“We Tactically Trim Risk”: JPMorgan Lists Four Reasons Why It Is Selling Stocks Here

For most of the past three years, JPMorgan strategists had been one of Wall Street’s biggest bulls, and foils to Morgan Stanley’s Michael Wilson who after 2017 emerged as the street’s biggest bear.

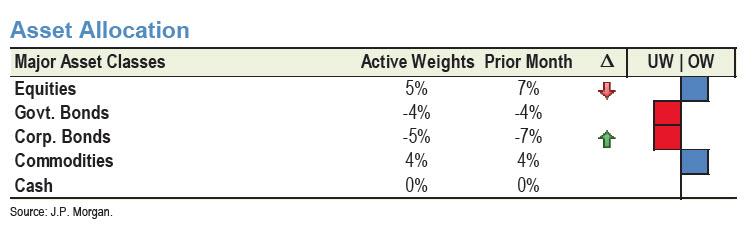

Yet, ironically or not, just as Michael Wilson appears to have thrown in the towel and believes that even the global viral pandemic will at best lead to a 5% correction, if that (especially with the S&P trading at all time highs), JPMorgan is turning increasingly bearish, and in a Global Asset Allocation note released overnight by the team of Panagirtzoglou-Kolanovic-Normand, the JPM analysts are turning bearish on stocks, and “tactically trim the risk of our portfolio further and recommend a more modest equity overweight of 5% vs. 7% previously.”

The reason: “the market has been too quick to price in a recovery from the coronavirus pandemic, any re-acceleration in coronavirus cases as a result of factory re-openings or any delay in re-openings beyond next week, would both be negative for markets.” As a result, “despite this week’s equity market rebound we are reluctant to chase short-term momentum” JPM’s strategist warn as they trim the risk of their portfolio further and recommend a more modest equity overweight of 5% vs. 7% previously.

Notably, it was just last month that JPM cut the risk of its portfolio by reducing its recommended equity overweight to a more modest 7% overweight: “the motivation of this change was the strong performance of the equity market, which at the beginning of January had already approached our 2020 year-end targets for US equities, as well as the significant increase in institutional investors’ equity positioning since last November.”

In retrospect, this move was both good and bad: good because, JPM’s more cautious stance “reduced somewhat the drawdown from market moves over the past three weeks which highlighted a vulnerability in equity markets to negative news.” Bad, because stocks appears to have now completely ignored any economic and market risks resulting from the pandemic and are trading at all time highs.

However, to JPM this is a mistake, and here’s why:

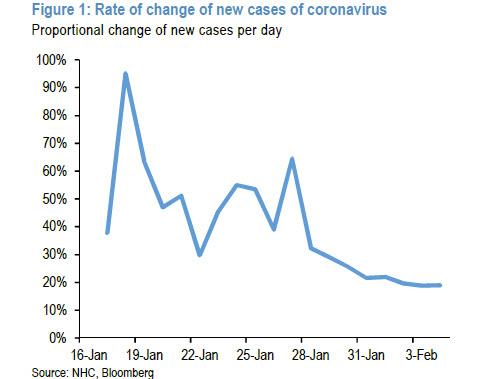

- First, although we recognize that the peak in the rate of increase in the number of new coronavirus cases appears to be behind us as containment measures thus far appear to have been effective (Figure 1), this could change as factories reopen in China and more people come in contact with each other. In other words, there is a significant risk of an unexpected re-acceleration of new coronavirus cases

