Global Stocks Slide, China Plunges Most Since May As Optimism Virus Is Conatined Mutates To Pessimism

Yesterday’s optimism that China’s coronavirus epidemic is contained (supposedly because Beijing was “transparent” with the fiasco and Trump was convinced by Xi) which sent S&P futures to an all time high of 3,333 has mutated into pessimism that it isn’t…

… after China quarantined two cities (one with 11 million, the other with 6 million people), which sent US equity futures and global markets sliding and Chinese stocks tumbling.

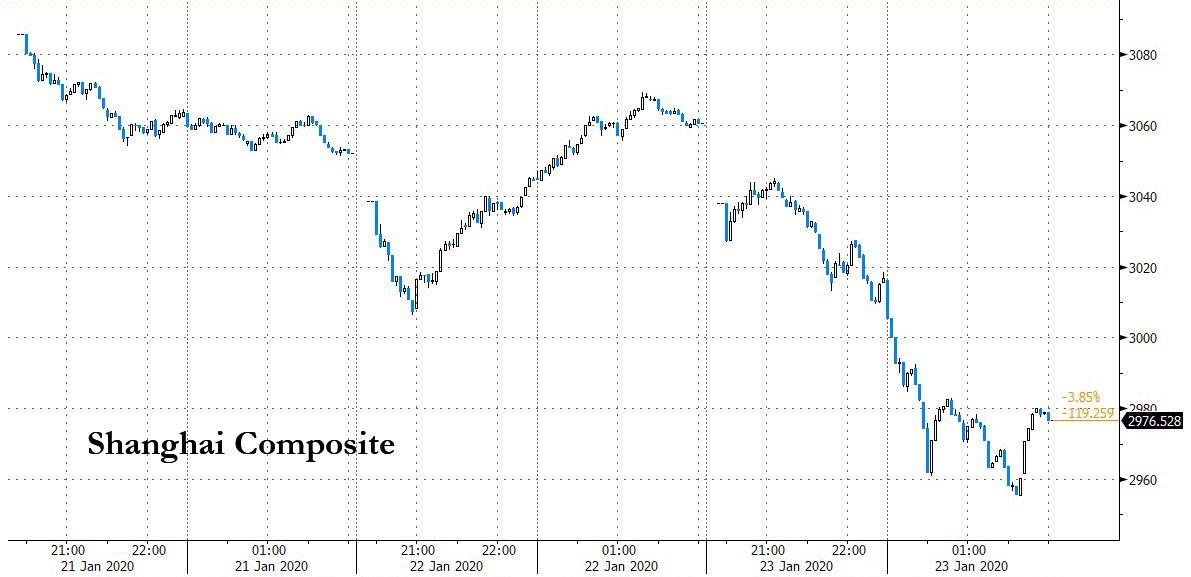

The global risk off mood, was led by the biggest decline in Chinese stocks in more than eight months, as concerns mounted that the spread of a deadly virus in China is now beyond Beijing’s control and will affect everything from tourism to corporate sales and economies. With millions of Chinese preparing to travel for the Lunar New Year which begins on Saturday, the potential the disease to spread, along with the tendency of traders to reduce their exposure before holidays, left markets struggling.

Deaths in China from the coronavirus rose to 17 on Wednesday, with nearly 600 cases confirmed. The outbreak has evoked memories of SARS in 2002-2003, another coronavirus that broke out in China and killed nearly 800 people worldwide.

“The coronavirus has introduced some caution,” said Michael McCarthy, chief market strategist at CMC Markets in Sydney. “There is no reason to expect a global pandemic now, but there is some repricing in financial markets.”

