Melt-Up Mania: Stocks Reach Most Expensive, Most Overbought Levels, Surpassing DotCom Bubble

The Fed has created a Full-Rick-Astley market…

And everyone knows, you never go full-Risk-Astley!

Source: Bloomberg

China was mixed on the week with a dash-for-trash rotation from big caps to small cap tech…

Source: Bloomberg

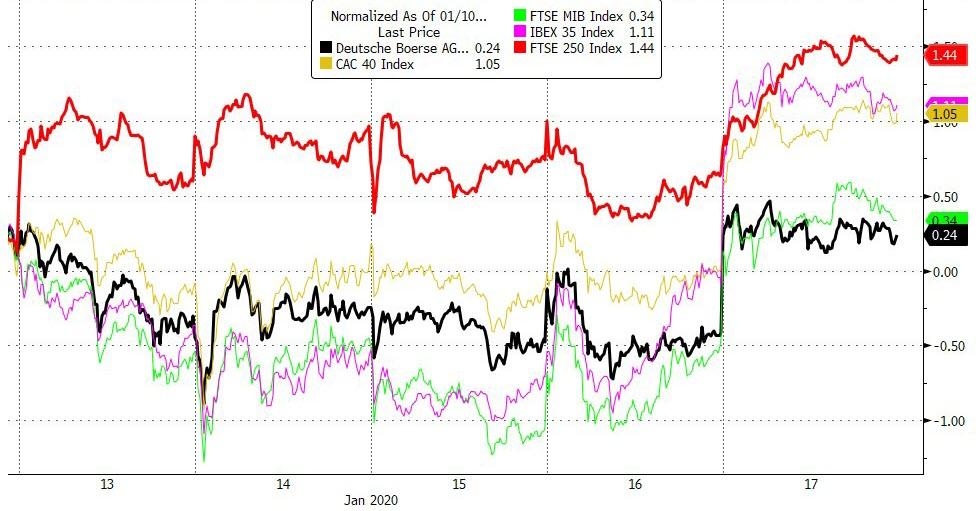

European markets were all green on the week with UK’s FTSE leading the way,,,

Source: Bloomberg

European ‘VIX’ hit a new record low today…

Source: Bloomberg

All major US indices were notably green this week with Trannies and Small Caps best…

Notably Small Caps and Trannies were weakest today (after some chaos at the open). The Dow was rescued every time it touched unch…

Defensives dominated cyclicals this week…

Source: Bloomberg

The S&P 500 has now had 70 straight days without a 1% loss… SURPRISE – since The Fed started re-expanding its balance sheet…

Source: Bloomberg

In case you wondered, the period before the Fed 2018 crash was 112 days without a 1% move.

