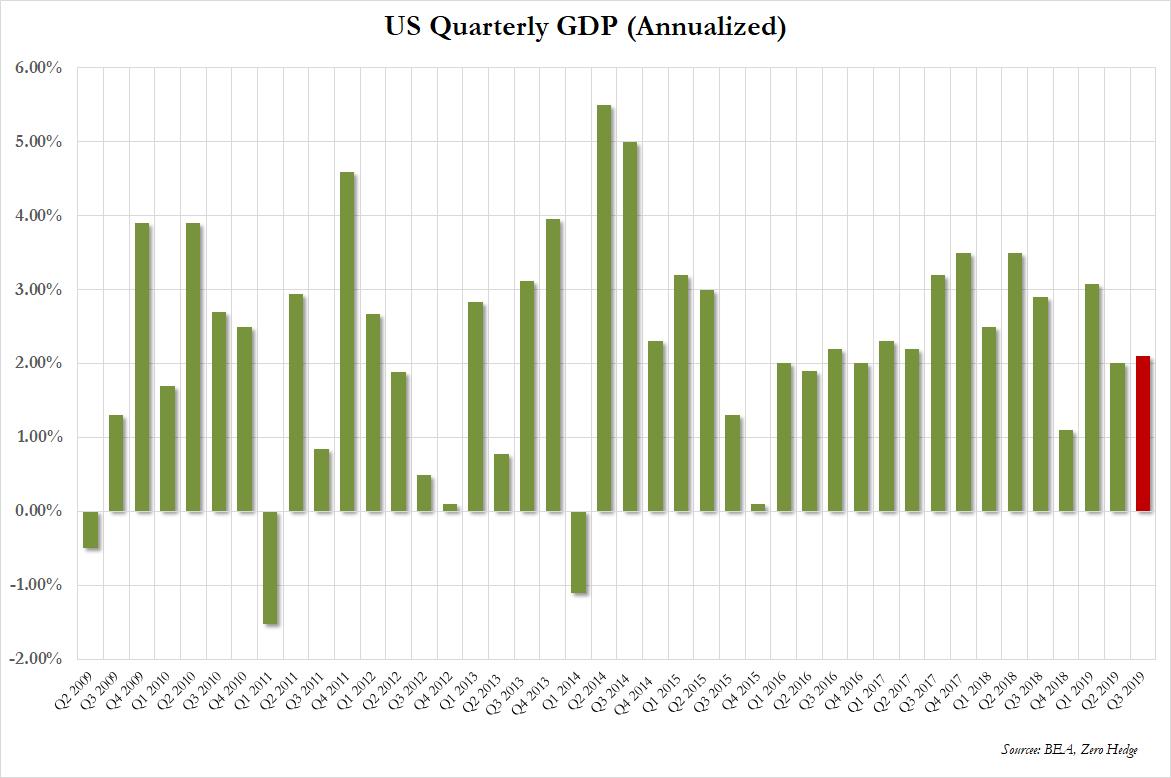

Final Q3 GDP Revision Unchanged At 2.1%: All Growth Comes From US Consumer Spending

The final revision of Q3 GDP came in as expected, at 2.1%, and unchanged from the second revision, rising fractionally from the 2.0% in Q2.

