Retail Investors Steamrolled By Monday Mauling After Berserker Buying Spree

Retail investors are legendary for chasing market momentum into a market meltup, buying stocks indiscriminately at all time highs with the confidence that a greater retail fool will buy the same stock from them at an even higher price. They are also notoriously fickle and dump stocks just as the momentum reverses, selling at lows. And following the biggest one-day market drop in years, we are about to find out if the record retail volume surge, and retail outperformance from the past few months is about to disintegrate with a bang.

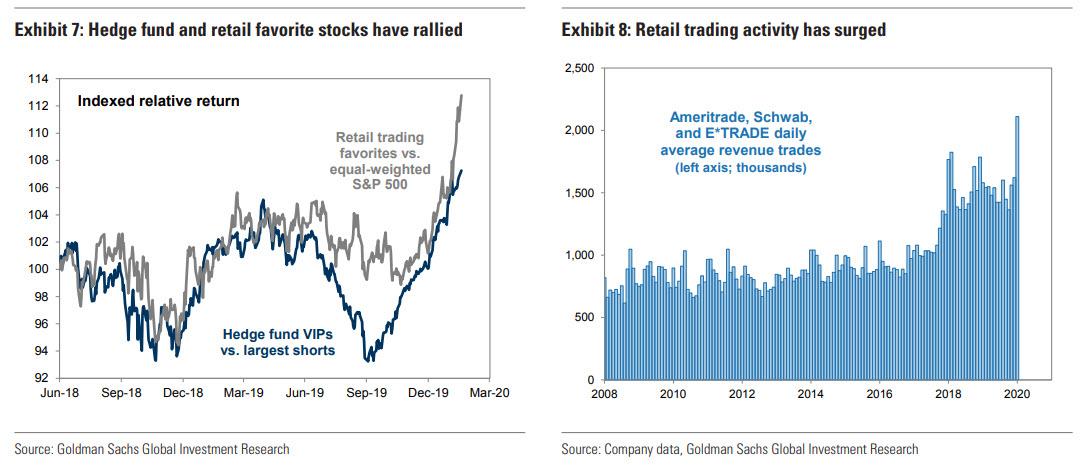

Remarkably, it was just two days ago that we musedhow, ever since the launch of the Fed’s QE4, in October, retail investors had trounced hedge funds.

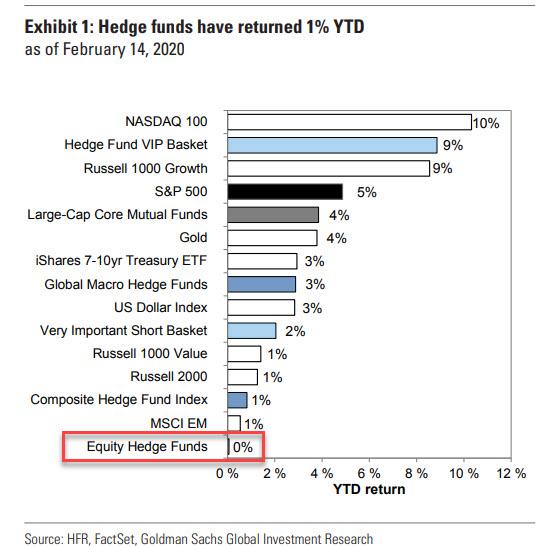

Curiously, the case can be made that the biggest reason why hedge funds did not do even worse in the YTD period, where the equity hedge fund cohort placed dead last in the list of assets tracked by Goldman…

… is because retail investors ended up buying a substantial number of the same stocks that comprise the 50 most popular, aka hedge fund VIP stocks, from tech giants to small-caps.

Yet while they have their similarities, the two baskets of most preferred stocks by retail and hedge fund investors, also have their differences, and as we said on Saturday, “ultimately it all really boils down to the far higher beta of the retail basket compared to the hedge fund VIPs: which means that while retail investors tend to win big, they also lose big when stocks tumble.”

We then concludes by noting that “while it is certainly a novelty to see retail investors outperform hedge funds, we doubt this divergence will last long.“

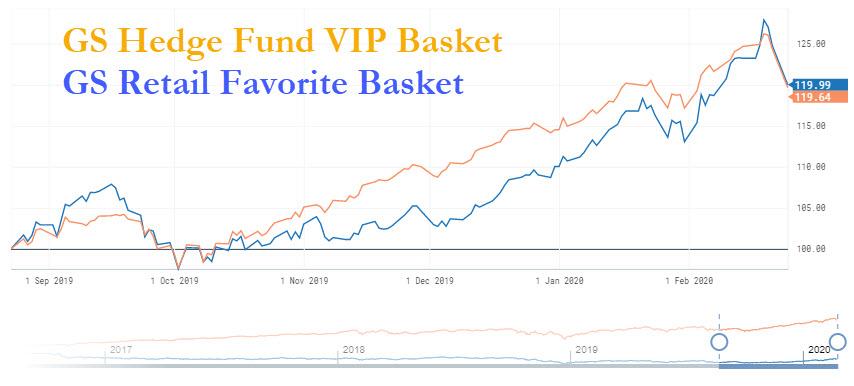

Sure enough, just as fast as momentum giveth, momentum taketh away, and one day after we discussed the remarkable, if fleeting outperformance of retail investors, the group was steamrolled by the Monday’s furious selloff which sent the S&P tumbling 3.35%, with the Goldman basket of retail favorites – among which Tesla, Spring PG&E and SPCE – tumbling the most in nine months, and catching down to the hedge fund VIP basket, with the two sets of stocks now neck and neck in their performance over the past 6 months.

