JPMorgan: Maybe We Were Wrong About The Main Reason To Be Bullish In 2020

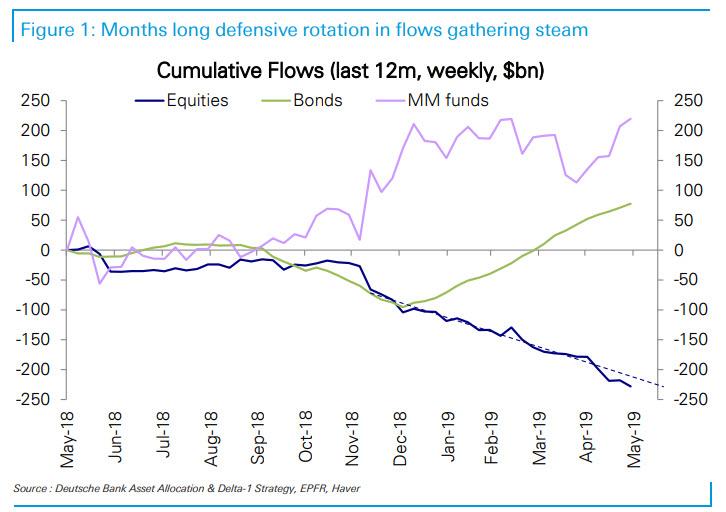

Readers will recall for much of 2019 we highlighted what we said was the market’s biggest paradox: one where the higher the market rose, the more money investors would pull out of equities, and allocate to bonds.

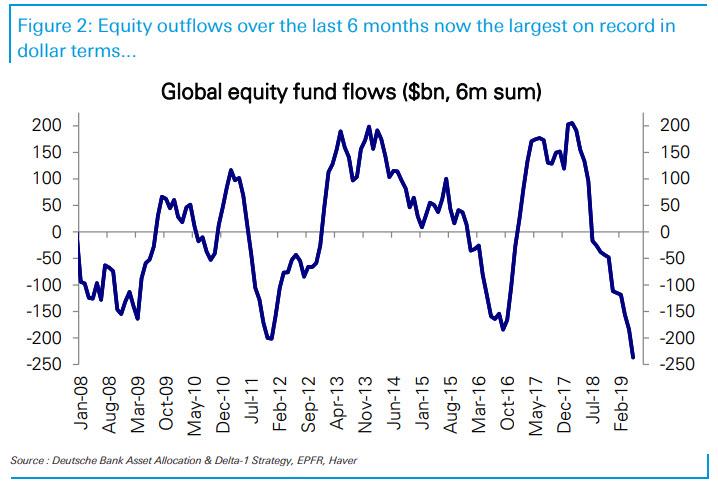

It culminated last June when , even as the S&P hit new all time highs, outflows over the last 6 months in dollar terms surpassed the previous record observed over any prior 6-month period.

Since then the market moved relentlessly higher hitting new record highs, buoyed in great part by the Fed’s announcement of repo liquidity injections at first, and subsequently by the return of POMO, as a result of the NY Fed’s monthly monetization of $60BN in T-Bills. And yet the paradox remained: investors continued to pull money out of equities and allocated it to bond and money market funds.

This lack of retail euphoria promptly was used by the major banks, most notably JPMorgan, as one of the catalysts behind the bank’s bullish outlook for 2020, with the bank arguing back in November that 2020 is likely to be the year of Great Rotation II, in a repeat of 2013 the year of Great Rotation I, which saw a sharp acceleration in equity fund buying and sharp deceleration in bond fund buying by retail investors globally.

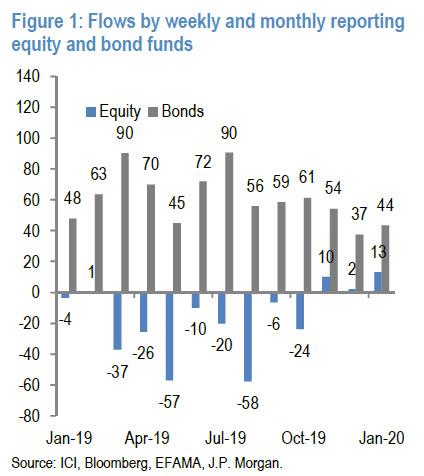

There is just one problem: despite the market’s continued meltup, this has so far failed to materialize, and as JPM derivatives strategist Nick Panagirtzoglou writes in his latest Flows and Liquidity report, “is the flow picture over the past few weeks consistent with the Great Rotation II thesis? The answer is not yet” because whether one looks at YTD fund flows or the flows over the past month or two, the picture is of continued strong flows into bond funds and of only modestly positive flows into equity funds.