Nasdaq is as overbought as it was during the dotcom bubble peak…

Source: Bloomberg

And the S&P 500 has never been more expensive…

Source: Bloomberg

This week saw the biggest short-squeeze since October…

Source: Bloomberg

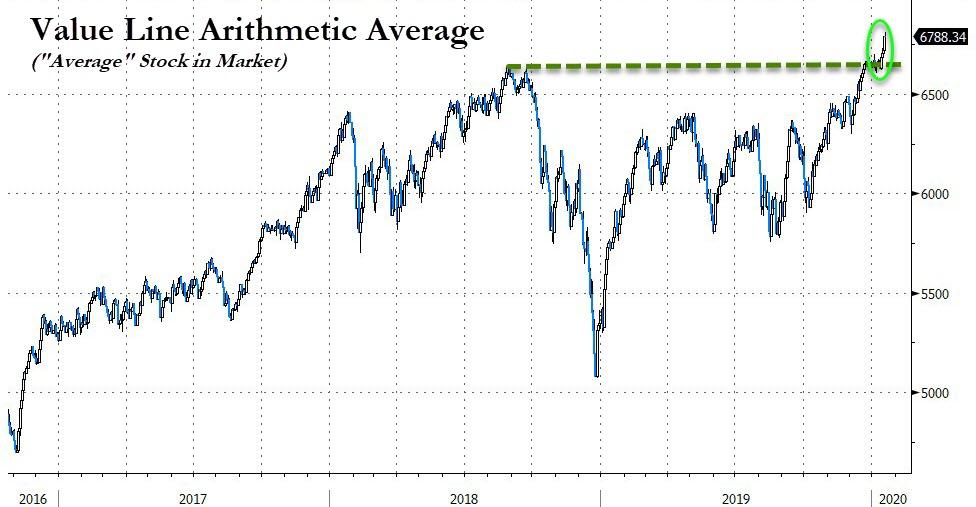

This week saw the ‘average’ stock in America finally transcend its previous highs of Sept 2018…

Source: Bloomberg

After this morning’s solid housing starts dats, PHLX Housing Index spiked to record highs…

Source: Bloomberg

Broker-Dealer stocks soared to all-time highs…

Source: Bloomberg

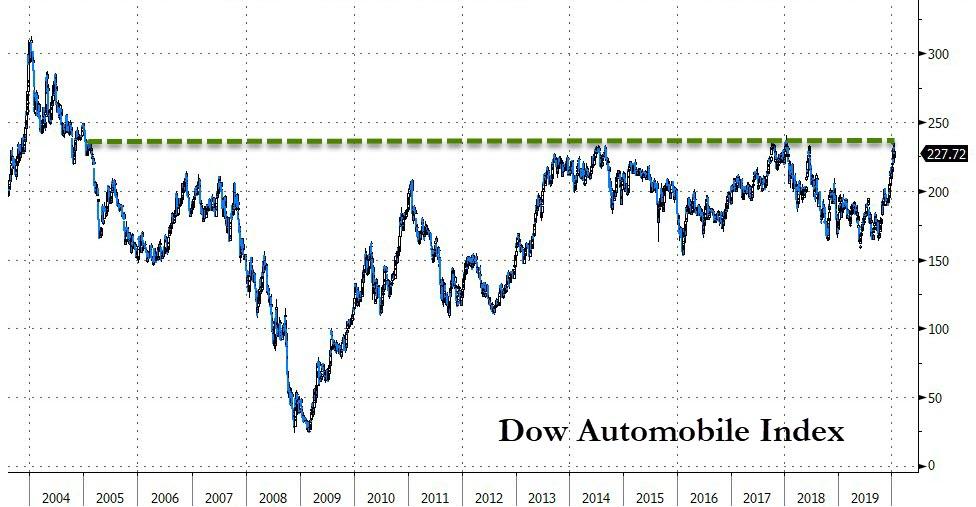

Auto stocks surged to the highest since 2004?

