Stock Market Liquidation Will Continue Until The Fed Does A 75bps Emergency Rate-Cut

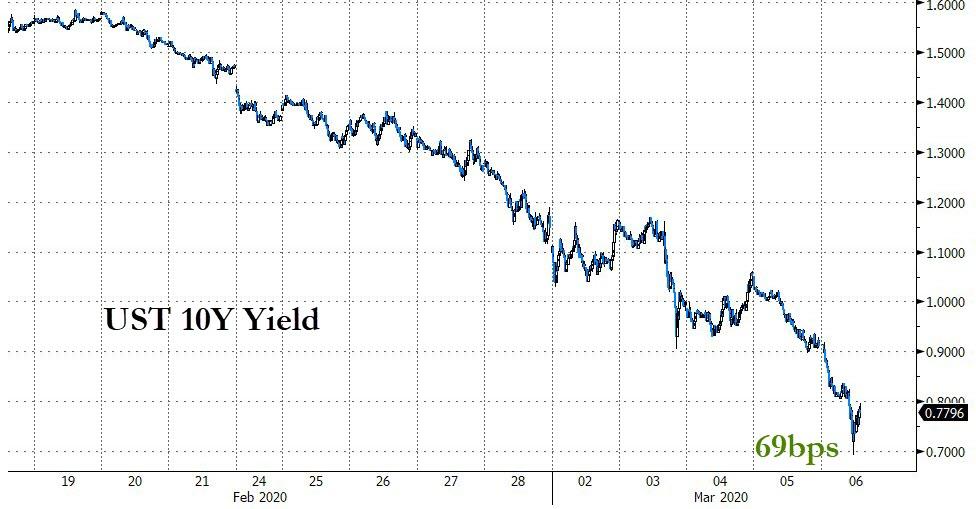

I had previously said I think 10yr US Treasury yields could bottom in April at 75-85bps. Well six days later we are below that range… risk happens fast I guess.

I think the Fed needs to steepen the curve to stop Japanese and European banks selling to primary dealers and crushing liquidity.

This chart below shows the repatriation of capital back to Yen when the curve inverts.

EU and Japanese banks have lent about $4Tn in this cycle via QE leakage to the US government, hence USD weakness and EUR and JPY strength on risk off/ curve inversion.

So if they actually understand what they are doing, The Fed should do an emergency 75bps. Until then we have liquidation, same as what was happening in October.

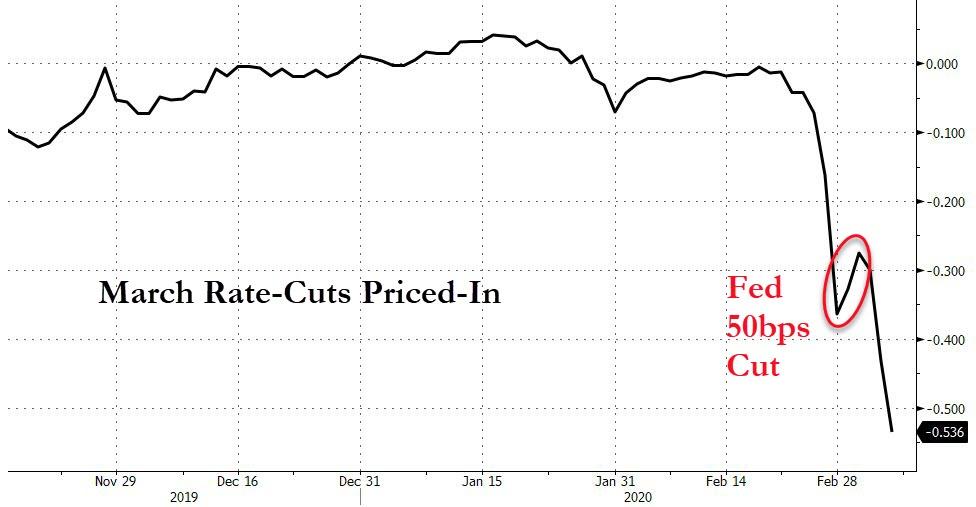

But if they do cut, it could turn the tables quite quickly. March is already priced for an additional 55bps of cuts (so 75bps would be a major surprise)…

But of course would scream “panic” to the market – and effectively empty The Fed’s rate-cut gun.

