Dow Dips As Wise Men Buy Bonds, Bullion, & Biotech

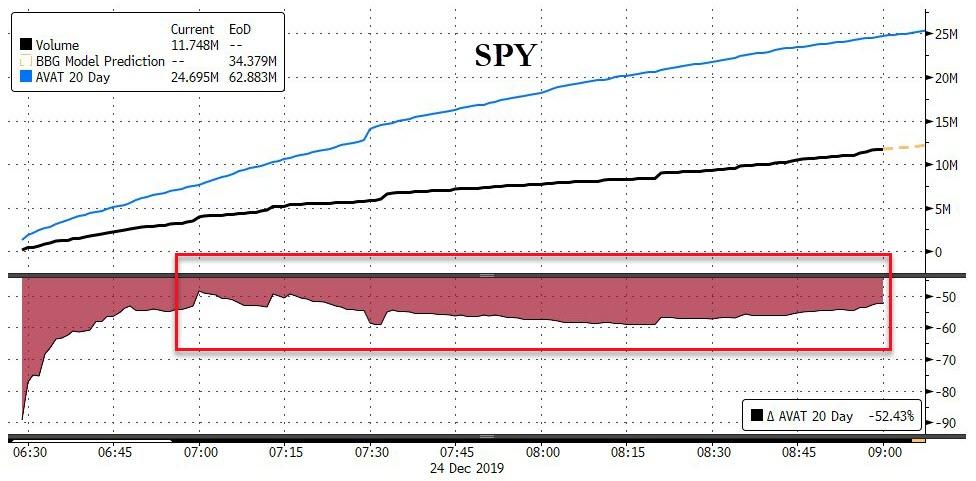

As one would expect volumes today were dismal, around 50% below average (pro-rata) ahead of the early close…

Source: Bloomberg

Gold and Silver were bid today…

Source: Bloomberg

“What is myrrh anyway?”

Biotechs (is that myrrh or frankincense?) have had only 4 down days since the start of November, rocketing back towards record highs once again…

