A State Of Denial

Authored by Sven Henrich via NorthmanTrader.com,

Once again investors are made to believe that nothing matters. Only 2 trading days after Friday’s sell off $NDX made new all time history highs. Only 3 days after Friday’s sell-off $SPX made a new all time closing high. Only 4 days after Friday’s sell off $DJIA, $SPX and $NDX make new all time human history highs in premarket. Fours day, four up gaps, all unfilled at the time of this writing. The market of the overnight gap ups.

Why? Because the economic impact of the coronavirus is over or contained? Of course not, it’s far from any of that. Shutdowns persist, warnings of individual companies are mounting i.e. $TSLA, tumbling a day after the technical warning issued, global economic growth estimates are coming down and with them invariably take downs in earnings estimates.

What do markets do? Make new all time highs, back on the multiple expansion game from 2019 when no slowdown in earnings mattered as the liquidity injections from our central bank overlords overrode everything.

This week the PBOC injected liquidity, the Fed kept flushing repo liquidity into the system, and of course a continued buying of treasure bills.

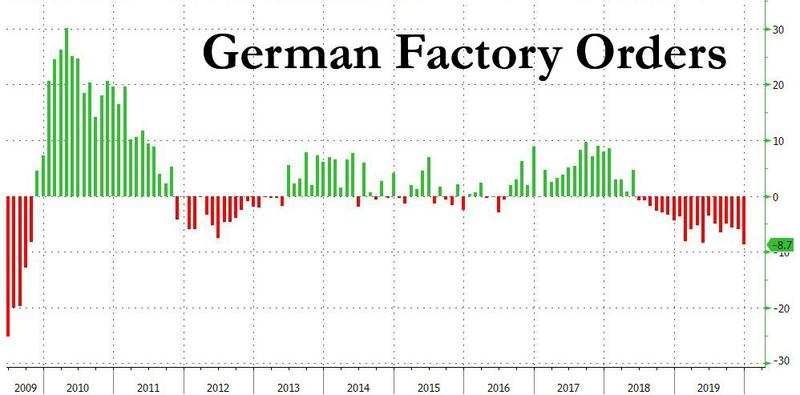

And so markets continue on their path of never pricing in any bad news and continue to disconnect farther and farther from the underlying size of the global economy no matter the ongoing data:

German factory orders:

Baltic Dry Index:

But there are no bubbles central bankers tell us. Don’t insult our intelligence I say. Especially since they perfectly well know that policies and words are closely followed by markets and are market impacting:

Lagarde: Traditionally, as central bankers we have been more comfortable speaking to experts and markets than to the general public. Markets closely follow what we do and what we say, and surveys and studies find that we are well understood by them.

— European Central Bank (@ecb) February 6, 2020

Yet in the same breadth they tell us their polices are not to blame for the distortions created in markets.

Here’s ECB president Lagarde today in full denial mode:

They’re in denial:

Lagarde: “I wouldn’t draw the conclusion that our current monetary policy has actually been the main factor in the rise of housing prices, has actually been the main factor in the declining profitability of some banks”https://t.co/xiDgJzlH5b

— Sven Henrich (@NorthmanTrader) February 6, 2020

Don’t blame our negative interest rate policies for housing price increases or bank profitability issues.

And besides there is no housing bubble when ordinary people struggle keeping up with ever rising house prices:

ECB’s Lagarde: Don’t Sees Strong Signs Of Housing Bubbles In The Euro Area As A Whole

— LiveSquawk (@LiveSquawk) February 6, 2020

But there is no inflation they same in the same breath.

Any wonder there are trust issues:

We don’t trust you until you are honest about the distortions central bank policies have unleashed on financial markets and come clean about what would happen if you ever normalize rates or your balance sheet. https://t.co/1PTLWECXfv

— Sven Henrich (@NorthmanTrader) February 6, 2020

We don’t believe you.

And central banks in denial about the distortions they have created and continue to create is not a recipe for long term success.

Fact is they remain trapped and beholden to a market whose entire valuation scheme and price discovery mechanism remains entirely dependent on ongoing central bank intervention.

It’s a historic absurdity we are witness to and an ultimate tragedy unfolding before our eyes.

Central banks are in denial about the existence of the financial bubbles and distortions they themselves have created.

For to admit them would be to take responsibility and acknowledge that asset prices are sky high overvalued which in itself could lead to a risk off event as the admission of bubbles would lead to a loss in confidence, confidence which must always be maintained.

Central banks are residing in glass tower la la land. There is no trust, no transparency, no accountability. Only denial.

And so we see a market running on nothing but optimism despite continued disappointment about the reality on the ground:

Lions and tigers and bears. Oh my!

Virus optimism

Trade optimism

and rate cut optimismoh my! https://t.co/tB3soMqQoV

— Sven Henrich (@NorthmanTrader) February 6, 2020

Overnight futures ramped on the news that China proactively cut tariffs. You think that’s a sign of China thinking the economic impact of the virus is contained and happy days a here again?

I wonder:

How long before people realize that China proactively capitulating on tariffs is a sign of how serious the economic impact of this virus situation actually is?

— Sven Henrich (@NorthmanTrader) February 6, 2020

Look, this tariff reduction was already agreed to. This in itself is not a rationale for further multiple expansion in markets, especially as one of the reasons for last year’s multiple expansion was based on supposed phase one terms which are now being walked back due to the coronavirus.

So you see there’s a circular drain that’s flushing down justifications for support of ever widening multiple expansion in lieu of growth projections again coming down.

Central banks are wanting you believe their policies cause no asset price distortions, don’t cause bubbles and will surely tell you they are not to blame when this bubble, that they deny to exist, eventually pops.

Central banks may have entered the state of denial, doesn’t mean investors have to. The economic impact of the coronavirus is real, but sentiment is managed with new highs in equity prices. For now. While the virus will at some point be properly contained as of now there is no verified cure and no clear visibility as of yet when the economic impacts will be alleviated, the longer it drags on the more profound the effects. The death toll has not anywhere near reached the annual deaths tolls from the common flue, but the impact is already lager then SARS and nobody knows as of this moment how far this will ultimately go, not the WHO, not China and certainly not central banks.

Reality is markets are getting ever more stretched and investors keep piling into tech even as $NDX is screaming a major warning signal.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Thu, 02/06/2020 – 09:05

via ZeroHedge News https://ift.tt/39bDj3W Tyler Durden