As The Fiscal Doomsday Machine Powers On, David Stockman Rages “Impeach The Congress, Too!”

Authored by David Stockman via LewRockwell.com,

If bringing one’s country to fiscal ruin were an impeachable offense, you’d have to impeach the entire city of Washington.

On December 16 the gross Federal debt breached a new level to $23.1 trillion, while the net debt after $401 billion of cash weighed in at $22.71 trillion. The latter monstrous figure is notable because on June 30, 2019 it stood at $21.76 trillion.

So what has happened in the last 167 days is a $948 billion increase in the Uncle Sam’s net debt, which amounts to a gain of $5.7 billionper day – including, as we like to say, weekends, holidays and snow days.

Worse still, not a single dollar of that gain got absorbed in government trust funds. The Treasury float held by the public actually rose by $953 billion.

So why in the world do the knuckleheads on bubblevision not understand where the spiking rates and ructions in the repo market came from?

The law of supply and demand is still operative, and the US Treasury is literally flooding the bond pits with new supply. Even at the bottom of the Great Recession, Uncle Sam did not drain $5.7 billion per day from the bond market.

But nary a soul down in the Imperial City has noticed this borrowing eruption at the tippy-top of the business cycle, which now teeters on borrowed time at a record 127 months of age. Instead, this very day the Congress is busily engaged in what is a fair approximation of abolishing the election process at the heart of American democracy.

We will address today’s hideous impeachment Gong Show below. But here we note that every talking head showing up on the screen today is claiming that the market can keep on bubbling higher because the pending impeachment of the nation’s 45th president is a great big nothingburger.

Au contraire!

It’s real, deeper meaning is that the Washington end of the Acela Corridor is now morphing into a disruptive missile aimed right at the canyons of Wall Street.

Of course, the Donald won’t be “convicted” by the Republican Senate. Indeed, the House impeachment resolution my never even be sent to the Senate if Nancy and her ship of fools conclude there won’t be a real “trial” in the Senate and therefore leave the resolutions sitting on the parliamentarian’s desk as camera ready campaign fodder for 2020.

But, hey, a government which can treat the supposedly solemn and extraordinary process of impeachment as a mere exercise in campaign theatrics is a government that has given the term “dysfunctional” an altogether new definition. It means that the conduct of the actual business of the people’s government has virtually ceased.

To be sure, we would ordinarily consider a government that does absolutely nothing to be praiseworthy. After all, the route to prosperity does not extend through the halls of Congress or the vast departments inside the beltway, but stems from the genius of free enterprise and the exertions and inspiration of workers, employers, savers, investors and inventors. They require neither help nor superintendence from an activist Federal government.

Likewise, a reticent government is all we really need for national defense. The latter has been more than taken care of by the god-created ocean moats which secure our shores and our already paid for nuclear deterrent which keeps distant foes at bay. All the rest of the $900 billion of so-called national security spending and the vast and unremitting Washington machinations it funds are in behalf of Empire, not the safety and liberty of the homeland.

But the fly in the ointment is that several generations of Washington politicians have turned the Federal budget into a Fiscal Doomsday Machine. Spending for both automatic entitlements and so-called discretionary programs alike gushes higher, pulling the public debt upwards as it goes, with virtually no meaningful legislative action.

Consequently, the fractured and inflamed partisanship evident in today’s demented proceedings has become the handmaid of the nation’s impending fiscal catastrophe. That is, government must take positive and sweeping legislative action to brake the Doomsday Machine, but James Madison’s checks and balances have always made large-scale statutory enactments difficult, while today’s metastasized partisanship have made them well nigh impossible.

It is generally understood that the giant entitlements – Social Security, Federal retirement, Medicare, Medicaid, Food Stamps and the lesser income security programs – are automatic, permanently authorized payments that currently flow to upwards of 160 million Americans and will continue to do so, whether Congress does its job or not.

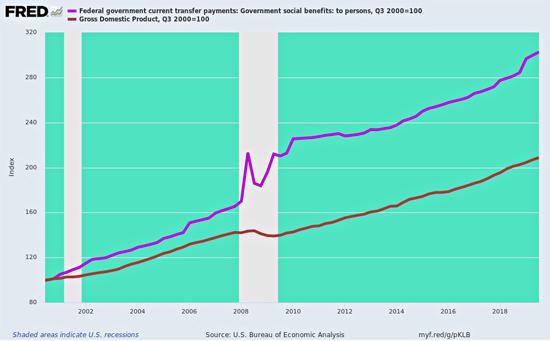

But what needs emphasis is that the rate of growth is accelerating – in effect, it is busting loose from the growth rate of the faltering national economy which must finance these massive entitlements.

