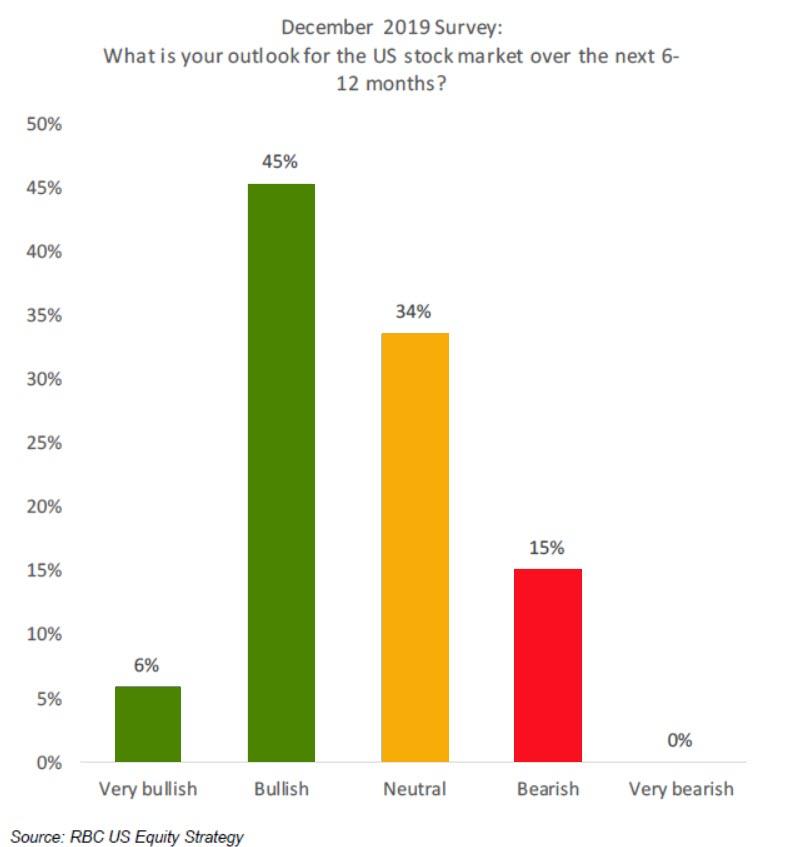

US Equity Markets Just Reached ‘Record Euphoria’

The bears have left the building and very few see anything potentially derailing this US equity market melt-up in the next 6-12 months…

