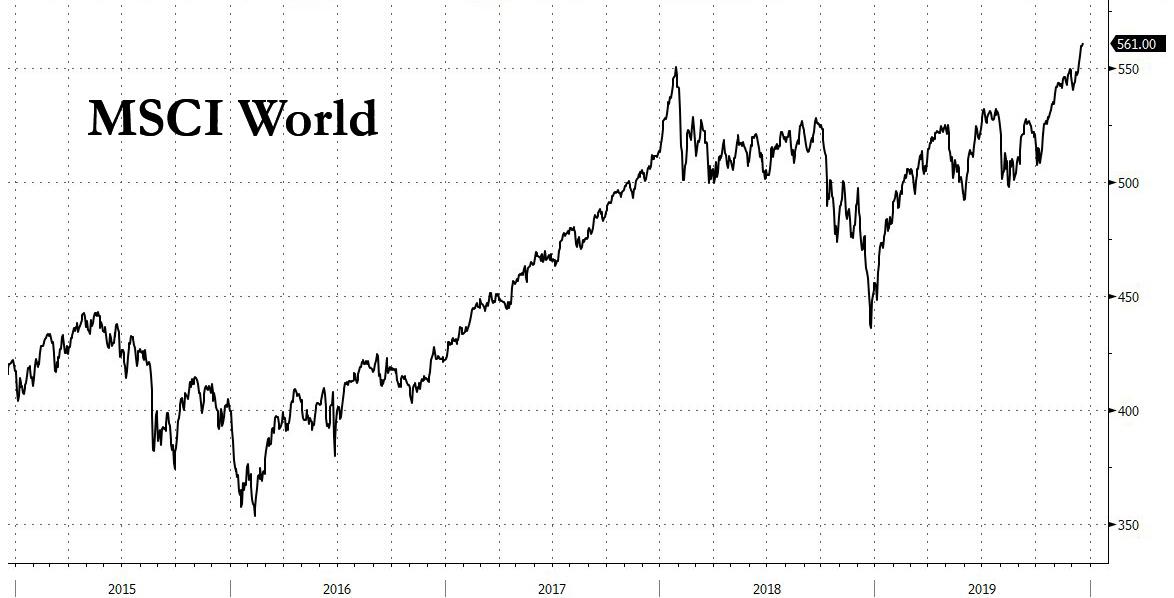

The MSCI world equity index gained to 561.31, beating the record set on Thursday and while there was no catalyst, traders ascribed the usual trade deal “optimism” for the ramp even though it increasingly appears that both sides have agreed to their own version of a deal.

The MSCI index is on track to advance more than 1% this week, in what would be its fourth straight week of gains. On Wall Street, Emini futures were flat near all-time highs, having risen more than 1% in the week.

The violent year-end melt up has pushed the S&P 500 to a sixth straight record, its longest such streak since January 2018. All three major U.S. indexes – S&P 500, Nasdaq and Dow – notched record closing highs.

Still, some data reminded investors of the fragile state of the world economy. The mood among German consumers deteriorated unexpectedly heading into January, a survey showed, suggesting that household spending in Europe’s largest economy could weaken at the beginning of next year.

Traders did not care, however, and European shares led the way higher, with the Euro Stoxx 600 gaining ground through the morning to add 0.6%. Indexes in Frankfurt, Paris and London all made similar gains in thin trading. Sectors are mostly in the green, but the energy sector sees underperformance on the back of an update from Shell (-1.2%) after the oil-giant warned it expects FY19 cash capital expenditures at the lower end of its previously guided range and sees. In terms of other individual movers, Adidas (+0.4%) shares were initially pressured in light of overall weak earnings from US peer Nike (-1.6% pre-market) and after Nike’s CFO expressed caution regarding trade tariffs hitting the group’s gross profit margins. Elsewhere, NMC Health (-19.1%) tumbled more with traders citing an FT report which notes the company held talks to raise GBP 200mln in off-balance sheet debt to fund new hospitals despite “having faced increased scrutiny from short-sellers over the scale of its borrowing”, which comes amid the Muddy Waters report earlier in the week.

