De Beers Diamond Sales Sump Again In Rough Year

De Beers, the world’s largest diamond miner, has been rocked this year with declining sales as the diamond crisis deepens in 2019 and set to worsen in 2020, reported Bloomberg.

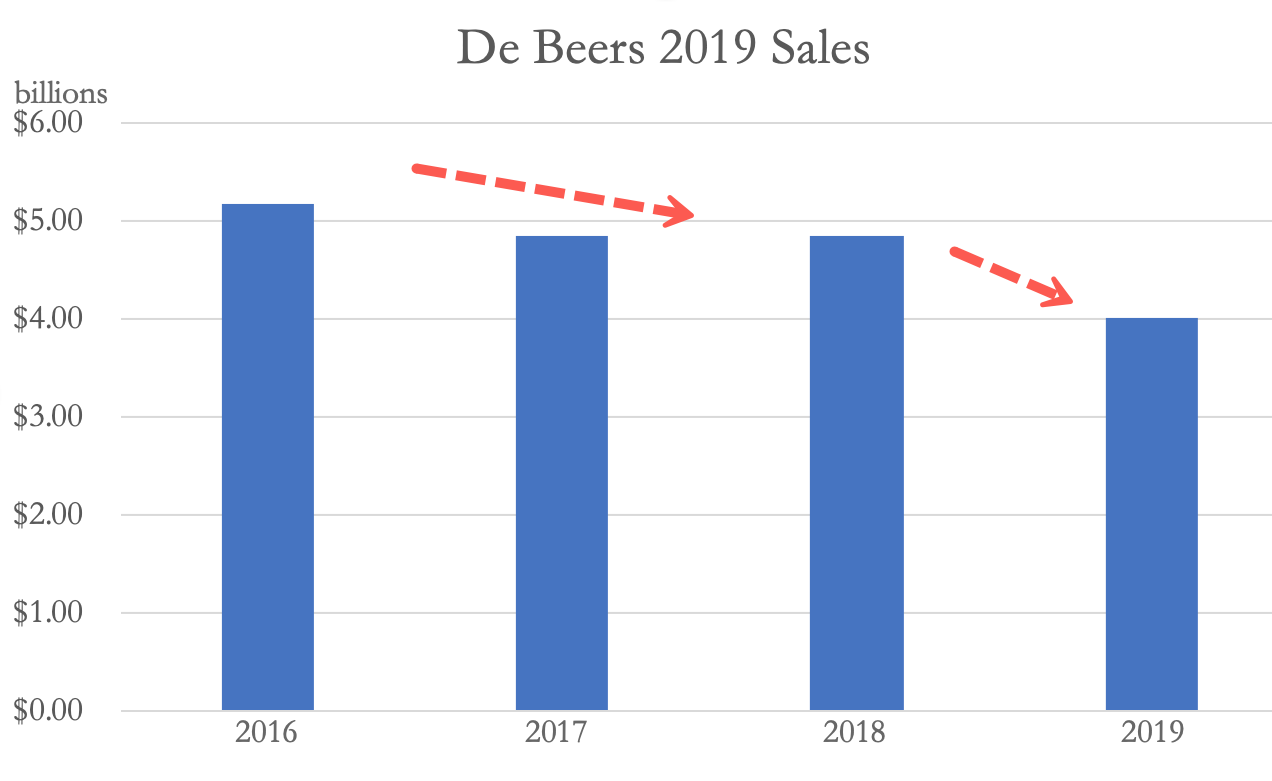

The Anglo American Plc unit reported sales this year fell by $1.4 billion, ending a year that has been filled with concerns of oversupplied markets, plunging consumer demand, and price cutting.

De Beers sold $425 million of diamonds this month at its latest sale. That brought the total to about $4 billion for the year.

De Beers has spent the back half of the year slashing diamond prices as global markets remained oversupplied into the holiday season, mostly reflecting demand woes for top markets in the US, Europe, and China.

Macroeconomic headwinds have primarily been the reason for waning diamond demand as a global trade recession continues to throw the global economy into a desynchronized formation.

As a result of oversupplied markets for rough diamonds and falling prices for polished stones, De Beers will mine one million carats less than previously thought in both 2020 and 2021. That equates to about 1% of the global diamond output and outlines how the world’s largest miner is slowing its expansion amid uncertain times.

To address oversupplied conditions, De Beers has lowered prices of rough stones, which has cut into profits.

The diamond midstream, the link between African mines and jewelry stores in Hong Kong, London, and New York, has too much inventory as spot prices continue to sink, and banks are starting to pull back on lines of credit. Many traders have been left unprofitable in 2019.

De Beers, which sets the price of diamonds to traders, slashed prices by 5% last month in hopes to stimulate demand. The company has ramped up digital, print, and television advertisements to persuade consumers on why they need a diamond.

Glancing at a composite of spot diamond prices, the IDEX Diamond Index shows how oversupplied conditions have weighed down prices in the last 12 months.

Tyler Durden

Fri, 12/20/2019 – 22:45

via ZeroHedge News https://ift.tt/2sR0HDO Tyler Durden