Source: RBC

Leaving investors at record levels of euphoria…

Source: RBC

-

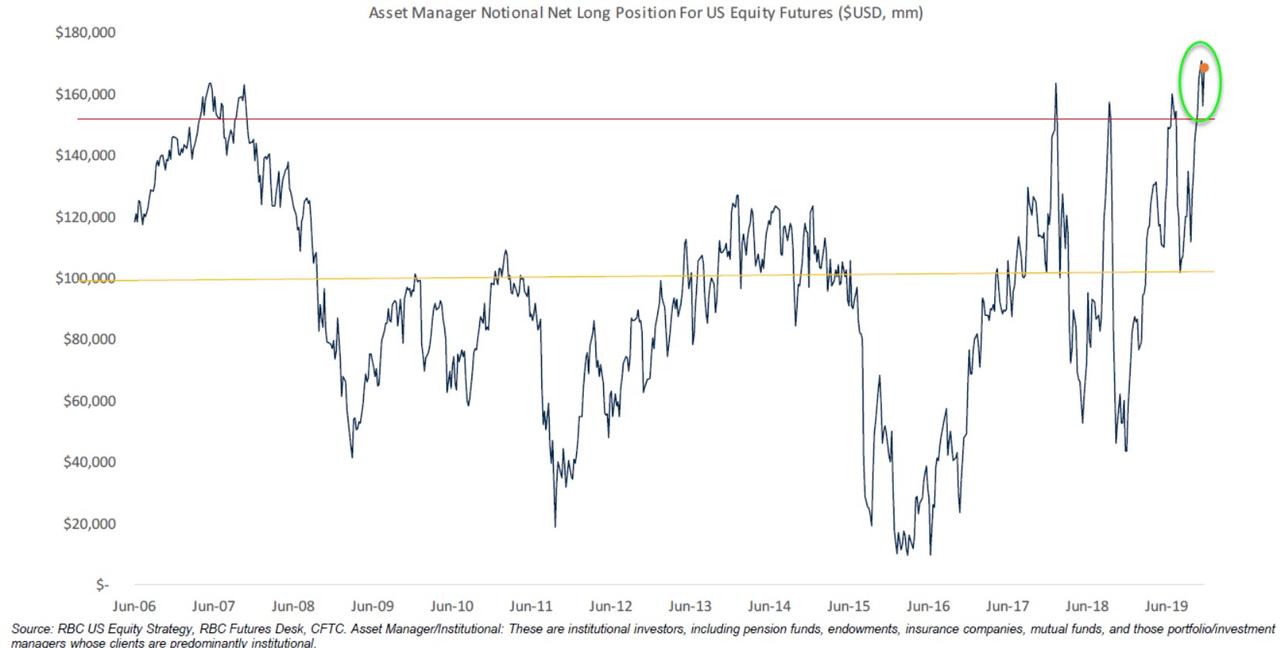

In July 2019, CFTC data on US equity futures positioning returned to the highs of January 2018 and September 2018, which in turn were in line with pre-Financial Crisis highs. This told us that institutional investor positioning was euphoric and that the US stock market was vulnerable to bad news. In August, positioning on this indicator fell sharply, getting about halfway back down to the May and December 2018 lows before stabilizing.

-

This indicator has moved up again in 4Q19, and as of December 10th (the latest data available) was slightly above the levels that have marked significant peaks in the stock market over the past few years.

-

Note that each of the recent peaks are associated with policy catalysts (Tax Reform, Trade War, Fed Cuts).

And the ‘extremest greed’ since the peak in 2017…

Source: CNN

With the S&P 500 trading at its richest to its 200-day moving average since the peak in Jan 2018…

Source: Bloomberg

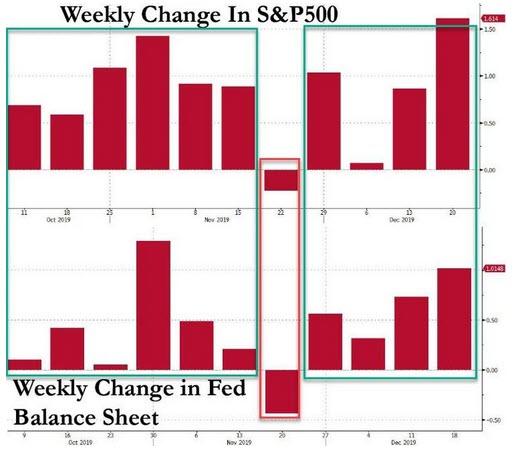

And in case you wondered why… it’s the fun-durr-mentals, stupid!!

Source: Bloomberg

And as central bank liquidity has soared, volatility across every asset class has been clubbed like baby seal…

Source: Bloomberg

“You have meddled with the primary forces of nature, Mr [Powell], and I won’t have it! Is that clear?

…There are no Russians. There are no Arabs. There are no Third Worlds. There is no West. There is only one holistic system of systems. One vast and immane, interwoven, interacting, multi-varied, multi-national dominion of dollars. Petro-dollars, electro-dollars, multi-dollars, reichmarks, rands, rubles, pounds and shekels…

All necessities provided. All anxieties tranquilized. All boredom amused.“

Ok, having got that off our chest, let’s look at the week in ‘markets’…

Chinese markets experienced all their exuberance on the first two days of the week…

Source: Bloomberg

European stocks were more mixed with Germany lagging (managing to get green today after the ridiculous ramp) and Italy leading with a big gain…

Source: Bloomberg

US equity markets were all exuberantly higher this week led by Nasdaq and Small Caps…

