Hedge Fund CIO: Once All Investing Becomes Passive, Then The Information Contained In Market Prices Will Be Meaningless

Submitted by Eric Peters, CIO of One River Asset Management

Looking

“I look at historical relationships that appear to no longer operate as before,” said the investor. “I look at measures of valuation that are stretched to levels rarely seen,” he continued.

“I look at corporate share buybacks as the only meaningful inflow. I look at outflows from retail investors and the flags that this raises.”

“Then I look at the fact that global interest rates have never been negative like this. I look at the working population and it has never before aged and shrunk like this.”

“And I look at the world and just don’t know how anyone can be certain of anything.”

* * *

Anecdote:

“Start with what we know for sure,” said Big Foot, creeping quietly through global markets, trackers desperate to front-run his every step.

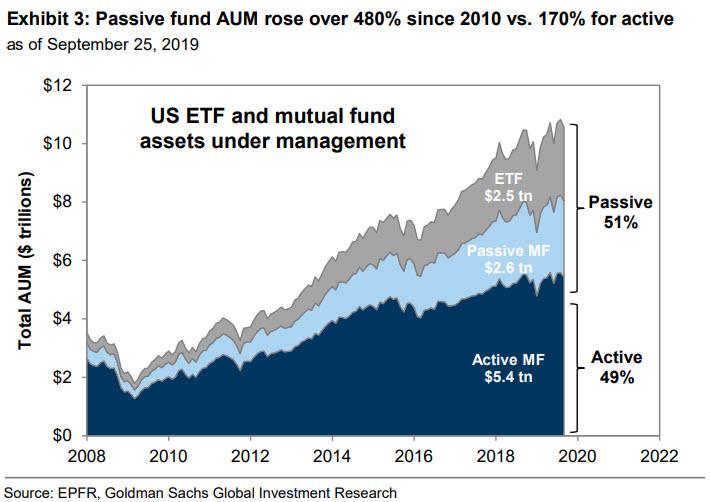

“If 100% of all investing is passive, then the information contained in market prices is meaningless,” continued the CEO of one of the industry’s largest investment firms. In 2009, assets in actively-managed mutual funds were 3x those of index-based funds/ETFs. In August 2019, US index-based fund/ETF assets surpassed actively managed assets. That trend continues.

With each incremental dollar that moves from active to passive management, roughly five more cents flow into equities (active managers hold 5% cash buffers while passive funds generally do not).

“We also know that if 100% of equity is taken private, then public markets would cease to exist.” The average institutional portfolio holds a 25% allocation in alternative investments. Of that allocation, private equity investments have surged to 25% of the assets, up from 18% in 2018. Private equity funds have $1.5trln in dry powder that will fail to pay fees unless their managers buy equity, which continues to appreciate.

US equity market capitalization is $35tlrn, a record 1.55x America’s $22.3trln annual GDP. “But what we do not know for sure is whether there comes a point well before 100% of all investing is done passively, or before all public equity is taken private, that the market price becomes meaningless,” said Big Foot.

You see, in a world where all investing is passive, how much would an incremental $1bln inflow move market prices up? How about a $1bln outflow? The price moves would become utterly extraordinary in such a world. And in a world where all public equity is taken private, PE managers would surely mark their holdings steadily higher, to ever more extreme multiples.

“Nor do we know whether we have already reached that point.”

Tyler Durden

Sun, 01/19/2020 – 20:33

via ZeroHedge News https://ift.tt/2RB8n69 Tyler Durden