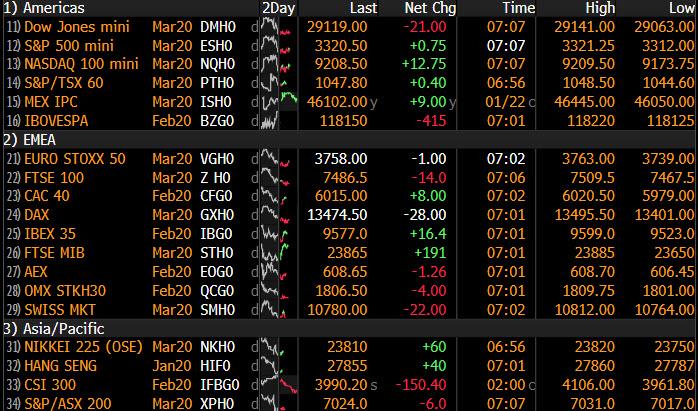

As the virus took hold, MSCI’s broadest index of Asia-Pacific shares outside Japan fell 1.07%. Chinese shares dropped 2.8%, the biggest daily decline since May, when Trump’s threats of additional tariffs on Chinese goods rocked financial markets, and biggest drop on the last trading day before the Lunar New Year holiday in the benchmark’s three-decade history. Hong Kong shares ended down 1.5% and Japan’s Nikkei index slid 1%.

European stocks followed Asia lower as mining shares led the Stoxx Europe 600 Index lower. Euro Stoxx 50 pares earlier losses to trade 0.2% lower, DAX down 0.4% after falling as much as 0.8%. E-mini S&P futures little changed.

Among major currencies, the Chinese yuan fell to a two-week low, on course for its worst week since August. The Japanese yen climbed 0.2% to secure a third day of gains. Other safe havens government bonds also rose with the yield on 10Y TSYs sliding to 1.75%. Core European, U.K and U.S. bond yields are 2bps-3bps lower across most maturities, with slight curve flattening bias in 2y-10y tenors. Italian bonds and equities outperform, shrugging off potential political uncertainty. 10-yr BTP yield -7bps, FTSE MIB +0.7%.

“Ultimately, the coronavirus is a slow-burning but important story for markets that is likely to last for months rather than just a few days,” said TD Securities’ European head of currency strategy, Ned Rumpeltin. “And the natural go-to currencies when there are headlines like these are the yen and the Swiss franc.”

Elsewhere in FX, the Bloomberg Dollar Spot index was little changed alongside the euro ahead of the European Central Bank policy decision. The Australian dollar led gains in the Group-of-10 currencies following better-than-expected jobs data which dampened rate-cut expectations. The Swiss franc rose to a near three-year high against the euro overnight, but it was trading little changed as the focus in Europe turned to its central banks. Norway’s central bank had already left its interest rates unchanged.

The ECB holds its first meeting of the year later on Thursday, where it’s expected to outline its first formal policy review in 17 years. It will probably last for most of the year and span topics from the inflation target to digital money and the fight against climate change. “Quite a lot has happened in the last 17 years,” Rumpeltin said. “They are due for a rethink.” ECB President Christine Lagarde will speak to the press afterwards.

In other central bank news, SNB Chairman Jordan does not see a new minimum exchange rate at present, noting that CHF remains highly valued and it’s important to keep expansive policy. Negative rates are a necessity in Switzerland could cut rates further if needed, he sees slight Swiss growth improvement this year, but more risks are to the downside; aware that negative rates have side effects, tiering aims to minimize these.

The threat to airline travel and an increase in supply pushed oil prices to seven-week lows: WTI crude dropped to its lowest level since early December.

Gold rose as China blocked travel to and from Wuhan, the city where the coronavirus outbreak originated. Gold later recovered in Europe.

Expected data include jobless claims and the Leading Index. American Airlines, Comcast, Kimberly-Clark, P&G and Intel are among companies reporting earnings.

Market Snapshot

- S&P 500 futures little changed at 3,318.75

- STOXX Europe 600 down 0.2% to 422.35

- MXAP down 0.7% to 172.35

- MXAPJ down 0.8% to 561.27

- Nikkei down 1% to 23,795.44

- Topix down 0.8% to 1,730.50

- Hang Seng Index down 1.5% to 27,909.12

- Shanghai Composite down 2.8% to 2,976.53

- Sensex up 0.6% to 41,373.12

- Australia S&P/ASX 200 down 0.6% to 7,087.96

- Kospi down 0.9% to 2,246.13

- German 10Y yield fell 1.8 bps to -0.278%

- Euro down 0.1% to $1.1079

- Italian 10Y yield fell 2.3 bps to 1.178%

- Spanish 10Y yield fell 2.8 bps to 0.385%

- Brent futures down 1.2% to $62.43/bbl

- Gold spot down 0.3% to $1,554.29

- U.S. Dollar Index little changed at 97.53

Market Snapshot

- Chinese officials halted travel from Wuhan, essentially locking down the city of 11 million people as they try to stop the spread of a new SARS-like virus that’s already killed 17 and infected hundreds