If the Fed cuts to 30bps or so EFFR it will mean the curve is steep and we start to see the capital come back out of Japan and EU.

But will they do 75bps in an emergency meeting next week? Or wait for the FOMC on the 18th or just do 50bps? Who knows.

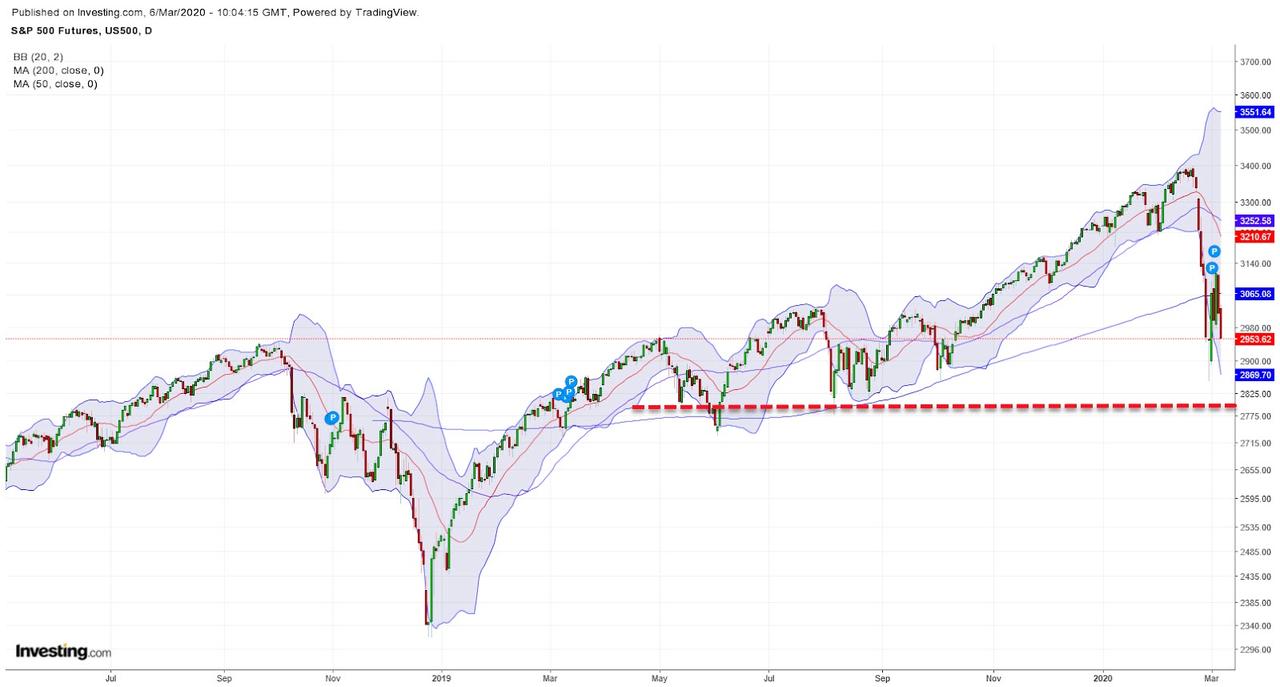

The S&P on the other hand looks to me like it could punch below 2800 without hitting too much technical resistance if there is no emergency meeting.

However, later this month I think the ‘Coronavirus is going exponential’ fears should subside. And I do think there is a second half economic rebound. So perhaps this slowdown and market clear out will be the pause that refreshes?

Tyler Durden

Fri, 03/06/2020 – 08:00

via ZeroHedge News https://ift.tt/32XbDOn Tyler Durden