Source: Bloomberg

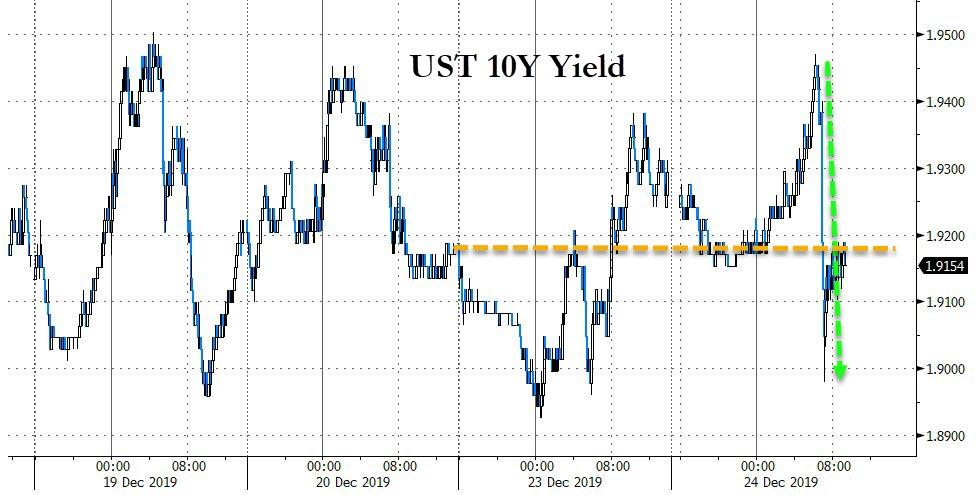

Bonds were bid after a very strong 5Y auction

Source: Bloomberg

Today’s drop in yields erased yesterday’s price losses…

Source: Bloomberg

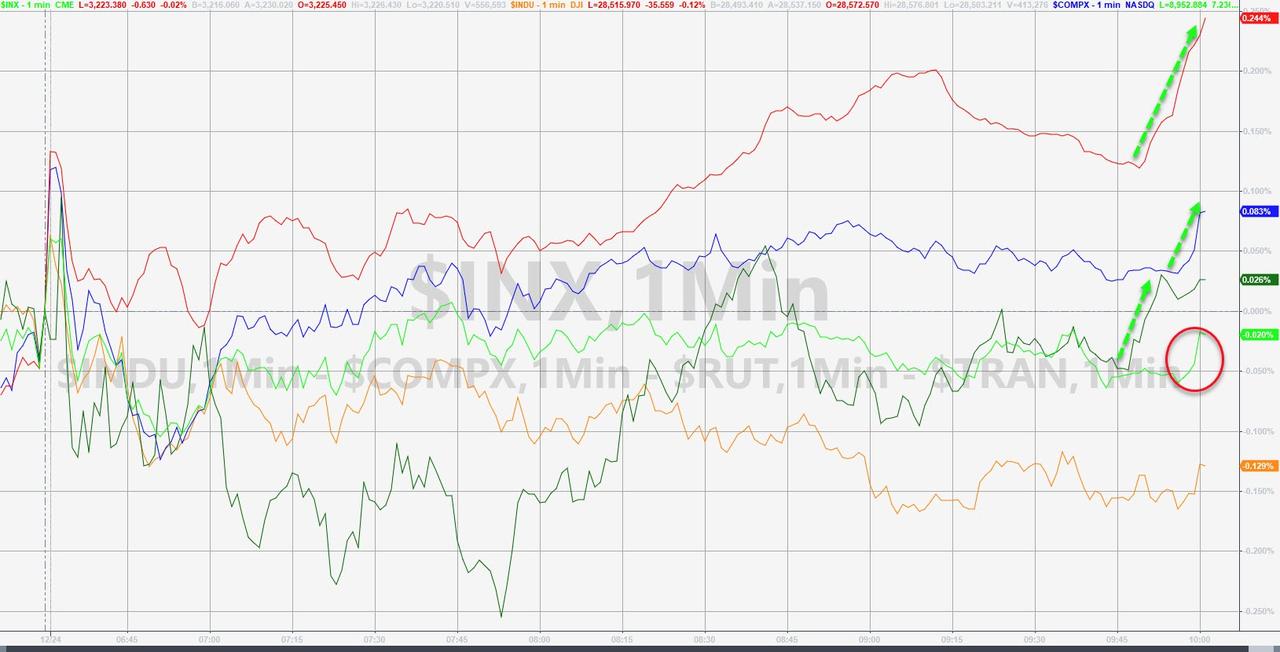

Stocks were mixed with Small Caps squeezed higher and The Dow lower (Nasdaq up 10 days in a row) S&P closed down by less than 1 point, breaking its 8-day win streak…

Here’s why Small Caps were bid – Shorts squeezed out of the gate again…

Source: Bloomberg

Defensives outperformed Cyclicals today…

Source: Bloomberg

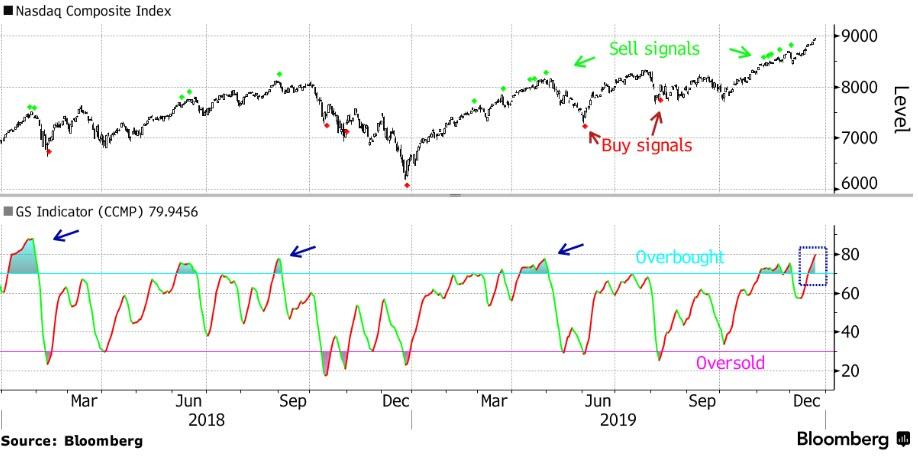

Nasdaq was higher for the 10th straight day, but as Bloomberg reports, the surge in the Nasdaq Composite Index as the year draws to an end may give stock bulls some pause. In just a few trading days, its GTI Global Strength Indicator — a technical measure of upward and downward movements of successive closing prices — has rocketed through 70, a level indicating overbought, and is a hair shy of 80 through Monday. Previous readings at this level over the last two years have been followed by deep reversals.

