US To Start Issuing New 20-Year Bond In First Half Of 2020 To Fund Soaring Deficit

After more than three years of careful consideration whether to issue 50 or 100 year bonds to take advantage of record low yields and an unprecedented scramble for duration, late on Thursday the Treasury announced the outcome of that process when it unveiled plans to issue… 20 year bonds.

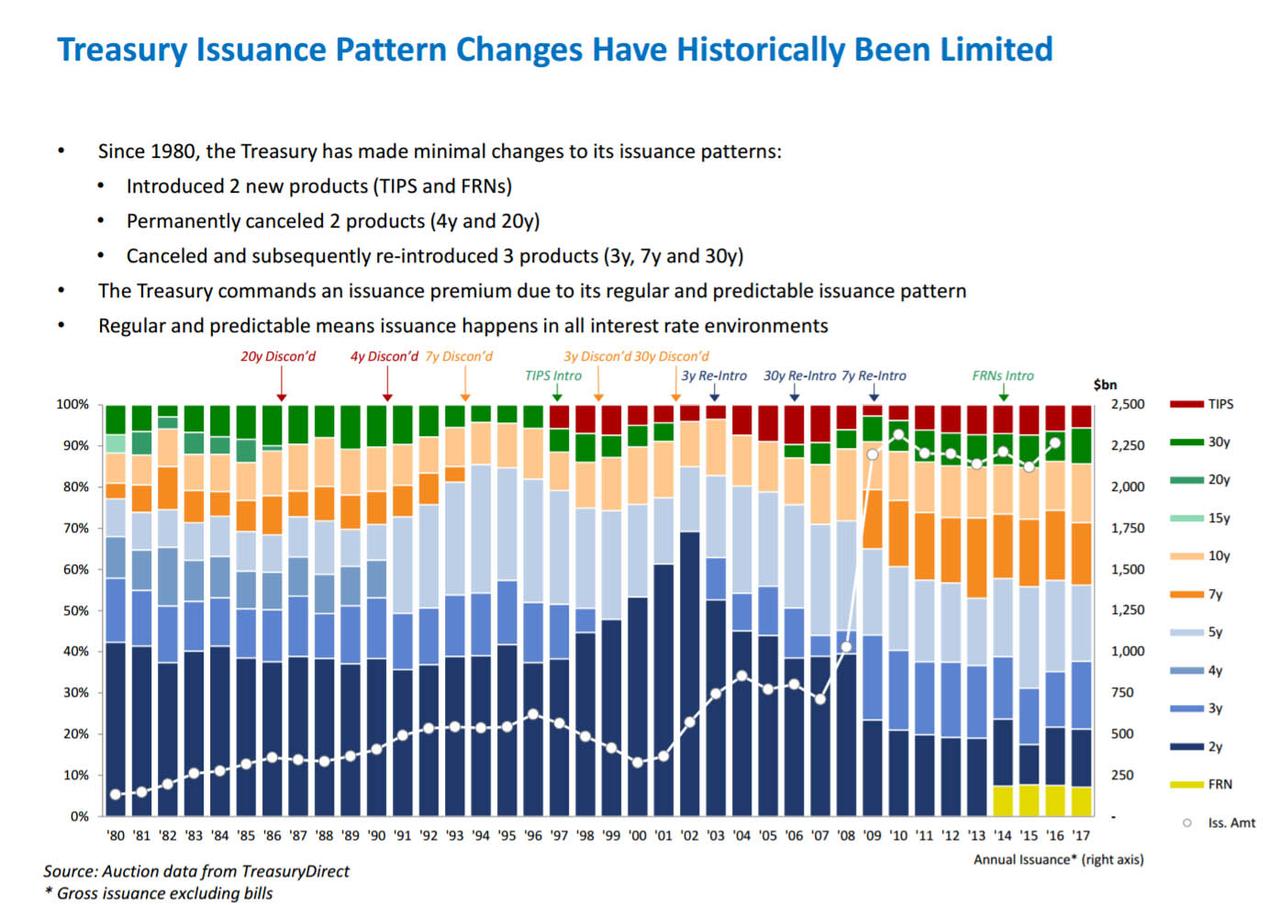

