First Credit, Now The Corona-Crash Is Freezing Equity Market Issuance

On the heels of global credit markets grinding to a halt this week as the Covid-19 outbreak, it appears the freeze has spread to equity markets as Bloomberg reports more than $650 million in IPOs to be pulled from European capital markets.

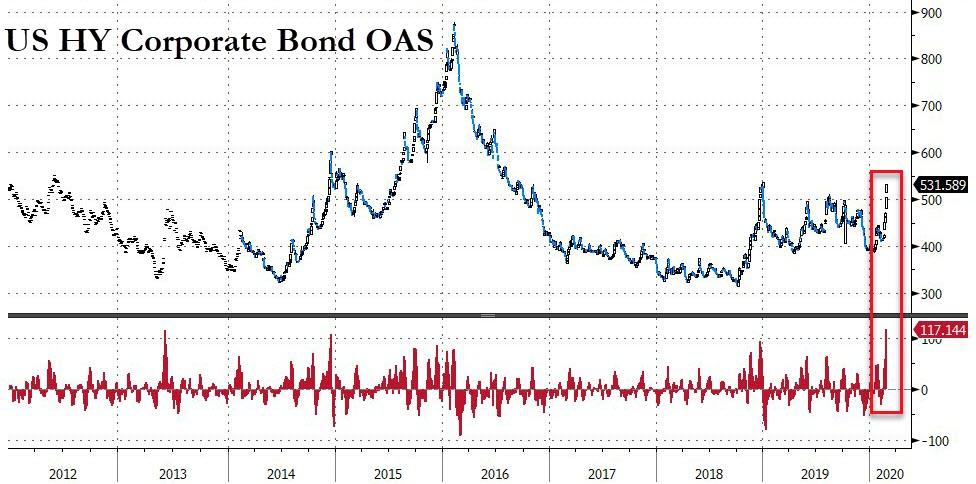

As we detailed previously, high yield and investment-grade spreads have surged this week, illustrating the stress permeating underneath markets.

In fact, high yield spreads have widened +117bps in a matter of days, the biggest move since the financial crisis.

And now that chaotic chill is rolling over to the equity market, as Bloomberg notes DRI Healthcare was the second company in days to pull a new listing in Europe, citing deteriorating market conditions driven by virus fear.

“The company [ DRI Healthcare Plc] is seeking to raise as much as $350 million in London. Raising equity capital in Europe was already tricky because of a growing disconnect between buyers’ and sellers’ valuation expectations. Now the market’s slump is making investors even more averse to risk, thinning out an already depleted pipeline,” said Bloomberg.

DRI, a fund that invests in rights to royalty-paying pharmaceuticals, didn’t set a new date for its initial public offering, which had been planned for March 11.

Somewhat stunningly, only 10 companies have priced IPOs in Europe this year, including three in London, as raising equity capital in Europe was already tricky because of a growing disconnect between buyers’ and sellers’ valuation expectations, and now the surge in risk is keeping investors even further away.

“If the selloff continues into next week, no one will want to price with that level of weakness in the market,” said Marco Schwartz, head of KPMG’s equity capital markets advisory team.

“Our advice to companies about to launch offerings would be to hold off and wait.“

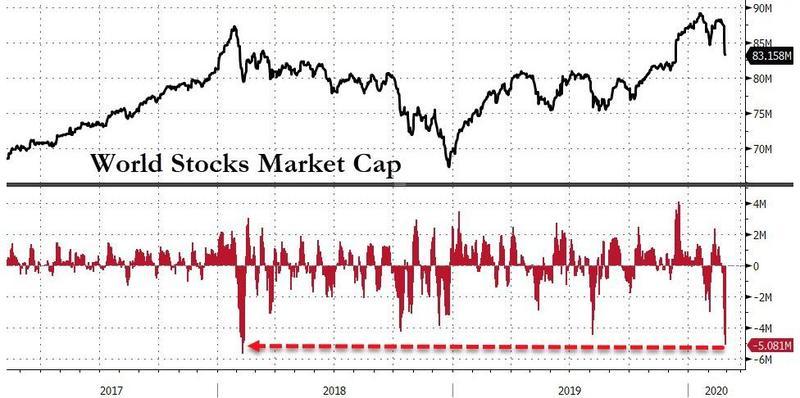

While none of this hardly a surprise considering $5 trillion in global equity value has been wiped out in the last five sessions.

Sustainable Farmland Income Trust Plc was another company this week that pulled its $300 million planned listing on the London exchange, citing market turbulence.

The IPO of Wintershall DEA, an oil and gas firm, was also postponed and could wait until the second half of the year to list.

Nacon SA, a French maker of computer parts, managed to price a $128.2 million IPO this week, despite increasing volatility in global equity markets.

The bust of the European IPO market started in 2019 when $2.85 billion worth of IPOs were postponed.

With central bankers seemingly impotent in the face of a health crisis (unable print vaccines and powerless to do anything that will help restart global supply chains or consumption), the sudden velocity of Covid-19’s effect on global markets has been nothing short of astonishing and while secondary trading markets are important, contagion spreading to the primary markets, freezing IPO and credit issuance this week is a significant problem.

Tyler Durden

Fri, 02/28/2020 – 18:05

via ZeroHedge News https://ift.tt/2wZF3Q9 Tyler Durden