Earlier, MSCI’s broadest index of Asia-Pacific shares outside Japan added a sliver, having risen 1.2% so far this week and almost 5% this month. The ASX 200 was subdued by weakness in energy and financials, with the consumer sectors the worst performers as markets continued to digest the dampened prospects for further easing as reflected by OIS which priced in an under 26% chance of an RBA rate cut in February, while Nikkei 225 (-0.2%) was pressured by recent adverse currency flows. Elsewhere, Hang Seng (+0.3%) and Shanghai Comp. (-0.4%) were indecisive after the PBoC conducted another respectable liquidity operation to bring this week’s total net injections to CNY 630bln but then kept its 1yr Loan Prime Rate unchanged which defied the consensus for a 5bps cut, while reports also suggested lingering uncertainty on the trade front related to the technological restrictions the US may impose on China.

As Bloomberg notes, investors have been in a holding pattern this week, buffeted by conflicting macro winds. President Donald Trump’s impeachment has morphed into a standoff, yet U.S. lawmakers managed to pass spending bills Thursday to avoid a partial government shutdown.

The signing of a first-phase trade deal was set for January, though terms remain unclear. While the US-China trade deal has been “completed” for now, China has voiced disagreement with what it is supposedly going to be signing off on. Meanwhile, the U.S. House of Representatives overwhelmingly approved a new North American deal that leaves $1.2 trillion in annual U.S.-Mexico-Canada tradeflows largely intact. Traders were already beginning to look at what the next steps for the Washington-Beijing saga will be in the new year.

“The focus will be on what the outlook is on a more comprehensive phase two deal – what the language is like, what Trump and the Chinese are saying about it,” said Neil Wilson, chief markets analyst at Markets.com.

In rates, the big mover was the Japanese 10Y bond: 10yr JGBs extended on the slump below the 152.00 level following selling pressure in T-notes and as the benchmark Japanese 10yr yield turned positive for the first time since March, which overshadowed the slightly firmer demand at the enhanced liquidity auction for longer dated JGBs. The move in positive territory came as Japan is boosting issuance of 40-year bonds to prevent low yields from squeezing institutional investors like pension funds and insurers and driving them into riskier assets.

The Treasury yield curve remained near its steepest in more than a year, typically the immediate trigger to a recession following an inversion. India’s longer-dated bonds jumped after the central bank unveiled plans to mount something akin to the U.S. Operation Twist, while European bonds tracked Treasuries lower.

On the currency front, sterling steadied after suffering a sharp reversal that left it facing its worst weekly fall since late 2017 of around 2%. Former Bank of England deputy governor Andrew Bailey will be the central bank’s next governor, Britain’s finance minister said. Bailey will serve an eight-year term, with investors expecting continuity on monetary policy. The pound was up 0.2% at $1.3031 having slipped overnight to below $1.30, a dramatic drop from a $1.3514 peak, after British Prime Minister Boris Johnson used his sweeping election victory to revive the risk of a hard Brexit.

“We see the biggest risks being to GBP/USD depreciation over the next two weeks as Brexit preparations take place amidst the most sluggish UK economy in 10 years,” said Richard Grace, chief currency strategist at CBA. The British parliament will vote at around 1430 GMT on Johnson’s Brexit deal.

In commodities, oil dipped and gold was range-bound.

Looking at the day ahead, releases include the third reading of Q3 GDP, November data on personal income and personal spending, December’s Kansas City Fed manufacturing activity, and the final University of Michigan sentiment indicator for December. From central banks, we’ll get remarks from the BoE’s Haskel, while in the political sphere, UK MPs will be debating legislation to implement the Withdrawal Agreement. BlackBerry, CarMax, and Carnival are among companies reporting earnings.