Why are the early January fund flows number important? Because as the JPM strategist explains, “January flows have added importance especially in years where a big flow shift is expected to take place. This is because January is typically a month when retail investors make their asset allocations for the whole year. Indeed, empirically there is a significant positive relationship between the full year equity fund vs. the January flow…. And during the previous Great Rotation year of 2013 when we had a big positive equity fund flow shift of the one we anticipate for this year, January saw a high share of almost 20% of the yearly equity fund inflow, i.e. much higher than its proportional 1/12 share.”

This, as Panigirtzoglou notes, “implies that the final fund flow numbers of weekly and monthly reporting funds for the month of January, which we are going to get in the second half of February, will be important in gauging whether the Great Rotation thesis is tracking or not for this year.”

Alas, as shown in the chart above, the trend so far is hardly a ringing endorsement of a second Great Rotation out of bonds and into stocks despite the market making new all time highs on a daily basis.

This in turn has prompted JPM to ask, just two months after positing its “Great Rotation II” thesis, that it may well be wrong about a great fund reallocation out of bonds and into stocks, and if that is the case what then, or as Panigirtzoglou humbly puts it, “what could make the Great Rotation thesis failing to materialize this year?”

To answer this question the derivatives expert says he needs to think about the factors for and against the Great Rotation thesis. In terms of the supporting factors, he had mentioned three main factors in our previous publication of November 22nd. This is what JPM said then:

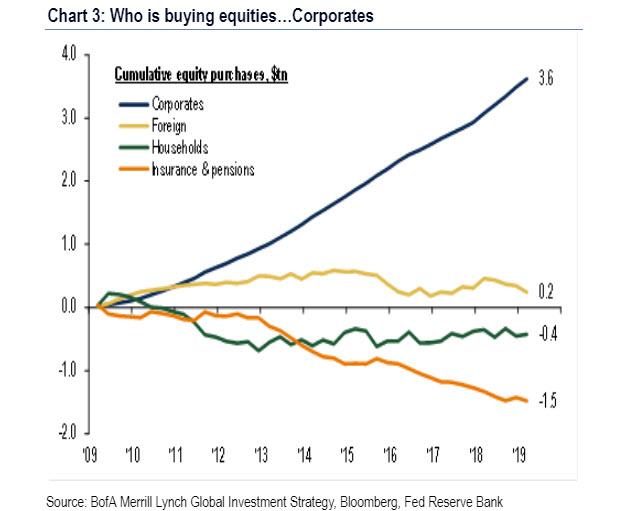

- 1) Historical patterns based on previous year’s equity/bond performance and on previous year’s extremity in equity and bond fund flows, pointed to a big change in fund flows this year – at least according to JPM if not this website which has argued for years that the biggest buyer of stocks is not retail or institutional investors but corporate buybacks – with more than reversal of last year’s equity fund selling and collapse in last year’s record high bond fund buying. In particular, JPM had argued that in terms of equity fund flows 2018 looked more like 2011 or 2015, as they were all equity correction years. As a result, 2019 looked more like 2012 or 2016, and 2020 is likely to look more like 2013 or 2017. In other words, the cautious stance of retail investors in 2019 was likely in response to 2018’s equity market correction and given 2019 was a strong year for equities driven by bullish institutional investors, then retail investors should turn big buyers of equity funds in 2020.

- 2) An improving macro picture. Further signs of an improvement in the global industry cycle into 2020 should also encourage a rotation from bond funds to equity funds. The upward trajectory in orders and inventories since the flash PMIs of October 24th has been so far underpinning this improving macro picture. Next week’s flash PMIs will be important in gauging whether this improvement trend continues.