- President Donald Trump put European leaders on notice, renewing a threat to hurt the economies of transatlantic allies if they aren’t willing to compromise on a trade deal before the U.S. elections. U.K.’s Sajid Javid snubs Trump trade offer, saying EU deal comes first

- Prime Minister Boris Johnson’s Brexit deal cleared its final hurdles in Parliament, bringing the crisis that paralyzed U.K. politics since the country voted to leave the European Union almost four years ago to a close

- Japanese exports dropped more than expected in December, with the slump dragging on for a 13th month despite recent signs of green shoots in global manufacturing. The value of shipments overseas fell 6.3% from a year earlier, weighed down by sliding exports of cars and auto parts

- Luigi Di Maio’s resignation as leader of the biggest party in Italy’s fractious coalition has set the stage for a bruising succession battle that threatens to destabilize Prime Minister Giuseppe Conte’s government

- China’s securities regulator is looking at the potential to raise the cap on foreign ownership in the nation’s listed companies, according to a senior official. Fang Xinghai, vice chairman of the China Securities Regulatory Commission, said there’s potential to lift the limit to “more than 30%” given that other countries in the region have higher caps

- House Intelligence Chairman Adam Schiff presented the U.S. Senate with a dark portrait of a deeply flawed, even dangerous president as he argued that Trump should be removed from office.

- The Swiss National Bank left the door open to a further easing of policy to rein in the “highly valued” franc, though a new currency cap isn’t in the cards for now, SNB President Thomas Jordan told Bloomberg TV

- Norway’s central bank kept its benchmark rate unchanged, and stuck to its message that monetary policy will be on hold for the foreseeable future

- Hedge funds suffered almost $98 billion in net outflows in 2019, the most in three years, as managers trailed the stock market rally, according to data compiled by eVestment

Asian equity markets weakened following the indecisive performance on Wall St where stocks finished relatively flat after a pullback from record highs, and with sentiment spooked amid ongoing coronavirus as the total confirmed cases in China rose to 571 and number of deaths at 17. ASX 200 (-0.6%) was dragged lower by heavy losses in Industrials, with better than expected jobs data dampening calls for an RBA rate cut next month. Nikkei 225 (-1.0%) was pressured by a firmer currency and disappointing trade data including a wider than expected decline in Exports, while Hang Seng (-1.5%) and Shanghai Comp. (-2.8%) slumped with investors reducing exposure heading into the start of the week-long mainland holiday closure and tomorrow’s shortened session in Hong Kong as focus centred on the outbreak concerns, with losses for the mainland bourse exacerbated on a break below the psychological 3000 level. Furthermore, it was reported that China shutdown public transit as well as the airport in Wuhan to contain the spread of the virus and local doctors estimated the number of cases could reach as many as 6000, in which the related jitters kept markets on edge and overshadowed the upward revision to Chinese December trade data, as well as the PBoC’s targeted medium-term lending facility announcement. Finally, 10-year JGBs were higher and tracked similar upside in T-notes with prices supported by the risk averse tone and with the BoJ present in the market today heavily concentrated on 5yr-10yr maturities.

Top Asian News

- China Refrains From Adding More Liquidity Ahead of Holiday

- Toyota Outlook to Neg. at Moody’s on Margins, Profitability

- Asia Gas Sinking to Bottom Under Weight of Fading China, Glut

European stocks trade relatively mixed, with bourses off worst levels [Eurostoxx 50 -0.1%] – following on from a downbeat APAC session which saw the Mainland underperform on coronavirus jitters alongside position closures ahead of its week-long Lunar New Year holiday. Sectors are mixed with defensives performing slightly better than cyclicals, and with underperformance seen in the consumer discretionary sector – heavily weighed on by Renault (-4.2%), following a downgrade at Citi. In terms of other individual movers, STMicroelectronics (+7.3%) leads the gains in the Stoxx600 following an upbeat earnings report in which it also stated that it will invest USD 1.5bln in Capex to support strategic initiatives. Sticking with upside, Novozymes (+6.4%) remains a top-gainer post-earnings in which it announced a share buyback programme. On the flip side, miners including the likes of Rio Tinto (-2.1%), Antofagasta (-2.8%) and BHP (-1.6%) bear the brunt of softer base metal prices. Broker-induced action includes Maersk (+1.1%), Compass Group (-1.6%) and Continental (-1.3%).