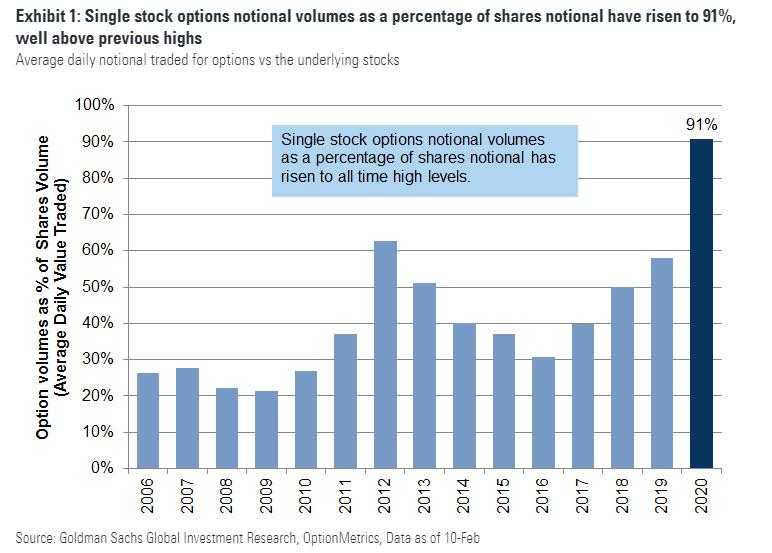

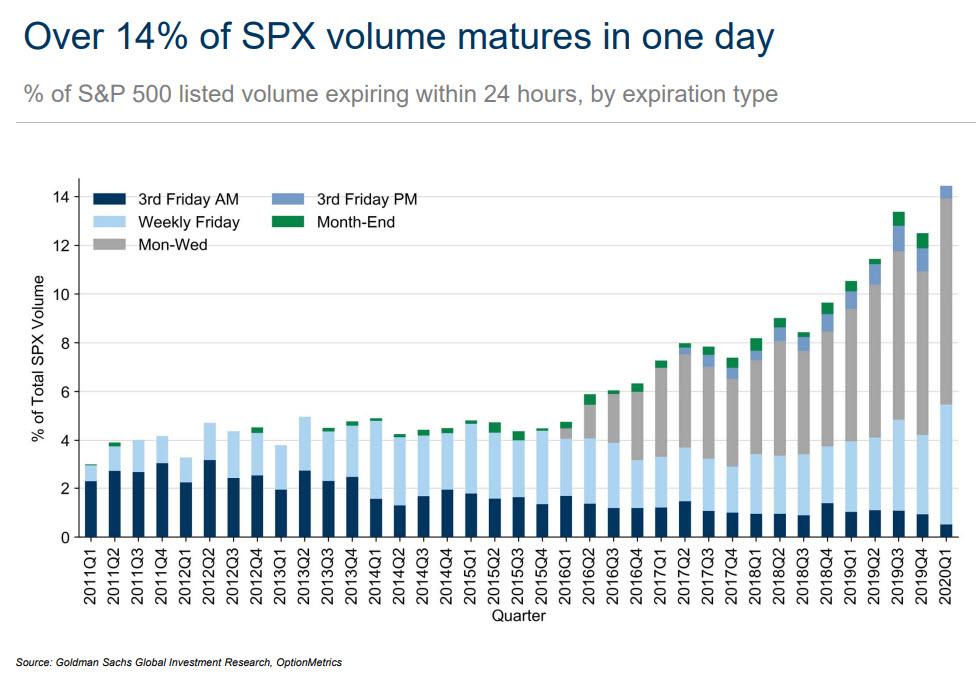

As shown above, Goldman’s basket of 50 most-popular stocks among individual (i.e. retail) investors fell 3.9%, its biggest one-day drop since last May, with all but two of the 50 stocks sliding, and as recent darlings Tesla and Plug Power each sank more than 6%. As Bloomberg notes, “it has been a decisive turnaround for retail investors”, whose picks we first noted last Friday had surged 13% in 2020 before this week, outperforming the S&P 500 by a factor of four as retail investors bought not only high beta, momentum stocks but also a record amount of calls on stocks…

… which mature within a week.

The question is what happens next: will retail investors just double down and BTFD, or – as they have traditionally done in the past – scatter at the first sign of a momentum reversal?

“A lot of that money does tend to be hot money,” FTSE Russell managing director Alec Young told Bloomberg: “It’s very sensitive to near-term losses” of which there have been a lot in just the past three days, because shortly after the S&P hit a new all time high less five days ago, the S&P 500 has dropped almost 5% from its record close, the bull market’s biggest slilde in six months, amid fears of a global coronavirus pandemic.