Market Snapshot

- S&P 500 futures little changed at 3,210.00

- STOXX Europe 600 up 0.2% to 415.97

- MXAP down 0.07% to 170.07

- MXAPJ up 0.06% to 549.52

- Nikkei down 0.2% to 23,816.63

- Topix down 0.2% to 1,733.07

- Hang Seng Index up 0.3% to 27,871.35

- Shanghai Composite down 0.4% to 3,004.94

- Sensex up 0.01% to 41,676.91

- Australia S&P/ASX 200 down 0.3% to 6,816.32

- Kospi up 0.4% to 2,204.18

- German 10Y yield rose 1.4 bps to -0.221%

- Euro down 0.03% to $1.1119

- Italian 10Y yield rose 4.4 bps to 1.213%

- Spanish 10Y yield rose 1.1 bps to 0.459%

- Brent futures down 0.2% to $66.42/bbl

- Gold spot little changed at $1,477.81

- U.S. Dollar Index little changed at 97.40

Top Overnight News from Bloomberg

- Andrew Bailey will be the next head of the Bank of England after the government chose to replace Mark Carney with the U.K.’s top financial regulator, just as Britain faces the next phase of its departure from the European Union

- The U.S. Federal Reserve will join the Bank of England in reviewing broadcast feeds for possible weaknesses after it was found that some traders and hedge funds were able to gain early access to audio of BOE briefings, the Financial Times reported.

- Confidence among U.K. businesses and consumers climbed in December, even before Boris Johnson’s decisive election victory brought some certainty to the Brexit process

- Chinese President Xi Jinping isn’t planning to attend the World Economic Forum in January, according to people familiar with the matter, taking one option for a face-to-face meeting with his U.S. counterpart Donald Trump off the table

- The U.S. Treasury yield curve reached its steepest point in over a year Thursday amid an improving growth outlook that’s boosted investors’ inflation expectations in recent weeks

- A key gauge of Japan’s price gains ticked up again in November in the wake of an earlier sales tax increase that is propping up the headline figure, complicating the picture of the underlying trend

- Japan’s cabinet approved a record budget for next fiscal year, with social security costs pushing up the bill for a government already struggling with the developed world’s biggest public debt

- China’s base rate for new corporate loans remained steady in December, reflecting policy makers’ uneven progress in reducing borrowing costs for the real economy

- The Senate sent President Donald Trump two spending bills Thursday that would provide $1.4 trillion to fund the U.S. government through September and avoid a shutdown on Saturday

- The U.S. Federal Reserve will join the Bank of England in reviewing broadcast feeds for possible weaknesses after it was found that some traders and hedge funds were able to gain early access to audio of BOE briefings, the Financial Times reported

- Japan’s cabinet approved a record budget for next fiscal year, with social security costs pushing up the bill for a government already struggling to rein in the developed world’s biggest public debt load

- Japan is boosting issuance of 40-year bonds to prevent low yields from squeezing institutional investors like pension funds and insurers and driving them into riskier assets

Asian equity markets traded mixed as the Christmas rally on Wall St, where all major indices notched fresh record highs and the S&P 500 breached the 3200 milestone for the first time, only partially transitioned into the region amid a lack of significant macro drivers. ASX 200 (-0.3%) was subdued by weakness in energy and financials, with the consumer sectors the worst performers as markets continued to digest the dampened prospects for further easing as reflected by OIS which priced in an under 26% chance of an RBA rate cut in February, while Nikkei 225 (-0.2%) was pressured by recent adverse currency flows. Elsewhere, Hang Seng (+0.3%) and Shanghai Comp. (-0.4%) were indecisive after the PBoC conducted another respectable liquidity operation to bring this week’s total net injections to CNY 630bln but then kept its 1yr Loan Prime Rate unchanged which defied the consensus for a 5bps cut, while reports also suggested lingering uncertainty on the trade front related to the technological restrictions the US may impose on China. Finally, 10yr JGBs extended on the slump below the 152.00 level following selling pressure in T-notes and as the benchmark Japanese 10yr yield turned positive for the first time since March, which overshadowed the slightly firmer demand at the enhanced liquidity auction for longer dated JGBs.