Top European News

- ACS, Hochtief Tumble on Mid-East Construction Troubles

- LVMH, Swatch Fall After China Shares Slump on Coronavirus Risk

- STMicro Beats Estimates Marking Another Chipmaker Rebound

- SNB Can Cut Rates But Isn’t Weighing New Franc Cap, Jordan Says

In FX, the marked G10 outperformers, as the Aussie rebounds firmly against the Greenback and Kiwi on the back of better than expected jobs data, albeit largely seasonal, to test resistance around the 200 DMA (0.6880) and reclaim 1.0400+ status respectively. To recap, December’s payroll count beat consensus almost 2-fold, and while entirely due to the part-time tally, the jobless rate dipped to 5.1% and prompted at least a couple of local banks to roll-back RBA rate cut forecasts. Meanwhile, the Yen has made a more concerted break above 110.00 vs the Buck towards 109.50 amidst renewed qualms over the spreading Chinese coronavirus and further retracement in the Renminbi through 6.9000 to 6.9330+.

NZD/GBP/EUR/CHF/SEK/NOK – All holding relatively steady vs the Usd, as the DXY continues to dither either side of 97.500 rather aimlessly awaiting further direction and/or independent impetus that may come via weekly claims and the LEI. On that note, Nzd/Usd remains retrained just below 0.6600 ahead of Q4 NZ CPI that will feed into February’s RBNZ policy meeting considerations, while Cable is still capped circa 1.3150 before Friday’s preliminary UK PMIs and following mixed data/surveys since several BoE members, including Governor Carney, revealed dovish leanings along the lines of existing MPC dissenters Saunders and Haskel. Conversely, Eur/Usd is not anticipating much from the upcoming ECB confab other than information about the strategic review, with the pair meandering under 1.1100, but keeping afloat of key support levels that kick in from 1.1070. Elsewhere, SNB chair Jordan has backed up Maechler’s insistence that being labelled as a currency fixer by the US will not impact policy, adding that NIRP and FX interventions are still necessary as the Franc remains highly valued. Moreover, rates may yet be required to be more negative, leaving Usd/Chf idling between 0.9674-93 and Eur/Chf nudging the top of a 1.0730-47 band. Turning to Scandinavia, Eur/Sek and Eur/Nok are pivoting 10.5400 and 9.9600 respectively, with the Swedish Crown deriving some support from a significant decline in jobless rates and Norwegian Krona acknowledging broadly unchanged assessments and guidance for steady depo rates from the Norges Bank.

CAD – The major laggard and still smarting after Wednesday’s dovish/cautious BoC outlook that was underscored by Governor Poloz stating that easing is now an option depending on how data unfolds and the domestic economy develops rather than a pre-emptive cut that was discussed. The Loonie has nursed some losses after sliding to circa 1.3170, though Usd/Cad remains above 1.3150 and still prone to extending gains towards upside chart targets ahead of 1.3200, such as the 100 DMA (1.3179).

