“Buy The Dip” – An American Tradition Since 1987

Authored by Bruce Wilds via Advancing Time blog,

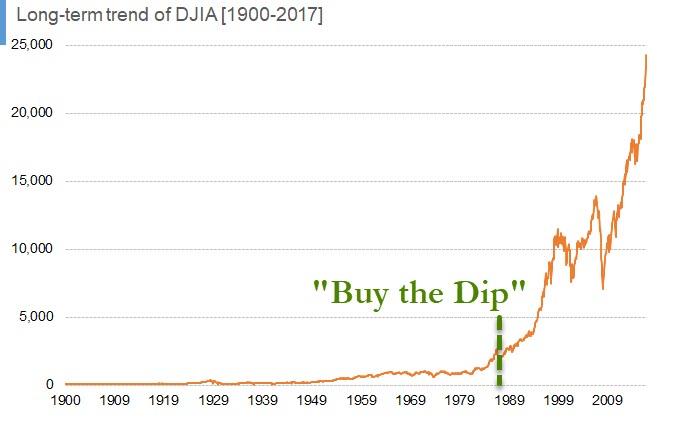

Buy the dip has been an American tradition since 1987. The first truly modern global financial crisis unfolded in the autumn of that year. October 19, 1987, has become the day known infamously as “Black Monday. It set forth a chain reaction of market distress that sent global stock exchanges plummeting in a matter of hours. In the United States, the Dow Jones Industrial Average (DJIA) dropped 22.6 percent in a single trading session. This loss remains the largest one-day stock market decline in history and marks the sharpest market downturn in the United States since the Great Depression.

Note Where “Buy The Dip” Started (click to enlarge)

The important significance of this event lies in the fact Black Monday underscored the concept of “globalization,” which was still quite new at the time. The event demonstrated the extent to which financial markets worldwide had become intertwined and technologically interconnected. This led to several noteworthy reforms, including exchanges developing provisions to pause trading temporarily in the event of rapid market sell-offs. More importantly, it forever altered the Federal Reserve’s response on how to use “liquidity” as a tool to stem financial crises.

Leading up to this event the stock markets raced upward during the first half of 1987 gaining a whopping 44 percent in just seven months. This, of course, created concerns of an asset bubble, however, few market traders expected the market could unravel so viciously. Prior to US markets opening for trading on Monday morning, stock markets in and around Asia began plunging. In response investors rapidly began to liquidate positions, and the number of sell orders vastly outnumbered willing buyers near previous prices, creating a cascade in stock markets.

Thomas Thrall, a senior professional at the Federal Reserve Bank of Chicago, who was then a trader at the Chicago Mercantile Exchange later said, “It felt really scary, people started to understand the interconnectedness of markets around the globe.”

Without a doubt, several new developments in the market enlarged and exacerbated the losses on Black Monday. Things like international investors becoming more active in US markets and new products from US investment firms, known as “portfolio insurance” had become very popular. These included the use of options and derivatives. A number of structural flaws also fueled the losses. At the time of the crisis, stock, options, and futures markets used different timelines for the clearing and settlements of trades, creating the potential for negative trading account balances and forced liquidations.

That is when, Alan Greenspan, then Federal Reserve chairman, came forward on October 20, 1987, with a statement that would shape traders’ actions for decades. Fed Chairman Alan Greenspan said, “The Federal Reserve, consistent with its responsibilities as the Nation’s central bank, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system” Prior to this markets were seen as a much riskier venture. The great legacy from the events taking place in 1987 is rooted in the actions and swift response of the Fed, that the central bank would backstop markets. This premise has grown over time.

After Black Monday, regulators overhauled trade-clearing protocols and developed new rules. One of the most important is known as circuit breakers which allow exchanges to halt trading temporarily in instances of exceptionally large price declines. Under these rules, the New York Stock Exchange will temporarily halt trading when the S&P 500 stock index declines 7 percent, 13 percent, and 20 percent. This is done in order to provide investors time to make better informed decisions during periods of high market volatility and reduce the chance of panic. Risk managers also re-calibrated the way they valued options.

