Panic-Buying Sends Dow To Best Point-Gain Ever On Hopes Of Intervention

The BoJ bought a bucketload of ETFs overnight,and lifted Japanese stocks. The PBOC‘s National Team performed miracles lifting Chinese stocks amid collapsing PMIs. The IMF/World Bank promised “help” and everyone is now anticipating the G7 – because they’ve always been so great at agreeing on a unifying action!

And all of that (along with Jay Powell‘s brief statement on Friday and Kudlow/Mnuchin’s calls for an emergency rate cut) was enough to lift US stocks, but a ton of worsening US virus headlines sparked some weakness as the day wore on, only to be rescued by Trump’s optimistic tone on vaccines and treatments…

Notably, S&P and Nasdaq broke above critical technical levels in the last few panic-buying minutes…

The market priced in 75bps of cuts in March earlier today, but slipped back to 50bps as stocks rallied…

Source: Bloomberg

Chinese markets were aggressively bid last night by someone…

Source: Bloomberg

And Japanese markets went vertical after the Sunday night open…

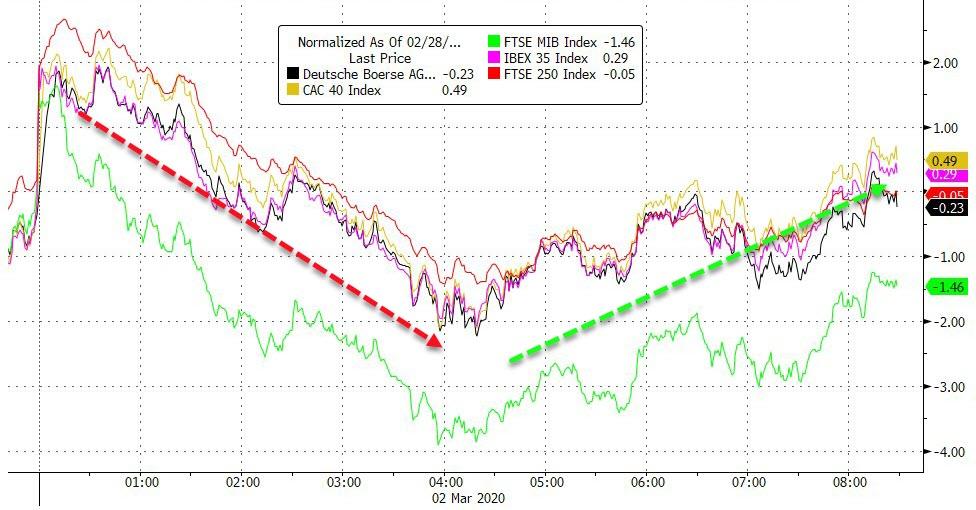

European markets were mostly higher today (ex Italy)…

Source: Bloomberg

S&P topped 3,000; Dow topped 26,000 (and led the day). Trannies were unable to stay positive…

This was The Dow’s biggest percentage gain since March 2009 (QE1 announced) AND bigger than the last time the PPT saved the world in Dec 2018 (Dow +1086 points that day)…

AAPL helped lift markets today with its buyback program raising the stock 7%!!

The big banks bounced after their bloodbath…

Source: Bloomberg

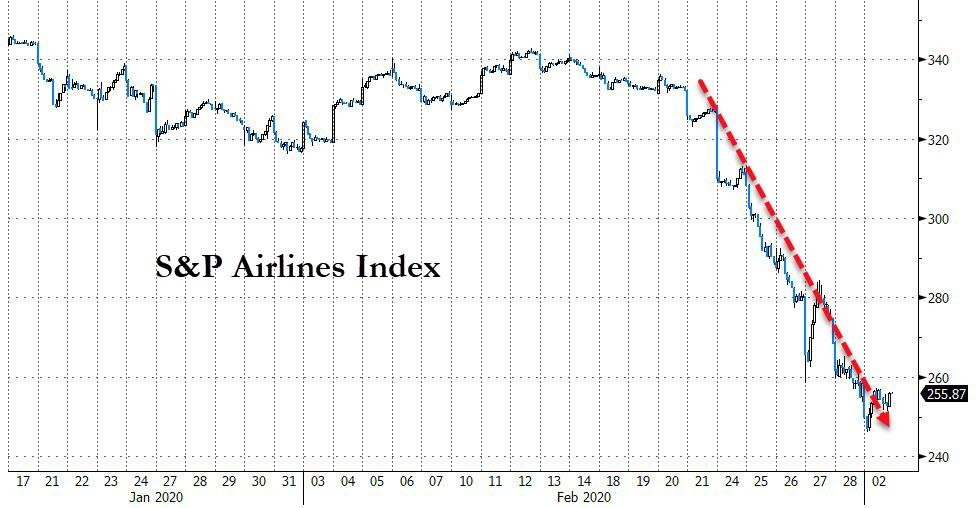

But while airlines bounced off opening lows, they ended red again (7th down day in a row, 11th drop in last 12)…

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

VIX fell today by the most since XIVmageddon in Feb 2018…

Stocks notably decoupled from bonds today, until the last hour when it seemed like more pension rebalancing sparked bond-selling, stock-buying…

