Liquidity Panic Returns: Term-Repo Most Oversubscribed Since Start Of Repo Crisis As Fed Injects $94.5BN

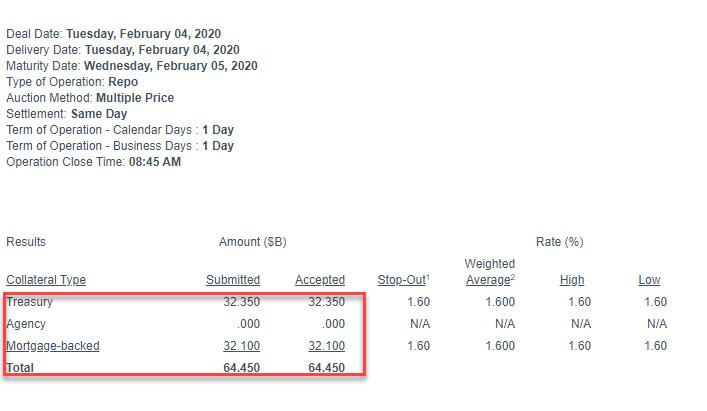

Update: confirming that liquidity is indeed quite scarce to start the month of February, moments ago the Fed also conducted its overnight repo which saw a whopping $64.45BN in liquidity injected…

… and which together with the massively oversubscribed $30BN term repo discussed below, means the Fed has injected $94.45BN in liquidity for today’s market needs.

* * *

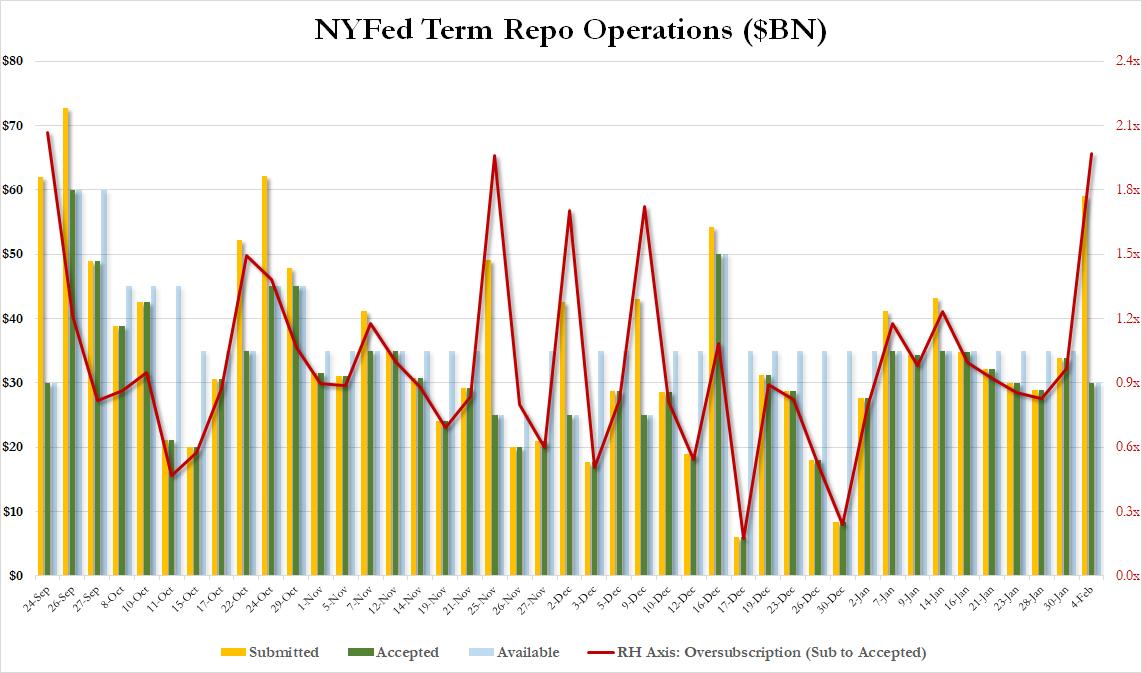

After several relatively uneventful reverse-repos to close off the month of January, which saw a gradual decline in submission, February has started off with a bang.

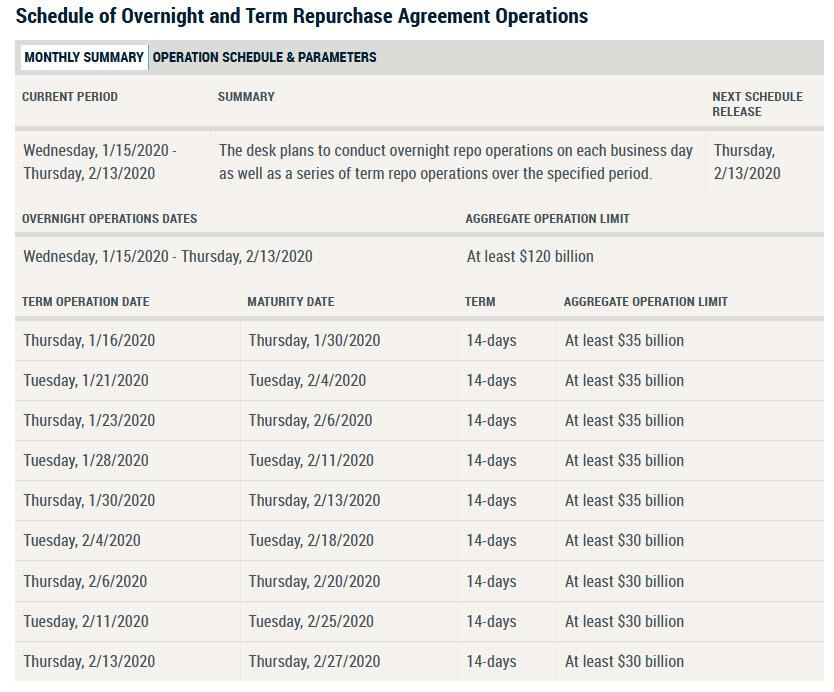

Even ahead of the results of today’s reverse repo, some traders were already closely watching to see how it would play out for one main reason: as we reported on Jan 14, this was the first “tapered” reverse repo, whose aggregate operation limit was shrunk modestly from $35BN to $35BN.

There were also some questions why the repo would be tapered by only $5BN when the Fed repeatedly said the liquidity injection via repo were just a temporary operation (one which ostensibly should have ended soon after the September repocalypse), and yet which to this day continues to be an integral part of the Fed’s balance sheet rebuild.

We got the answer moments ago, when the Fed announced that while the operation went off without a glitch, the demand for Fed liquidity was simply unprecedented, with $59.05BN in securities submitted ($41.75BN in TSYs, $17.3BN in MBS) for the downsized $30BN term repo maturing on Feb 18. As such, the nearly 2.0x submitted-to-accepted ratio made today’s repo the most oversubscribed since the first term repo issued at the depth of the September repo crisis (and not by much), which saw $62BN in submissions for $30BN in liquidity.

Ominously, the massive demand for term repo today means that the liquidity crisis that continues to percolate just below the surface of the market and has clogged up the critical plumbing within the US financial system, is getting worse, not better, and today’s massive oversubscription indicates that one or more entities continues to face a dire shortage of reserves, i.e., cash. As for what they are doing with that cash, one look at Tesla this morning may provide an answer.

Tyler Durden

Tue, 02/04/2020 – 08:45

via ZeroHedge News https://ift.tt/2GQHdTG Tyler Durden