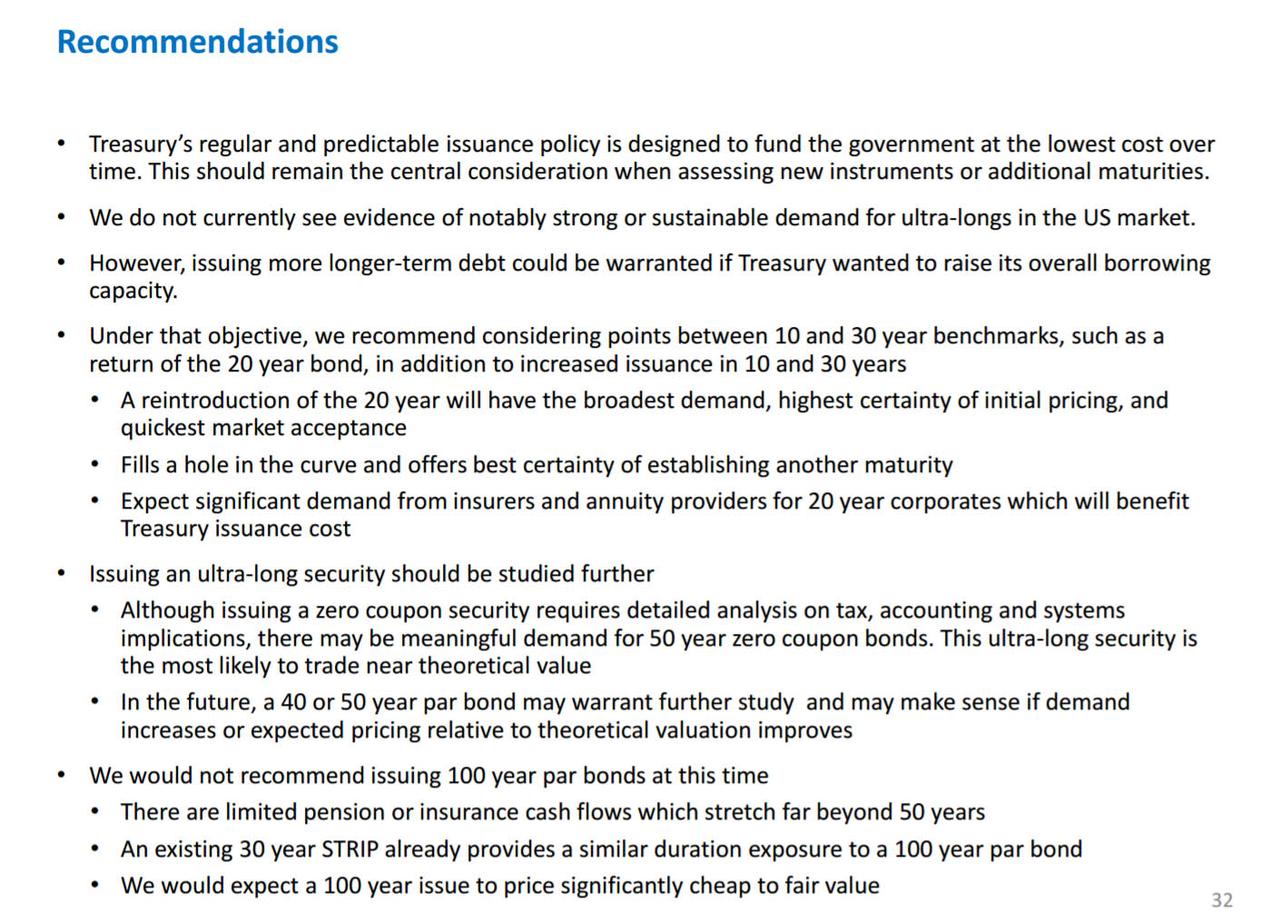

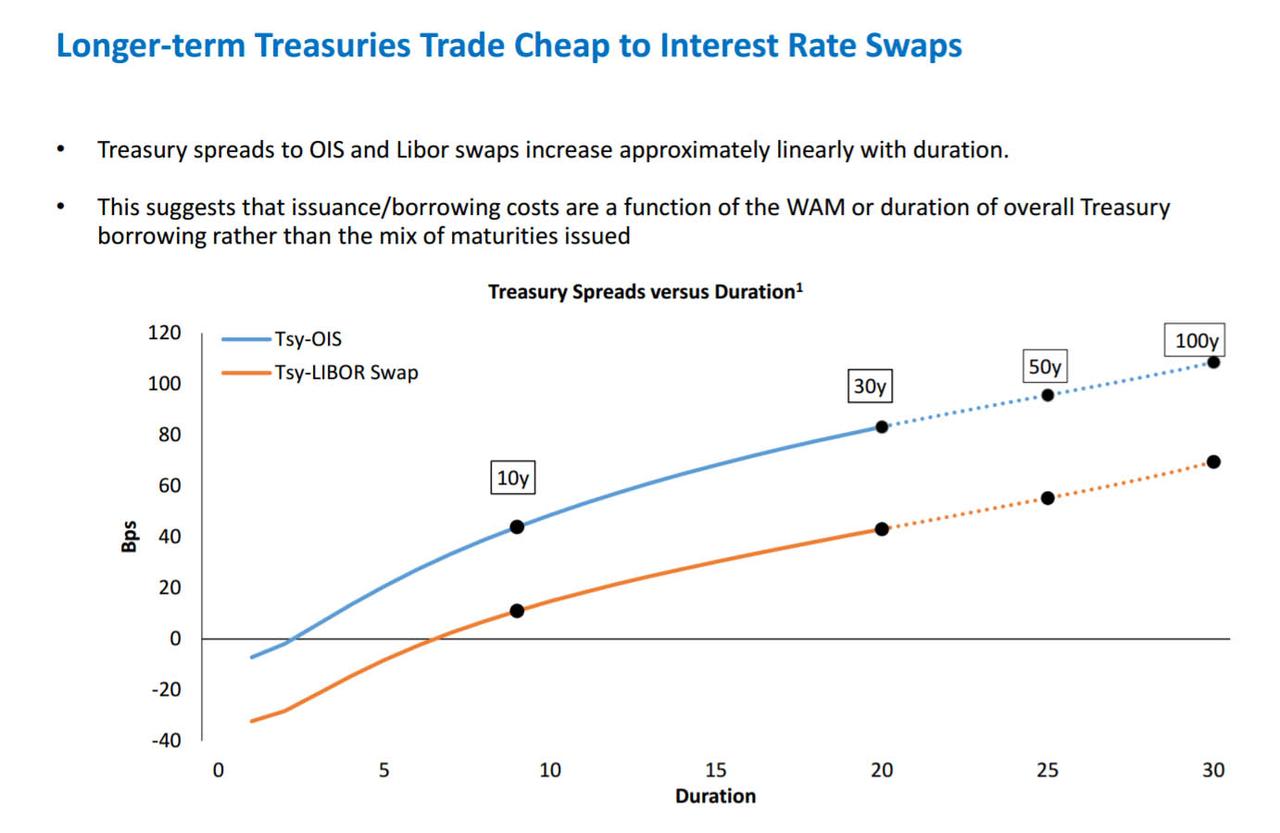

As we have periodically reported over the past several years, the Treasury had explored a range of potential new debt products, including 20-year, 50-year, and 100-year bonds, as well as floating-rate notes linked to the Secured Overnight Financing Rate—all with the goal of expanding borrowing capacity to finance the soaring federal deficit at the lowest possible cost. The decision to pick 20 year bonds is not surprising in light of persistent pushback by the Primary Dealer community against longer durations. Furthermore, the fact that the Treasury previously issued 20 Year bonds means it is familiar with the mechanics and market demands (the Treasury discontinued the issuance of 20Y bonds in 1986).