Source: Bloomberg

Jeff Bezos is still not a member of the “four commas” club…

Source: Bloomberg

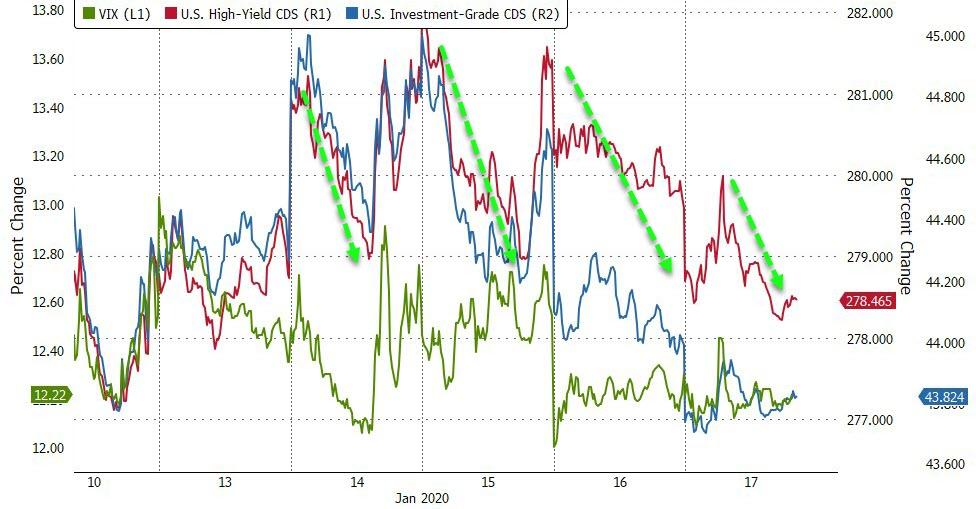

Credit spreads were hammered lower every day this week as equity protection costs tumbled to an 11 handle briefly…

Source: Bloomberg

Treasury yields roundtripped on the week after dropping early and rising in the last two days to end unchanged…

Source: Bloomberg

The Dollar spiked today, testing a key resistance level and failing once again…

Source: Bloomberg

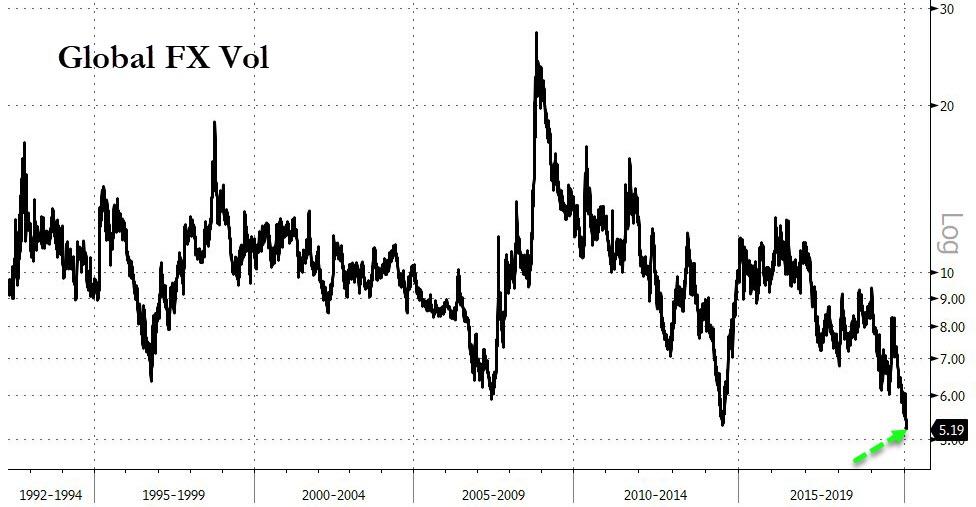

Global FX Vol fell to a new record low…

Source: Bloomberg

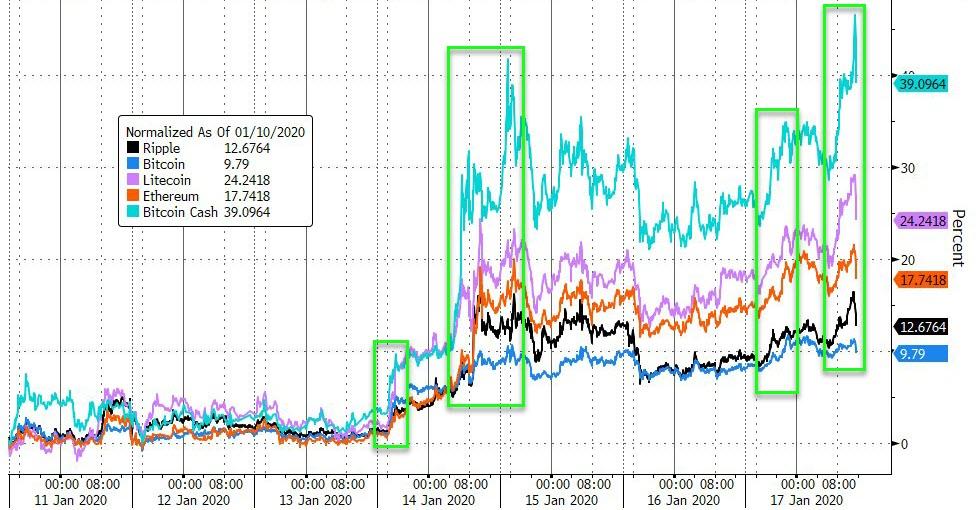

A big week for cryptos led by Bitcoin Cash…(NOTE – late day today cryptos were dumped)

