“A Fragile Truce”: Here’s What’s In Trump’s “Big Beautiful Monster” Of A Trade Deal

Earlier this month, President Trump referred to his ‘Phase 1’ trade pact as a “big, beautiful monster.” But for most of the trade hawks in his administration, it will likely be a disappointment – though hope remains for a more comprehensive ‘Phase 2’ pact after the election, assuming Trump wins a second term.

Rather than ending trade tensions with Beijing, the “hard fought” agreement will help establish a “fragile truce” between the world’s two largest economies, the FT reports. Indeed, many feel like the only reason we’re even getting a deal is thanks to escalating anxieties about slowing growth (in Beijing) and worries about a major market selloff heading into November (in Washington). Trump is worried because it’s an election year, and President Xi is worried because China’s powerful growth engine has started to slow, threatening to sow instability and discord among China’s population.

Based on what we know so far, this is the core of the agreement: The US has agreed to halve 15% tariffs on $120 billion in Chinese imports and an indefinite delay on further tariff hikes. In return, China has promised to make structural reforms, and buy an additional $200 billion over 2017 levels in goods and services over the next two years.

The agreement will be signed by Trump and Vice Premier Liu He during a White House ceremony at 11:30 am, and the full text is expected to be released on Wednesday, though some details will remain secret.

However, the deal leaves in place the bulk of tariffs imposed by Trump on $360 billion of Chinese imports – nearly all of the Chinese made products flowing into the country – while the top concerns of America’s trade negotiators remain unaddressed: China refused to offer concession on issues from state subsidies to rampant cyber theft. As one Communist Party functionary said this week: “If the policies are working, why should we change?”

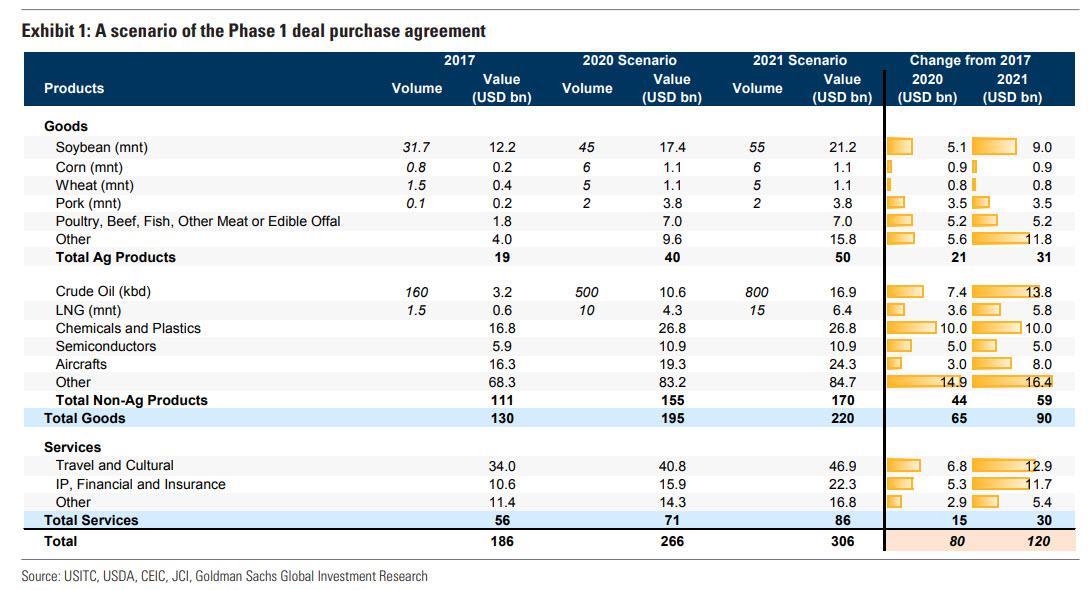

Initial skepticism about the capacity for Beijing’s state-controlled companies to increase imports by such a large margin has been rebuffed by a team of analysts at Goldman Sachs, who now believe that China can fulfill its $200 billion promise as we reported yesterday. They even devised a sample scenario of what that might look like:

The trade deal with Beijing is essentially an informal agreement, not a treaty or an official trade pact (like USMCA), which means Trump doesn’t need Congress’s approval to sign off. At 86 pages, it’s pretty thin for a trade agreement. There’s something else about the deal that’s unique: As Bloomberg points out, it embraces a “socialist-style central planning” that might have been anathema to prior Republican administrations.

That’s because the deal sets fixed amounts for China’s purchases of American products. A classified part of the deal breaks down the planned purchases in detail.

The deal also embraces a level of Socialist-style central planning that would have made past American presidents wince. While trade pacts traditionally set the rules and leave the details of actual commerce to markets, the one that Trump’s team has negotiated includes a classified annex that details the $200 billion Chinese buying spree.

That includes some $32 billion in additional purchases of American farm exports and $50 billion in natural gas and crude oil, according to people briefed on its contents. The administration insists the different nature of the deal is by design and that it won’t need the approval of Congress. “

This is not a free trade agreement,” it told supporters in a memo last month. “Its purpose is to rectify unfair trade practices.”

One analyst argues that the deal, while a welcome development for the markets, does little to curb the economic rivalry between the two countries or even meaningfully reduce trade tensions (since most of the tariffs will remain in place until at least November as an enforcement measure). Moreover, significant uncertainties remain on the parameters of the purchase agreement.

It also does nothing to de-escalate the growing military tensions in the Pacific, tensions with Taiwan, and objections to Beijing’s internment of Muslims in Xinjiang.

“The signing of this truce, while welcome, does not obviate the reality that both countries view one another in increasingly antagonistic terms,” said Ali Wyne, a policy analyst at the Rand Corporation, a think-tank in Washington. “Washington regards Beijing’s economic ascendance as a threat to its national security and that of its allies and partners; Beijing, meanwhile, considers the acceleration of indigenous innovation and the cultivation of alternative export markets to be existential imperatives.”

As the administration began the process of selling the deal to the American public, Treasury Secretary Steven Mnuchin appeared on CNBC Wednesday morning to try and butter up the market.

And some analysts are already singing Trump’s praises.

“It’s a major victory for the president,” said Stephen Vaughn, who until last year helped oversee Trump’s trade policies as the general counsel and right-hand man to U.S. Trade Representative Robert Lighthizer. “He has gotten China to make stronger commitments than it has made in previous agreements.”

Will Trump’s ‘Phase 1’ deal finally break the ‘Trade War cycle’ that has partly dominated markets over the last two years?

If not, fear not: speaking on CNBC, Steven Mnuchin said that a Phase 2 deal could come in multiple steps, such as 2A, 2B, 2C and so on… in other words, whatever it takes to push stocks higher on constant “trade deal optimism.”

Tyler Durden

Wed, 01/15/2020 – 08:04

via ZeroHedge News https://ift.tt/2TsRXz8 Tyler Durden