It’s “The 1%” vs Everyone Else: FAAMG Earnings Soar As Russell 2000 EPS Growth Craters

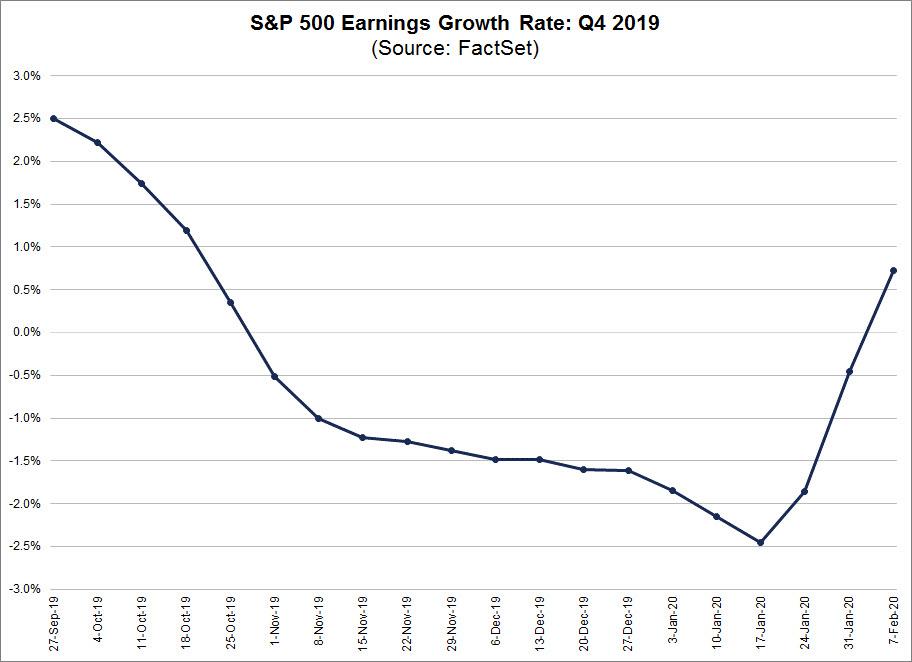

The earnings recession which lasted for all of 2019, is finally coming to an end. According to Factset, with a majority of companies reproting, the blended earnings growth rate for the S&P 500 for the fourth quarter is 0.7% as of February 7. This growth rate is above the estimated earnings decline of -1.7% at the end of the quarter (December 31).

More importantly, if 0.7% remains the actual growth rate for Q4 after all companies have reported, it will mark the first time the index has reported year-over-year growth in earnings since Q4 2018 (13.3%), and will represent an end to the earnings recession that lasted for all of 2019. As such, it is not surprising that the index is now reporting earnings growth for the fourth quarter.

This long-awaited rebound in EPS – which is mostly a byproduct of the ravenous stock buybacks unleashed by tech companies – comes at a key time, just as the world asks what the economic growth impact in China and pass-through to

the US economy will be as a result of the coronavirus pandemic.

So back to the actual earnings season, where as Goldman’s David Kostin writes, 49% of S&P 500 companies beat consensus EPS estimates by more than one standard deviation, slightly above the long-term average of 46%. The Goldman strategist observes that companies that beat EPS estimates outperformed the S&P 500 by +113 bp the day after reporting, consistent with history. However, investors punished companies missing consensus estimates; firms that missed lagged the S&P 500 by -334 bp, underperforming by much more than the long-term average of -211 bp. This suggests that with stocks priced to perfection, even modest deviations from expectations are promptly punished by the market.

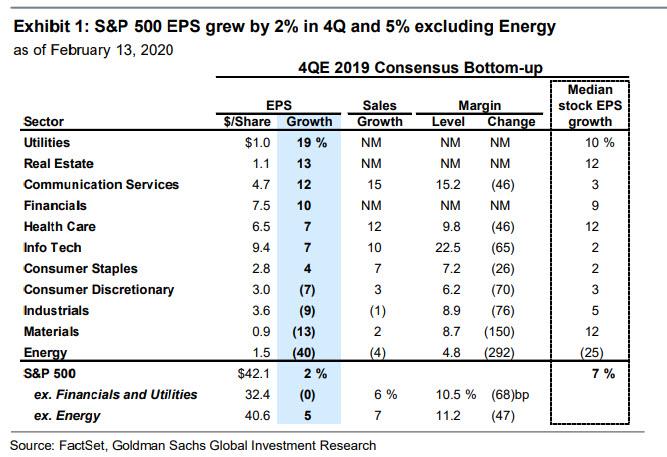

Unlike Factset, which sees earnings growth of just 0.7%, Goldman’s calculations find that S&P EPS will grow by 2%, after they were expected to fall by 1% at the start of the season.

Much of the earnings disappointment is due to energy companies: excluding the 40% drop in Energy EPS, S&P 500 EPS grew by an even stronger 5% in the quarter, while overall S&P 500 sales grew by 6%, in line with the 6% forecast, and while net profit margins fell by 68 bp in the fourth quarter, the decline was less than originally anticipated (-100 bp). Finally, the main reason why companies are beating is Trump himself: i.e., a much lower effective tax rate than expected (17% vs. 20%) aided in company margin beats, even as overall margins contracted in every sector in the S&P 500 and declined in aggregate for the fourth consecutive quarter.

