Fed To Cap How Many Bills It Buys As Part Of QE4

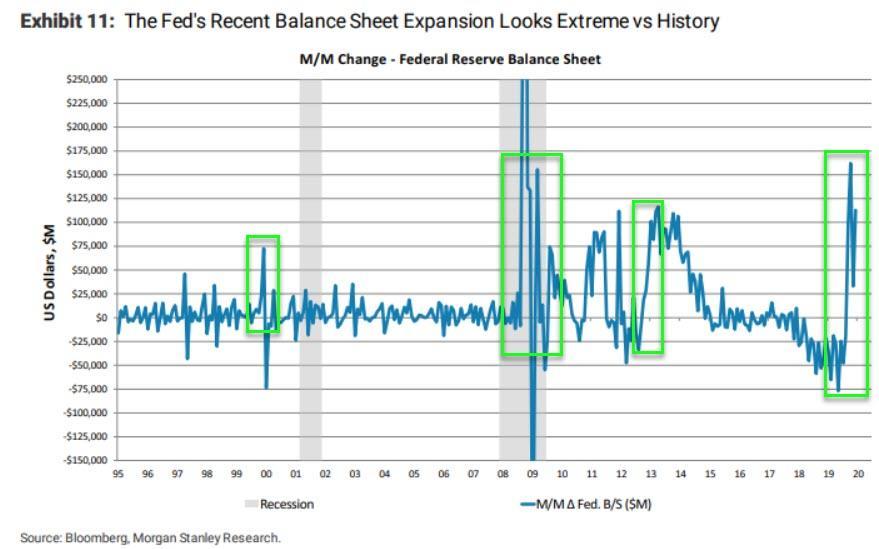

Now that we are no longer pretending that the Fed’s “NOT QE” is not in fact “QE 4“, investors and strategists are starting to look more carefully at how the Fed is monetizing the T-Bills as part of its market boosting reserve management Permanent Open Market Operation remit. And, as it turns out, so is the Fed, because oddly enough after several of our posts accused the Fed of implicitly monetizing the debt, by exposing just how fast the Fed was repurchasing from Dealers the same Bills it had issued just days earlier as described in…

- Helicopter Money Is Here: How The Fed Monetized Billions In Debt Sold Just Days Earlier

- The Fed Just Monetized $6.4 Billion In Debt Sold Earlier This Week

- And Again: The Fed Monetizes $4.1 Billion In Debt Sold Just Days Earlier

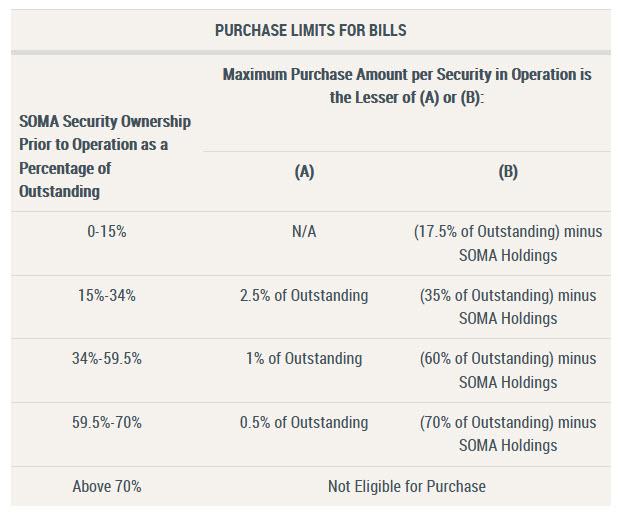

… on Wednesday, the Fed unexpecteldy issued new guidance capping the amount of individual T-Bills it will purchase as part of QE4. Specifically, on Jan 14, the New York Fed announced that while it is maintaining T-bill purchases at $60b/month, it will limit the amount of individual securities it purchases, to wit:

In order to slow the rate of purchases for securities in which the SOMA portfolio already has large holdings as a proportion of Treasury securities outstanding, the Desk will allow the share of SOMA holdings of an individual Treasury security to rise above certain levels only in modest increments, as specified in the tables below. Subject to market conditions, the Desk may further limit the size of additional purchases in certain issues or otherwise change the stated limits as needed.

For bills, the Desk will allow the share of SOMA holdings of an individual Treasury security to rise above 17.5 percent in increments, as shown below. These limits will support market functioning and operational efficiency by smoothing the distribution of bill holdings and maturities within the SOMA portfolio.

The new limitations are shown schematically in the table below:

Commenting on this new self-imposed limitation, interdealer broker Wrightson ICAP said that the decision to impose “graduated caps” on its purchases of T-bills should help guard against the risk that the central bank absorbs such a large share of an issue “as to seriously compromise its liquidity in the secondary market.”

Of course, nobody has any concerns what happens to this liquidity on the other end, i.e., as the Fed is soaking liquidity from the Bill market, it is injecting it into the stock market, something that Bloomberg’s Richard Breslow so rightfully raged against earlier today.

And while the Fed always had some limits on how much it can buy, those for T-bills are now separate and “more stringent” so they’ll take less of bills they already own, said Gennadiy Goldberg at TD Securities. This means that Fed demand for just issued On The Run Bills will be far more capped. As Goldberg notes “it could spread purchases more evenly across the bill curve since the new limits will prevent the Fed from buying old 1y bills too quickly.” And as an example consider that the New York Fed already owns 39% of the Oct. 8, 2020, security and 36% of the Nov. 5, 2020, both of which we highlighted as part of our series on Fed T-Bill monetizations.

We bring this up because momentarily the Fed will conduct its latest $7.5BN T-Bill POMO as part of QE4, in which for the first time we will see how the new limitations on individual Bill securities play out in practice.

Tyler Durden

Thu, 01/16/2020 – 13:02

via ZeroHedge News https://ift.tt/3aqsj4e Tyler Durden