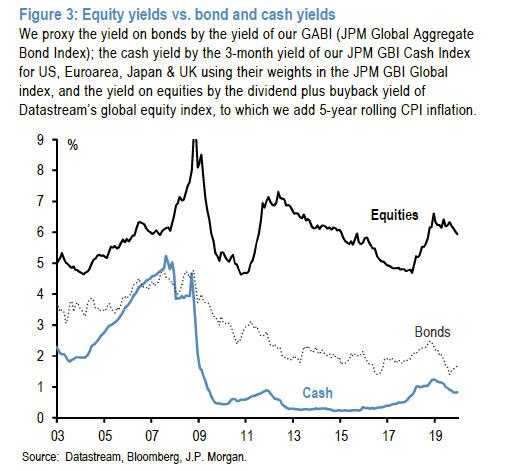

- 3) The third supporting factor JPM had mentioned is the global yield backdrop across asset classes. Following last year’s rate cuts by central banks, cash and bonds yield significantly less than before and significantly less than equities. So in the absence of negative surprises it would be difficult for retail investors or other asset allocators to ignore the yield advantage of equities and not accept ever higher equity weightings.

What about the factors against Great Rotation (which as regular readers may recall, we said would not happen around the time JPM made its “contrarian” call, for the simple reason that there is little impetus to keep selling bonds).

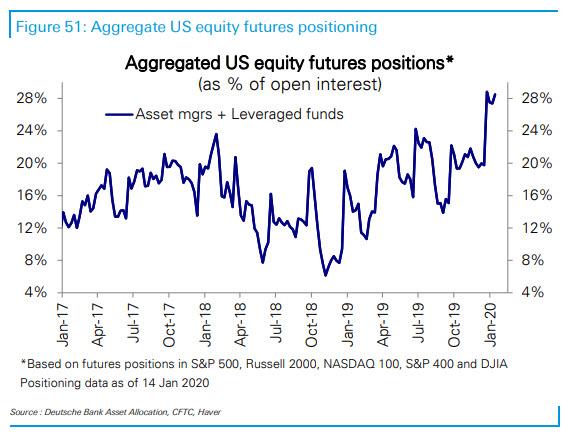

Here, JPM says that “the main risk or impediment” to its Great Rotation thesis stemmed from already elevated retail investor equity positions (as a reminder, earlier today we noted that virtually every investor class is now all-in stocks) that need to rise beyond previous equity cycle peaks for the Great Rotation thesis to play out this year. This impediment, JPM adds, “looks even bigger at the moment following the equity rally over the past two months.”

To illustrate this “challenge” to getting his key thesis for 202 right, Panigirtzoglou updates his position proxies for retail investors to incorporate more recent price and flow information including the last week’s release of quarterly reported fund flows for Q3 2019. This is how he explains the key indicator he is watching:

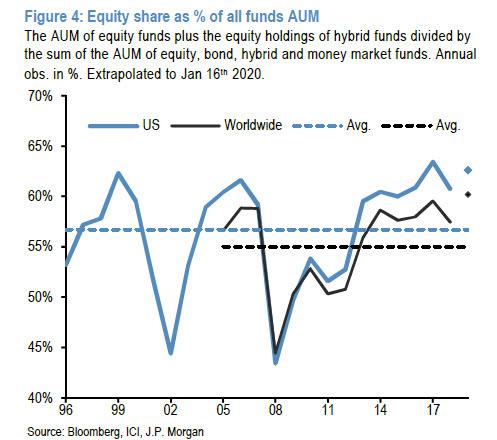

The retail investor position proxy is the share of equities in US domiciled or worldwide fund universe of equity, bond, hybrid and money market funds. The equity share in the fund universe is proxied by the AUM of equity funds plus the equity holdings of hybrid funds divided by the sum of the AUM of equity, bond, hybrid and money market funds. This share could

be considered as a proxy of how overweight equities retail investors are.

This proxy is shown in Figure 4 for funds domiciled in the US since 1996 and funds domiciled worldwide since 2005. This equity fund share, extrapolated to January 16th by the dots, looks even more elevated after the equity rally of the past few months and currently stands at record high levels for funds domiciled worldwide and very close to record high levels for funds domiciled in the US. Said otherwise, this confirms what we said earlier, namely that retail investors are indeed “all in” US stocks to a never before seen degree.

