What Happens To The S&P500 After An Emergency Fed Rate Cut

There is a reason why the stock market freaked out yesterday when the Fed announced its emergency rate cut: traditionally when the Fed engages in such an unexpected move, it means that the economy (or markets, or both) are already in freefall, and the Fed is far behind the curve. One look at historical market performance following emergency rate cuts confirms as much.

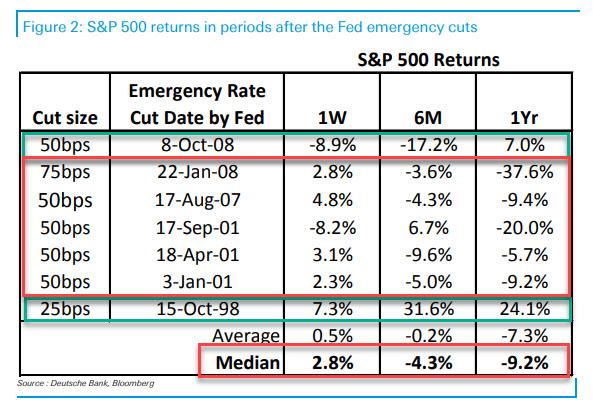

This morning, DB’s Jim Reid looked at what happened to the S&P 500 in the week, six months, and one year after the Fed’s last 7 emergency cuts. What he found was surprising: while the near term impact was largely favorable, the longer term was clearly negative, to wit:

-

+2.8% after 1 week

-

-4.3% after 6 months

-

-9.2% after 1 year

When one considers the average 1 year price return (excluding dividends) for the S&P 500 is around 6% then, as Reid points out that is a considerable 6 months and one year under-performance when the Fed deems it necessary to do an emergency cut, and may explain what was behind the market’s angst.

As shown in the chart above, there is one notable upside outlier: while most emergency rate cuts saw a sharp drop in stocks 1 year out, 1998 was the big positive outlier as one didn’t see a subsequent recession (that can was instead kicked into the dot com bubble) and instead Greenspan moved into maximum bubble phase with the extra stimulus in response to LTCM and the Asian Crisis, and the Y2K liquidity spike shortly after. That, as Reid notes, would be the bull hope. However for now the market will debate whether they have fired too much of their ammo too early.

Indeed, with the Fed Funds rate now in the 1-1.25% range “it feels a little like the flood defenses to zero have seen a big erosion over the last 24 hours.” Reid is not surprise by this, adding that he thinks “the Fed balance sheet will explode in the years ahead with the forward debt profile of the US (and other countries to be fair)” – as such, yesterday’s intermeeting rate cut will only accelerates that move.

However, since the Fed was already trapped in the biggest asset bubble of all time and the only thing it could do was keep kicking the can as the alternative would result in a catastrophic market crash, “to be fair to the Fed they were probably damned if they did and damned if they didn’t” Reid concludes.

Tyler Durden

Wed, 03/04/2020 – 16:25

via ZeroHedge News https://ift.tt/2PPaD9w Tyler Durden