Source: Bloomberg

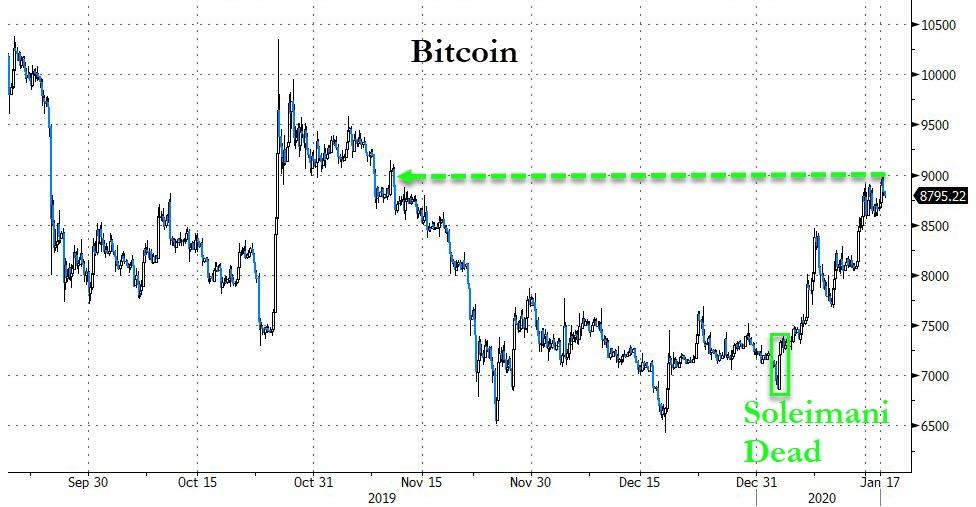

Bitcoin tagged $9,000 intraday today…

Source: Bloomberg

Commodities were mixed with PMs flat, copper up and crude lower…

Source: Bloomberg

US NatGas dropped below $2 for the first time since 2016

Source: Bloomberg

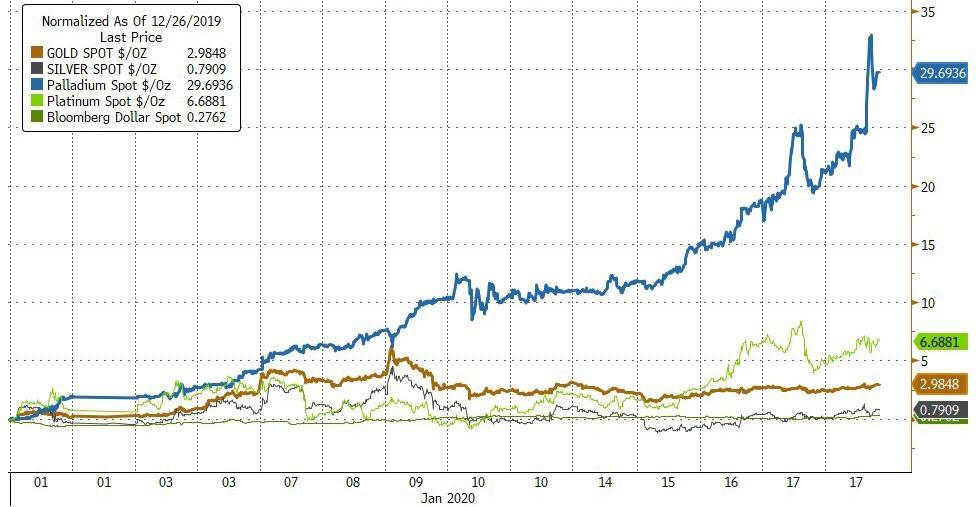

Palladium has gone utterly parabolic, soaring 8% today – the biggest daily spike since Dec 2009