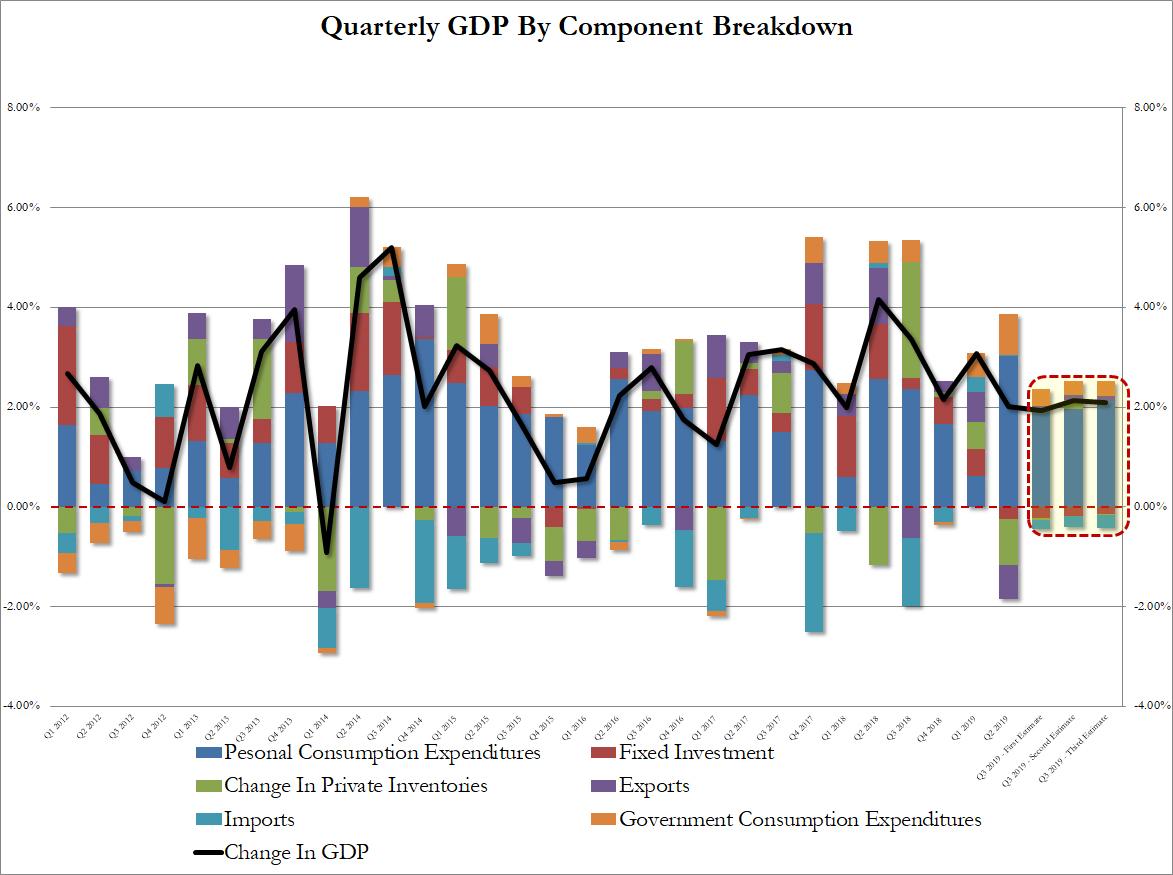

While overall GDP growth was unrevised from the second estimate, upward revisions to consumer spending and business investment were offset by a downward revision to inventory investment. Some more details:

-

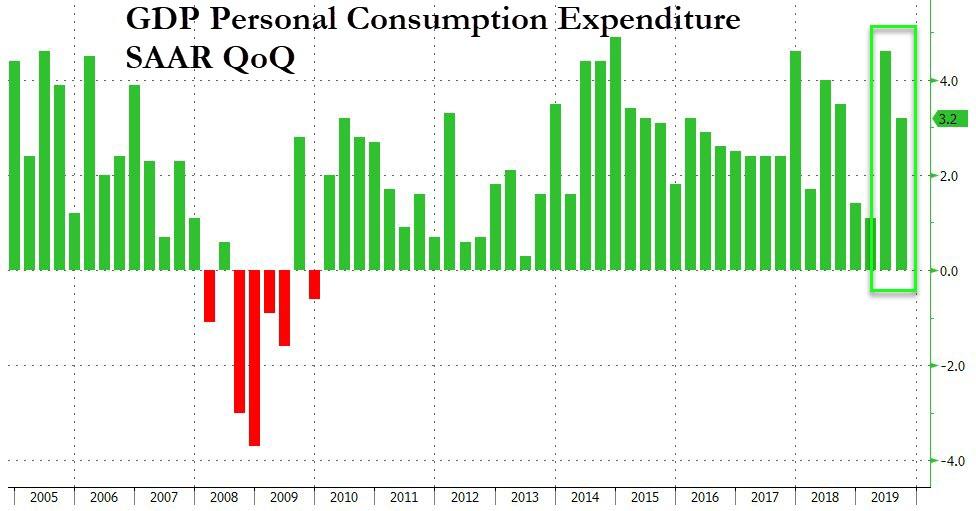

Personal Consumption was came in at 3.2% annualized, above the 2.9% in the prior revision and above the 2.9% expected if below the 4.6% in Q2, and contributed 2.12% of the bottom line GDP print of 2.1%, indicating the consumer was once again the major driving force behind GDP.

-

Fixed Investment was revised modestly lower, from -0.18% to a -0.14% detraction from GDP – the first consecutive drop in investment since 2009.

-

Nonresidential fixed investment, or spending on equipment, structures and intellectual property fell 2.3% in 3Q after falling 1% prior quarter

-

-

Private inventories were unexpectedly revised back into negative territory, subtracting -0.03% from GDP, after adding 0.17% in the prior revision.

-

Net trade shrank modestly, from -0.11% to -0.15%.

-

Government spending rose fractionally, up from 0.28% to 0.30%.

Visually:

As has been the case in recent quarters, personal consumption has been the sole driver of US economic growth.

While the economy grew just as expected, inflation remained subdued, with the GDP price index rising 1.8% in 3Q after rising 2.4% prior quarter, and in line with the 1.8% expected. Meanwhile, Core PCE rose 2.1% in 3Q, unchanged from the prior revision, after rising 1.9% prior quarter;

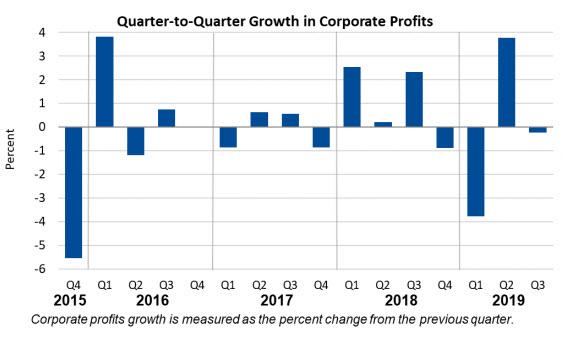

Finally, corporate profit growth ground to a halt in Q3, declining at a 0.2% quarterly rate in the third quarter, revised from a 0.2% increase, after rising 3.8% in the second quarter:

- Profits of domestic nonfinancial corporations decreased 0.5% after increasing 3.2%.

- Profits of domestic financial corporations decreased 1.1% after increasing 0.6% .

- Profits from the rest of the world increased 102% after increasing 7.7% .

Tyler Durden

Fri, 12/20/2019 – 08:45

via ZeroHedge News https://ift.tt/35KvBfY Tyler Durden