Top Asian News

- Yen Revival on Its Way After Quietest Year in Five Decades

- Founder Group Bondholders Agree to Extension, Avoiding Default

Choppy but ultimately positive trade for European bourses in holiday-thinned conditions [Eurostoxx 50 +0.7%] following a mixed APAC handover in which the region traded without conviction; albeit, the FTSE MIB somewhat outperforms. As a reminder, today’s Quadruple Witching may prompt some volatility around expiry times (full scheduled posted on the Newsquawk headline feed). Sectors are mostly in the green, but the energy sector sees underperformance on the back of an update from Shell (-1.2%) after the oil-giant warned it expects FY19 cash capital expenditures at the lower end of its previously guided range and sees its Q4 chemical cracker and intermediate margins materially lower than in Q3 this year; citing a weak macro environment. In terms of other individual movers, Adidas (+0.4%) shares were initially pressured in light of overall weak earnings from US peer Nike (-1.6% pre-market) and after Nike’s CFO expressed caution regarding trade tariffs hitting the group’s gross profit margins. Elsewhere, NMC Health (-19.1%) experiences renewed downside with traders citing an FT report which notes the Co. held talks to raise GBP 200mln in off-balance sheet debt to fund new hospitals despite “having faced increased scrutiny from short-sellers over the scale of its borrowing”, which comes amid the Muddy Waters report earlier in the week.

Top European News

- Andrew Bailey Selected to Be Next Bank of England Governor: FT

- Russia Says Shooter at Moscow’s Spy Headquarters Was Lone Wolf

- U.K. Consumers, Firms End 2019 on Upbeat Note as Sentiment Jumps

- Nestle Sells 60% of Herta Meats Into Spanish Joint Ventur

In FX, sterling is consolidating recovery gains with the aid better than forecast data in the guise of final Q3 GDP that was tweaked higher, albeit modestly. Cable is forming a firmer base on the 1.3000 handle after dipping under the psychological level yesterday, while Eur/Gbp is paring back from 0.8550+ highs to sub-0.8525 awaiting a speech from BoE dove Haskel and then the Brexit WAB vote in parliament that should be a formality, but will include an addendum aimed at preventing any move to extend the transition period. Note also, hefty option expiry interest in Cable today from 1.3000 extending up to 1.3250, but the closest from 1.3000-15 and 1.3040-50 in 1 bn clips.

- USD – Notwithstanding the Pound’s partial revival and outperformance in several other G10 currency peers, the DXY is holding a firm/fine line between 97.454-381 awaiting another round of US economic releases, including the last Q3 GDP revision, November personal income and spending and final Michigan sentiment for the current month.

- SEK/NOK – The Scandi Crowns have regained or retained momentum following respective December policy meetings from the Riksbank and Norges Bank, as Eur/Sek revisits Thursday’s post-25 bp repo hike lows below 10.4500 with some impetus from frothier Swedish PPI in the absence of retail sales that have been delayed until next Friday for no official reason. Meanwhile, Eur/Nok is still under the 10.0000 marker in response to a gentle incline in the depo rate path to 1.6% in 2022 from the current 1.5%.

- AUD/NZD – In contrast to the above, divergence between the Antipodean Dollars has persisted in wake of Australia’s upbeat jobs report that is keeping Aud/Usd afloat near 0.6900 and Aud/Nzd elevated around 1.0450 even though Nzd/Usd is pivoting 0.6600.

- JPY/EUR/CAD – Narrowly mixed vs the Greenback and not straying far or outside of recent ranges, as the Yen meanders above 109.50, Euro hovers over 1.1100 and Loonie straddles 1.3130. Usd/Jpy, Eur/Usd and Usd/Cad all look capped by big expiries given 3 bn+, almost 4 bn and 1.1 bn respectively around 109.45-50, between 1.1140-45 and 1.1150 and between 1.3140-50 respectively.