While the week was celebrated as being bullish as all heck, we note that Defensive stocks dominated (and every day saw post-open selling in cyclicals)…

Source: Bloomberg

And while the early week was driven by yet more short-squeezes, the machines seemed to run out of ammo today…

Source: Bloomberg

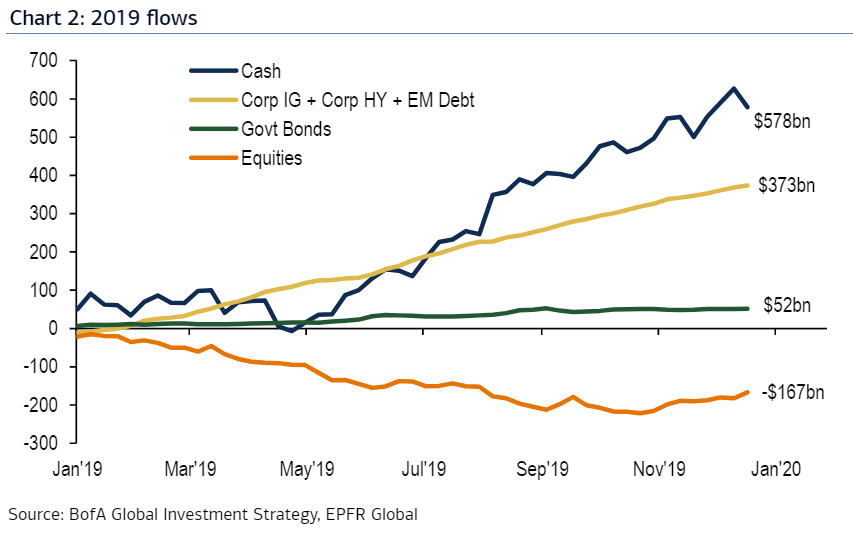

And this has all happened amid a record $167 billion in equity outflows in 2019…

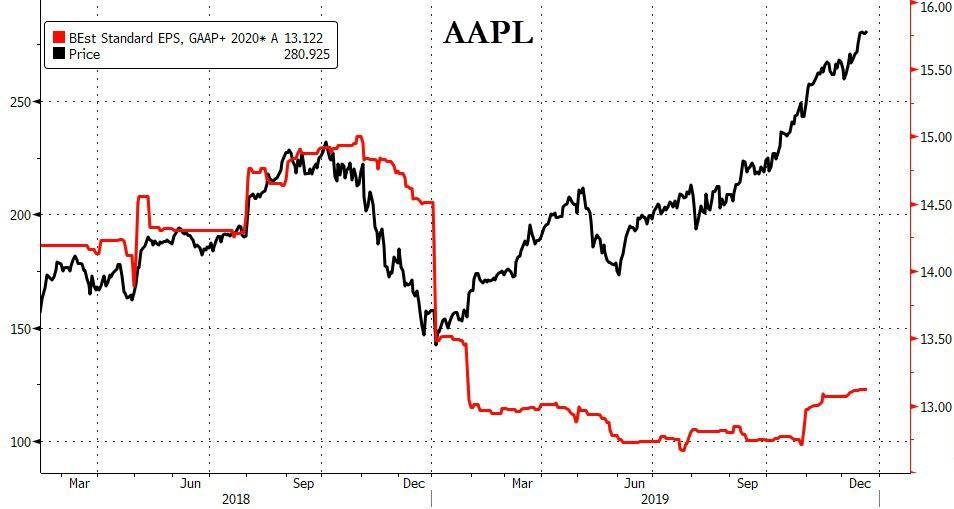

Apple share hit a new all-time high, lifting the broad equity markets with its vast size. Apple has now added over hgalf a trillion in market in 2019 alone… as Fwd EPS expectations slump… WTF!

