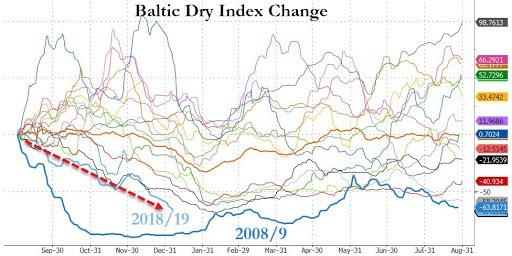

Baltic Dry Plunges Most Since 2008 As Tariff-Frontrunning Ends

The Baltic Exchange’s main sea freight index fell for the 20th consecutive session to an eight-month low (the longest streak of losses since Nov 2015) as world trade continues to slump amid signs the so-called “front-loading” effect ahead of tariff deadlines has ended.

The Baltic Dry Index, which tracks rates for capesize, panamax and supramax vessels that ferry dry bulk commodities across the world, plunged 2.3%, or about 18 points, to 773 on Wednesday (according to Refinitiv data), the lowest level since April 2019:

-

The capesize index .BACI fell 74 points, or 5.8%, to 1,197 – its lowest since May 8. Average daily earnings for capesizes, which typically transport 170,000-180,000 tonne cargoes including iron ore and coal, decreased $2 to $9,020.

-

The panamax index .BPNI declined 42 points, or 5%, to 803 points, its lowest since Feb. 27.

-

Average daily earnings for panamaxes, which usually carry coal or grain cargoes of about 60,000 tonnes to 70,000 tonnes, dipped $386 to $7,223.

-

The supramax index .BSIS fell 18 points to 593.

Beleggers Belangen analyst Karel Mercx tweeted that “the Baltic Dry Index is the most important indicator for the rates of bulk shipping. The rate is determined based on the rates that are paid to transport raw materials on the 25 busiest shipping routes. Prices are falling sharply due to the cooling global economy.”

The Baltic Dry Index is the most important indicator for the rates of bulk shipping.The rate is determined based on the rates that are paid to transport raw materials on the 25 busiest shipping routes. Prices are falling sharply due to the cooling global economy. pic.twitter.com/lCQ0KUFY4H

— Karel Mercx (@KarelMercx) January 8, 2020

With the index already tumbling the most since 2008, it may suggest the global economy is, in fact, continuing to decelerate.

The chart below makes clear that the spike in shipping rates was a one-off event spurred by importers front-running tariffs in 2019, now that is over, shipping rates are plunging as a manufacturing recession in the US deepens.

And while shipping demand tends to be an economic bellwether of the global economy, it seems that semiconductors have priced in a recovery that might be fantasy.

Plunging shipping rates suggests the global economy continues to decelerate, not accelerate like everyone is hoping.

The question is, what shocks people back into the view the macroeconomic headwinds counting to mount? Is it heighten geopolitical tensions in the Middle East?

Tyler Durden

Wed, 01/08/2020 – 23:05

via ZeroHedge News https://ift.tt/3038X09 Tyler Durden