In commodities, little by way of fresh catalysts to drive the energy complex in the run-up to the holiday season with the futures trading modestly in negative territory. WTI and Brent futures remain caged within relatively tight intraday bands of USD 0.30-50/bbl and around USD 61.00/bbl and under USD 65.50/bbl respectively at time of writing. On the geopolitical front, a US probe into the attacks on the Aramco facilities showed it came from the north, with US Envoy to Iran Hook suggesting Iran launched the strike. Tehran, in response, denied carrying out the assault. Elsewhere, spot gold trades sideways above the USD 1475/oz mark and gravitates around its 50 DMA (USD 1477.09/oz) as the yellow metal remains on standby for macro developments. Copper meanwhile trades on the backfoot, having lost the 2.80/lb mark in early EU trade, which may have triggered more pronounced downside amid potential stops tripped at the round figure.

US Event Calendar

- 8:30am: GDP Annualized QoQ, est. 2.1%, prior 2.1%

- Core PCE QoQ, est. 2.1%, prior 2.1%

- 8:30am: Personal Consumption, est. 2.9%, prior 2.9%

- 10am: Personal Income, est. 0.3%, prior 0.0%; Personal Spending, est. 0.4%, prior 0.3%

- 10am: PCE Deflator MoM, est. 0.2%, prior 0.2%; PCE Deflator YoY, est. 1.4%, prior 1.3%

- 10am: PCE Core Deflator MoM, est. 0.1%, prior 0.1%; PCE Core Deflator YoY, est. 1.5%, prior 1.6%

- 10am: U. of Mich. Sentiment, est. 99.2, prior 99.2

- 10am: U. of Mich. Current Conditions, prior 115.2; Expectations, prior 88.9

- 10am: U. of Mich. 1 Yr Inflation, prior 2.4%; 5-10 Yr Inflation, prior 2.3%

- 11am: Kansas City Fed Manf. Activity, est. -2.5, prior -3

DB’s Craig Nicol concludes the overnight wrap

Happy Friday to all and welcome to the last EMR of 2019 and indeed the entire decade. It’s been an eventful period, and over that time we’ve seen a massive global equity rally, the rise of populism, higher global debt levels, the survival of the Euro and the longest-ever US expansion. Amidst these seismic events, the last decade has arguably been the best yet on a number of metrics, whether it’s record-breaking global life expectancy, literacy rates or reductions in poverty. On a personal level too, the 2010s saw me get my first graduate job working for Jim Reid. Let’s hope this flattery works when it comes to my next appraisal.

In markets, investor sentiment is similarly buoyant as the move towards risk assets continues, and US equity markets pressed on yesterday to yet another record high. The S&P 500 ended the session +0.45%, breaching the 3200 mark for the first time, while the Dow Jones (+0.49%) and the NASDAQ (+0.67%) also powered forward to new records. In Europe, the STOXX 600 advanced by +0.17%, not quite at its all-time high but still just a +0.65% increase away from its record earlier in the week. Elsewhere, Brent crude was up +0.56% yesterday in its 6th successive move higher, closing at a fresh 3-month high.

It was the reverse picture in bond markets, with sovereign debt selling off on both sides of the Atlantic. 10yr Treasury yields rose +0.4bps to 1.920%, and the 2s10s curve steepened by +0.5bps to close at its highest level since November 2018. In Europe bunds (+1.5bps), OATs (+1.2bps) and BTPs (+4.5bps) all saw yields rise, with Greek sovereign debt underperforming as 10yr yields rose +9.4bps.

The sell-off came as the Riksbank became the first central bank in the world to move out of negative interest rates yesterday, thanks to a 25bp hike in the repo rate to 0%. Although the move was in line with expectations, this sets a potential precedent for other central banks to similarly move away from negative rates. That said, the Riskbank’s forecast for the repo rate didn’t show much sign of going higher than zero anytime soon, with the forecast for the repo rate remaining at zero for Q4 2020 and Q4 2021.

