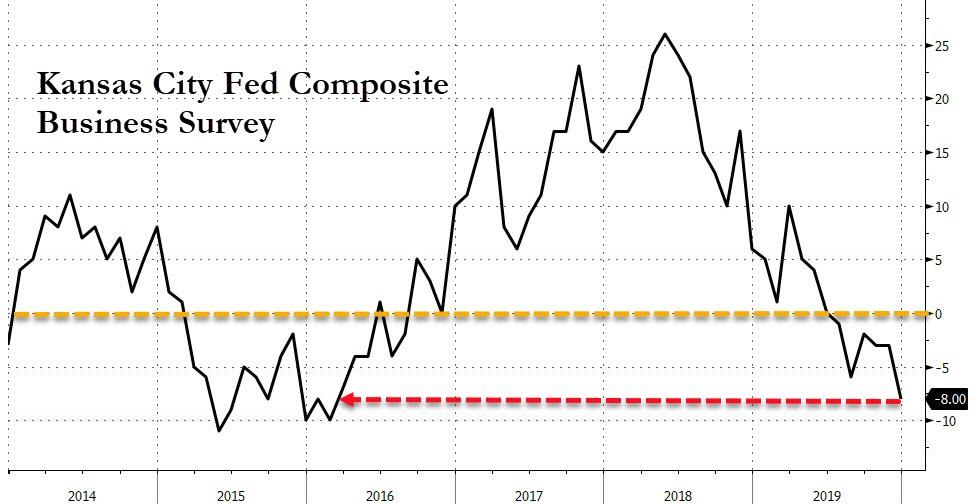

Kansas City Fed Biz Survey Crashes Near 4-Year Low

Despite a pickup in PMIs – that appears to be heralded as ‘proving’ the trough is in – Kansas City Fed’s business survey has plunged to its lowest since Feb 2016 (confirming the weakness also seen in the Philly Fed).

Kansas Fed Survey fell to -8 from -3…

Source: Bloomberg

Comments from survey respondents are mixed. Some of the more negative ones include…

-

“The cost of fossil fuel energy has a direct impact on our business. The higher the cost of fossil fuels, the stronger the conditions in my business, and vice versa.”

-

“Weakness in the oil and gas market is significantly negatively impacting our business until we can offset that business with work from other sectors.”

-

“We are on hold until someone decides what the next round of tariffs will be.“

-

-

“The tariff on steel and the trade issues are still a concern for 2020. We are being very conservative on capital expenditures and use of cash until these two things calm down.”

Some relative positives though – spending up and labor market tight…

-

“Our business is somewhat seasonal, so this month vs. last being down is a normal cycle. Overall customer spending is more robust than years past.”

-

“The holiday seasonal temp workers have made it even more difficult for us to find and retain employees. We literally have people coming to us for the first day of work and leaving because they got an offer $1 to $2 higher down the street. Labor is and continues to be our biggest struggle.“

-

“Best winter backlog we’ve seen in a while.”

-

“Capital expenditures and labor efficiency has helped the bottom line for net profits.”

-

“We are being aggressive and proactive in both sales and the pricing arena.”

-

“Overall the economy is running smoothly at this time without major wage pressure or problems finding reasonable labor for entry-level work. We regularly train personnel and promote from within and are finding more personnel who are interested in improving their own skills.”

This is the sixth consecutive negative (contraction) monthly print for the index and under the hood, it’s a $hit$how…

-

Prices paid for raw materials rises to 16 vs 14 prior month

-

Volume of new orders falls to -16 vs -3

-

New orders for exports falls to -11 vs -6

-

Production falls to -7 vs -5

-

Number of employees falls to -10 vs -9

-

Average employee workweek falls to -7

-

Shipments falls to -6 vs 7

-

Composite six-month outlook falls to 10 vs 15

So everything fell (apart from costs which rose)?!

Tyler Durden

Fri, 12/20/2019 – 11:03

via ZeroHedge News https://ift.tt/2ZdY7UO Tyler Durden