He Knows You Know That They Know…

Authored by Sven Henrich via NorthmanTrader.com,

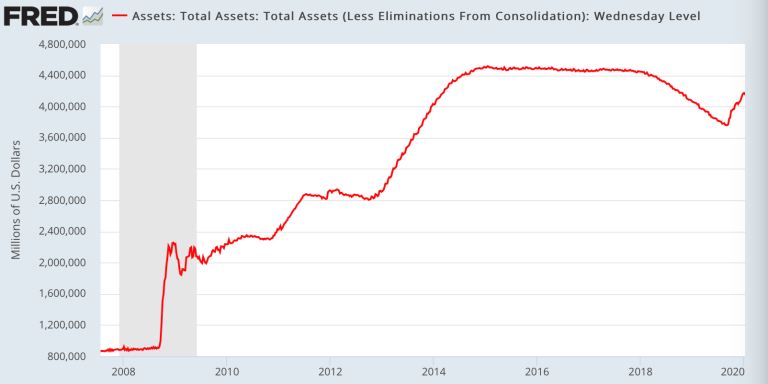

Last week we found out that Dallas Fed president Kaplan knows that the Fed is creating excess and imbalances in stocks. Yes, bloating the Fed’s balance sheet by over $400B in four months has a massive impact on stock markets. And billions of repo liquidity unleashed each day can be seen impacting the daily action as well (see: Repo Lightning).

So what’s Jerome Powell have to say about all this? Silence. Not a word.

Of course he doesn’t have to because the crack reporters never confront him on the issue in his post Fed meeting press conferences. Bubble away accountability free. Why bother asking the hard questions? That may just get you disinvited from the next press conference. Too strong of an assessment? I let you be the judge, but why are the hard questions not asked when it matters?

But actually we don’t need to wait for the answer from a press conference. Why? Because we already know the answer and the answer is: He knows.

Powell knows exactly the behavior he’s instilling in investors, the artificial levitation of asset prices and the disconnects and dangers that is poses.

All one has to do is dig in the Fed minutes from October 2012. Pages 192-194. It’s all there:

“I have concerns about more purchases. As others have pointed out, the dealer community is now assuming close to a $4 trillion balance sheet and purchases through the first quarter of 2014. I admit that is a much stronger reaction than I anticipated, and I am uncomfortable with it for a couple of reasons.

First, the question, why stop at $4 trillion? The market in most cases will cheer us for doing more. It will never be enough for the market. Our models will always tell us that we are helping the economy, and I will probably always feel that those benefits are overestimated. And we will be able to tell ourselves that market function is not impaired and that inflation expectations are under control. What is to stop us, other than much faster economic growth, which it is probably not in our power to produce?”

Why stop indeed? Clearly he’s not stopping now, he just went into overdrive launching the most aggressive balance sheet expansion since 2009:

And he knows perfectly well what’s happening as a result:

“Second, I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that it is easy for them to make money but that they have every incentive to take more risk, and they are doing so.”

” Should give us pause” Cute. Except he’s not pausing now is he? The Fed’s official mission is centered around low unemployment and stable prices. “We will be there to prevent serious losses”. That is the Fed’s actually primary function, hence constant interventions at the first sign of trouble. And Powell knows that expanding the balance sheet takes on more risk taking.

He continues:

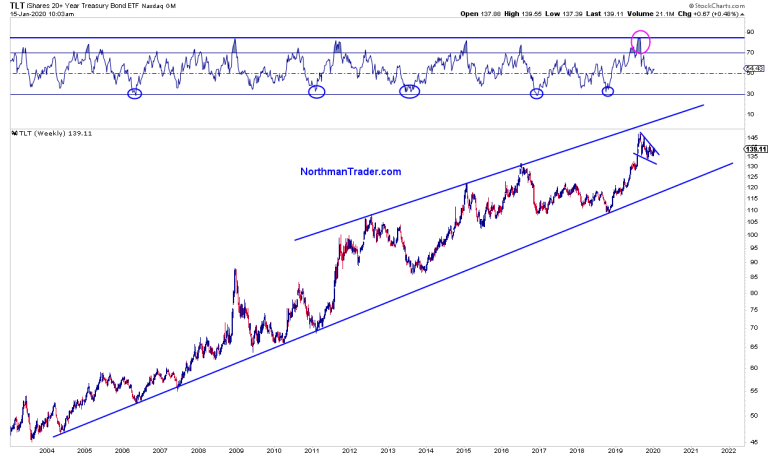

“Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy”.