Thus, between 1987 and 2000, total Federal entitlement spending soared from $358 billion to $778 billion or by 117%. But during those first 13 years of Greenspan’s reign, the Fed’s easy money was able to goose nominal GDP by 115%, meaning that the entitlement claim on GDP remained constant at about 7.5%.

Since then, it has been off to the races as shown in the graph below. During the last 19 years, nominal GDP (brown line) doubled again, but Federal entitlement spending (purple line) tripled, and it’s claim on GDP rose from 7.5% to 11.0%.

What this means is that every year the legislative stalemate and inaction persists is another year in which the Fiscal Doomsday Machine gathers even more momentum.

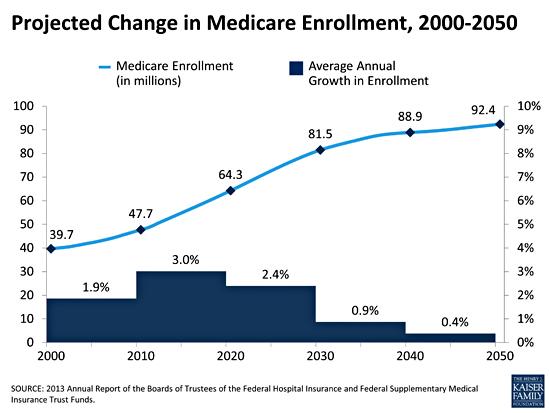

Moreover, the surge of beneficiaries behind the above divergence is by no means over. The 80-million strong Baby Boom will continue to clamber on to the Social Security/Medicare welcome wagon at a rate of 11,000 per day until the end of the 2020s.

The graph below is dispositive. The 39.7 million Medicare (and social security retirement, too) beneficiaries at the turn of the century are already more than 60 million, which total will rise to 81.5 million by 2030 and 92.4 million by 2050.

Needless to say, the rate of entitlement spending growth, which has already broken loose from GDP, will diverge to an even greater degree during the decades ahead. Quite simply, the already baked-in-the cake demographics of American society guarantee that work force and GDP growth will continue to weaken, even as the exploding retirement population gets ever older (on average) and therefore more costly to support.

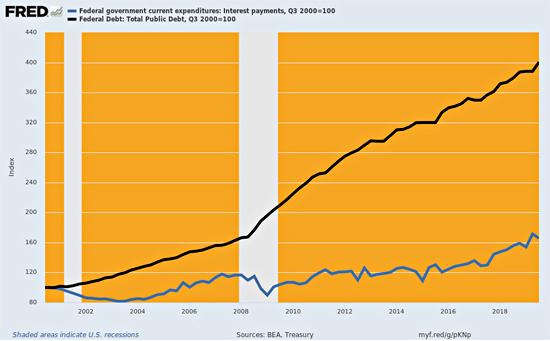

Nor is the automatic entitlement the only aspect of the budget threatening a further breakout in the Turbulent Twenties ahead. Mandatory interest on the debt is fixing to soar at quadruple the rate of the last 19 years owing to the math of debt and interest rates.

To wit, the first 19 years of this century witnessed the full fury of central bank interest rate repression. The 10-year U.S. Treasury (UST) yield fell from 6.5% to a recent sub-basement level of just 1.75%.

Accordingly, even as the Federal debt erupted from $5.7 trillion to nearly $23 trillion, or 300%, during that period, the interest expense of the US Treasury crept up at a far more moderate pace.

Thus, interest outlays during Q3 2000 posted at a $353 billion annual rate, representing 6.2% of the $5.67 trillion of public debt then outstanding. But during the next 19 years of explosively growing Federal debt, interest expense crept up to just $584 billion at an annual rate during Q3 2019, representing but a 65% gain since the turn of the century.

Here’s the thing. Annualized interest expense in Q3 2019 amounted to just 2.6% of the debt outstanding – or barely one-third of the 6.2% level registered in Q3 2000.