Unlike previous financial crises, the Black Monday decline was not associated with a deposit run or any other problem in the banking sector. Still, it was very important because the Fed’s response set a precedent that has over time when coupled with other events massively increased the moral hazard associated with intervention in free markets. Following the rout stock markets quickly recovered a majority of their Black Monday losses. In just two trading sessions, the DJIA gained back 57 percent, of the Black Monday downturn. Because of the Fed action in less than two years, the US stock markets surpassed their pre-crash highs and was not followed by an economic recession.

And now for the grand point of this post, we should not underestimate how the Fed’s response to Black Monday ushered in a new era of investor confidence in the central bank’s ability to control market downturns. The actions by Fed Chairman Greenspan galvanized the mantras “buy the dip” and “don’t fight the Fed” and powered them to the top of trading lexicons. It has also been a key factor in allowing the stock market to morph into a much larger symbol of the economy than it merits. This is reflected in how over the decades growth in the financial sector has soared dwarfing that in the real economy.

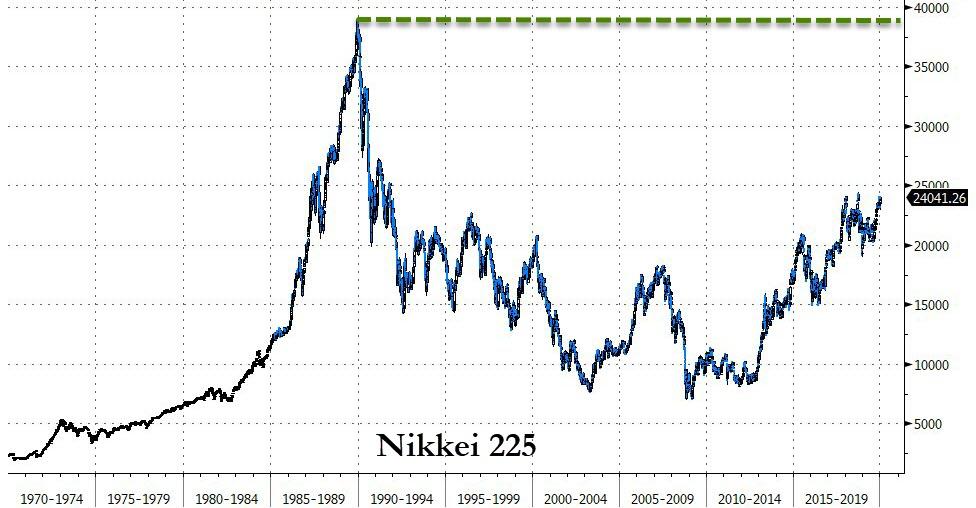

Decades Of Nikkei Action (click to enlarge)

To all those market aficionados that forget markets can fall and for decades fail to regain their luster I point to the Japanese markets and their fierce meltdown in 1990. The chart to the right would look far more depressing had the market trends over the last decade coupled with buying from the central Bank Of Japan not bolstered its performance. We should also remember many market high-flyers simply vanish into a deep hole and that during the 1930s the Fed was unable to bring the economy out of its funk.

Another often overlooked issue is how changes in tax laws over the years have moved more wealth into stocks. These include the often forgotten and seldom mentioned changes many made by the Bush administration following the dotcom bust and 9-11. These factors and money constantly funneled into markets by pension funds and such coupled with soaring central bank liquidity has levitated markets to record high, after record high, despite stagnant fundamentals. It seems the “fear of missing out” and exuberance has caused many investors to become blind to the idea that years of profits can vanish in a blink of the eye.

This should force us to question the utter madness displayed in the widening disconnect between current valuations and underlying fundamentals. It could be argued that because of these actions QE has amplified speculation as investors seeking yield now feel almost invulnerable to future losses. We can cast away all the terms and warnings about “moral hazards” and “slippery slopes,” however that does not guarantee they will not return to haunt us. Historically our hubris and arrogance has shined as a beacon illuminating the fact that every time those in high finance declare it is different this time they have been proven wrong.

Tyler Durden

Sun, 01/19/2020 – 12:55

via ZeroHedge News https://ift.tt/37jRunb Tyler Durden