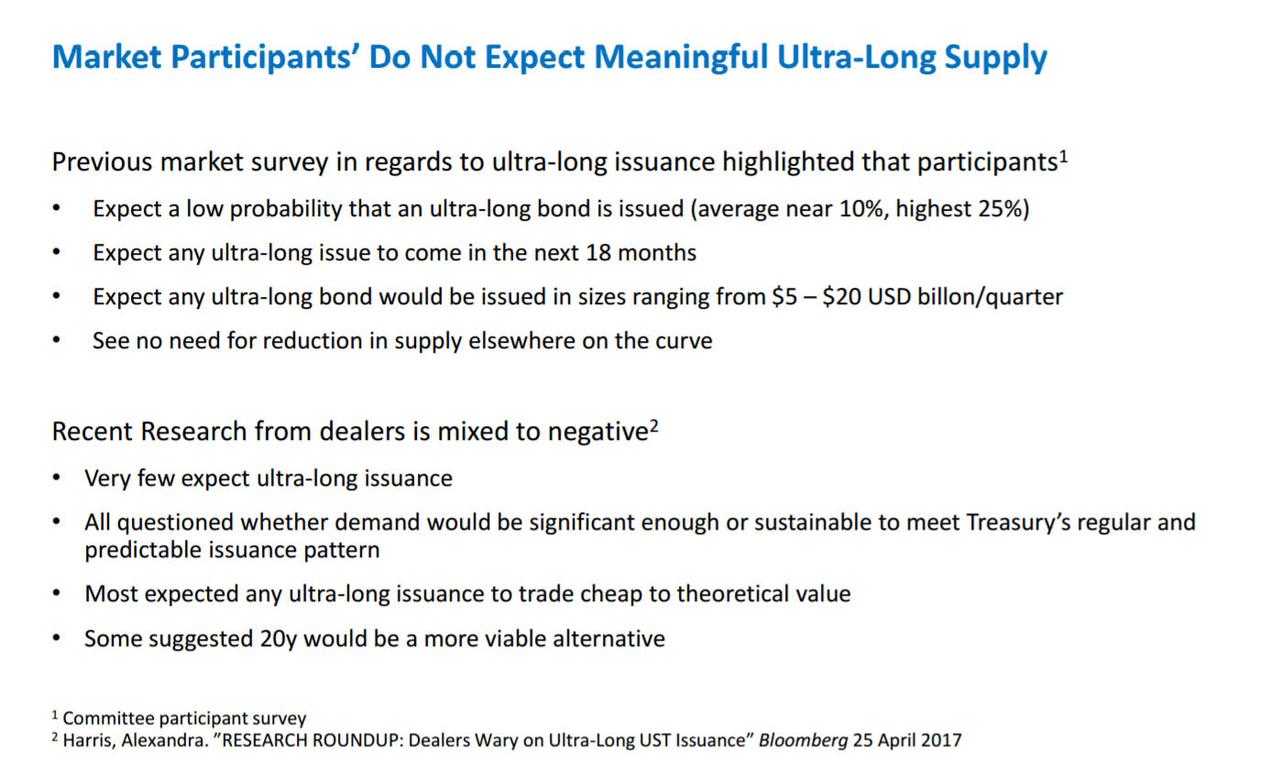

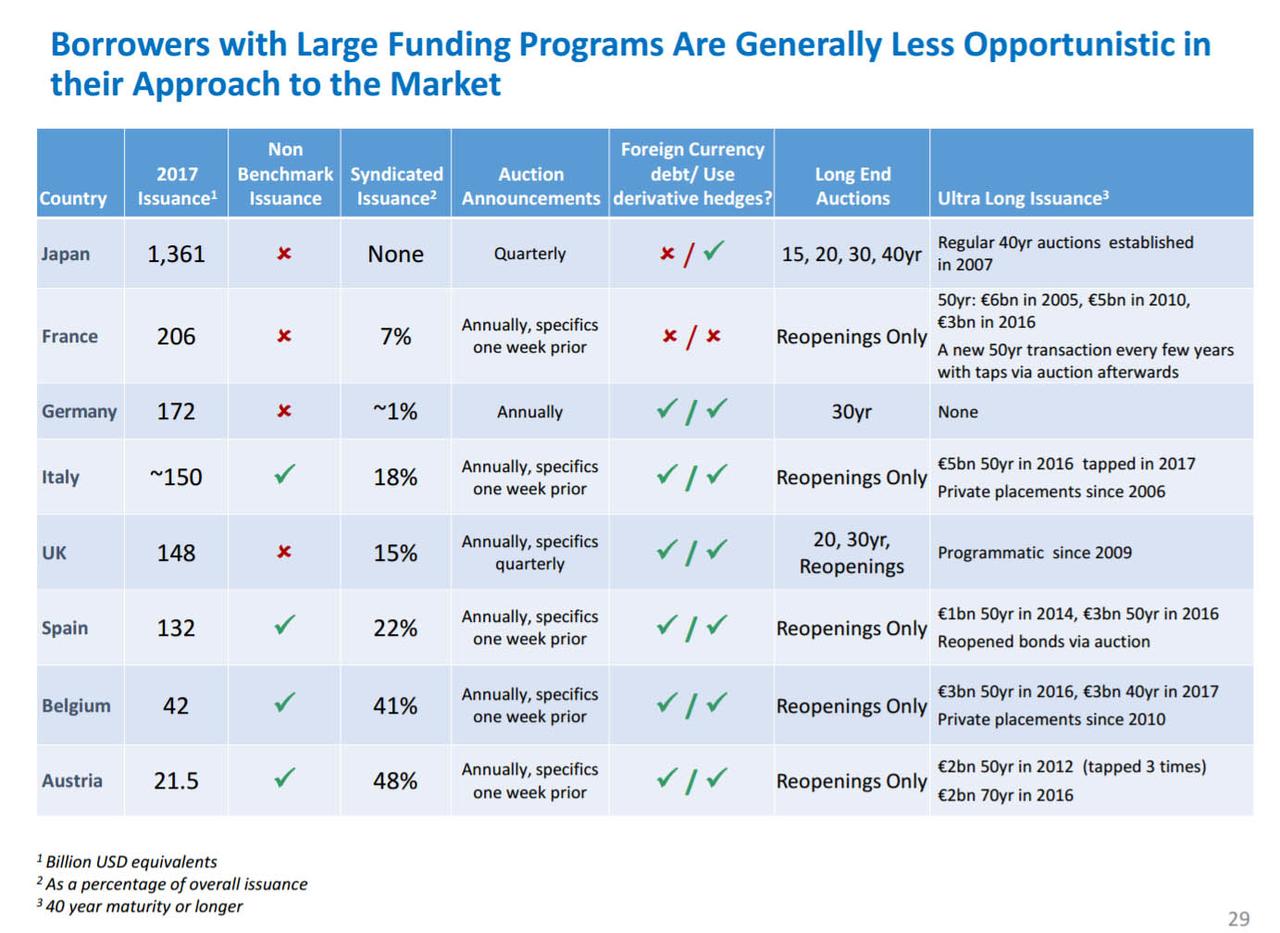

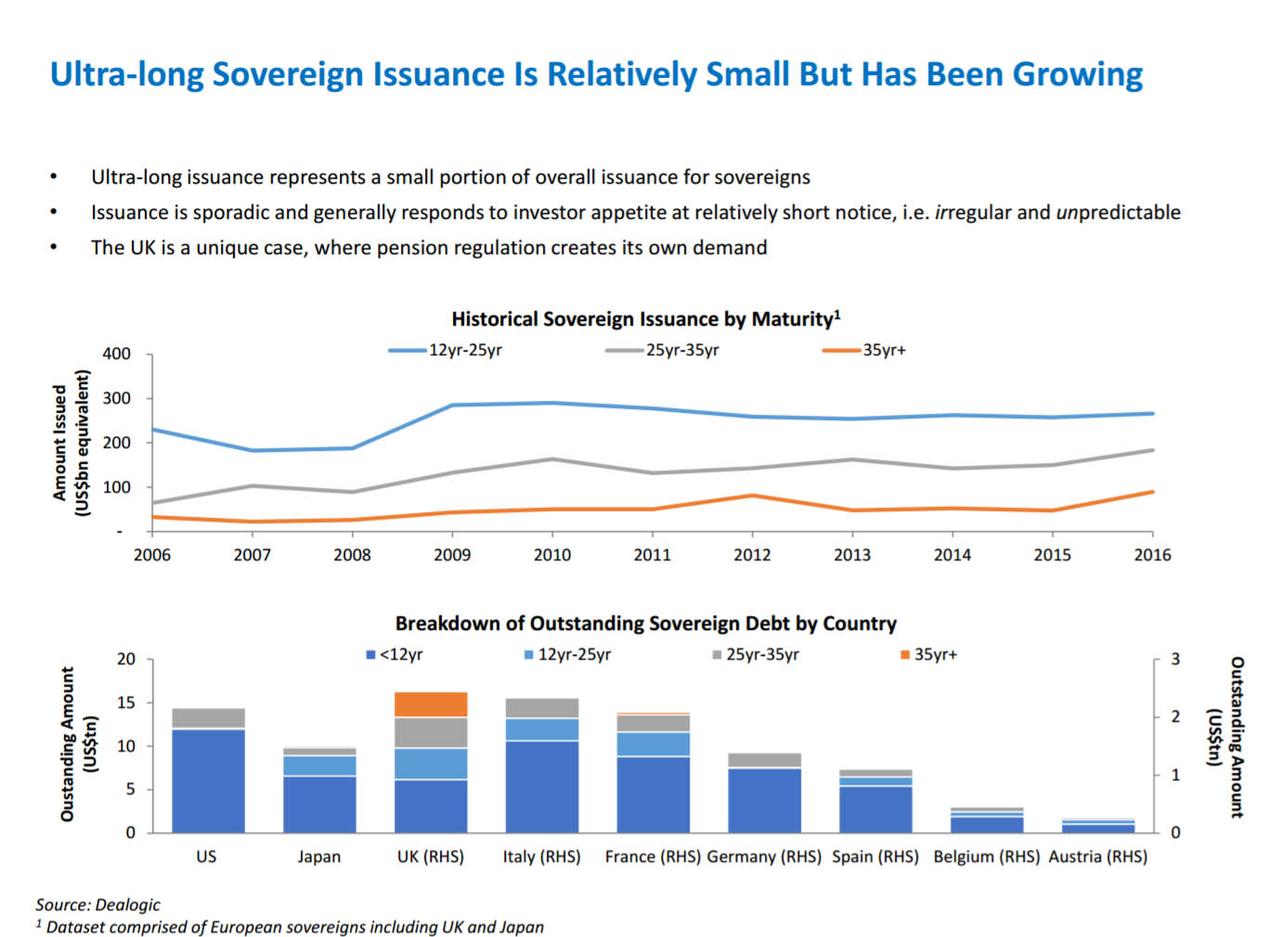

As part of its consideration of new products, Treasury gathered feedback on these potential products from a large and diverse set of market participants. Curiously, while choosing to ignore 50 and 100-year bonds, despite the tremendous demand these issues have seen across Europe (if not so much Argentina)…

… the Treasury believes that there will be strong demand from investors for a 20-year bond, which will increase Treasury’s financing capacity over the long term.

“The Treasury Department appreciates the input of market participants, including the Treasury Borrowing Advisory Committee and primary dealers, for their contributions to Treasury’s decision to launch a 20-year bond,” said Treasury Secretary Steven T. Mnuchin. “We seek to finance the government at the least possible cost to taxpayers over time, and we will continue to evaluate other potential new products to meet that goal.”

The announcement of the 20Y bond will probably not come as a surprise: in its August presentation to the Treasury, the TBAC stated that “market participants do not expect meaningful ultra-long supply.”