In commodities, a subdued session in the commodity sphere for now– WTI and Brent front-month futures remain in the doldrums given the implications of coronavirus on sentiment, global growth and on airline fuel demand, with added pressure from the surprise build in API crude (+1.6mln vs. Exp. -1.0mln). Desks also keep in mind the recent supply-side developments that markets seem to have overlooked for now: 1) Libya’s output decline on force majeures, 2) Iraqi blockades, 3) halted Kazakh oil flows to China and 4) Shell declaring force majeure of its Nigerian Bonny Light imports. Analysts at ING calculate that the disruptions add up to around 1.4mln BPD – “which would be more than enough to shift the global market into deficit over 1H20”, ING says, adding that spare capacity is capping gains with OPEC’s +3mln BPD holding. On that note, Nigerian Oil Minister Sylva stated that the current OPEC+ cuts are sufficient to avoid oversupply, whilst stating that his preferred Brent prices stands between USD 60/bbl and the “upper 60s”. WTI Mar’20 futures dipped below the USD 56/bbl having taken out in its 200 and 100 DMAs at 57.53/bbl and 57.29/bbl respectively, whilst Brent Mar’20 hit seems to be capped by its 100 DMA at 62.82/bbl. Elsewhere, spot gold retains its 1550/oz+ status with little by way of fresh fundamental catalysts to influence price action – although from a technical standpoint, the 50 and 200DMA have converged to form a golden cross around 1500/oz. Copper has meanwhile succumbed to the humdrum risk sentiment with prices finding mild intraday support at its 50 DMA ~2.7415/lb.

US Event Calendar

- 8:30am: Initial Jobless Claims, est. 214,000, prior 204,000

- 8:30am: Continuing Claims, est. 1.75m, prior 1.77m

- 9:45am: Bloomberg Economic Expectations, prior 56.5

- 9:45am: Bloomberg Consumer Comfort, prior 66

- 10am: Leading Index, est. -0.2%, prior 0.0%

- 10am: Revisions – LEI

- 11am: Kansas City Fed Manf. Activity, est. -6, prior -8

DB’s Jim Reid concludes the overnight wrap

Some of the speaker highlights today at Davos are special addresses by German Chancellor Merkel (2.15pm CET) while prior to this DB CEO Christian Sewing also speaks on the panel topic “After Brexit: Renewing Europe’s Growth” at 10.15am CET. So plenty of potential headlines to track. Meanwhile, Italian PM Conte’s (4pm CET) address has been cancelled at the last minute following yesterday’s resignation of Luigi Di Maio – leader of the M5S party (more below). Elsewhere at the event, Mr Trump was a bit more hawkish towards Europe yesterday than he was the day before suggesting that tariffs were possible on EU autos before the election if negotiations don’t progress. Also the U.K.’s Sajid Javid said they will go ahead with a digital tax in April which may complicate a free trade agreement with the US and risk tariff reprisals but I’m sure they would have had discussions on this behind the scenes.

As I now return from Davos, while I’m sure many readers will be cynical that the leaders present will do anything about sustainability in the months and years ahead, I certainly detected that the general mood was that if they didn’t do something then it will be disadvantageous to them in terms of news-flow and financially. So business is moving to varying degrees even if it’s for self-interest. Will governments and citizens do so too? As we say in our report, difficult trade-offs lie in the near future if the globe wants instant action.

About 500km north of Davos the ECB will be holding their latest policy meeting today. No surprises are expected and our economists, in their preview which you can find here, concluded that they expect the ECB to maintain that an accommodative policy stance remains appropriate. They also expect the Council to conclude that the balance of risks remain tilted to the downside but continue to acknowledge that the risks have become less prominent with an upgrade to neutral being the main upside scenario. The main interest will likely lie with the Strategic Review which may also be announced today and ultimately remains uncertain still, however the potential for market volatility can be counter-balanced by a strong commitment to the current stance in any case.

Just on this, Bloomberg yesterday reported that the Strategy Review could be broken into two, one part will deal with inflation, the policy making framework and policy tools and the other with “financial stability, climate and communications”. This does not necessarily mean the ECB conservatives already have the upper hand and “climate” — potentially requiring large-scale policy coordination — has been relegated. We suspect the differentiation between the two parts of the Strategic Review reflects legal issues and political sensitivities. Price stability is the ECB’s primary goal. If the ECB is to move more into the area of climate etc., it needs to do this with the proper legal and political authority (that is, with Treaty change). This is consistent with the conclusions of DB’s December report on the Strategy Review that decisions made outside Frankfurt will be more important than decisions made inside Frankfurt.