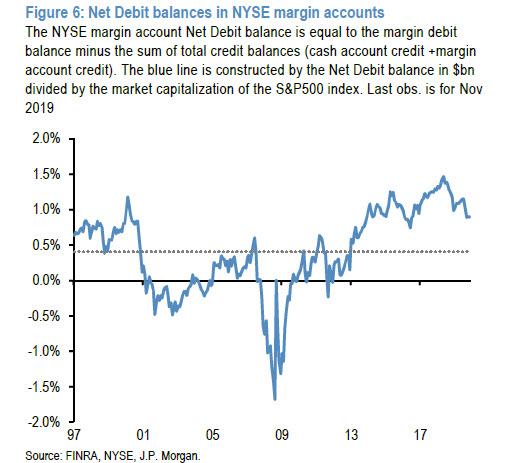

Another key metric to assess retail investors’ positioning is based on the NYSE Net Debit balance as a proxy for US individual investor leverage. In contrast to hedge funds who can get leverage more easily or cheaply via options and futures (and of course, repos, as we discussed extensively), individuals rely more on Federal Reserve Regulation T. This regulation, which governs customer cash accounts and the amount of credit that brokerage firms and dealers may extend to customers for the purchase of securities, stipulates that one can borrow up to 50% of the purchase price of securities that can be purchased on margin. This is known as the “initial margin”. NYSE rules also require equity in an account to be at least 25% of the securities market value, i.e., the “maintenance margin.”

Figure 6 shows this NYSE Net Debit balance calculated as the difference between margin debit balance minus the sum of total credit balances (cash account credit +margin account credit). This leverage proxy has been rising steeply over 2016-2017, and hit a record high of 1.5% in May 2018. Curiously, despite what Figure 4 above shows, this metric has declined significantly since then and the latest reading for November 2019 stands close to those seen previously at the end of 2016.

In other words, and contradicting the prior observations, the previous extremity in US individual investor leverage seen in Q2 2018 has been largely unwound. But, as the JPM strategist notes, “what is more striking in Figure 6 is that this metric declined last year despite strong equity market performance. This again shows how unwilling US retail investors were last year to leverage their equity bets.” This unwillingness likely indicates that leveraged US retail investors feel that their equity exposures and leverage are already elevated and are thus reluctant to add even with the equity market at historical highs. Incidentally, and this is not JPM but ZH talking, not adding when stocks are at all time highs is precisely what investors should be doing – instead of selling low and buying high as the dumb money has historically done, in this case we see the opposite, or what some may call, perfectly logical, reasonable behavior. It’s also why JPM is stumped…

In any case, back to the JPMorgan argument, which sees in this “unusual deleveraging” in NYSE margin accounts in a strong equity year, coupled with the “unusual selling” of equity funds and the record high buying of almost $1tr of bond funds last year, the possibility that retail investors are more motivated by rebalancing rather than responding to long term momentum. Once again, this is merely a way for JPM to feign shock that instead of unleashing animal spirits, a market all time highs is now nothing more than a logical signal for most investors to sell.

Well, if this is indeed the case, then Panigirtzoglou concludes that retail investors would be unwilling to accept even higher equity weighting from here “and our Great Rotation thesis would fail to materialize.”

Oops… because as the title summarizes, this is just a way for one of JPM’s most respected strategists to admit that just maybe he was wrong about the main argument for him to turn bullish on stocks in 2020.

* * *

So what would the implications be if the Great Rotation fails to materialize this year, according to JPM? As a reminder, the largest US bank had argued at the end of last year that retail flows would be crucial in determining the 2020 demand/supply balance for both equities and bonds. So if the Great Rotation fails to materialize this year, the implications would be important for both equities and bonds. For equities the implication would be that the equity market would remain at the mercy of institutional investors, which, as noted earlier are already all in, and have little room to push the equity market higher from here and instead leave it vulnerable to negative surprises.

In other words, in the absence of significant retail inflows, the equity market would be range bound rather than trending up. That, of course, ignores the elephant in the room: the Fed’s injections of roughly $100BN in liquidity between repos and QE4 each month. But since JPM also happens to be the biggest recipient of such Fed intervention, it is understandable why the bank would rather not discuss what the real reason for the stock surge in late 2019 and early 2020 has been.

As for bonds, the implication would be that the bond market would remain supported, producing at least coupon-like returns “and yield curves would fail to steepen by as much as we envisaged for this year.”

In all, as Panigirtzoglou summarizes, while he continues to believe that the Great Rotation still “has a decent chance of happening this year”, he admits that “the fund flow picture is not yet consistent with this thesis”… and is 100% consistent with our own thesis set forth in late November 2019, according to which JPM is dead wrong and that retail investors are now fully inert elements in a market dominated by the Fed and buybacks, and that what they do has absolutely no bearing – and has zero predictive insight – on the market.

Tyler Durden

Sun, 01/19/2020 – 19:20

via ZeroHedge News https://ift.tt/38qveYW Tyler Durden