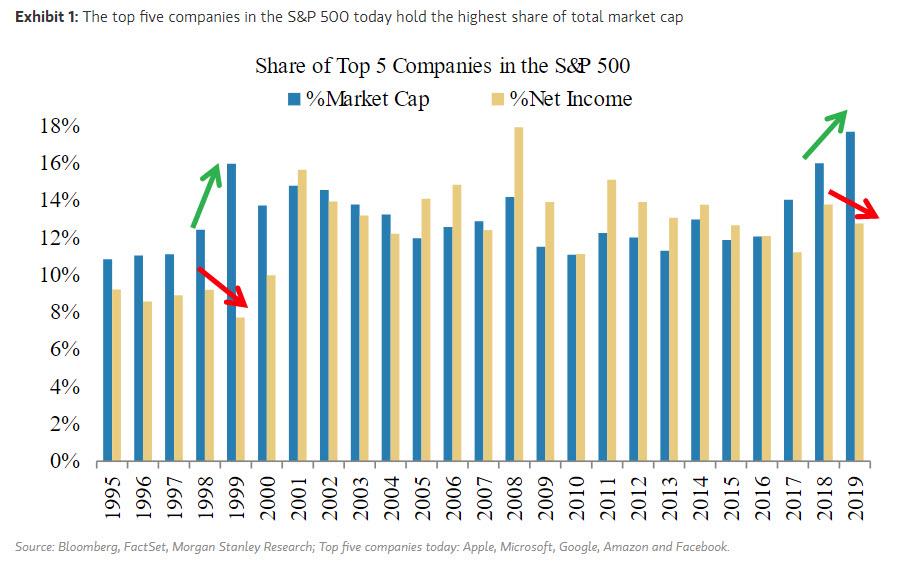

Which brings us to the most fascinating aspect of Q4 earnings season, namely the impact of what Morgan Stanley previously called “The other 1 percent“: the outsized influence of the five biggest companies in the S&P.

As Goldman notes, results were disparate across the size spectrum, with the 5 largest stocks (FB, AMZN, AAPL, MSFT, GOOGL) disproportionately boosting aggregate S&P 500 results in 4Q. As Morgan Stanley first noted a month ago, FAAMG account for 18% of S&P 500 market cap and 14% of S&P 500 earnings.

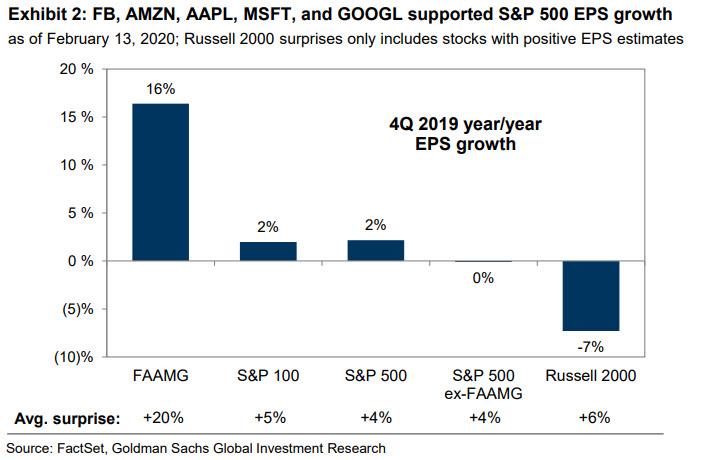

During the fourth quarter, these 5 stocks posted an average earnings surprise of +20%, compared with just 4% for the average S&P 500 company. And the most striking conclusion from earnings season: the “other 1%”, i.e., FAAMG, grew EPS by 16%, compared with 0% for the S&P 500 excluding these five stocks, or as Goldman puts it, “mega-cap earnings strength contrasts with small-cap earnings weakness.”

As shown in the chart above, while the 5 biggest companies are just getting bigger as they stretch their monopolistic wings, scorching EPS growth of 16% Y/Y, the rest of the market is suffering, and the Russell 2000 experienced a whopping 7% earnings drop during the fourth quarter, as many smaller firms posted weak top-line growth and had difficulty absorbing rising wages and other input costs. The Russell 2000 has lagged the S&P 500 by 175 bp since the start of earnings season (+1% vs. +3%).

So what happens next as investors turn their attention to Q1 earnings which will be adversely affected by the Coronavirus impact?

