Fed Is Now Trapped: If Powell Fails To Taper “Not-QE”, He Will Admit It Was “QE 4” All Along

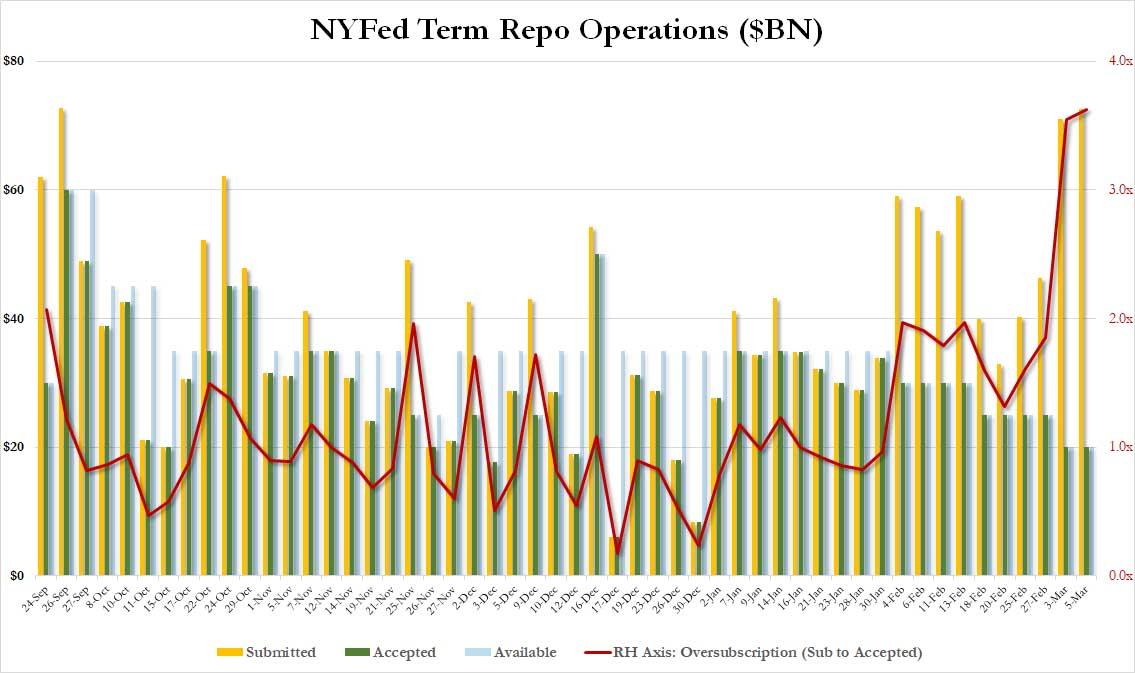

The unexpected scramble by dealers to obtain repo funding in recent days has taken the market, and especially STIR traders by surprise: after all, the primary catalyst behind the Fed’s decision to (emergency) cut by 50bps was to ease financial conditions. And yet the record oversubscribtion in both term and overnight repos in the past few days confirms that contrary to the Fed’s expectations, market liquidity has in fact deteriorated sharply.

And yet, as liquidity gets worse in response to the coronavirus market shock and, paradoxically, the Fed’s rate cut, the Fed faces a conundrum: will it continue tapering its repo operations and the permanent purchases of T-Bills, as it promised previously it would… or will the Fed capitulate and no only no longer taper, but in fact boost the availability of these products.

Herein lies the rub: if the Fed does in fact capitulate as most expect it to do, it will be effectively admitting that “Not QE” was in fact QE4 all the time, as this website and a handful of other Fed critics have claimed all along, and will make yet another mockery of all those finance hacks who, living in their mom’s basement, claimed that the Fed’s QE4 was not in fact QE4.