It goes without saying that this disconnect between the debt and its cost of carry was a one-time fiscal windfall that has actually functioned to obfuscate the magnitude of the budget crisis gestating down below the top line. Yet according to the sheer math of the thing, it can’t happen again in the decades ahead because interest rates have already been pushed to sub-economic and unsustainable levels by the Fed and other central banks.

At minimum, therefore, interest expense will grow just as fast as the baked-in-the-cake growth of the Federal debt, which is heading toward well in excess of $40 trillion by the end of the 2020s. Accordingly, even at today’s average yield Federal interest expense will surge to $1.1 trillion per year during the next 10 years, and a lot more when interest rates finally normalize.

Growth of Federal Debt Versus Interest Expense, 2000-2019

Finally, even the so-called discretionary part of the budget – annual appropriations for defense and domestic programs – has succumbed to a form of de facto automaticity.

To wit, the Imperial City has been so fiscally euthanized by the Fed’s gift of unending cheap money and massive monetization of the public debt that both parties are on the same side of the budgetary boat. That is, in favor of more spending – with the GOP neocons and hawks pushing defense spending skyward in trade for equivalent levitation of domestic appropriations, as especially favored by the Dems.

Moreover, the Trumpified GOP has developed a deathly fear of being blamed for another government shutdown, which it falsely blames for its wipeout at the polls in 2018. So the GOP has essentially joined a bipartisan conspiracy in favor of a rolling suspension of the Federal debt limit and annual omnibus appropriations bills that are loaded with budget busting pork.

Crazily, the talking heads on bubblevision this AM were making the absurd argument that there is smooth sailing ahead because Congress just passed a 2300 page $1.4 trillionomnibus appropriations bill for the balance of FY 2020, even as it is in the midst of a partisan donnybrook on impeachment.

Supposedly, this means the government is still functioning. No sweat!

Well, yes, it is functioning, but to literally blow the top off from even the tiny discretionary spending corner of the Federal budget that until the Donald came along was exhibiting a modicum of restraint.

No more. The two-year budget deal being sent to the White House will blow the budget caps for FY2020-2021 by $320 billion, but even that isn’t the half of it.

Due to Congress’ crooked, self-serving scoring rules, budgetary caps become the basis for the outyear current policy baseline in subsequent years. Accordingly, for FY 2020 the existing caps were supposed to cause total defense and non-defense appropriations to drop by $125 billion – from $1.244 trillion in FY 2019 to $1.119 trillion in FY 2020.

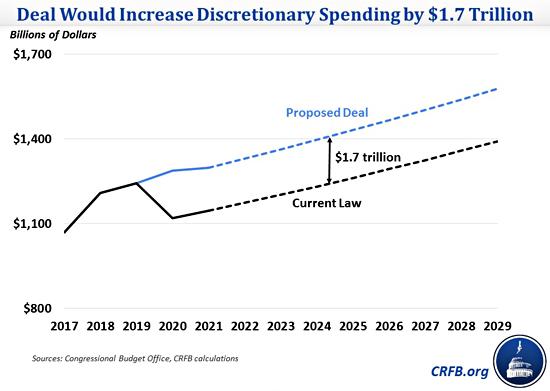

This is shown in the solid black line in the chart below, and also shown by the dotted black line is the convention for projecting 10-year baseline spending from the old FY2020 and FY2021 caps.

Thanks to Congress’ alleged ability to “function” in the midst of partisan madness, however, those caps have now been blown away and none have been enacted for subsequent years. Hence the baseline for discretionary spending in the outyears is now plotted by the dotted blue line.

The difference over 10-year? A cool $1.7 trillion, and you can believe that the bipartisan duopoly on Capital Hill will drive every dime of this increase right into Uncle Sam’s trillion+ per year borrowing requirement.

Even then they were not done as they honed today’s impeachment brickbats. While they were at it, they repealed $375 billion of health care taxes that the one and same Pelosi-led Dem majority rammed through in 2010 in order to prove that Obamacare would not add to the public debt!

We have no particular brief for the medical taxes and are not surprised at all by the blatant Dem hypocrisy. After all, for the most part these massive taxes have never actually gone into effect because implementation has been deferred time and time again just before the effective dates.

Still, if you can’t repeal ObamaCare spending as the GOP miserably failed to do in 2017 and 2018, why do you get to repeal these financing means and brag you have made a blow for America’s taxpayers?

Not only do these actions bury taxpayers deeper in debt, they also guarantee that some day down the road even higher taxes will be imposed in order to finally stem the flood of red ink.