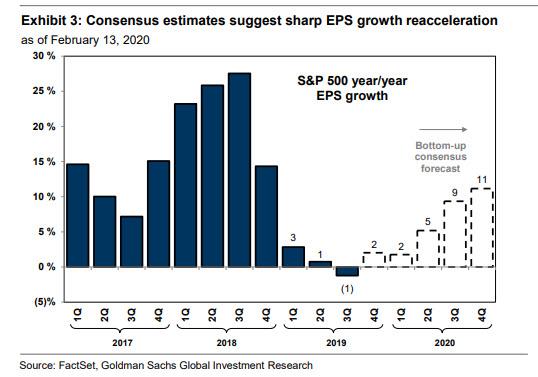

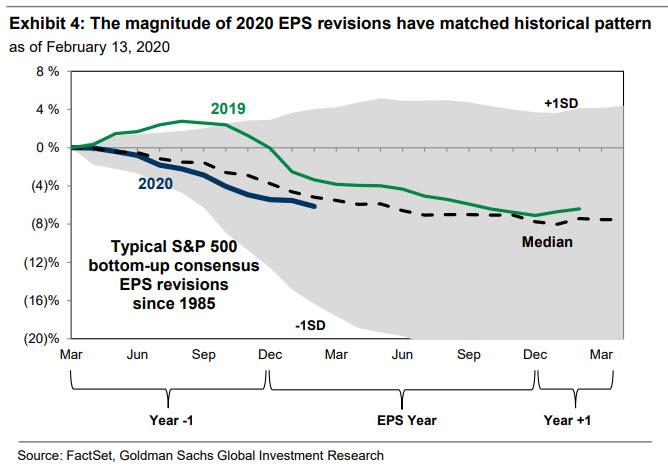

Here, as Goldman writes, consensus 2020 EPS estimates have been revised lower since the start of earnings season, matching the historical pattern, after initially suggesting a sharp EPS growth reacceleration.

Of course, consensus estimates are typically too optimistic, and since 1985, during the entire estimate period, bottom-up estimates have been revised higher during just 7 years. The 2020 EPS estimate has been cut by 0.7% during the past month and 1.2% during the past 3 months. The magnitude of revisions is roughly in line with the historical trend.

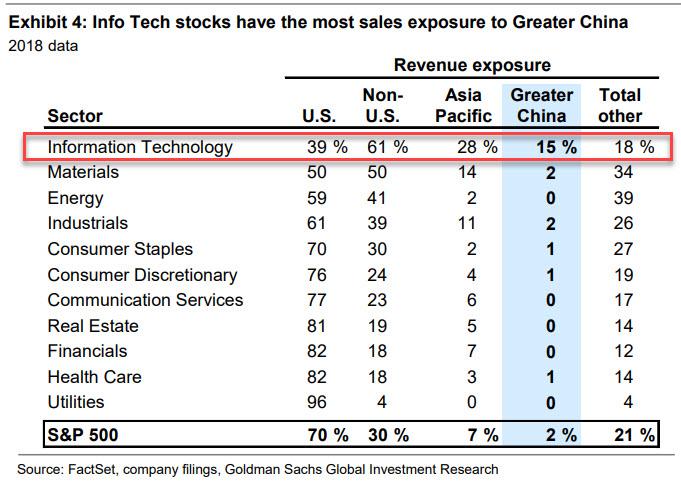

And while the macro environment today appears broadly consistent with Goldman’s baseline assumptions, the bank admits that earnings risks are tilted to the downside. In part due to the impact of the coronavirus, Goldman economists expect US and world GDP growth to average 2.3% and 3.2% in 2020, below its modeled baseline. In addition, the 15% decline in oil prices YTD (to $56 per barrel) could threaten the Energy EPS rebound in consensus estimates. However, there is some evidence that analysts have started to incorporate these downside risks. Earnings revisions in the commodity-exposed Energy sector have been the most negative across sectors. Some stocks likely to be affected by the coronavirus outbreak, such as airlines, cruises, and stocks with high China sales, have also experienced more negative EPS revisions than sector peers. As expected, stocks with high exposure to China have lagged the S&P 500 by 360 bp since late January, although so far the one sector most exposed to China, namely tech…

… has been virtually immune to any selling largely thanks to the wave of buybacks these tech companies deploy any time there is even a modest pullback.

Finally, margins remain a risk for investors and Goldman expects only limited margin expansion through 2021. Although part of the 65 bp of margin contraction in 2019 was due to a few large Energy and Semiconductor companies, rising input costs also weighed on corporate profitability. The US economy is in the 11th year of the economic expansion and the unemployment rate stands near its lowest level since 1969. The tight labor market has pushed the Goldman Wage Tracker to 3.4%, the highest level this cycle, and average hourly earnings growth has risen by 3%+ in each of the last 18 months. As an example, the share of NABE respondents reporting rising wage and input costs has been much higher than the share reporting higher prices charged to consumers, illustrating margin pressures.

The bottom line is that while tech managed to salvage Q4 earnings, unless the coronavirus epidemic is contained and China’s economy reboots itself and goes back to normal in the coming days, the earnings recession will promptly return with a vengeance, and this time it will be the tech companies who are hardest hit, potentially triggering the first bear market since the brief “2018 Christmas Eve” massacre, which ended with one phone call from Steven Mnuchin to the banks. Alas, if techs tank this time, no amount of calls will have any impact on the market.

Tyler Durden

Sun, 02/16/2020 – 18:48

via ZeroHedge News https://ift.tt/3bHOROr Tyler Durden