With Stocks In Full-Blown Melt Up, Here Are The Key Gamma And Delta Strikes To Watch

Yesterday we presented a lengthy explanation why in a technically and position-driven market such as this one, gamma is arguably one of the most important factor explaining short-term market moves. This prompted numerous reader inquiries what are the key gamma (and delta) strikes to watch. Today, courtesy of Nomura’s Charlie McElligott, and in light of today’s year-end quad withing day, we answer this question.

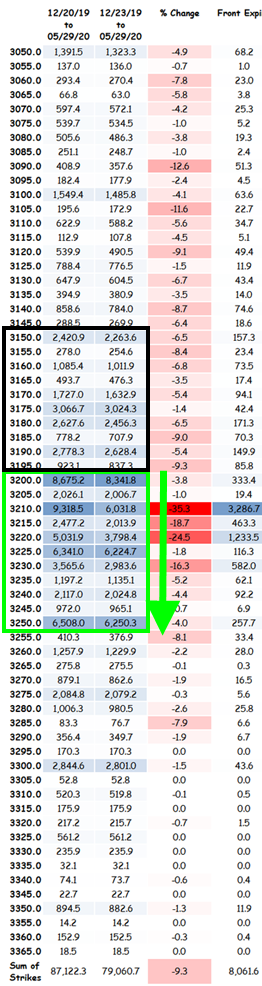

First, looking at the market gamma pins, McElligott notes that the big strikes now are at 3,210, 3,225 and 3,250 as gamma shifts to ever higher strikes on account of overwriters rolling “out and up.”

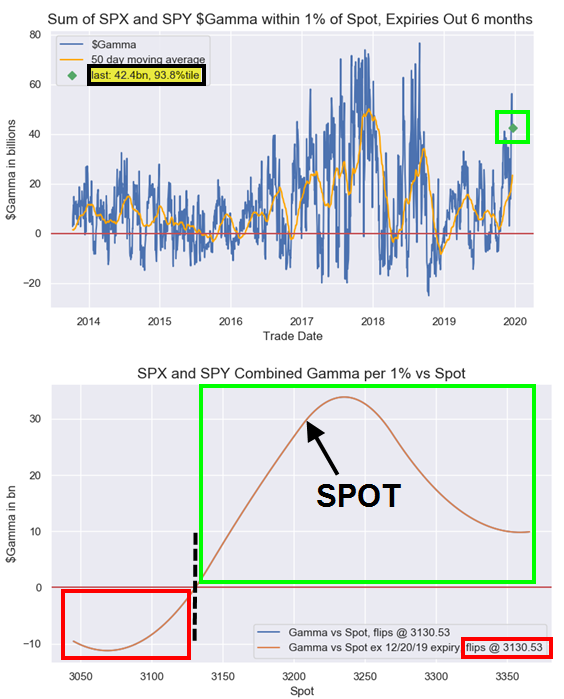

With overall dealer gamma having spiked in recent week, McElligott calculates that gamma won’t flip negative until well below 3,130, as shown in the second chart below.

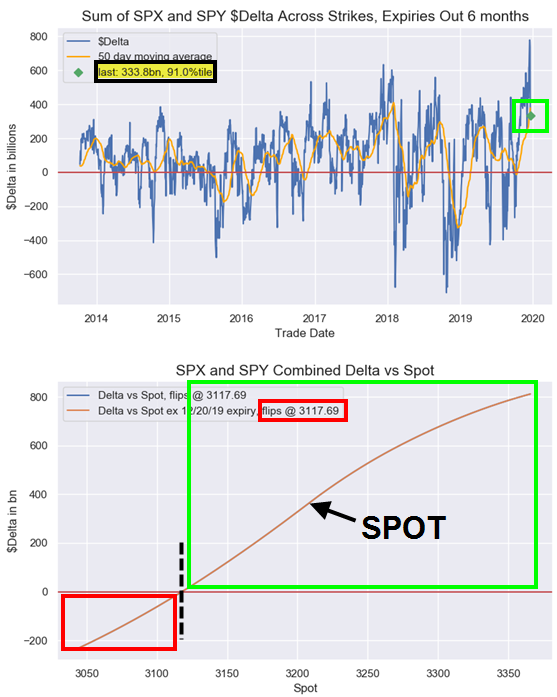

With gamma having a ways to go before it starts feeding on any selloff, the delta “flip” level even lower, and would require a 100+ point drop in the S&P, to 3,117, before it is triggered.

Meanwhile, with the year-end meltup in full force, what we are getting instead, is a clobbering of the VIX which has slumped all day…

… pushing the S&P to new all time highs around the 3,225 gamma pin.

Tyler Durden

Fri, 12/20/2019 – 11:12

via ZeroHedge News https://ift.tt/2EEasYP Tyler Durden