Source: Bloomberg

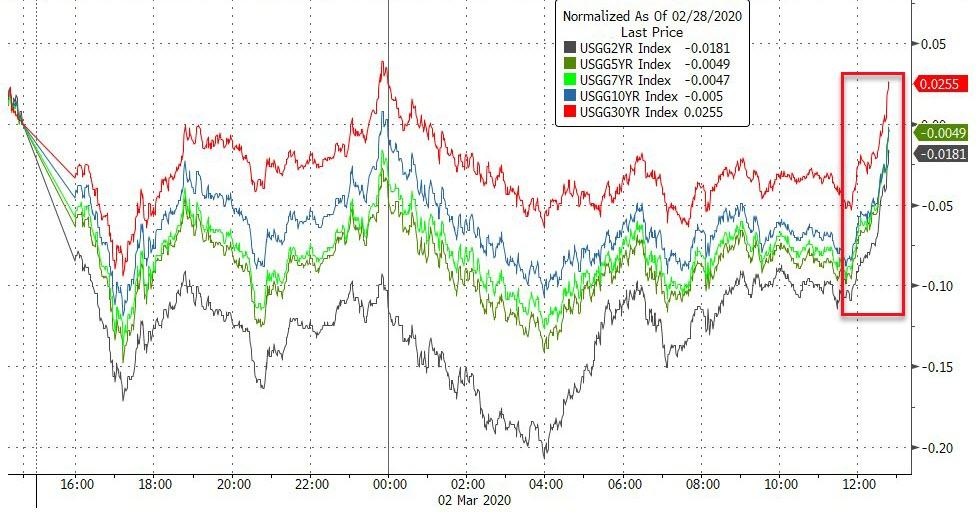

Treasury yields collapsed today – led by the short-end, before blowing out late on…

Source: Bloomberg

The long-end bond yields broke a 7-day compression streak…

Source: Bloomberg

Yield curve

Source: Bloomberg

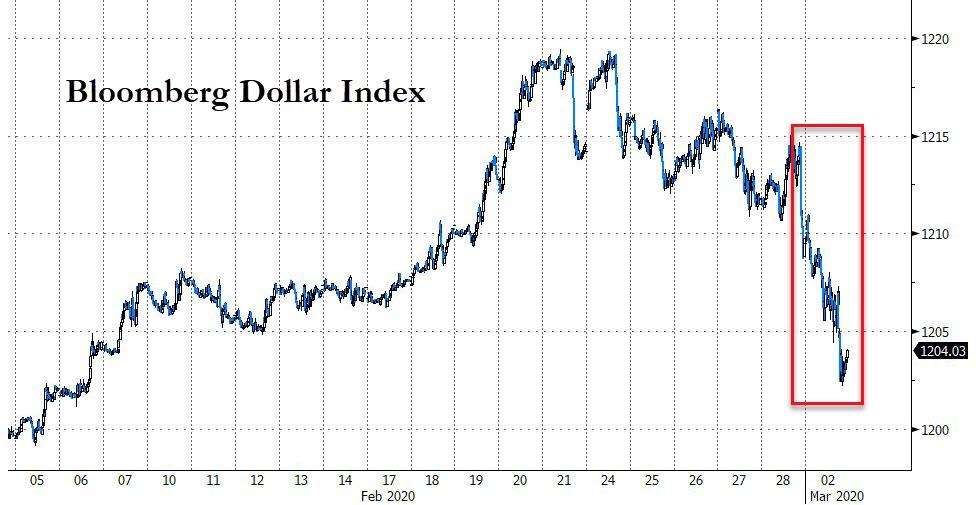

The Dollar was clubbed like a baby seal today, plunging most since Sep 2019…

Source: Bloomberg

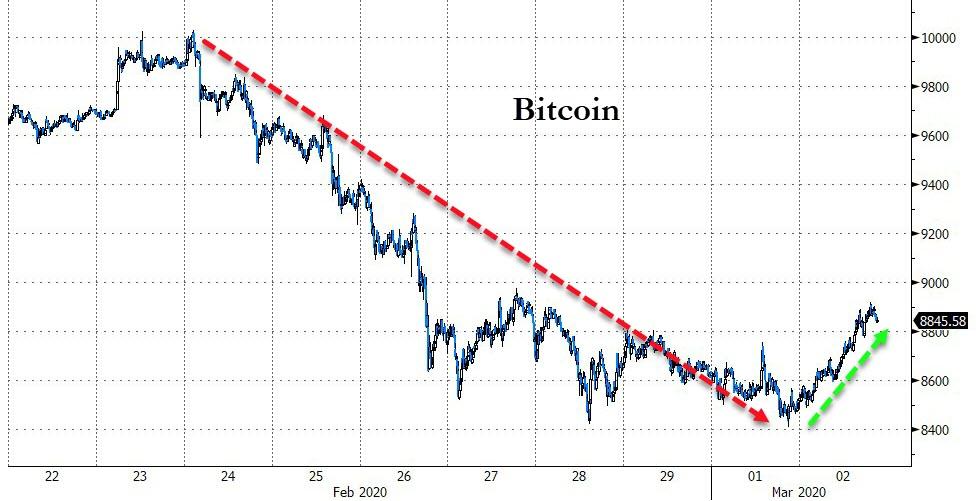

Bitcoin rallied for the first day in the last 8…

Source: Bloomberg

Source: Bloomberg

Commodities were all higher as the dollar plunged with crude soaring and PMs barely clinging on…

Source: Bloomberg

Gold slipped back below $1600 after breaking above it earlier…

Source: Bloomberg

WTI roared over 4% back above $47 after opening down over 3% at around $43.25…

Notably stocks and crude were tick for tick today…

Source: Bloomberg

Finally, we’re not cheap!

Source: Bloomberg

And The Hindenburg Omen struck again…

Source: Bloomberg

Tyler Durden

Mon, 03/02/2020 – 16:01

via ZeroHedge News https://ift.tt/2wjbloS Tyler Durden