Source: Bloomberg

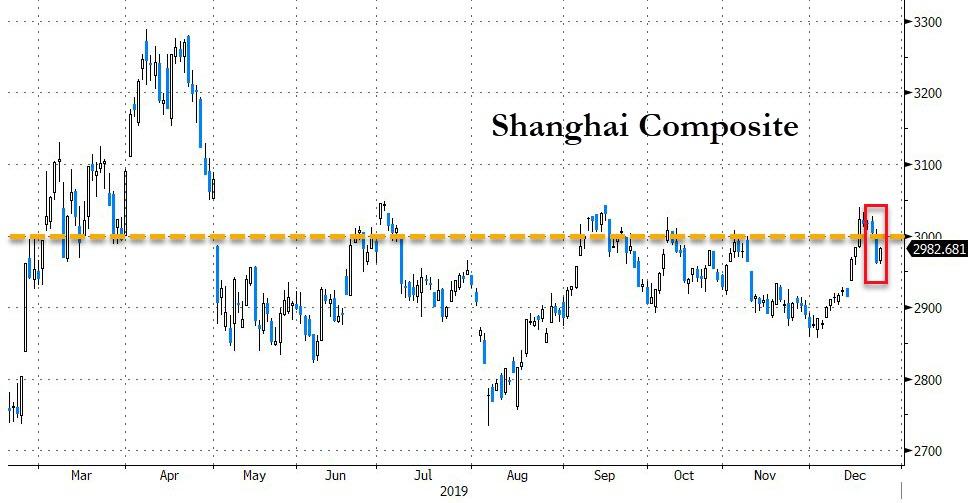

Chinese investors failed to hold the key 3,000 level for Shanghai Composite…

Source: Bloomberg

The Dollar trod water once again – following a similar pattern to yesterday…

Source: Bloomberg

Cryptos were flat-ish today, despite a quick drop early on…

Source: Bloomberg

WTI pushed back above $61 today…

Source: Bloomberg

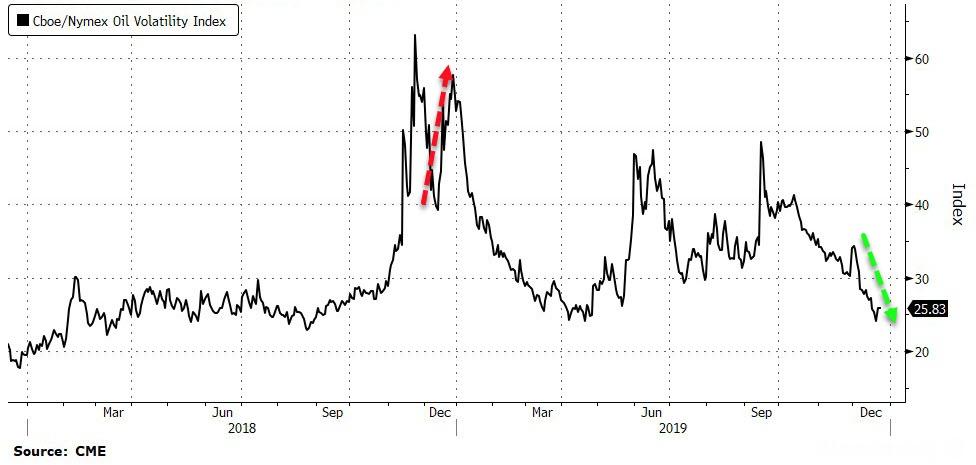

And oil vol is less than half what it was last Xmas Eve…

Source: Bloomberg

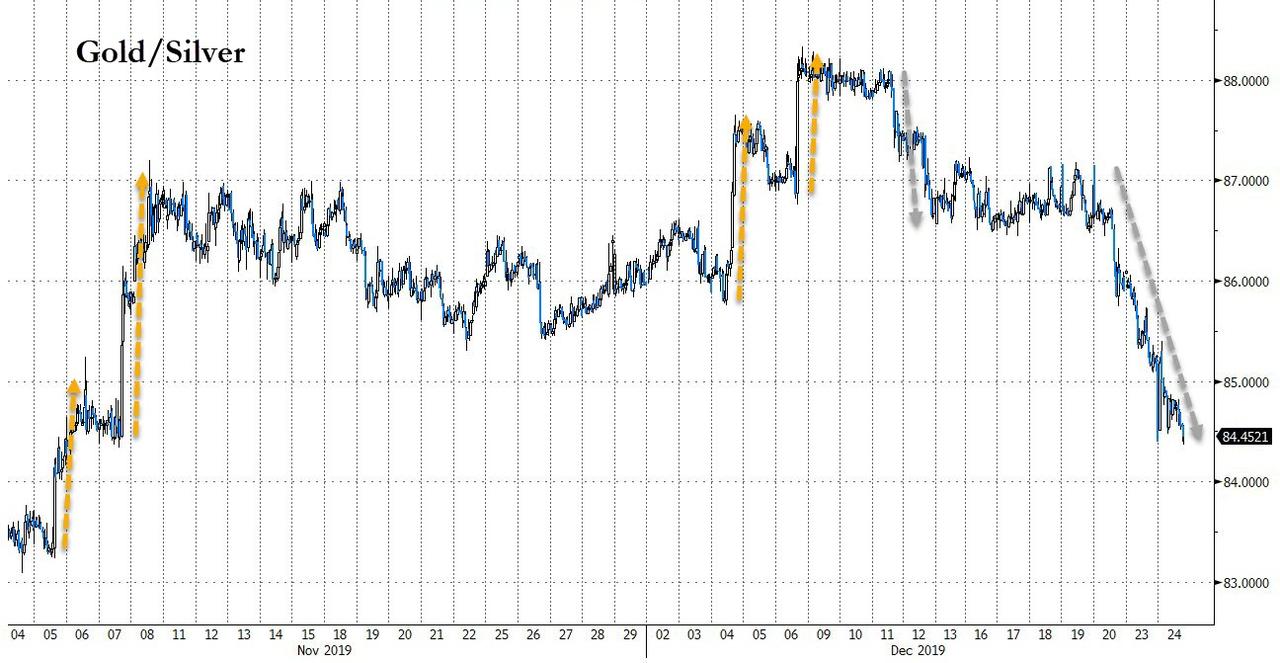

And silver’s ongoing outperformance of golds has pushed its to its strongest relative to the barbarous relic since early November…

Source: Bloomberg

Finally, we note the difference between now and one year ago exactly…

Tyler Durden

Tue, 12/24/2019 – 13:01

via ZeroHedge News https://ift.tt/35UJS9S Tyler Durden