All that to look forward to at 1.45pm CET. Yesterday saw US equities pare back stronger gains from earlier in the session, with the S&P 500 and NASDAQ closing up +0.03% and +0.14% respectively. The pullback happened as news came through from China that public transport would be suspended in Wuhan, the city where the coronavirus outbreak began, with outbound flights and trains coming to a halt. It comes amidst concerns that the upcoming Chinese New Year holiday, which involves large amounts of people travelling, could accelerate the spread of the virus. The latest on the virus is that there have now been 571 confirmed cases with the death toll standing at 17 as January 22 (9 as on January 21). Elsewhere, Macau has cancelled all Lunar New Year festivities while Hong Kong has halted high-speed rail ticket sales to Wuhan (inbound from Wuhan already halted) – a city of 11 million people.

Risk aversion has returned to Asian markets this morning due to renewed concerns about the virus with Chinese bourses leading the declines. The CSI (-3.02%; the largest decline since May 2019), Shanghai Comp (-2.67%; the largest decline since July 2019) and Shenzhen Comp (-3.42%) are all down c. 3%. It should be noted that today is the last trading day for Chinese bourses before the week long Lunar New Year holiday starts. Meanwhile, the Nikkei (-0.96% ), Hang Seng (-2.04% ) and Kospi (-0.99%) are also down. As for Fx, the onshore Chinese yuan is down -0.33%% to 6.9274. Elsewhere the Australian dollar is up +0.26% as investors pared their bets on a rate cut by the RBA on better than expected jobs data. Futures on the S&P 500 are down -0.21% and yields on 10y USTs are -2.6bps while in commodities crude oil prices are down a further c. -2% after an even bigger fall yesterday (more below).

Back to the equity moves yesterday, and it was the tech sector that led the way in the US, helped in part by IBM’s latest earnings report released the night before. Of particular note was a +4.09% gain for Tesla which saw the car manufacturer pass the $100bn market cap mark and which means it now only trails Toyota in terms of the world’s most valuable auto makers. A fairly staggering rise from the $32bn market cap back in June and a huge +218% move.

Elsewhere, bond markets have been fairly muted for the last 24 hours. Indeed 10y Treasuries continue to hover around 1.770% (-0.5bps) with the move index of Treasury volatility hovering around 8-month lows. In Europe yields were around 1bp lower while the STOXX 600 closed -0.08%. The FTSE MIB (-0.58%) did struggle however following Di Maio’s resignation as leader of the Five Star Movement. The regional elections in Italy this weekend will be the next focal point for Italian political risk, though the spread of BTPs over bunds actually tightened by -1.1bps by the close yesterday. Meanwhile, in commodities it was a rough day for oil where Brent and WTI declined -2.14% and -2.81% respectively on supply issues and in reaction to the virus news in China which could be seen as hurting demand.

Before we get to yesterday’s data and the day ahead, last week we published the latest edition of The House View ‘Gaining Speed’ (link here) and now we’ve released an 11 minute podcast version of the report with Marion and Luke, both on my team. You can find it at https://www.dbresearch.com/podzept/ or on the usual podcast providers. Instructions in the link. ***

As for the data yesterday, there was some interest in the CBI survey data in the UK. Both the orders data and optimism data improved. Trends total orders improved 6pts to -22 (vs. -25 expected) while business optimism improved an eye-opening 67pts to 23 (vs. -20 expected) – the highest level since 2014. A word of caution though that the data is notoriously volatile and shouldn’t really be seen in isolation. Data on the whole since the election has been weak to mixed with the big weakness coming in retail sales and the PMIs in particular so it’s unlikely that yesterday’s data will move the dial for the BoE unless they heavily weight survey data versus hard data. Sterling bounced back above $1.31 post the data while the market is pricing in around 13bps of cuts for the January meeting next week.

Finally in the US the December existing home sales print of +3.6% mom bettered expectations for +1.5%. That was actually the highest reading since February 2018 also, underscoring the positive trend in home sales.

Looking at the day ahead, the main focus today is likely to be on the ECB meeting. In terms of data we have the January consumer confidence reading for the Euro Area while in the US we’ve got claims, December leading index and January Kansas Fed manufacturing activity index all due. Away from that the Davos panels will continue, while in Washington the US-China economic and security review commission is due to hold a hearing, mandated by Congress to report annually on national security implications. Finally, earnings highlights include Intel and Proctor & Gamble.

Tyler Durden

Thu, 01/23/2020 – 07:38

via ZeroHedge News https://ift.tt/30RpJQq Tyler Durden