And while the TBAC was pessimistic about demand for 50 Year paper, it explicitly recommended against issuing a 100-year bond due to “limited pension or insurance cash flows beyond 50-years and the preferable attributes of stripped 30-year bonds to meet a similar duration as a 100-year coupon bond.”

Hence, we get 20 year bonds.

In its notice, the Treasury said that “consistent with Treasury’s longstanding issuance practice, Treasury plans to issue this product in a regular and predictable manner in benchmark size. Additional information regarding the launch of the 20-year bond will be provided in Treasury’s quarterly refunding statement on Wednesday, February 5, 2020.”

Institutional investors have been demanding more longer-dated, risk-free securities that offer some nominal yield, amid a global total of $11 trillion of debt with negative rates. As Bloomberg notes, Japan recently announced that it will sell more 20-year bonds in 2020, responding to such calls.

The new U.S. 20-year security is set to offer a notable premium over comparable notes abroad, presuming it slots somewhere between 10-year and 30-year yields, currently at about 1.81% and 2.26%. Japanese 20-year bonds yield about 0.32% and German ones just 0.07%.

“The 20-year bond fits more easily into the existing market structure because it’s likely to be an attractive trading instrument with the markets because it lines up with existing with other cash market instruments,” Wrightson ICAP LLC chief economist Lou Crandall told Bloomberg.

“This is a way of taking advantage of long-term interest rates that are low by historical standards without introducing a wild-card such as an ultra-long bond, which would have had more growing pains.”

At President Donald Trump’s request, Mnuchin in August launched his second review since he took office into ultra-long bonds. Trump has said repeatedly that the U.S. should seek to take advantage of historically low interest rates. Issuing extremely long-term debt would limit the cost to taxpayers of plugging a budget deficit that is set to surpass $1 trillion annually in 2020. As a result, pension funds would enjoy a few extra points of returns amid falling yields.

Persistently low interest rates have given the Treasury a reason to revisit a proposal it has shelved in the past. Some observers see a window for the U.S. to issue extremely long-term debt instruments, even though the idea has been met with a cool reception on Wall Street. Mnuchin examined the issue when he took office in 2017, but put the idea to rest following a review with the Treasury Borrowing Advisory Committee, or TBAC. This time around he decided to give in to the market’s demands especially since the US deficit is about to go exponential.

Tyler Durden

Thu, 01/16/2020 – 19:03

via ZeroHedge News https://ift.tt/2trhPkb Tyler Durden