SaxoBank: Equities Are In Rough & Unpredictable Seas, Central Banks Will Not Alleviate The Pain

Authored by Peter Garnry via SaxoBank,

Summary:

Equities are tilted towards a negative outlook short-term as volatility remains very high and equity valuations leave more reasons for investors to sell their equities as the short-term growth outlook is deteriorating from the spreading COVID-19.

Obviously government and central bank intervention is coming creating a short-lived risk-on bounce but it will not alleviate the pain for the corporate sector. We also take a look at which industry groups and stocks that have done the best and worst during the period when COVID-19 hit the news in January.

Equities are caught in the middle of what may become the first global flu pandemic since the Hong Kong flu in 1968. S&P 500 was down 11.5% last week but was down a whopping 14.2% at the low. In today’s session the S&P 500 futures have fluctuated wildly currently down 0.8% from Friday’s close. While initial green shoots earlier today was off a good Chinese session and anticipation of a coordinated central bank action. Our view is that the Fed could cut by 50 bps. this week to try to infuse some stability and confidence into the system as markets the week of policy panic. But the impact will be short lived as a pandemic drives actual consumer behaviour that can cause an entire society to a halt as we have observed in China. That has real impact on earnings and growth.

The key factors influencing equities are inflation, growth, valuation, recession and volatility. Inflationary forces are likely in check for now and COVID-19 is currently a mixture of demand and supply shock should we anticipate little impact on inflation for now. Long-term growth is obviously not impacted unless COVID-19 turns into a nasty global recession with dramatic default in credit markets which could happen but we still put the probability in the low end. Short-term growth will obviously be impacted and that’s the real transmission into falling equities.

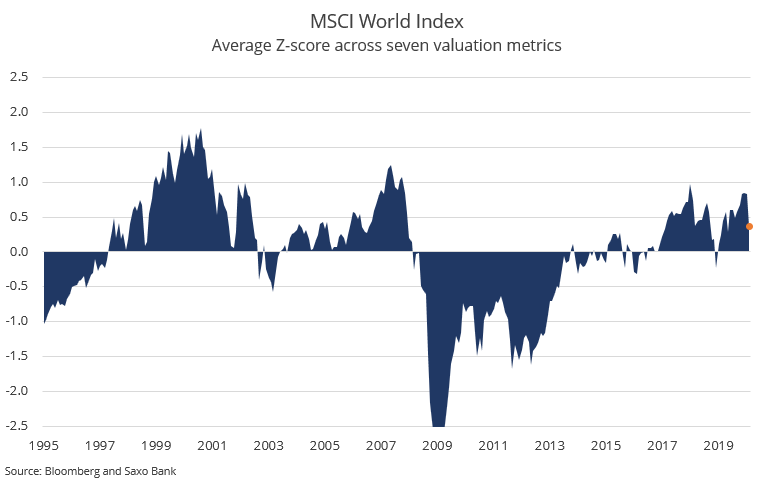

Equity valuations have come down quite a bit from high levels but are still hovering above the long-term average in the MSCI World Index. This in combination with downward pressure on earnings and revenue leaves more room for declines in equities over the coming six months as the COVID-19 spreads further.