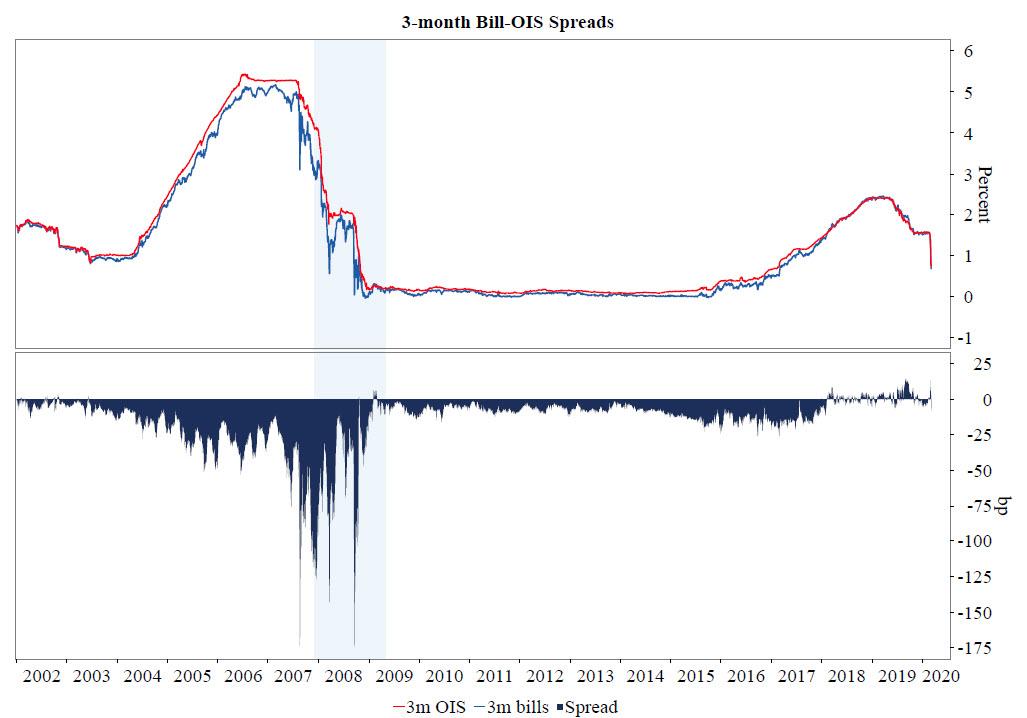

Addressing precisely this issue, on Thursday morning BMO’s rates strategist Jon Hill discusses the recent divergence in the 3M Bill-OIS spread…

… and touches on the various factors that he thinks would have an impact on a possible compression of the front-end Treasury/OIS spread, where he highlights “the possibility the Fed calls off tapering the bill purchase program”, although as noted above, he admits doing so would signal the Fed’s critics were right all along, and would be a prelude to the Fed losing even more credibility. To wit:

We still believe that the Fed will follow through on its forward guidance and taper its non-QE program. In their minds (and ours) this is not a facility designed to ease financial conditions, but rather one to address a reserve scarcity that emerged in September last year. To deviate from their tapering schedule would be to either tacitly acknowledge that it’s been shadow QE this whole time or further capitulate to some in the market’s interpretation of what the demand represents. That said, the probability that the tapering never occurs is clearly non-zero, if only because of the Committee’s extreme reticence to startle the market at this extremely precarious moment.

While in BMO’s mind, this facility may have been designed to address reserve scarcity, in “our mind” we have made it abundantly clear that the Fed’s non-QE POMO, i.e., T-Bill monetization, was meant to goose stocks all along, even if the Fed would never dare admit it. In other words, it was QE-4 all along. And we are certain that when the time comes in a few weeks, the Fed will prove us right by refusing to taper, as doing so would result in another market crash catalyst, an outcome the Fed is doing everything in its power to avoid.

Tyler Durden

Thu, 03/05/2020 – 12:15

via ZeroHedge News https://ift.tt/38lIWM4 Tyler Durden