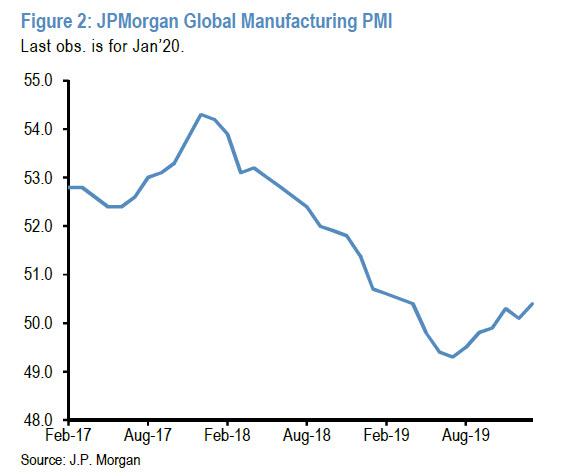

- Second, the economic impact of the coronavirus outbreak could prove a lot more severe if factories fail to reopen next week as expected. According to JPM’s Chinese economists each additional week of Chinese factory closure, would suppress the annualized pace of Chinese GDP growth for Q1 by 4-5 percentage points. As such, JPM’s Q1 forecast would be revised to a contraction of 4-5% if the Chinese factory re-opening is delayed by only one week. In addition, a more protracted factory closure could delay the subsequent V-shaped recovery. Meanwhile, as discussed last night, the economic spillovers from China to the rest of the world in the event of more adverse scenarios are likely to be significant. China is a lot more important for the world economy than during the SARS outbreak of 2003. Global PMIs will inevitably take a hit in the coming releases, clouding the macro picture for at least the next 1-2 months. This could remove from the macro picture the positive impulse from the global PMI rebound that propelled equity and risky markets since last October.

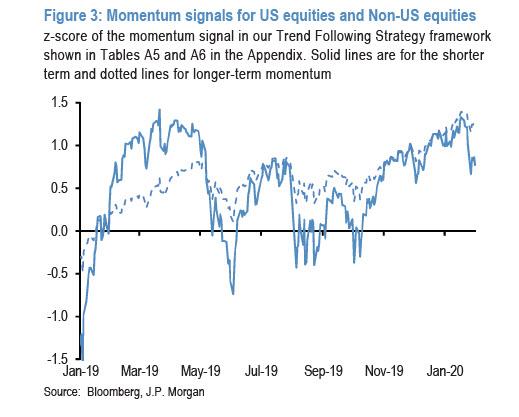

- Third, certain institutional investors such as CTAs and other momentum traders likely still have elevated positions in US equity futures, implying plenty of room to propagate further negative news if the closures of Chinese factories prove more protracted than currently expected. As a reminder, we also pointed out over the past three weeks that virtually every investor class is now all in, suggesting the risk of a waterfall liquidation is high in case of a major economic deterioration. In addition, JPM warns that retail investors appear reluctant to support the equity market by as much as the bank had hoped for previously. The reason: “the Great Rotation thesis for 2020, i.e. a sharp deceleration in bond fund buying from last year’s $1tr record pace and an acceleration in equity fund buying, does not appear to be happening yet”

- Fourth, the previous re-steepening of the US curve that, at the end of last year, gave support to the idea that a midcycle adjustment is taking place in the US similar to that seen during 1995/1996, is now reversing. The gap between the 1-month USD OIS rate 2-years forward minus the equivalent rate 1-year forward, had exhibited persistent negativity during 2018/2019, resembling the previous recessions of 2001 and 2007, rather than the mid-cycle adjustments of 1995 and 1998. This leads JPM to conclude that “while it was encouraging that this forward spread had moved closer to zero in Q4 2019, it has failed to enter positive territory on a sustained basis and in fact shifted back into negative territory this year (Figure 5). In our opinion this reduces the confidence to the thesis of a repeat of the 1995/1996 mid cycle adjustment for the US economy which at the time also saw significantly higher equity prices and bear steepening of core government yield curves.”

And so, because of all the above four reasons JPM is selling even more equities, as it prefers “to tactically adopt a less bullish or less pro cyclical stance by cutting our equity OW from 7% to 5%.”

Among JPM’s other recommendations:

- within commodities JPM exits its previous UW in Gold “as both retail and central bank flows provide sustained support.

- The banks raises its allocation to corporate bonds by two percentage points “which reduces the size of our previous credit UW given the tactical reduction in our equity OW.”

- Option markets currently embed below average volatility risk premia. Vol risk premia are particularly low for Eurostoxx50 and MSCI EM indices making them suitable for investors favoring long volatility trades “

And visually:

f

Tyler Durden

Thu, 02/06/2020 – 10:45

via ZeroHedge News https://ift.tt/2S1Jn9s Tyler Durden