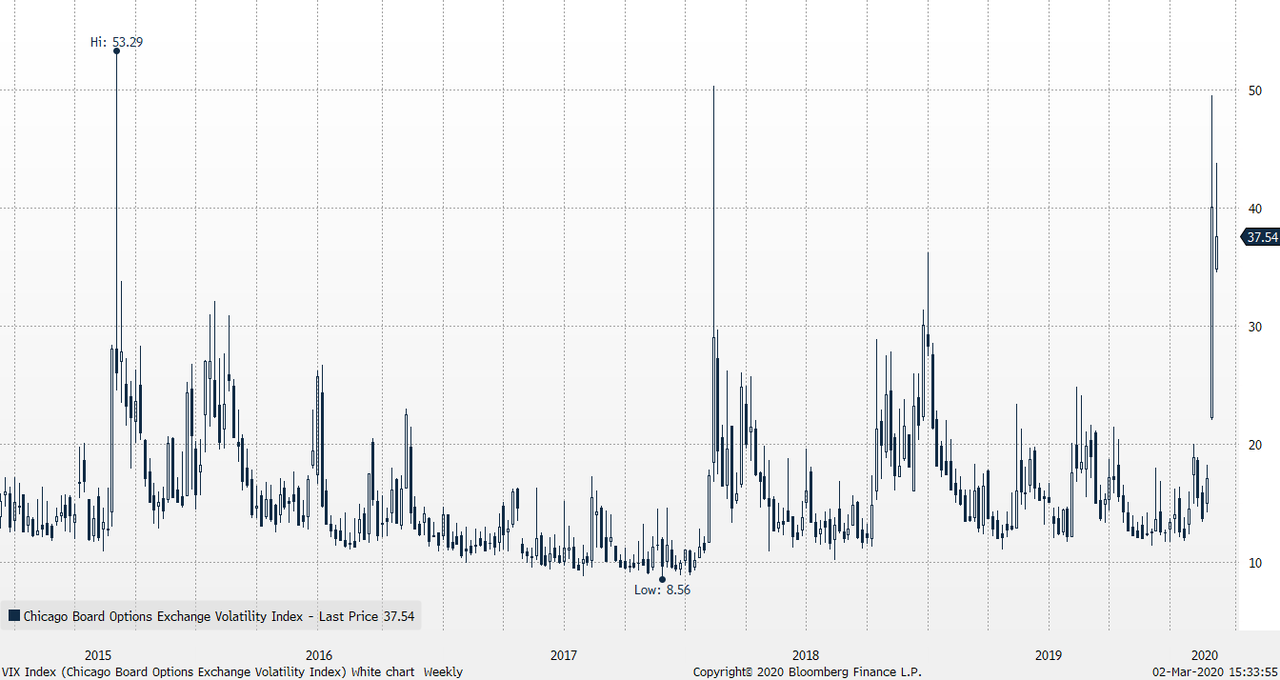

The virus has obviously increased the recession risk for the US economy which already stood at 31% on a 12-month horizon based on numbers from January. This again is obviously negative in the short term. The final factor, and an important one, for short-term predictions is volatility. The VIX Index is currently at 41 which is significantly above the long-term equilibrium in the VIX term structure at the 22 level (see Lihn 2017). The current market state is characterized by negative return expectations, significant volatility and high kurtosis (fat tails). The 5-day average in VIX is currently 35 which is more than during the February 2018 volatility crash and Q4 2018 meltdown in equities.

There is also a major point to learn here. All the most critical information in financial markets happen in the tails. Last week’s significant decline in equities could likely mark a prolonged painful period for equities as the ‘perfection or TINA’ premium is removed from equities.

High sensitivity stocks to COVID-19

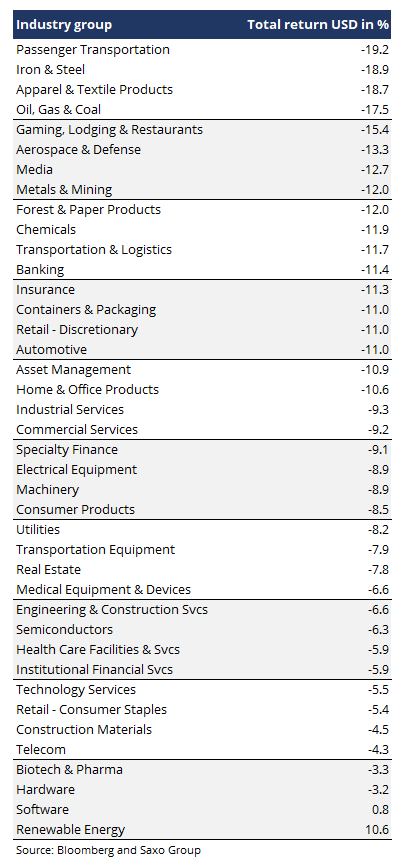

Not surprisingly the most sensitive industry groups to COVID-19 are passenger transportation which is dominated by airliners, but also industry groups such as Iron & Steel, Apparel, Oil & Gas, Restaurants & Gaming.

Some of the well-known names in those industries are: Ryanair, Southwest Airlines, Delta Air Lines, American Airlines, Air Canada, East Japan Railway, BHP Group, Fortescue Metals, Rio Tinto, Tata Steel, Nippon Steel, Burberry, LVMH, Under Armour, Christian Dior, Royal Dutch Shell, PetroChina, ConocoPhillips, Exxon Mobil, Baker Hughes, Carnival, Las Vegas Sands, Wynn Macau, MGM China and Intercontinental Hotels.

As we have been arguing many times in the past the technology sector has become a defensive sector. As the table shows software, hardware and technology services have all done well and then renewable energy is living its own life due to the focus on climate change.

Impact on earnings?

Equities are a long duration asset class pricing future growth and as such a one year shock to the economy, and in this case a virus, should not materially impact long-term growth which is a function of productivity growth (technological development) and human capital. Thus one year with declines in earnings per share should of course impact equity prices and valuations, but to what degree?

Tyler Durden

Mon, 03/02/2020 – 15:50

via ZeroHedge News https://ift.tt/3cnBXFC Tyler Durden