Source: Bloomberg

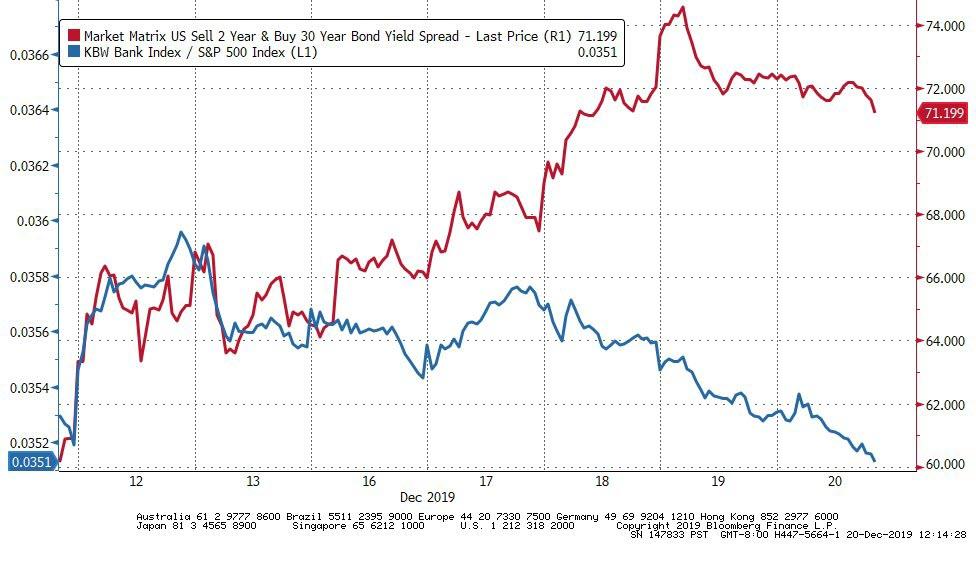

Notably, while bank stocks were higher on the week, they underperformed the broad market and decoupled from the steepening yield curve…

Source: Bloomberg

VIX was monkeyhammered into the open but came back during the day

Does this look like normal price action to you?

Source: Bloomberg

Also, as we noted earlier in the day, the opening panic bid was created by extreme gamma driving the Dec S&P futs contract into its expiration at the open…

Source: Bloomberg

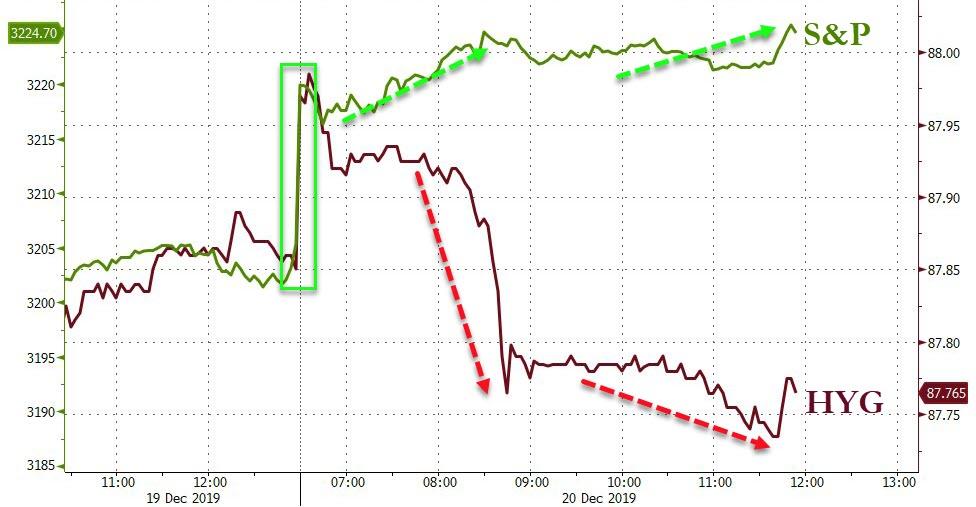

HYG notably decoupled from stocks today…

Source: Bloomberg

Treasury yields were unchanged today but higher across the curve on the week with the short-end dramatically outperforming…