Desperate to preserve their reputation as Wall Street insiders – because what good is their job, and their 7 figure comp if amateur mom and pop can outperform their stock picsk – some strategists took offense at the outperformance of retail investors, who they claim are buying bonds not stocks, and that equity markets are the realm of institutions and other “smart money.”

“A lot of what is happening with bonds has to do with demographics,” said Baird strategist Michael Antonelli. “Baby Boomers are retiring, the world is starved for yields.” The equity market, on the other hand, “is really controlled by institutions. This up-and-down price action, that’s not retail money,” he said, although nobody who has seen the ridiculous moves in some momo stocks in the past month actually believes him.

A simple counter to Antonelli’s argument is who panic buys stocks at all time high valuations, which is where the market has been trading in recent weeks. There is just one group that does: as Bloomberg notes, when pointing to last week’s 19x P/E multiple for the S&P, the highest since the dot-com era, “no other investor group than retail has a greater propensity to chase winners regardless of valuations and company fundamentals. Among retail’s darling stocks, 10 scored year-to-date gains exceeding 20%, including Plug Power, Tesla and Virgin Galactic. Yet only two made profits in 2019.”

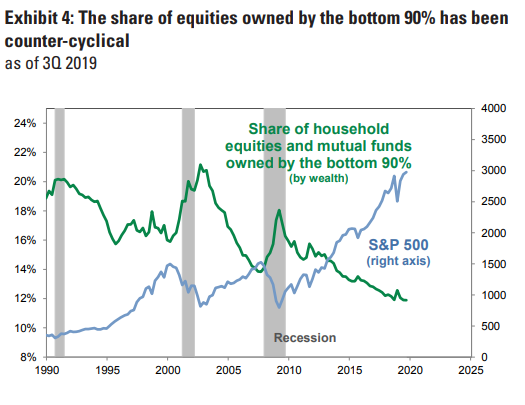

Yet while retail investors are legendary for their late cycle euphoria, and their desire to participate in distributions, in which the rich sell to the poor just before a recession hits…

… hedge funds were just as happy to capitalize on retail investor euphoria: as we said last Friday, retail infatuation with such hedge fund darlings as Apple, Amazon.com, Facebook and Microsoft has contributed to the top-heavy market that some strategists have warned is becoming hard to sustain, as today’s selloff clearly demonstrated.

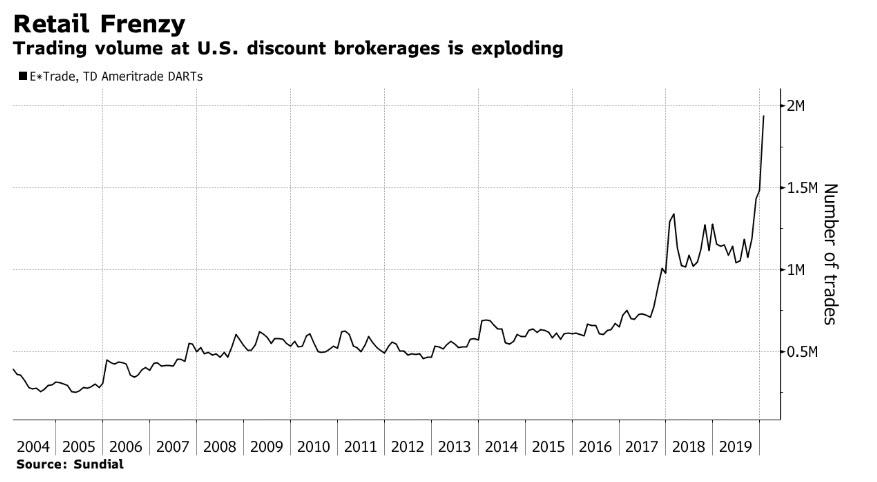

Of course, such a retail buying frenzy, which as shown in the chart below was also facilitated by the recent decision by online brokers E*Trade, Schwab and TD Ameritrade to cut commissions to zero which in turn double the daily average number of trades…

… is not new, and reminds Peter Cecchini of the retail over-involvement in the late 1990s that marked the end of the golden age of equities and foreshadowed the crash.

“While retail involvement in and of itself is not always a sign of frothy markets, when that involvement generally appears to be based on a fear of missing out or otherwise uniformed decision-making, as now, then it is cautionary,” said Cecchini, chief market strategist at Cantor Fitzgerald.

The problem, as Cecchini adds, is that “the coronavirus may help demonstrate how quickly it can all come unraveled when fundamentals disconnect from the narrative hype.”

And in a world in which retail investors have outperformed both the market and hedge funds, it would not be surprising if everyone looks at what Joe Sixpack does tomorrow to determine whether the post-QE4 meltup is now over, or if the coronavirus scare was merely the latest blip, whose dip was quickly bought.

Tyler Durden

Mon, 02/24/2020 – 19:10

via ZeroHedge News https://ift.tt/37TjkWM Tyler Durden