Aramco Slips For Fourth Day After Losing $2 Trillion Dollar Valuation

Saudi Arabia’s stock market stalled on Sunday as Saudi Aramco shares continued a four-day decline, reported Reuters.

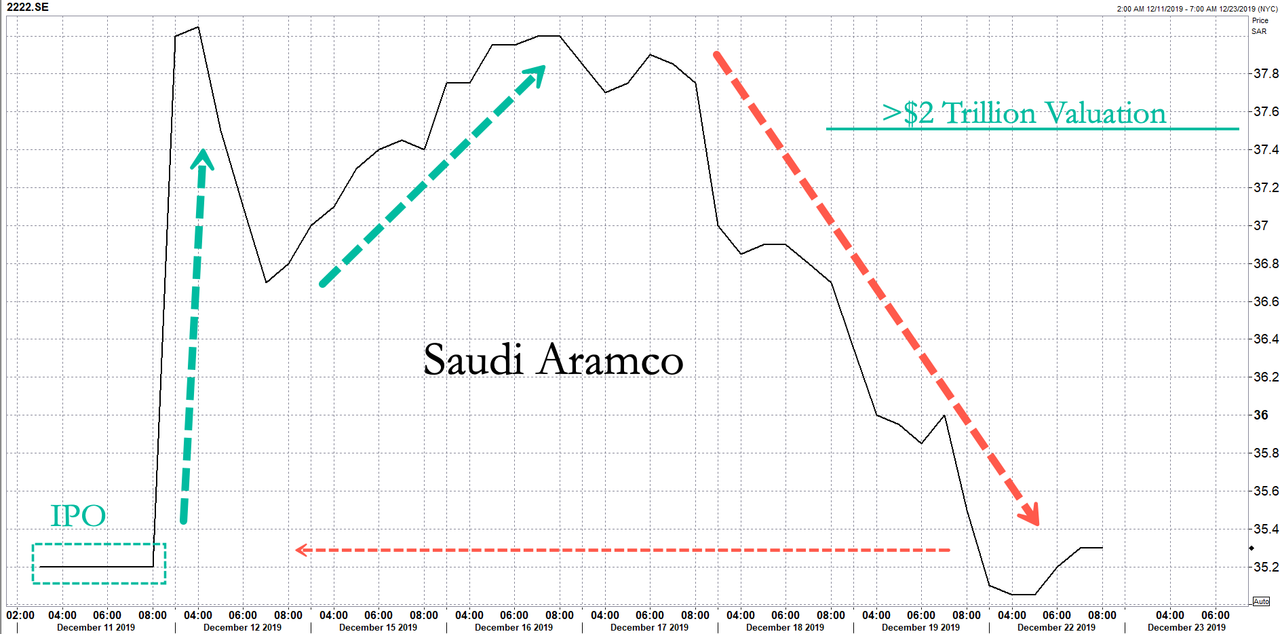

Aramco shares have erased much of its gains post-IPO. The initial listing price was at 32 SAR, jumped to 38.738 SAR on Dec. 11, but has since slid 9.30% to 35 SAR in six sessions.

Shares struggled to hold the $2 trillion valuation mark above 37.51 SAR last week, a level that Prince Mohammad Bin Salman (MbS) has justified as the fair value of the state-owned oil company.

The near 10% drop in six sessions comes as Aramco was added to MSCI, Saudi Tadawul index, and FTSE benchmark.

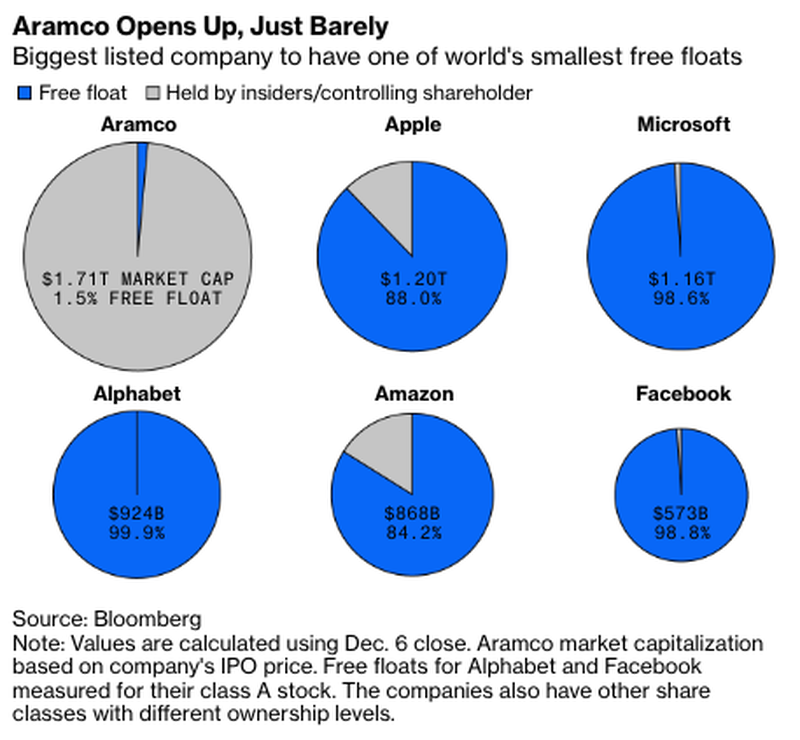

MbS, Aramco, and Saudi newspapers have been promoting Aramco’s $1.7 to $2 trillion valuations as the world’s largest IPO. Western banks have avoided the IPO on valuation concerns.

Several months ago, Wall Street banks valued Aramco at $1.2 to $1.5 trillion, now trading around $1.7 trillion.

Earlier this month, analysts at Sanford C. Bernstein & Co. warned that investors need to cash out of Aramco because of valuations concerns.

We noted that the kingdom incentivized domestic funds and citizens to buy the stock on the day of the IPO, a move that was in an attempt to create a massive stock pump.

Despite local media outlets stating, “Aramco at the top of the world” and “A dream come true,” the reality is $2 trillion valuations were hard to maintain, and the pinning of the price at 37.51 SAR appears to be much harder than the kingdom previously thought.

Macroeconomic headwinds of a slowing global economy, falling Chinese demand and declining fuel consumption across the world could pressure oil prices in the new year after the reflation trade sputters out. This could result in lower Aramco valuations, and a break below 32 SAR IPO price would be embarrassing for the kingdom – considering they’ve already taken an early victory lap on the greatest IPO ever.

Don’t forget the last time a state-owned oil company had an overinflated valuation debuted on the public market — and what happened shortly after was nothing less than devastation.

It perfectly top-ticked the S&P.

Tyler Durden

Sun, 12/22/2019 – 09:55

via ZeroHedge News https://ift.tt/2So9bNo Tyler Durden