The other major central bank decision yesterday was here in the UK, where the Bank of England left rates unchanged at 0.75%, in line with expectations. However, as happened at the previous meeting, 2 of the 9 MPC members voted for a 25bp cut. In the summary released after the meeting, the MPC kept their options open, saying that they “could respond in either direction to changes in the economic outlook in order to ensure a sustainable return of inflation to the 2% target.” In a note out yesterday (link here), our UK economists stuck to their base case of a January rate cut, writing that “we think there is sufficient time for the MPC to turn more dovish” before the January meeting.

Speaking of the Bank of England, last night the FT reported that Andrew Bailey had been selected as the next governor, though no official announcement has yet been made at time of writing. Bailey is currently the head of the UK’s Financial Conduct Authority and was previously a Deputy Governor at the BoE. It comes ahead of incumbent governor Mark Carney’s departure at the end of January, having served as the BoE governor since July 2013.

Staying with the UK, sterling extended its losses yesterday, in spite of its brief move higher following the BoE’s decision, to close -0.53% lower against the US dollar, as investors continued to weigh the possibility that the UK could reach the end of the Brexit transition period at the end of 2020 without having agreed a trade deal with the EU. It came as the government announced its legislative agenda for the coming session of Parliament, with MPs due to start debating the legislation to ratify the Withdrawal Agreement today. In line with the government’s commitment not to extend the transition period, the bill that was published yesterday included a section that expressly prohibited a UK minister agreeing to an extension.

Overnight in Asia, equity markets have mostly followed the US upwards. Although the Nikkei is unchanged this morning, the Hang Seng (+0.37%), the Shanghai Comp (+0.19%) and the Kospi (+0.18%) have all moved higher. S&P 500 futures are pointing to little change, currently down -0.01%. Looking at other news from overnight, Bloomberg reported that Chinese President Xi was not planning to go to the World Economic Forum at Davos, removing the possible opportunity of a meeting with President Trump, who Bloomberg reports will be in attendance.

In terms of data, we had a number of releases from the US yesterday, but they pretty much all surprised to the downside. The Philadelphia Fed’s business outlook indicator fell to +0.3 (vs. +8.0 expected), below all estimates on Bloomberg and the weakest since June. Initial jobless claims came in above expectations at 234k last week (vs. 225k expected), sending the 4-week moving average up to 225.5k, its highest level since February. Existing home sales fell to a seasonally adjusted annual rate of 5.35m (vs. 5.44m expected) in November, while the Conference Board’s leading economic index was unchanged (vs. +0.1% expected).

The data was marginally more positive in Europe. The INSEE’s business climate indicator for France in December came in at 106 (vs. 104 expected), with the manufacturing confidence indicator also beating expectations at 102 (vs. 99 expected). UK retail sales were more subdued however, falling -0.6% (vs. +0.2% expected) in November. The figure brings the yoy increase down to +1.0%, the lowest since April 2018.

To the day ahead now, and it’s a fairly busy one for data releases. From Europe we’ve got the Euro Area’s current account balance for October, along with the European Commission’s advance consumer confidence indicator for the Euro Area in December. In Germany, GfK will be releasing their January consumer confidence index, and here in the UK, we’ll get the final reading of Q3 GDP along with November public finance data. Over in the US, releases include the third reading of Q3 GDP, November data on personal income and personal spending, December’s Kansas City Fed manufacturing activity, and the final University of Michigan sentiment indicator for December. From central banks, we’ll get remarks from the BoE’s Haskel, while in the political sphere, UK MPs will be debating legislation to implement the Withdrawal Agreement.

Tyler Durden

Fri, 12/20/2019 – 08:09

via ZeroHedge News https://ift.tt/34Fw4yB Tyler Durden