Besides that, $200 billion of the revenue loss buried in the Omnibus appropriations bill is attributable to permanent repeal of the so-called Cadillac Tax on ultra-high cost, gold-plated – mainly union – health care plans, which have a total cost of more than $30,000 per year.

That’s right. The bipartisan duopoly has now agreed to keep spending trillions over the next decade for ObamaCare but can’t even see its way clear to tax the excess value of health care plans which cost about the same as the average annual wage among the 170 million payroll tax filers in the US.

Nevertheless, when you add $70 billion of other tax loopholes which were extended and the associated debt service cost, the very “functional” Congress at work this week blew a $500 billion hole in the revenue collections over the next decade to fit on top of the $1.7 trillion of added discretionary spending.

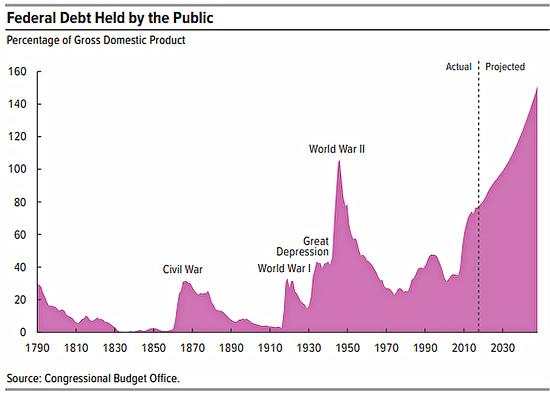

So the Federal budget has indeed become a full-bore Doomsday Machine. There is not a scintilla of capacity or will on either side of the partisan divide to even brake its trajectory. As shown below, the publicly-held debt is heading toward 150% of GDP – a level which would crush what remains of US economic growth or encourage the Fed to print so much money monetizing this exploding public debt as to virtually destroy the financial system in the process.

Yet this gets us back to today’s contretemps.

Obviously, the Dem impeachment case is absurd. The meddling in the 2016 election was done by the Deep State intelligence agencies with the encouragement of partisan Obama officials, not the Russians; and Ukraine’s cesspool of corruption would not have smeared American politics in the slightest had Washington not fomented a coup in February 2014 against a government it didn’t like for being too friendly with its historic Russian neighbor and suzerain.

So the Donald had every reason of state to want the Ukraine corruption investigated. For crying out loud, the prosecutor fired by Biden has told exactly why it happened.

In early 2106, he had seized the property of the corrupt Ukrainian oligarch and owner of Burisma, who had hired Hunter Biden and the son-in-law and chief of staff to the Secretary of State, John Kerry. Then out of the blue, wham! He was removed from office at Biden’s command in exactly the quid pro quo manner Uncle Joe famously bragged about before an audience at the Council on Foreign Relations.

So how much stench do you really need in your nostrils to recognize that the Hunter Biden led crew of fortune hunters in Ukraine after February 2014 weren’t on the up and up?

But actually, the threadbare articles of impeachment arising from the stench of Ukraine are not really about the Donald’s 25 minute phone call and purported quid pro quo at all. The Dems have adopted the posture that the American election process itself is imperiled by the nefarious meddling of Russkies and other fureners, and are focused not on governance, but on this alleged threat to their ability to win office and hold power.

At the same time, the GOP has lost all sense of its fundamental missions in behalf of sound money, fiscal rectitude, free markers and homeland defense. Instead, it’s going full retard on its own fatuous version of the supposedly imperiled U.S. election process.

That’s what the Donald’s insane Wall on the Mexican border and the GOP’s increasingly shrill anti-immigration policy is all about. It opposes more immigrants and brown people because it believes they will vote Democrat and thereby deprive the GOP of its rightful claim on political power.

Needless to say, two parties fighting over alleged existential threats to the very essence of American democracy is the very opposite of the nothingburger ballyhooed by bubble vision this AM.

What the Trump impeachment is really about is a brutal, raw struggle for power that threatens the very survival of American democracy, and which could end up in a hung 2020 election that would make the hanging-chad ordeal of 2000 look like a walk in the park.

Even then, the Fiscal Doomsday Machine will power forward unrestrained.

And these fools on bubble vision want you to buy-the-dip.

Don’t you dare!

Tyler Durden

Sun, 12/22/2019 – 21:30

via ZeroHedge News https://ift.tt/34MtZAT Tyler Durden