Source: Bloomberg

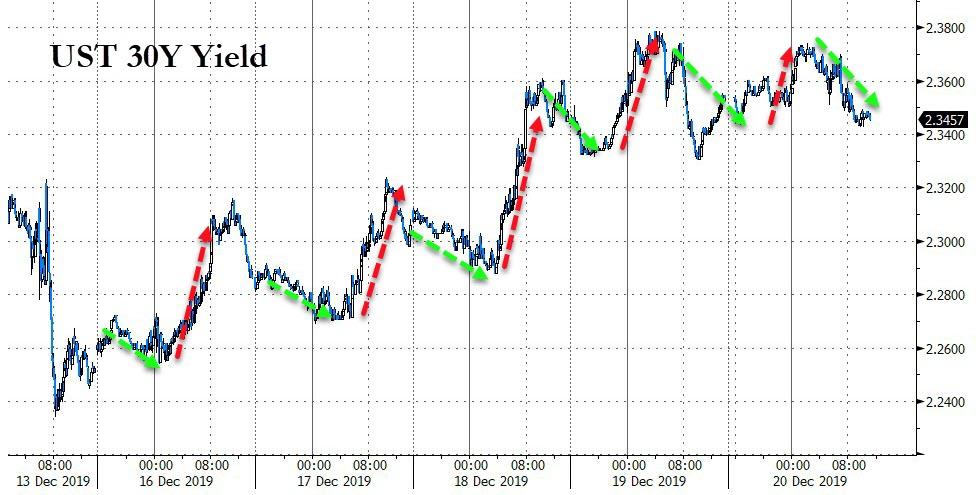

But, the daily pattern of Asia buying, Europe selling, US (post-EU) buying continues…

Source: Bloomberg

Sending the yield curve up to the highs from early November, and notably rolling over…

