Barclays To Eliminate 100 Senior Investment Bankers

As the real economy continues to decelerate and the Federal Reserve’s ‘Not QE’ catapults growth stocks to record highs, thousands of bankers are being fired every month.

Bloomberg reports Barclays Plc is the latest big bank to layoff 100 senior staff at its investment bank unit.

The job cuts are expected throughout Europe and the US and will be mostly managing directors and director-level staff.

The restructuring was spurred by Barclays’s investment bank chief, Tim Throsby, who warned staff that he’d reduce bonuses. He also said pay for top performers would increase while pay cuts will be seen for non-performers.

With layoffs nearing, CEO Jes Staley is attempting to recapture the lost market share of its investment bank segment after years of dwindling profitability.

Banks across the world – the ones who should be benefitting from the trillion dollars global central banks printed in the last four months and 80 rate cuts in the previous 12 months – have unveiled the biggest round of job cuts in four years as they reduce costs to weather the global trade recession.

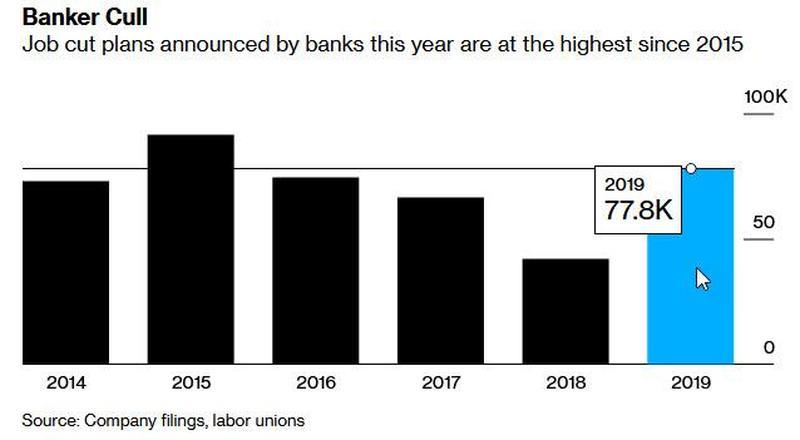

In 2019, 50 major banks announced plans to cut at least 77,800 jobs, the most since 91,500 in 2015.

Morgan Stanley, one of the most bearish banks on the global economy, fired 2% of its workforce last month, “due to an uncertain global economic outlook,” CNBC reported.

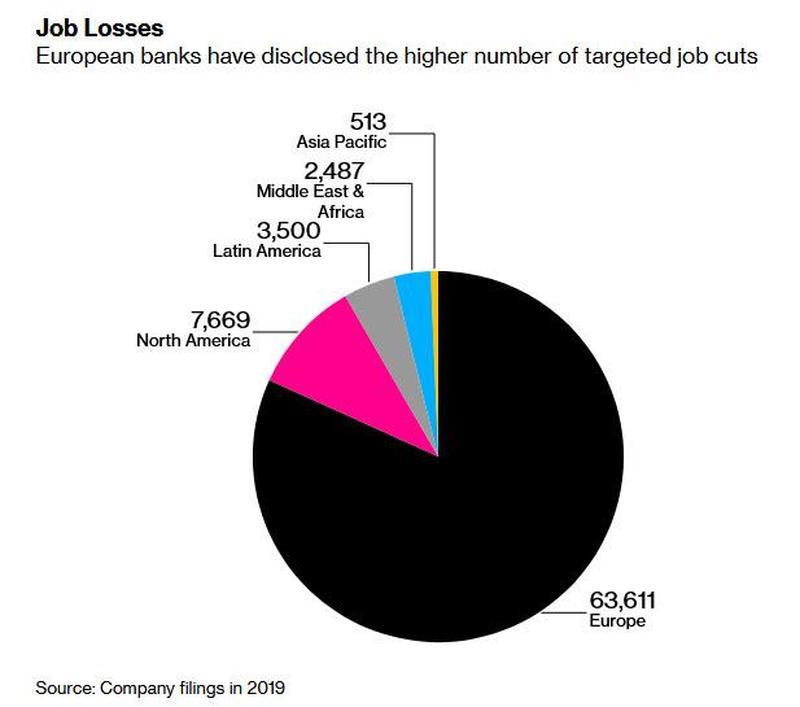

Banks in Europe have been crushed by the ECB’s catastrophic NIRP policy and face the added burden of negative interest rates that is crushing profitability and led to the most job losses last year.

Even as stocks continue to new highs on ‘Not QE,’ the banking industry is increasing cost-cutting measures as the real economy continues to stagnate, squeezing bank profitability.

Tyler Durden

Thu, 01/16/2020 – 13:30

via ZeroHedge News https://ift.tt/37aVsOV Tyler Durden