Source: Bloomberg

And while Palladium had a massive 2019, it has started 2020 off exponentially strong…

Source: Bloomberg

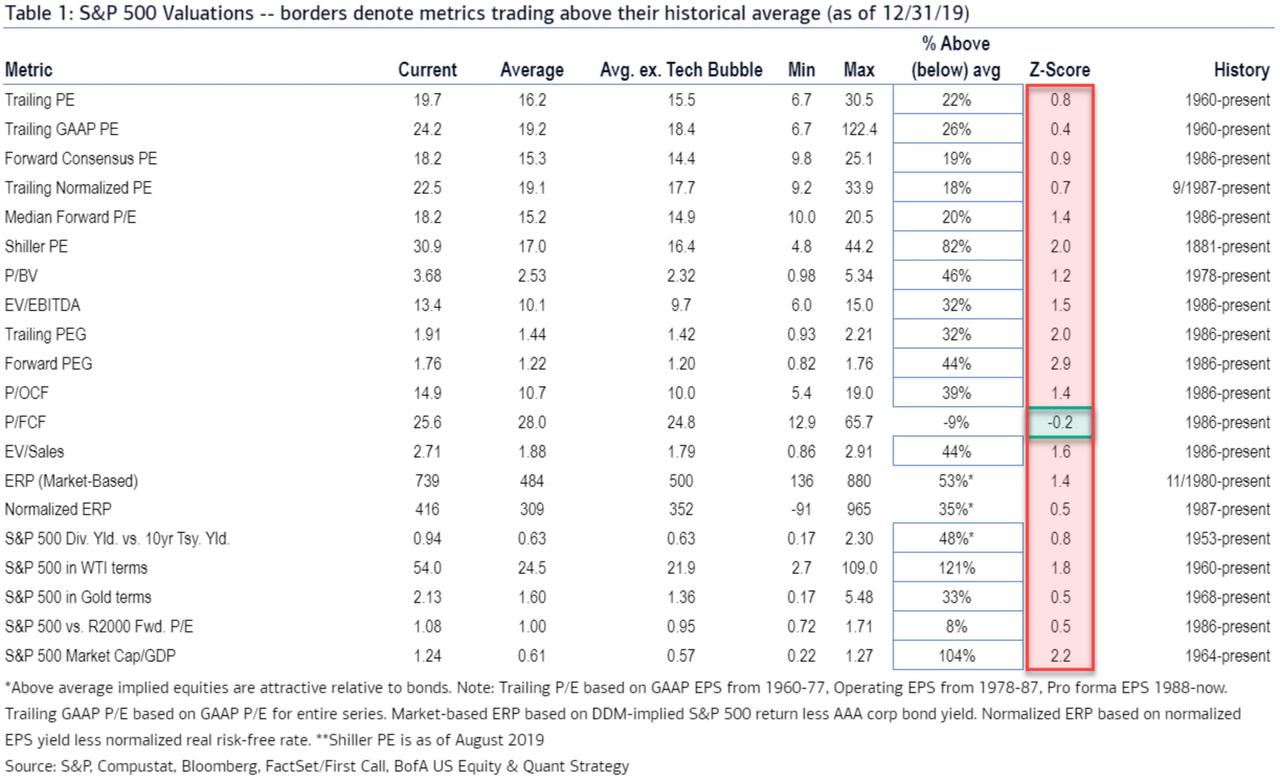

Finally, according to BofA, the S&P is overvalued on 19 of 20 metrics

So there’s still hope!

And the Y2K Fed Liquidity Analog is still holding…

Source: Bloomberg

Tyler Durden

Fri, 01/17/2020 – 16:00

via ZeroHedge News https://ift.tt/3apURLh Tyler Durden