You think?

Mission accomplished.

But then he gets to the fun part:

“My third concern—and others have touched on it as well—is the problems of exiting from a near $4 trillion balance sheet. We’ve got a set of principles from June 2011 and have done some work since then, but it just seems to me that we seem to be way too confident that exit can be managed smoothly. Markets can be much more dynamic than we appear to think.

Take selling—we are talking about selling all of these mortgage-backed securities. Right now, we are buying the market, effectively, and private capital will begin to leave that activity and find something else to do. So when it is time for us to sell, or even to stop buying, the response could be quite strong; there is every reason to expect a strong response.

That’s right and that’s what we saw in December 2018. Markets fell apart and Powell went back to grab the Fed’s safety blanket. More easing and back to balance sheet expansion.

Powell knows. The entire cabal knows.

And so the easy money train has created the most ridiculous debt load ever hanging over the global economy:

“Spurred by low interest rates and loose financial conditions, we estimate that total global debt will exceed $257 trillion in Q1 2020.

A total of more than $19 trillion of syndicated loans and bonds will mature in 2020. https://t.co/RgUypqQhuj pic.twitter.com/FUjWSlavCy— Sven Henrich (@NorthmanTrader) January 13, 2020

And now we’re back into a Fed created asset bubble.

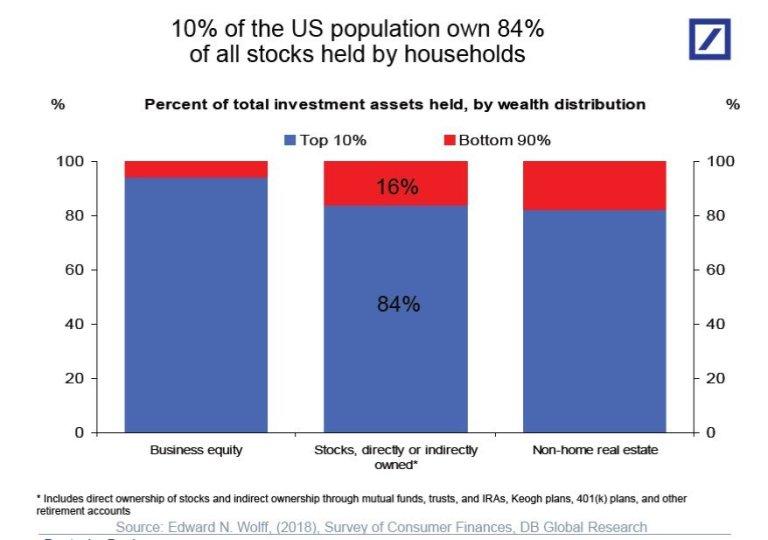

And who benefits from all this?

The few, not the many:

And I see absolutely nothing changing this paradigm until something serious happens to force the system to change.

What’s the incentive for the global power structure to change any of this? I submit there is none unless they are forced to. But central banks with cheap money give license for politicians to do nothing. And so the runaway train continues.

The crisis of 2008 was the opportunity to change things. Instead we now have more debt, much more debt, more easy money, a lot more easy money, and ever wider wealth inequality.

Yes, it’s different this time. It’s worse, much, much worse.

And Powell knows.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Wed, 01/15/2020 – 12:25

via ZeroHedge News https://ift.tt/2QUut4k Tyler Durden