Source: Bloomberg

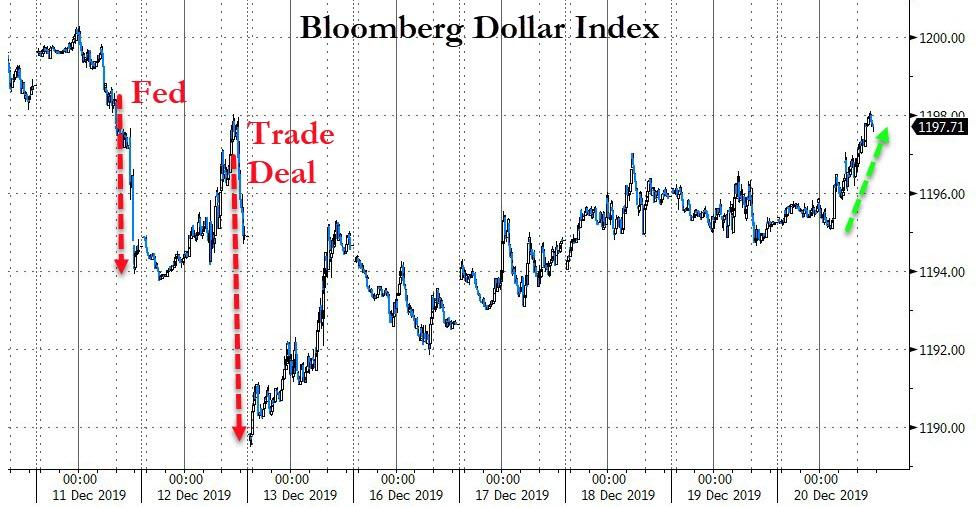

After two down weeks, the dollar rallied back to pre-trade-deal levels…

Source: Bloomberg

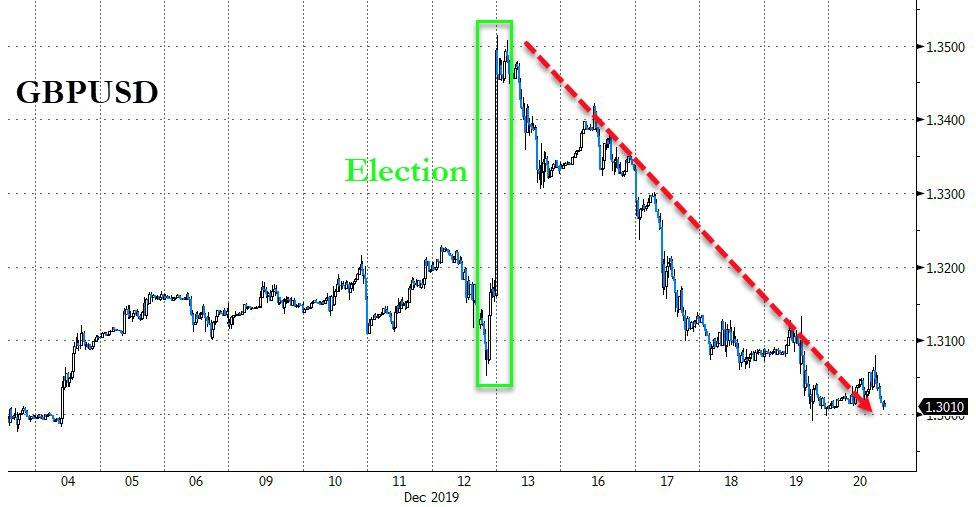

Cable tumbled this week – post-election – suffering its biggest weekly loss since Oct 2017…

Source: Bloomberg

While US equities surged this week (along with the USD and bond yields), yuan was dead, seemingly glued to 7.00…

Source: Bloomberg

Cryptos had another highly volatile week with only Bitcoin managing (barely) to get back to even after the early week collapse…

Source: Bloomberg

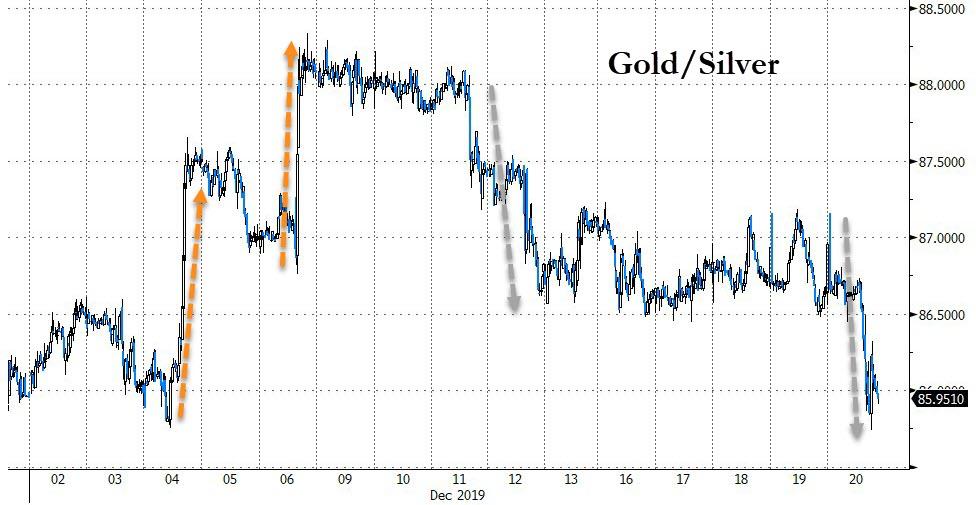

Silver was the week’s biggest gainer (unusually) as crude tumbled on the day to lose the the crown…

Source: Bloomberg

Silver is back above $17 and back at pre-Thanksgiving slump levels…

The dramatic silver outperformance sent it back to its strongest vs gold in December…

Source: Bloomberg

WTI Crude tumbled today, back to the top of its recent uptrend channel…

Finally, yeah we know we’re whining but still… this happened in 2019…the S&P 500 is up almost 29% while earnings expectations are down almost 5%

Source: Bloomberg

No really, it’s not about fun-durr-mentals…

Source: Bloomberg

Four straight weeks higher for the S&P 500… Dear Bulls, thank The Fed…

Source: Bloomberg

Tyler Durden

Fri, 12/20/2019 – 16:00

via ZeroHedge News https://ift.tt/2PJmLJE Tyler Durden