Buying A Home Is More Affordable Than Renting In Just Over Half Of The US

In ATTOM’s latest annual report on the state of the American housing market, the company, which maintains a popular proprietary service for housing-market data, found that owning a median-prices three-bedroom home is more affordable than renting a similar property in just over half of the more than 850 counties examined.

However, there’s a clear split between urban/suburban markets, and their rural counterparts: Typically, home ownership is more affordable than renting in lightly populated markets, while renting is more affordable than owning in major cities and their surrounding suburbs.

The annual report used wage data from the BLS, along with recently released data on fair-market rent data from the Department of Housing and Urban Development. The study also incorporated ATTOM’s proprietary data about publicly-recorded home sales. The ultimate conclusion was that, in 455 of 855 US counties analyzed (roughly 53%), home ownership is more affordable than renting.

The gist is that home ownership is a more financially sensible option than renting in a slim majority of American markets.

“Home ownership is a better deal than renting for the average wage earner in a slim majority of U.S. housing markets. However, there are distinct differences between different places, depending on the size and location from core metro areas,” said Todd Teta, ATTOM’s chief product officer. “For sure, either buying or renting is a financial stretch or out of reach for individual wage earners throughout most of the country in the current climate. But with interest rates falling, owning a home can still be the more affordable option, even as prices keep rising.”

Though this isn’t true for the 136 counties with populations greater than 500,000 people. In 69% of these counties, renting is the more “affordable” option.

That’s hardly a surprise. As we’ve explained many times in the past, millennials, now the generation that represents the greatest share of workers in the American labor force, are fueling an unprecedented boom in the American rental economy.

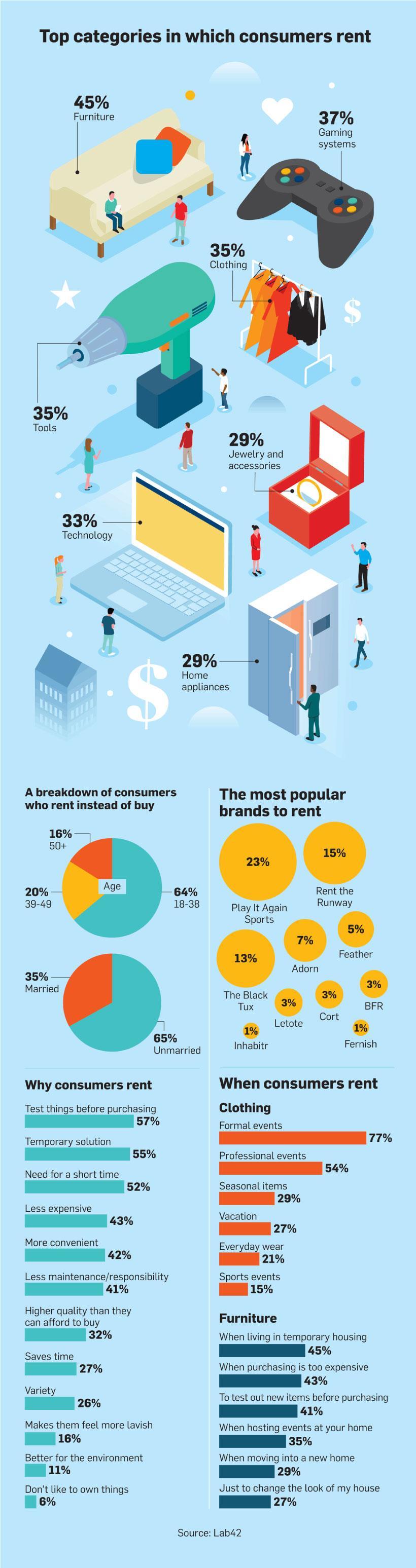

And this doesn’t apply solely to homes. The “renting revolution” is sprawling to include furniture, clothes and even video game consoles.

In 36 of the 43 counties (about 80%) with a population of at least 1 million or more people, renting is the more affordable option, the author of the report explains. These counties include LA County, Cook County (Chicago), Harris County (Houston), and Maricopa County (Phoenix), as well as San Diego.

In a comparison between home prices and average rents, the study found that the former is rising faster than the latter in 67% – or 575 – of the 855 counties examined by ATTOM’s staff. This ncludes Harris County, San Bernardino, Bexar County (San Antonio), Wayne County (Detroit) and Philadelphia. That figure is slightly better for average rents, which are climbing faster than median home prices in 280 counties (or just 32% of those examined).

Moving on to the subject of wage growth, the study found that home prices in 66% of the markets examined are rising faster than average weekly wages. Meanwhile, average weekly wages rose faster than home prices in about 34% of the counties examined.

The takeaway is clear: Young people who are hoping to own their homes – long seen as a critical component of building long-term wealth – are better off living in more suburban and rural parts of the south and Midwest. Though well-paying jobs are typically scarce in these regions, as more companies migrate to these typically low-tax states, that could soon change, too.

Tyler Durden

Mon, 01/13/2020 – 14:35

via ZeroHedge News https://ift.tt/2FIqotF Tyler Durden