Escaping Hong Kong – Residents Purchase Overseas Homes As Protests Continue

Police in Hong Kong battled pro-democracy demonstrators on Christmas as unrest is expected to roll into the new year. Many residents have had enough of the sustained protests, are now fleeing the city, and buying homes abroad, reported Bloomberg.

Real estate brokers in top housing markets across the world have reported an uptick in interest in December from Hongkongers:

“There’s been an increase in capital outflows from Hong Kong-based investors into other major global real estate markets, with Australia, Singapore, Japan, and the U.S. all seeing an increase in purchasing activity,” said Ben Burston, Knight Frank LLP’s Australia-based chief economist.

Pro-democracy protests have entered the sixth month, with no end in sight, has thrown the city into a deep economic recession.

The protests started in June over a controversial extradition bill, and have now transformed into a much larger movement that encompasses democratic reforms.

Protesters were seen on Christmas throwing petrol bombs at police. Hong Kong has canceled New Year’s Eve fireworks over security concerns, a move that will continue pressuring the city’s tourism industry.

Residents are furious over the socio-economic chaos that has unfolded in the back half of 2019.

“I have to come up with a back-up plan,” said Cat Liu, a salesperson in her 40s who’s considering buying an apartment in Taiwan or Malaysia, partly because of the current political situation. “The situation hasn’t gotten any better. Both sides are standing firm and there’s no way to reach a compromise.”

CBRE Group Inc.’s Australia residential director, Colin Griffin, said many Hongkongers are moving to “Australia viewed as a safe haven.”

Griffin said the exodus is nothing new and has been underway for the last several years.

He said Hongkongers are starting to purchase high-end residential real estate in major metros across Australia.

David Ho, a Vancouver-based senior vice president at CBRE, said Canada is another top destination of Hong Kong flight.

“They’re 35 to maybe 45, young families. A lot of people are just trying to learn about Canada and set up a conference call with immigration consultants, education consultants, mortgage brokers, accountants that give them a broad view of everything,” Ho said.

And with Hong Kong real estate some of the priciest in the world, an exodus of residents is disastrous news for a fragile market that could soon see fire sales and the eventual topping of the market.

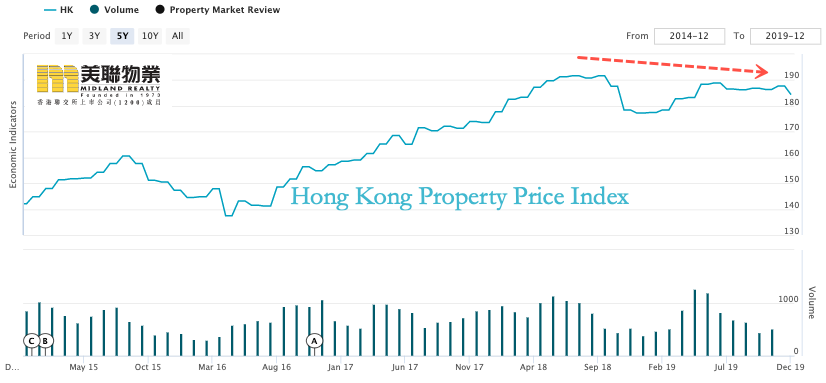

Hong Kong property market exhibiting symptoms of a possible double top.

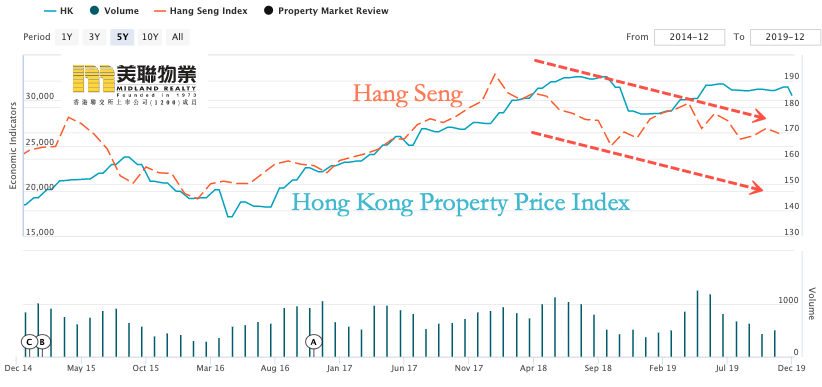

Hong Kong property market and regional stock market index are both under pressure.

Tyler Durden

Thu, 12/26/2019 – 12:50

via ZeroHedge News https://ift.tt/2MtxXrG Tyler Durden